Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

At its core, your debt to income ratio (DTI) is a simple concept. It’s the percentage of your monthly income that goes toward paying off your debts. Lenders look at this one number to get a quick snapshot of your financial health, and it heavily influences whether they’ll approve you for a new loan.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Breaking Down the DTI Formula

So, how do you actually figure this out? It’s just one simple calculation, but it’s one of the most powerful numbers in your financial life.

Calculating your DTI gives you the same vantage point a lender has. It lets you see your finances through their eyes, which is incredibly valuable when you’re getting ready to apply for a mortgage, a car loan, or even a new credit card. It tells you where you stand before you even walk in the door.

The Simple Math Behind Your DTI

The formula isn’t nearly as intimidating as it sounds. Here’s all there is to it:

(Total Monthly Debt Payments ÷ Gross Monthly Income) x 100 = DTI Ratio (%)

Let’s run through a quick example. Imagine your monthly debt payments—things like your car note, student loan, and credit card minimums—add up to $1,500. Now, let’s say your gross monthly income (that’s your pay before taxes and other deductions) is $5,000.

Plugging those numbers in, we get: ($1,500 ÷ $5,000) x 100 = 30%.

Your DTI is 30%. In plain English, this means for every dollar you earn, 30 cents is already spoken for by your existing debt.

What Counts as Debt and Income?

The trickiest part of this whole process is just making sure you’re using the right numbers. Not every bill you pay counts as a “debt” in the eyes of a lender, and not all money you receive is considered stable “income.”

Getting this part right is absolutely critical for an accurate calculation.

Here’s a general guide to help you sort your finances into the right buckets:

| Category | What You Should Include | What You Can Exclude |

|---|---|---|

| Monthly Debt Payments | Mortgage or Rent Payments, Car Loans, Student Loans, Personal Loans, Alimony/Child Support, Minimum Credit Card Payments | Groceries, Utility Bills (Gas, Electric), Cell Phone Bills, Car Insurance, Streaming Subscriptions |

| Gross Monthly Income | Your Salary (before taxes), Freelance Income, Regular Bonuses/Commissions, Alimony/Child Support Received, Pension or Social Security | One-time cash gifts, Expense reimbursements from work, Money from family, Unrealized stock market gains |

This table should give you a solid starting point for gathering your documents. Up next, we’ll dig into why lenders place so much importance on this metric and walk through a more detailed checklist so you can be confident you haven’t missed a thing.

Why Lenders Care So Much About Your DTI

Ever wonder what lenders are really looking at when they pull your file? While your credit score gets all the attention, your debt-to-income (DTI) ratio is the number that often tells them the most important part of your story: can you actually afford to take on new debt?

To a lender, DTI isn’t just another box to check. It’s their go-to risk assessment tool.

When you apply for a loan—whether it’s for a house, a car, or something else—the lender’s core question is always the same: “Can this person reliably make the monthly payments?” Your DTI gives them a straightforward answer. A high ratio is an immediate red flag, suggesting your income is already stretched thin. Adding another payment could push you over the edge.

On the flip side, a low DTI paints a picture of financial stability. It tells them you manage your money well, which makes you a much more appealing, lower-risk customer in their eyes.

The Magic Numbers Lenders Look For

Lenders live by specific DTI benchmarks to quickly sort through applications. While the exact numbers can shift from one institution to another, there are some widely accepted standards you should know.

Most lenders consider a DTI ratio below 36% to be the sweet spot. It shows a healthy balance between what you earn and what you owe.

When you’re trying to get a mortgage, it gets a bit more specific. Lenders often break DTI into two parts:

- Front-End Ratio: This looks only at your future housing expenses (the new mortgage payment, property taxes, and homeowners insurance). Lenders typically want this to be 28% or less.

- Back-End Ratio: This is the big one. It includes your new housing payment plus all your other existing monthly debts, like car loans, student loans, and credit card minimums.

