Table of Contents

- What Frugal Living Really Means for Your Finances

- Shifting Your Money Mindset from Scarcity to Strategy

- Building Your First Frugal Spending Plan

- Cutting Costs on Your Biggest Expenses

- Using Technology to Automate Your Savings

- Common Frugal Living Mistakes to Avoid

- A Few Common Questions About Frugal Living

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Frugal living has a bit of a PR problem. Many people hear the word and immediately picture a life of extreme deprivation—no lattes, no fun, just endless penny-pinching. But that’s not what it’s about at all. Real frugality is about being intentional. It’s about taking control of your money and making sure it goes toward the things that genuinely matter to you, whether that’s financial independence, escaping financial worries, or simply more freedom.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of yourself as the captain of a ship. You’re not just frantically plugging leaks; you’re carefully charting a course to your destination, using your resources wisely to get there. It’s a shift from reacting to your bills to proactively building the life you want, moving you closer to achieving financial freedom.

What Frugal Living Really Means for Your Finances

Let’s clear up the biggest misconception right away: frugality is not the same as being cheap. They come from completely different mindsets and have different impacts on your long-term financial goals.

Being cheap is all about the price tag, period. It’s buying the absolute least expensive option, often without thinking about quality or how long it will last. Frugality, on the other hand, is about resourcefulness and getting the best value. A frugal person asks better questions.

Instead of asking, “What’s the cheapest?” they ask, “What’s the smartest use of my money for my goals?” This one change in perspective turns money from a source of anxiety into a powerful tool. It’s the difference between buying flimsy $20 shoes that fall apart in a few months and investing in a well-made $100 pair that lasts for years. The cheap option costs more in the long run and moves you further away from your financial freedom goals.

The Core Philosophy of Frugality

At its heart, frugal living is simply mindful consumption. It’s about creating a moment of pause before you buy something to ask yourself if it truly adds value to your life or gets you closer to where you want to be financially. This habit is your best defense against impulse buys and helps you channel your cash toward what’s truly important.

Millions of people around the world practice a form of frugality out of pure necessity. It’s estimated that 40-50% of the global population lives on an income below the upper-middle-income poverty line, as defined by the World Bank. There’s a powerful lesson we can learn from this reality: track your expenses. Studies have shown that the simple act of writing down where your money goes can help you cut unnecessary spending by 20-30% in the very first month. It shines a bright light on all those little financial leaks you never knew you had. You can dig into more global income and poverty data from Our World in Data.

Benefits Beyond Your Bank Account

While saving money is the most obvious perk, the real rewards of a frugal lifestyle go much deeper. It’s a path to genuine financial freedom and a calmer state of mind.

Here are a few of the key benefits people experience:

- Reduced Financial Stress: There’s an incredible peace of mind that comes from knowing you’re in control of your finances, not the other way around.

- Increased Financial Security: Having an emergency fund and growing savings acts as a safety net for whatever curveballs life throws your way.

- Faster Goal Achievement: Saving for a house, paying off debt, or investing for retirement happens so much faster when you’re directing your money with purpose.

- Greater Personal Freedom: When you aren’t buried under debt or living paycheck to paycheck, you open up a world of choices for your career, your lifestyle, and your future.

Ultimately, learning to live frugally isn’t about cutting back on everything. It’s about building a strong, sustainable financial foundation that supports the life you actually want to live.

Shifting Your Money Mindset from Scarcity to Strategy

Before we dive into the nuts and bolts of frugal living, we need to talk about what’s happening between your ears. Getting good with money starts in your mind, long before it ever shows up in your bank account.

The real secret is moving from a scarcity mindset to a strategy mindset. A scarcity mindset fixates on what you’re giving up or cutting back. It feels like a loss. A strategy mindset, on the other hand, celebrates what you’re gaining—control, freedom, and a future you’re actively building.

Think about it this way: when you cancel a subscription you barely use, you’re not “losing” access to it. You’re redirecting that cash into your freedom fund. This simple reframe turns saving from a painful chore into an act of empowerment. Suddenly, it’s not about deprivation anymore. It’s about consciously pointing your money toward the things that actually matter to you.

