Table of Contents

- Why Expense Tracking is a Financial Game-Changer

- Finding the Right Expense Tracking Method for You

- How to Build a Personal Expense Tracking System That Works

- Turning Your Spending Data into Smarter Financial Decisions

- Common Expense Tracking Mistakes and How to Sidestep Them

- Common Expense Tracking Questions, Answered

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Do you ever get to the end of the month and have no idea where all your money went? If that sounds familiar, you’re not alone. Learning how to track expenses is the single most important skill for getting a handle on your finances. This isn’t about pinching every penny; it’s about gaining clarity so you can tell your money where to go, instead of wondering where it went.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Expense Tracking is a Financial Game-Changer

So, what does “tracking expenses” actually mean? It’s simply the habit of noting down where every dollar goes, from that morning latte to your rent payment. It gives you a brutally honest look at your spending habits. Without this clear picture, trying to reach your financial goals is like trying to drive to a new destination with your eyes closed.

People often mix up tracking with budgeting, but they’re two different sides of the same coin. Tracking is the fact-finding mission—you’re just gathering the data. Budgeting comes next; that’s when you use that data to create a spending plan. You can’t make a realistic budget until you know your real-world spending patterns.

The Real Power Is in the Awareness

Knowing your numbers does more than just get you ready to budget. It gives you the power to make smarter, more conscious decisions with your money every single day.

- Spot the “Money Leaks”: You’ll probably be shocked to see how much those small, mindless purchases add up. Think daily coffees, unused subscriptions, or impulse buys online.

- Spend on What Matters: Does your bank statement reflect your priorities? Tracking helps you see if you’re spending on things you truly value and cut back on the stuff you don’t.

- Lower Your Financial Anxiety: So much financial stress comes from the unknown. When you know exactly where you stand, that feeling of uncertainty disappears, and you regain a sense of control.

Expense tracking isn’t about shaming yourself for past spending. It’s about collecting intel to empower your future self. This is how you go from being a passive consumer to the person actively designing your financial life.

In the end, learning how to track expenses is the non-negotiable first step toward building wealth and leaving financial stress behind. It’s the bedrock habit that makes all your other goals—like getting out of debt or investing—possible. Once you’ve got a handle on tracking, you’ll be ready to take the next step, and our guide on budgeting tips for beginners is the perfect place to start.

Finding the Right Expense Tracking Method for You

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Now, let’s get into it. Choosing how to track your expenses is a lot like picking a workout routine—the “best” one is simply the one you’ll actually do.

It’s easy to get caught up in finding the most high-tech, feature-packed system. But if it doesn’t fit your personality, you’ll ditch it in a month. The real key is to pick a method that feels natural for you, whether you’re a pen-and-paper traditionalist, a spreadsheet wizard, or someone who wants an app to do all the heavy lifting.

The Mindful Method: Pen and Paper

In a world of one-tap payments, there’s something powerful about physically writing down what you spend. This old-school approach forces you to pause and acknowledge every single transaction. It’s a tactile experience that creates a strong mental link to your spending habits.

This method is perfect if you feel overwhelmed by apps and screens or if you’re trying to break a cycle of mindless spending. The simple act of putting pen to paper introduces a tiny bit of friction, which can be surprisingly effective at curbing impulse buys.

Imagine a student trying to figure out where their money goes. Having to physically write down “£8.50 – Coffee and cake with friends” makes that expense feel much more real than just seeing another line on a digital bank statement. It builds an awareness that apps sometimes gloss over.

The Control-Oriented Method: Spreadsheets

For anyone who loves data and wants total command over their financial picture, spreadsheets are the ultimate tool. With Google Sheets or Microsoft Excel, you’re the architect of your own system. You build it from the ground up.

You get to create your own categories, design custom formulas, and build charts that show you exactly what you want to see. This is hands-down the best option for freelancers tracking business and personal expenses, or for families managing multiple income streams and complex savings goals. You have the power to analyze your spending from any angle and truly own your data.

A spreadsheet gives you the freedom to build a system that is perfectly tailored to your unique financial life. You aren’t confined to an app’s predefined categories or reporting features. Every cell, formula, and chart is under your command.

A simple setup might have columns for the date, vendor, amount, category, and a note. With a basic SUMIF formula, you can create a summary dashboard that automatically totals your spending in categories like ‘Groceries’ or ‘Transport’ each month. It’s a hands-on approach that delivers incredibly deep insights.

The Efficiency-Driven Method: Budgeting Apps

Let’s be honest—sometimes the best system is the one that does most of the work for you. Modern budgeting apps are built for this very purpose. They sync directly with your bank accounts and credit cards, automatically pulling in your transactions as they happen.