The absolute ceiling for most conventional mortgages is a back-end DTI of 43%. This is the highest a borrower can typically have to get a Qualified Mortgage, a type of loan with safer features. However, government-backed programs like FHA loans can be more flexible, sometimes allowing a DTI as high as 50% if you have other strong factors like a high credit score or significant savings.

A Lesson Learned from the Financial Crisis

This intense focus on DTI isn’t arbitrary. Its importance was burned into the financial industry’s playbook after the 2007-2008 global financial crisis. During the housing boom, lending standards were dangerously loose, and many people were approved for mortgages with sky-high DTI ratios they couldn’t sustain.

When that bubble burst, the fallout was catastrophic. Since then, regulators and lenders have made DTI a non-negotiable part of the process. It’s a critical guardrail designed to protect both you from getting in over your head and the entire financial system from instability. You can see how dramatically household debt has shifted over the years in this global household debt timeline on Statista.

The Real-World Impact of Your DTI

Your DTI ratio directly affects what you can and can’t do financially. It’s not just about getting a “yes” or “no” on a loan—it shapes the very terms of the deal you’re offered.

A high DTI can slam several doors shut:

- Outright Loan Denial: If your ratio is too high, many automated underwriting systems will simply reject your application on the spot.

- Higher Interest Rates: A lender might still approve you with a borderline DTI, but they’ll charge you a higher interest rate to compensate for the added risk. On a 30-year mortgage, even a fraction of a percent more can cost you tens of thousands of dollars.

- Less Borrowing Power: Lenders will cap how much they’re willing to give you based on your DTI. This could mean qualifying for a smaller mortgage, a less expensive car, or a lower credit limit than you were hoping for.

Simply put, knowing how to calculate your debt to income ratio puts you back in control. It lets you see your own finances through a lender’s lens and gives you a chance to fix any issues before you apply. This one number holds the key to unlocking better loan offers and reaching your financial goals.