Redefining Your Relationship with Money

One of the biggest mental shifts is changing the questions you ask yourself before you pull out your wallet. Most of us are stuck in a simple, dangerous loop, asking just one thing: “Can I afford this?” If the money’s there, the answer is usually yes, and that’s how we end up with purchases that don’t really serve us.

A strategic mindset asks a much better, more powerful question: “Is this the best use of my money to get me closer to my goals?”

This one question changes everything. It forces you to weigh the fleeting thrill of a purchase against the deep, lasting satisfaction of being debt-free or putting a down payment on a home. It makes every single pound work for you, not against you.

“Frugality is not about stinginess. It’s about efficient consumption and not thoughtlessly wasting material resources. When such an action also saves me money, I appreciate it. But it’s not the point.”

This perspective turns frugality into a game of optimization. You’re not just mindlessly cutting costs; you’re maximizing the value and impact of every pound you spend, making sure it lines up with the life you’re trying to build.

Overcoming Common Mental Hurdles

Let’s be honest, adopting this new way of thinking isn’t always a walk in the park. Modern life is designed to make us spend, and a few common psychological traps can trip up even the most well-intentioned person. Knowing what they are is the first step to beating them.

- Fear of Missing Out (FOMO): Your social media feed is a highlight reel of fancy holidays, new gadgets, and nights out. It creates an intense pressure to keep up and can easily trigger impulse spending just so you don’t feel left behind.

- Societal Pressure: We’re constantly fed the message that success looks like a new car or a designer handbag. Pushing back against that requires a really strong sense of your own values and what you truly want.

- Decision Fatigue: Making hundreds of small choices about money every single day is draining. This is precisely why building solid habits and automating your finances is a game-changer for staying on track long-term.

Cultivating Financial Resilience and Confidence

Think of your strategic money mindset as a muscle. The more you use it, the stronger it gets, and eventually, making conscious spending decisions becomes your default setting.

You don’t have to go all-in at once. Start small and celebrate the wins. Managed to walk away from an impulse buy? Fantastic. Immediately transfer the money you would have spent into your savings account and give yourself a mental high-five. Found a clever way to get something you needed for less? Acknowledge your own resourcefulness.

This kind of positive reinforcement is what builds momentum and real confidence.

Ultimately, getting your head in the right place is the foundation for everything else. It makes all the practical tips and tricks sustainable because you’re being driven by a positive vision for your future, not by a negative feeling of lack in the present. This is how you escape the cycle of money worries and start building real, lasting financial freedom.

Building Your First Frugal Spending Plan

Alright, this is where the theory stops and the real work begins. We’ve talked about the mindset behind frugal living, but putting it into practice with a solid spending plan—what most people call a budget—is how you actually start making progress.

Think of it less as a set of rules designed to restrict you and more like a roadmap. A good budget doesn’t just tell you where your money can’t go; it gives every pound a specific job to do, making sure your cash is actively working toward the life you want.

First, Figure Out Your Cash Flow

Before you can tell your money where to go, you have to know where it’s going right now. This is hands-down the most important first step, and you can’t skip it.

For one month, track every single penny. Use a simple notebook, a note on your phone, or your bank’s app—the tool doesn’t matter, but consistency does. This isn’t about making yourself feel bad about your past spending. It’s about gathering the raw data you need to make smarter choices from here on out.

Set Clear Financial Goals That Actually Motivate You

Once you have a clear picture of your spending, you can start being intentional. Vague goals like “save more” are pretty useless because they’re hard to get excited about and even harder to track. You need specific, actionable targets that light a fire under you.

- Build a Starter Emergency Fund: Your first goal should be to save £500. This small cushion is a game-changer, covering unexpected costs without blowing up your entire financial plan.

- Attack High-Interest Debt: Got a credit card with a painful 21% APR? Make that your prime target. Create a plan to throw extra cash at it until it’s gone.