This method is a lifesaver for busy professionals, families juggling chaotic schedules, or anyone who just wants convenience. The app handles the tedious data entry, freeing you up to focus on what matters: understanding your habits and making better decisions. Most will categorize your spending, show you where your money is going with handy reports, and even send alerts when you’re nearing a budget limit.

There are a ton of great apps out there. To help you narrow it down, we’ve reviewed some of the top options in our guide to the best free budgeting apps. It’s a great place to start if you want powerful features without the price tag.

To make the choice even clearer, here’s a quick breakdown of how these three methods stack up.

Comparing Expense Tracking Methods

Use this table to quickly compare the primary expense tracking methods and find the best fit for your lifestyle and financial goals.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Pen and Paper | Visual learners and those needing to curb impulse spending. | • High awareness of each purchase • No tech required • Very low cost | • Time-consuming • Prone to human error • Hard to analyze long-term trends |

| Spreadsheets | Detail-oriented people and those with complex financial situations. | • Complete customization • You own your data • Powerful analysis tools | • Steep learning curve • Requires manual data entry • Easy to break formulas |

| Budgeting Apps | Busy individuals and anyone who values automation and convenience. | • Automatic transaction import • Real-time updates • Easy-to-read reports & alerts | • Potential subscription fees • Privacy concerns • Less customization |

Ultimately, your goal is to find a system that makes you want to stay on top of your finances. Whether it’s the mindful pause of a notebook, the granular control of a spreadsheet, or the seamless automation of an app, the right tool will make tracking your money feel less like a chore and more like a path to financial freedom.

How to Build a Personal Expense Tracking System That Works

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Picking an app, a spreadsheet, or even a simple notebook is just the starting line. The real magic happens when you build a reliable system around that tool. A great expense tracking system isn’t really about the software; it’s about the habits and structure you create. Without a solid framework, even the fanciest app won’t give you the clarity you need to really move the needle on your financial goals.

The foundation of any good system is creating spending categories that actually make sense for your life. Generic labels like “Shopping” or “Miscellaneous” are just too vague to be helpful. They don’t tell you anything you can act on. Your categories should be a mirror, reflecting your unique lifestyle, goals, and where you are financially.