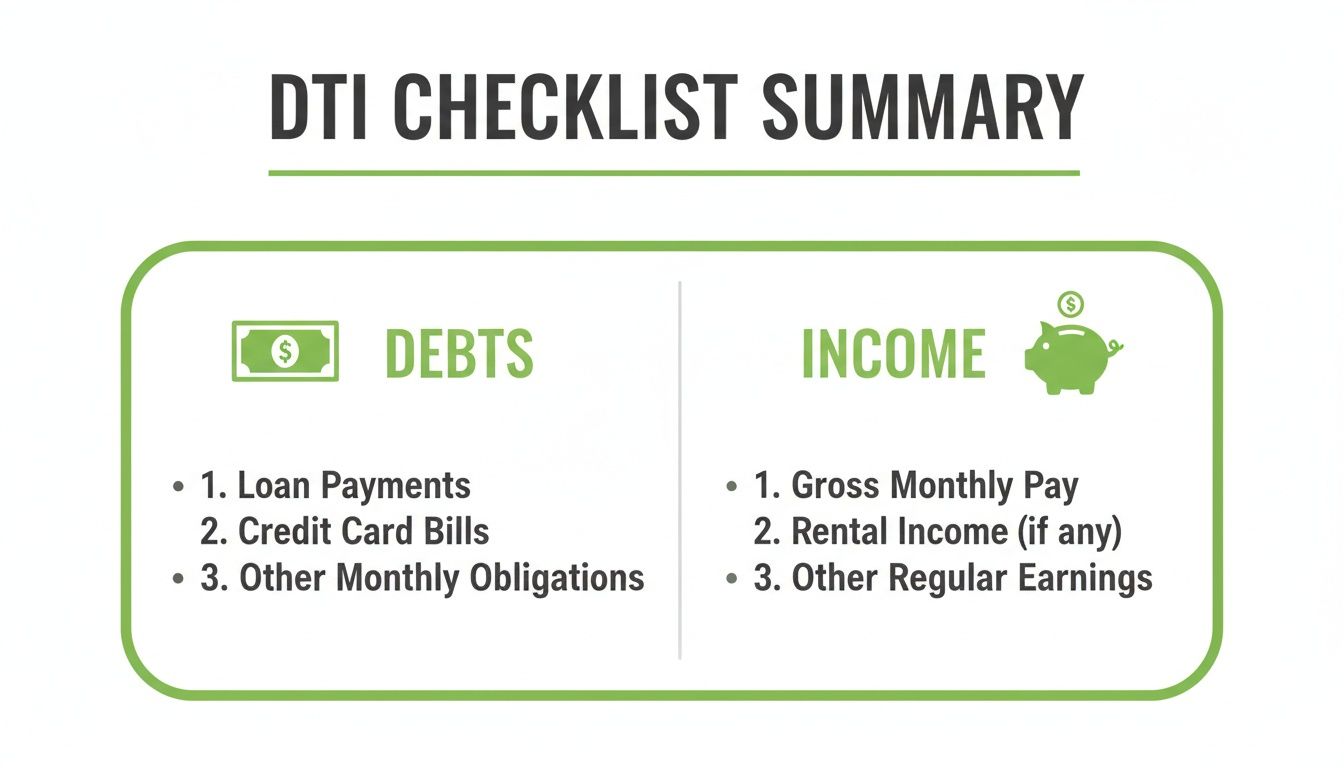

A Practical Checklist for Gathering Your Numbers

Before you can punch numbers into a calculator, you need to know which numbers to use. Calculating your DTI is all about organizing your finances into two simple piles: what goes out each month in debt payments, and what comes in as income.

Getting this right is the most important part of the whole process. Think of it as a quick financial health check—a way to see your cash flow exactly how a lender would. Let’s break down what you need to hunt down for both your monthly debts and your gross income.

Tallying Your Monthly Debt Obligations

First up, let’s nail down the “debt” part of the equation. This isn’t every single dollar you spend. Lenders are only interested in recurring, contractual debts—the kind of payments that show up on your credit report and you’re legally obligated to make.

One of the biggest hang-ups people have is telling the difference between a true debt and a regular living expense. Your Netflix subscription, grocery budget, or power bill? Those are expenses, not debts. Lenders don’t factor those into your DTI.

Here’s exactly what you need to add up:

- Housing Payments: This is your total monthly mortgage payment (Principal, Interest, Taxes, and Insurance—often called PITI) or your rent. It’s usually the biggest piece of the puzzle.

- Car Loans: The full monthly payment for any auto loans.

- Student Loans: Your required minimum monthly payment for all federal and private student loans.

- Credit Card Payments: This is a big one—use the minimum monthly payment listed on your statement, not your total balance.

- Personal Loans: Any monthly payments for loans from banks, credit unions, or online lenders.

- Other Installment Loans: Think furniture, electronics, or anything else you’re paying off over time.

- Court-Ordered Payments: If you pay alimony or child support, these absolutely count.

Pro Tip: Not sure if something counts? Check your credit report. If it’s a loan or line of credit listed there, it almost certainly belongs in your DTI calculation.

Identifying Your Gross Income Sources

Now for the fun part: what you earn. The key here is to use your gross monthly income. That’s your total earnings before a single penny is taken out for taxes, health insurance, or 401(k) contributions.

Why gross? Because it shows a lender your full earning power before life’s deductions, which can vary wildly from person to person.

If you have a steady 9-to-5, finding this number is as easy as looking at a pay stub. It gets a little more involved if you’re a freelancer, work on commission, or juggle multiple jobs. For a better idea of where to look, check out our guide on how to read a bank statement in minutes.

Here are the most common income sources to include:

- Salaries and Wages: Your base salary or hourly pay before deductions.

- Bonuses and Commissions: If you get them consistently, lenders will typically average them out over the past 1-2 years.

- Self-Employment Income: For business owners and freelancers, this is usually based on the net income from your last two years of tax returns, averaged out monthly.

- Rental Income: If you’re a landlord, you can typically include a portion of the rent you receive.

- Alimony or Child Support: Any court-ordered payments you receive regularly.