- Save for Something Real: Whether it’s a down payment, a certification course, or a long-term investment, having a tangible goal makes it so much easier to say no to random purchases.

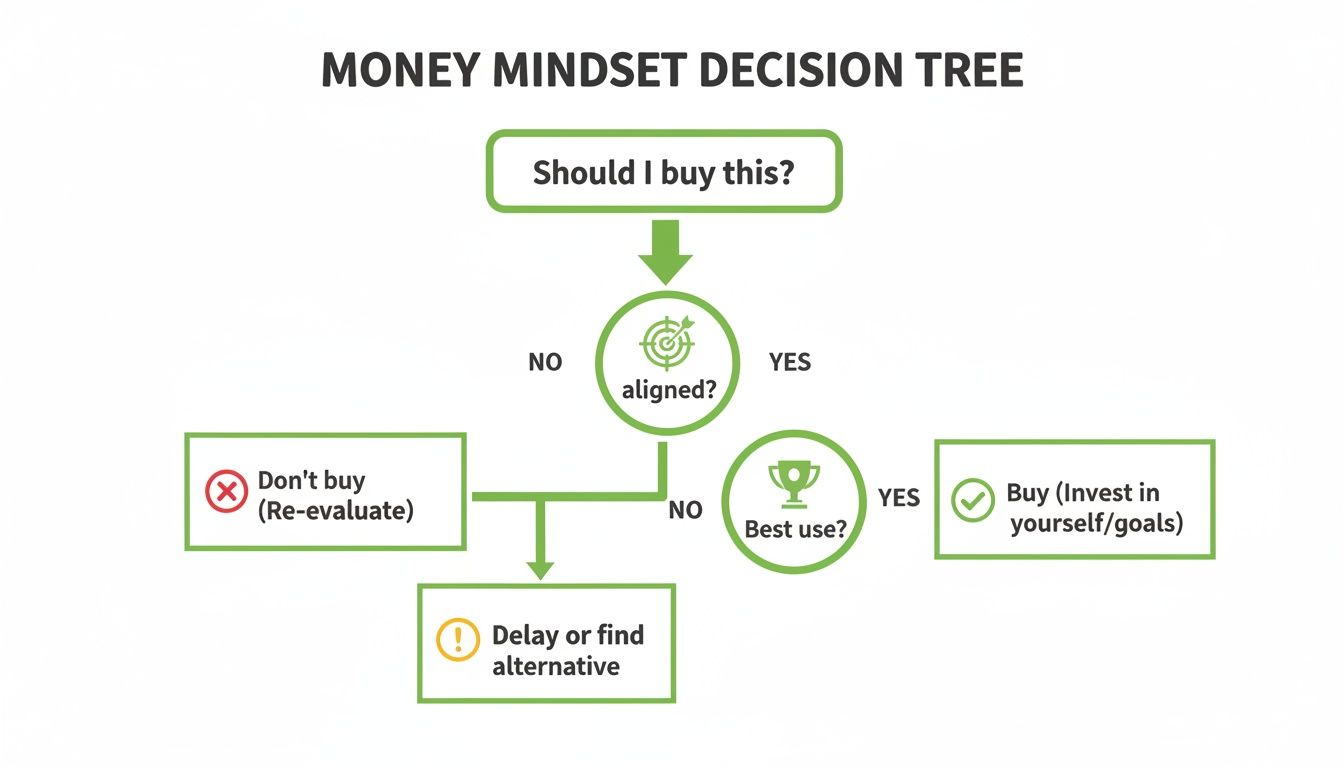

This little decision-making flowchart is a great tool for your day-to-day spending. It forces you to pause and connect your purchases back to your big-picture goals.

Simply asking, “Does this purchase get me closer to my goals?” can completely reframe how you view your money. It shifts you from being a reactive spender to a strategic one.

Choose a Budgeting System You Can Actually Stick With

The best budget in the world is useless if you hate using it. The key is finding a system that clicks with your personality. If you don’t, you could be part of the average household that wastes 20-30% of its income on impulse buys and forgotten subscriptions. With rising costs pressuring 81% of people worldwide, this is money you can’t afford to lose. The good news? People who start using tracking apps often cut their discretionary spending by 25% in just a few weeks.