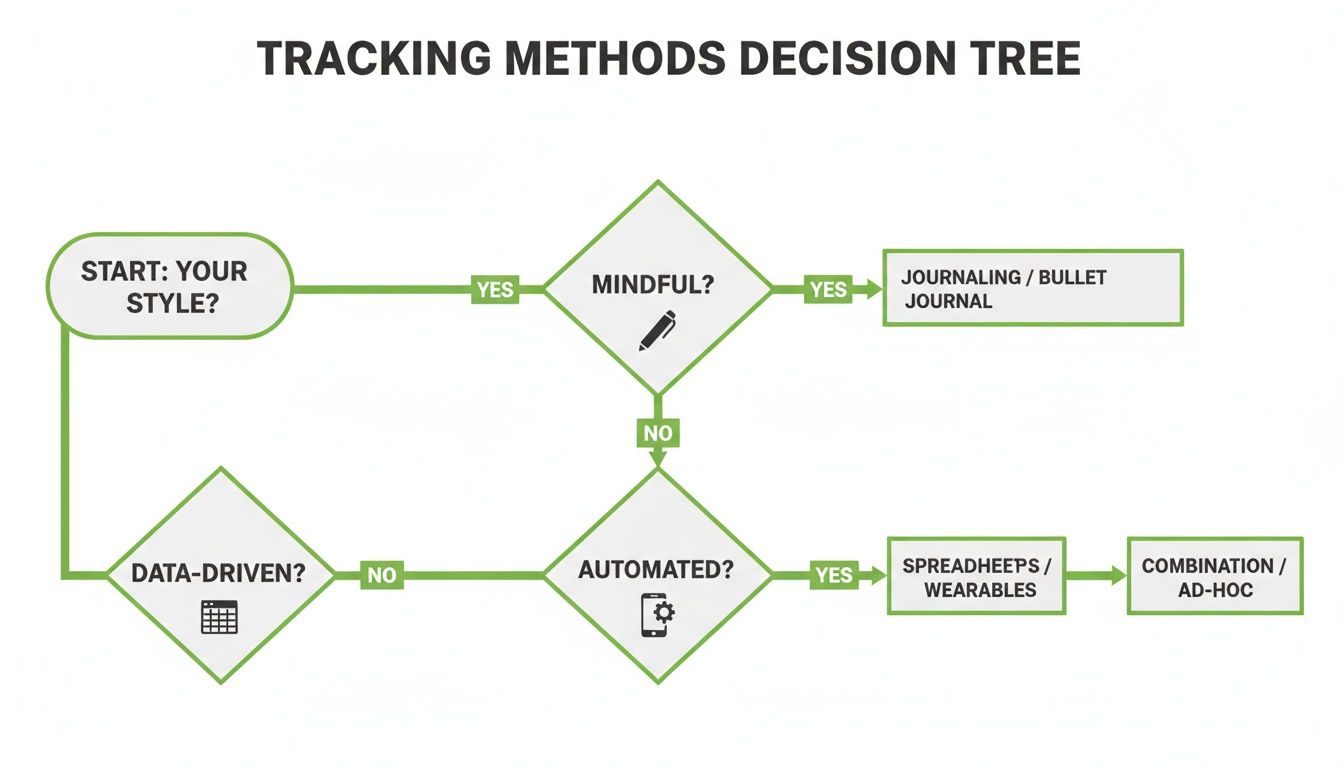

This decision tree can help you see which tracking method fits your personality best, setting you up for a system you’ll actually stick with.

The main takeaway here is that success comes from matching your method to who you are—whether you’re someone who prefers a hands-on approach, loves digging into data, or just wants to set it and forget it.

Crafting Your Personal Spending Categories

Think of your categories as buckets that hold your spending. For them to work, they need to be specific enough to tell a story. A freelancer’s buckets might include ‘Client Software Subscriptions’ and ‘Networking Lunches,’ while a family might need ‘Kids’ Extracurriculars’ and ‘Holiday Fund.’

Here’s a simple way to create categories that actually work for you:

- Start with the Big Three: These are your non-negotiable, core expense areas. For most people, this means Housing (rent/mortgage), Transportation (car payment, gas, public transport), and Food (just groceries, for now).

- Add Your Fixed Costs: Next, list out all your predictable, recurring bills. This is everything from utilities and insurance to loan payments and subscriptions like Netflix or your gym membership.

- Define Your Variable Spending: This is where you can really personalize things. Instead of a single “Entertainment” bucket, you might break it down into “Dining Out,” “Social Events,” and “Hobbies.” It gives you a much clearer picture.

The goal is to find a balance. Too few categories, and you won’t get any real insight. Too many, and tracking just becomes a chore. I’ve found that starting with around 10-15 categories is a great sweet spot. You can always tweak them later as you learn more about your own habits.

Your tracking system shouldn’t feel like a restrictive diet. It’s an information-gathering tool. The goal isn’t to judge your spending but to understand it, so you can align it with what truly matters to you.

Capturing Every Transaction Consistently

An expense tracker is only as good as the data you feed it. Missing transactions, even the small ones, can completely warp your perception of where your money is going and lead you to the wrong conclusions. Consistency is everything if you want a reliable financial picture.

One of the best habits I’ve seen work is the daily ‘money minute.’ Seriously, just set aside 60 seconds at the end of each day. Use it to log any cash purchases, quickly scan your bank transactions, and file away any receipts. This tiny habit prevents those little expenses from slipping through the cracks and makes the whole process feel manageable instead of overwhelming.

If you’re using an app that syncs with your bank accounts, most of the work is done for you. But you still need to check in and categorize things. Apps get it wrong all the time, so a quick daily review keeps your data accurate. It also gives you a near real-time look at your spending. For a deeper dive into making sense of all those line items, our guide on how to read a bank statement in minutes is a huge help.

Managing Irregular Income and Expenses

One of the biggest reasons people give up on tracking expenses is because life gets messy. A fluctuating income or a big, unexpected bill can make a perfectly organized system feel chaotic and pointless. But a good system is actually designed to handle exactly that kind of unpredictability.

For Irregular Income (Freelancers, Commission-Based Roles):

- First, get a crystal-clear picture of your baseline living expenses. This is the bare minimum you need to cover your essential costs each month.

- When a payment comes in, immediately move money into separate accounts for taxes, those essential expenses, and your savings goals.

- Whatever is left over is your discretionary spending fund for that period. This strategy creates a sense of stability even when your income is all over the place.

For Irregular Expenses (Annual Subscriptions, Car Repairs):

- List out these periodic costs and estimate what they’ll cost you over a year.

- Divide that total by 12. This is your monthly savings target for these expenses.

- Set up an automatic transfer for that amount into a dedicated savings account—people often call this a “sinking fund.” When the bill finally arrives, the money is just sitting there waiting. No panic, no disruption to your regular monthly budget.

When you build a system that anticipates and plans for these real-world financial situations, tracking stops feeling like a reactive chore. It becomes a proactive tool that puts you in control of your money, paving the way for more security and freedom.