Finding the right system is a personal journey, but here’s a quick look at a few popular methods to get you started.

Choosing Your Beginner Budgeting Method

There are plenty of ways to track your money, and what works for your friend might not work for you. This table breaks down a few popular options to help you find a good starting point based on your habits and goals.

| Method | Best For | Key Benefit |

|---|---|---|

| The 50/30/20 Rule | Beginners who want simplicity and clear guidelines. | Easy to understand and implement without meticulous tracking. |

| Digital Envelope System | Those who want strict control over spending categories. | Prevents overspending by allocating cash to digital “envelopes.” |

| Automated Budgeting Apps | Tech-savvy users who prefer convenience and automation. | Automatically tracks spending and categorizes transactions for you. |

Don’t be afraid to experiment. If one system feels like a chore, ditch it and try another. For a more detailed walkthrough, check out our guide on budgeting tips for beginners.

Ultimately, the goal is to find a method that reduces your financial stress, not one that adds to it. A well-chosen spending plan is your most powerful tool for building a more secure and intentional financial life.

Cutting Costs on Your Biggest Expenses

If you want to make a real dent in your savings goals, you have to think bigger than just skipping your morning latte. The biggest wins in frugal living almost always come from tackling your largest expenses head-on. For most of us, that means housing, transportation, and utilities.

This isn’t about depriving yourself; it’s about being smart and strategic. A few thoughtful changes in these areas can free up more cash than a hundred tiny cuts elsewhere. It’s how you put your major financial goals on the fast track.

Optimizing Your Housing Costs

For the vast majority of people, the roof over their head is their single biggest monthly bill. While moving to a cheaper city is a massive step, there are plenty of powerful ways to lower this cost right where you are.

One of the best tools I’ve found for this is a simple mortgage overpayment calculator. These free online tools show you the truly staggering amount of interest you can save by paying just a little extra each month. Kicking in an extra £100 a month might not sound like much, but it can literally shave years off your loan and save you thousands in the long run.

Another smart play is investing in energy efficiency. Yes, things like better insulation or installing solar panels have an upfront cost. But think of it as prepaying for future energy savings—a classic frugal move that prioritizes long-term value over short-term spending.

Rethinking Transportation Expenses

That car in your driveway? It feels like a necessity, but it’s absolutely critical to understand what it’s really costing you. It’s so much more than the monthly payment. You have to factor in:

- Fuel: The obvious one, and it can swing wildly.

- Insurance: A huge yearly or monthly cost that varies from one provider to the next.

- Maintenance and Repairs: From routine oil changes to that unexpected breakdown, it all adds up.

- Depreciation: This is the silent killer—the value your car loses every single day you own it.

Take a moment to calculate the total cost of ownership for your vehicle. Now, compare that number to the alternatives. Could you use public transport, cycle, or use a car-sharing service for those occasional trips? You might be shocked to find you could save thousands a year by going down to one car or simply using yours less.

The goal isn’t just to find a cheaper way to get from A to B. It’s to reclaim the money tied up in a depreciating asset and redirect it toward assets that grow, like investments or debt reduction.

And please, do yourself a favor: shop around for car insurance every single year. Insurers count on you not bothering, and loyalty rarely pays off. A few minutes on a comparison site can lead to some seriously significant and immediate savings.

Taking Control of Utility Bills

Gas and electricity bills are another one of those big expenses where you have more control than you think. The energy market is always shifting, and the great deal you signed up for last year is probably not so great anymore.

First, you need to know your numbers. Look at your recent bills to understand how much energy you use and when you use it. This information is power. Armed with that data, you can find a tariff that actually fits your life. Many companies offer cheaper rates for off-peak usage, so if you can run the dishwasher or washing machine late at night, you could see some real savings.

Make it a habit to use energy comparison websites regularly. Switching providers is usually a painless process that can immediately lower your monthly bills without you having to change a single habit. It’s one of the quickest wins you can get.