Turning Your Spending Data into Smarter Financial Decisions

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

The whole point of tracking expenses isn’t just to have a long list of what you’ve spent. That’s only half the battle. The real magic happens when you turn that raw data into genuine insight. It’s about transforming numbers on a page into a clear story about your financial life—a story that helps you make much better decisions down the road.

This is where you stop being a bookkeeper and start being a strategist for your own money. The goal isn’t to beat yourself up over every coffee purchase. It’s to spot the meaningful patterns that can guide your choices and get you to your financial goals faster.

Your Most Important Financial Habit: The Monthly Review

Your most powerful tool here is the monthly review. Set aside a little time—even just 30 minutes is enough—to sit down with your numbers and ask some simple questions. This single habit is what keeps expense tracking from feeling like a chore and turns it into an active planning session.

Here’s how I like to approach my own review:

- Tally the Categories: First things first, get the final score. How much did you actually spend on ‘Groceries,’ ‘Transport,’ and ‘Subscriptions’?

- Spot the Big Three: Which three categories ate up the most cash? This immediately tells you where your money is really going.

- Look for Surprises: Was anything unexpectedly high or low? Maybe that ‘Dining Out’ category crept up without you realizing it. Or maybe you spent less on ‘Shopping’ than you thought.

- Celebrate the Wins: Did you nail your budget in a certain area? Give yourself credit! Acknowledging success is key to staying motivated.

This quick check-in moves you past a single scary spending total. It’s the difference between knowing you spent £3,000 and understanding that £600 of that went to food, which gives you something concrete to work with.

Don’t Skip This Step: Reconciling Your Accounts

Before you can trust your analysis, you have to trust your data. That’s where reconciling comes in. It’s just a fancy word for making sure the numbers in your tracking system match what’s on your actual bank and credit card statements. This crucial step confirms you haven’t missed anything.

If your spreadsheet says you spent £2,850 but your bank statement shows £2,900 left your account, you’ve got a £50 mystery to solve. It could be a forgotten cash withdrawal, a typo, or even a fraudulent charge. Reconciling gives you confidence that you’re making decisions based on the real picture.

Analyzing your spending data isn’t about creating guilt. It’s about asking a simple, powerful question: “Does where my money went this month reflect what I truly value?”

Asking the Right Questions to Actually Change Things

With accurate, categorized data in hand, the real work begins. This isn’t about complicated spreadsheets; it’s about getting curious. Let’s say you discover your ‘Dining Out’ category was way higher than you expected.

Instead of just vaguely vowing to “spend less next month,” dig a little deeper:

- What was the context? Was it a few expensive celebration dinners or a dozen quick lunches grabbed on the go?

- What was the trigger? Did you eat out because you were tired, because you were meeting friends, or just out of habit?

- Was it worth it? Did that spending bring you real joy, or was it just mindless?

Answering these questions gives you a specific problem to solve. If convenience was the issue, maybe planning some meals ahead of time is the fix. If it was all social, perhaps suggesting a get-together at home is a better option for next time. This is so much more effective than a fuzzy, non-committal goal.

This level of review is just as critical for a small business as it is for a household budget. In fact, in corporate settings, up to 71% of finance leaders report struggling with expense compliance when relying on manual processes, partly because they lack this kind of real-time clarity. You can find more business expense management trends on expenseout.com. By analyzing your own data, you’re giving yourself the kind of visibility that even big companies are still chasing.

Common Expense Tracking Mistakes and How to Sidestep Them

Getting started with expense tracking is a huge win for your financial health. But I’ve seen it time and time again: people kick off with a ton of enthusiasm, only to lose steam a few weeks later. It’s rarely a lack of willpower. More often than not, they’ve fallen into a few common, and totally avoidable, traps.

Knowing what these pitfalls are before you start can make all the difference. It’s what separates a system that sticks from one that gets tossed aside. Let’s walk through them so you can build a setup that actually works for you in the long run.

The Overly Complicated Category Trap

One of the biggest mistakes I see is getting way too granular with categories right out of the gate. Starting with 50 different spending buckets—separating “lattes” from “drip coffee” or “work lunches” from “weekend brunches”—is a recipe for burnout. You’re just creating a mountain of administrative work for yourself.

That level of detail might seem smart, but it quickly becomes a huge pain. You’ll end up spending more time deciding how to classify a £5 purchase than you will actually learning from your habits. Before you know it, tracking feels like a chore you dread, and you just stop.

The Solution:

Keep it simple, especially at first. Kick things off with just a handful of broad categories that cover the big pillars of your life. You can always get more detailed later, once the core habit is locked in.