Strategizing Your Grocery Spend

Food is a universal budget-buster, and it’s only gotten tougher with recent global events. A 2023 IMF report pointed out how supply chain chaos caused food prices to spike, with some places seeing average jumps of 24%. This squeeze has pushed more people to get savvy, with 30% of frugal adopters now using strategies like bulk buying to fight back against inflation. You can see the bigger picture of these economic trends in the IMF’s full report.

While we won’t get into specific recipes here, the financial strategy behind your food shop is crucial. For a much deeper dive into practical tips you can use at the supermarket, check out our guide on how to save money on groceries. The most important takeaway is this: planning is everything. Knowing exactly what you need before you walk into the store is your single best defense against those impulse buys that destroy a budget.

Using Technology to Automate Your Savings

Let’s be honest: one of the hardest parts of living frugally is just sticking with it. Motivation comes and goes, and it’s easy to get tired of making conscious decisions about every single penny. This is where technology becomes your secret weapon.

Think of it as putting your savings on autopilot. By using a few smart apps and tools, you can build good financial habits directly into your routine, no constant effort required. This system works quietly in the background, making sure you’re always moving toward your goals.

The idea is to set up a network of tools that tracks your spending, finds savings opportunities, and moves money for you. This frees you up from the small stuff so you can focus on the big picture.

Automated Budgeting and Tracking Apps

You can’t manage what you don’t measure. While a pen and paper or a spreadsheet can work, they’re a hassle to keep up with. This is where modern budgeting apps completely change the game.

These apps connect securely to your bank and credit card accounts, automatically pulling in and categorizing everything you spend. Suddenly, you have a real-time, crystal-clear picture of your financial life without typing in a single transaction. You can see exactly where your money is going and spot areas to cut back. If you’re looking for a place to start, checking out some of the best free budgeting apps can help you find a perfect fit.

By letting an app handle the tedious tracking, your job shifts from bookkeeper to strategist. Instead of logging receipts, you’re using that time to make smart decisions based on the data in front of you.

This simple shift is a huge deal for frugal living for beginners because it gets rid of the most boring part of the process.

Micro-Saving and Round-Up Tools

Beyond just tracking, technology can help you save money in such small amounts you barely even notice it. These are often called micro-saving apps, and they’re brilliant for building savings without feeling the pinch.

A really popular feature is the “round-up.” Every time you buy something, the app rounds the purchase up to the nearest pound and sends the spare change to a separate savings or investment account. Your £2.50 coffee becomes a £3 transaction, and that extra 50p is automatically saved for you.

Fifty pence here and there might not seem like much, but it adds up surprisingly fast over a year. It’s a completely passive way to build an emergency fund or even dip your toes into investing, turning your daily spending into a savings habit.

Smart Shopping and Bill Comparison Tools

The last piece of the puzzle is using tech to make sure you’re not overpaying for anything. This is all about cutting down on your outgoing expenses.

- Browser Extensions: Install one of these and forget about it. When you’re shopping online and get to the checkout, it will automatically hunt for coupon codes and apply the best one to your order. It’s free money for zero effort.

- Price Comparison Websites: Before you renew your car insurance, switch energy providers, or sign up for a new phone plan, always use a comparison site. They let you see all the available deals side-by-side, guaranteeing you find the best rate.

Setting these tools up takes a little bit of time upfront, but they pay you back over and over again. By creating this automated financial system, you build a safety net that consistently improves your finances, turning frugal living from a daily chore into a natural part of your life.

Common Frugal Living Mistakes to Avoid

Starting a frugal lifestyle is exciting. It feels like you’re finally taking control of your money. But that initial burst of energy can quickly fade if you fall into a few common traps. Think of this as a marathon, not a sprint. Knowing what these pitfalls are ahead of time is the best way to sidestep them and build a financial plan that actually lasts.

The whole point of living frugally is to find a healthy balance, not to punish yourself. It’s about making smart, conscious choices that line up with what you truly value. Let’s look at a few classic mistakes so you can make sure your journey toward financial freedom is both successful and, believe it or not, enjoyable.

Mistaking Frugality for Deprivation

This is the big one. It’s the number one reason people throw in the towel. They think frugal living for beginners means a life of misery, cutting out every single thing that brings them a little joy. That all-or-nothing approach just doesn’t work long-term. You’ll end up with “frugal fatigue”—a feeling of being so worn down and deprived that you eventually snap and go on a huge spending spree to make up for it.

The fix? Plan for things you enjoy. Seriously. Build treats and a bit of wiggle room right into your budget. Frugality isn’t about constantly telling yourself “no.” It’s about being able to say a guilt-free “yes” to the things that genuinely matter to you. Set aside a specific amount of cash each month for a hobby or whatever makes you happy. This is what keeps you in the game.

Setting Vague or Uninspiring Goals

“I want to save more money.” It sounds sensible, but it’s a terrible goal. Why? Because it has no heart. Saving money just for the sake of it is a chore, and it’s nearly impossible to stick with a chore when a tempting purchase pops up. A goal without a powerful “why” behind it will crumble at the first sign of pressure.

You have to get specific. Make it real. Instead of that vague wish, try something like, “I’m going to save £500 for a starter emergency fund by the end of next month.” Or, “I’m going to wipe out that £1,200 on my credit card in the next six months.” See the difference? These goals have a finish line. Every pound you save becomes a concrete step toward something real and meaningful.

A key mindset shift is viewing saving not as a restriction on your present, but as a direct investment in your future freedom and security.

Obsessing Over Every Penny

Look, tracking your spending is vital when you’re just starting. You need to know where your money is going. But there’s a fine line between awareness and obsession. If you find yourself spending hours agonizing over a £2 purchase or tracking every last coin, you’ve gone too far. It creates a ton of anxiety and can make you so tired of the whole process that you just give up.

The goal here is awareness, not accounting perfection. Let technology do the heavy lifting for you—budgeting apps are brilliant for this. Once you have a good picture of your main spending categories, put your energy where it counts. Focus on the big wins, like your housing, transport, and utility costs. That’s where you’ll see massive savings. Don’t sweat the small stuff. Just focus on making steady progress, and you’ll get there.

A Few Common Questions About Frugal Living

Starting down a new path always brings up a few questions. When it comes to embracing a more frugal lifestyle, a few common worries tend to surface as people start to rethink their relationship with money.

Getting these cleared up from the start can help you set realistic expectations and keep your motivation high for the long run. Let’s tackle the questions I hear the most.

How Long Does It Take to See Results?

You’ll see small wins almost immediately. The second you cancel that subscription you forgot about, you’ve kept money in your pocket. That’s an instant result.

The big, life-altering changes, though? Paying off a mountain of debt or hitting your first $10,000 in savings—those take time and consistency. Think of it as a marathon, not a sprint. Real financial progress is built on hundreds of small, intentional choices stacking up over months and years.

Can I Still Enjoy Life While Living Frugally?

Yes, absolutely. This is probably the single biggest myth about being frugal. It’s not about depriving yourself; it’s about intentional spending.

Frugality is really about giving yourself permission to spend generously on the things that truly matter to you by being ruthless about cutting costs on the things that don’t. It’s about making sure your spending actually lines up with what brings you joy.

Frugality is your ticket to defining what a rich life looks like on your terms, instead of letting advertisers and social media dictate how you should spend your money to be happy.

What Is the Most Impactful First Step for a Beginner?

Hands down, the most powerful thing you can do to start is to track your expenses for one full month. That’s it. Don’t try to change a single habit or judge your spending—just watch and record where every dollar goes.

This one simple act is like flipping on the lights in a dark room. It shows you the reality of your cash flow and makes it painfully obvious where the easiest savings opportunities are hiding. This is the raw data you need to build a budget that actually works for you.

Ready to turn these ideas into action and build real financial security? At Collapsed Wallet, we’re all about giving you the practical guides and straightforward advice you need to take back control. Find more clear strategies by visiting https://collapsedwallet.com.