- Housing: Rent or mortgage, council tax, utilities, insurance—anything to keep a roof over your head.

- Transportation: Fuel, public transport passes, car payments, insurance.

- Food: For now, lump groceries and dining out together. Just get it tracked.

- Personal Spending: This is for the fun stuff—hobbies, entertainment, clothes.

- Savings & Debt: All your loan payments and contributions to savings accounts or investments.

This streamlined approach makes logging your spending quick and painless, which is exactly what you need to build momentum.

Letting Small Cash Purchases Slide

“It’s just a few quid, it doesn’t matter.” Sound familiar? This mindset is a silent budget killer. That single coffee or snack might not seem like a big deal, but those little cash purchases add up to a shocking amount by the end of the month.

When your tracked numbers don’t line up with what’s leaving your bank account, you start losing faith in the whole system. It creates a gap in your data that makes you feel like the entire picture is incomplete, so why bother? This is precisely why learning how to track expenses with accuracy is so critical for sticking with it.

The goal of expense tracking is not perfection, but awareness. Don’t let the fear of missing a small purchase stop you from tracking the big ones. Consistency over time is what truly matters.

The Cycle of Spending Guilt

This one might be the most destructive mistake of all. You track everything perfectly, sit down to review it, and are hit with a wave of guilt or shame. You beat yourself up over that new book you bought or the fancy dinner you enjoyed with friends.

This emotional reaction turns a neutral, helpful tool into a source of anxiety. Once tracking gets tied to negative feelings, your brain will naturally want to avoid it. You stop logging purchases to dodge the guilt, and the whole system crumbles.

The Solution:

You have to reframe what tracking is for. It isn’t a tool to judge yourself with; it’s a tool for information. Your spending data is just that—data. It’s a non-judgmental report on your past actions that gives you the power to make different choices in the future, if you want to. See every transaction as a data point, not a moral report card. This mindset shift is everything if you want to build a sustainable and positive relationship with your money.

Common Expense Tracking Questions, Answered

Once you start digging into your spending, a few practical questions almost always pop up. Getting these sorted out early can be the difference between creating a habit that sticks and getting frustrated and quitting.

Let’s tackle some of the most common hurdles you’ll face. Think of this as your cheat sheet for the real-world challenges of tracking your money.

How Long Should I Track My Expenses Before Making a Budget?

My advice? Give it at least one to three months. A single month is a start, but a full three-month period gives you a much more honest look at where your money is actually going.

Why so long? Because it helps you catch all those irregular expenses that can totally derail a budget built on just one month of data. I’m talking about things like:

- Annual subscriptions (like Amazon Prime)

- Quarterly utility bills

- Car insurance payments

- Occasional gifts or travel

Tracking for a longer stretch smooths out these spending spikes and lets you calculate a true monthly average. This gives you a rock-solid foundation for a budget you can actually live with, instead of one that feels impossible from day one.

A budget built on guesswork is destined to fail. A budget built on three months of honest expense tracking is a roadmap for success. It replaces assumptions with facts, giving you the clarity needed to plan effectively.

What Is the Best Way to Track Shared Expenses With a Partner?

When you’re sharing finances, clarity and communication are king. The best system is simply the one you both agree on and will actually use.

For shared bills like rent, groceries, and utilities, an app like Splitwise is a lifesaver. It’s designed specifically for this, letting you log who paid for what and making it incredibly easy to see who owes who.

If you prefer a DIY approach, a shared Google Sheet is a fantastic free alternative. You can set up columns for the date, item, cost, who paid, and how it’s split. The most crucial part? Sit down together and decide on the system before you start. A little planning upfront prevents a lot of headaches and arguments later.

How Can I Effectively Track Expenses With an Irregular Income?

This is a big one for freelancers, commission-based workers, and small business owners. When your income is a rollercoaster, a traditional fixed budget just doesn’t work. The trick is to shift your mindset from budgeting to managing your baseline costs.

First, track your spending for a few months to nail down the absolute minimum you need to cover your non-negotiables—rent, food, utilities, etc. This number is your baseline. From there, adopt a “pay yourself first” strategy. Every time a payment comes in, immediately move money into separate accounts for taxes, savings, and that baseline amount.

Whatever is left over is what you have for discretionary spending. This system creates a buffer and ensures your most important bills are always covered, bringing a sense of stability even when your income is all over the place.

Ready to put this advice into practice? The path to financial control begins with this one simple habit. At Collapsed Wallet, we offer the tools and insights you need to build that foundation. Check out our other resources and keep building a stronger financial future. Learn more at https://collapsedwallet.com.

4 thoughts on “How to Track Expenses A Guide to Financial Clarity”