- Pension, Social Security, or Disability: These stable income sources are always included.

Your DTI Calculation Worksheet

To keep things simple and make sure you don’t miss anything, jot your numbers down in a worksheet like this. It’ll make the final calculation a snap.

| Category | Item (Examples) | Your Monthly Amount ($) |

|---|---|---|

| Debts | Mortgage or Rent | |

| Car Loan Payment | ||

| Student Loan Minimum | ||

| Credit Card Minimum #1 | ||

| Credit Card Minimum #2 | ||

| Personal Loan | ||

| Total Monthly Debts | $ | |

| Income | Gross Salary / Wages | |

| Consistent Overtime/Bonuses | ||

| Self-Employment Income | ||

| Other Income (e.g., Pension) | ||

| Total Gross Monthly Income | $ |

Once you’ve filled in your totals, you have the only two numbers you need. Now you’re ready to plug them into the DTI formula and see where you stand.

Putting DTI to the Test: Real-World Calculations

The formula for debt-to-income is straightforward on paper, but numbers on a page don’t always capture the nuances of real life. The best way to really wrap your head around your own DTI is to see how it plays out in different financial situations.

Let’s walk through three common scenarios. We won’t just do the math; we’ll also look at the final number from a lender’s point of view. Seeing your finances through their eyes is the key to understanding your borrowing power before you ever fill out an application.

Before we jump in, this checklist is a great way to start organizing your own numbers.

Think of it as setting up your workspace—getting your debts on one side and your income on the other is the first step to an accurate calculation.

Example 1: The Single Professional

Meet Alex. He’s a graphic designer with a steady paycheck who is thinking about buying a condo in the next year or two. He wants to know where he stands.

First, let’s round up all of Alex’s monthly debt payments:

- Car Loan: $400

- Student Loan: $250 (just the minimum payment)

- Credit Card Minimum Payment: $75

- Personal Loan (for a new laptop): $100

Adding those up gives us his total monthly debt:

$400 + $250 + $75 + $100 = $825 Total Monthly Debt

Now, let’s look at his income. Alex earns $66,000 a year before taxes. We need his gross monthly income for this calculation.

$66,000 ÷ 12 = $5,500 Gross Monthly Income

With both pieces of the puzzle, we can run the numbers:

($825 ÷ $5,500) x 100 = 15% DTI

What This Means: A 15% DTI is fantastic. To a lender, this screams “low-risk borrower.” It shows Alex has his finances well in hand and has a ton of room in his budget to take on a mortgage. He’d likely be a top-tier candidate for loan approval and could expect to see some very competitive interest rates.

Example 2: The Dual-Income Couple

Next up are Ben and Chloe, a married couple who are getting serious about buying their first home. For them, we need to combine everything—both of their incomes and all their debts.

Here’s a look at their combined monthly payments:

- Ben’s Car Loan: $450

- Chloe’s Car Loan: $350

- Ben’s Student Loans: $300

- Chloe’s Student Loans: $200

- Combined Credit Card Minimums: $250

Let’s get their total monthly debt figured out.

$450 + $350 + $300 + $200 + $250 = $1,550 Total Monthly Debt

On the income side, Ben brings in $4,000 a month and Chloe earns $5,000.

$4,000 + $5,000 = $9,000 Total Gross Monthly Income

Now for the DTI calculation:

($1,550 ÷ $9,000) x 100 = 17.2% DTI

What This Means: With a DTI of 17.2%, Ben and Chloe are in an excellent position. This incredibly strong ratio shows lenders they have massive financial capacity and a healthy cushion. When they apply for that mortgage, this number will open doors to maximum borrowing power and the best rates on the market. If your DTI isn’t quite this low, our guide on how to pay off debt fast has some great strategies.

Example 3: The Self-Employed Freelancer

Finally, let’s look at Maya, a freelance writer. Her income isn’t the same every month, which makes her DTI calculation a bit trickier. Lenders get nervous about fluctuating income, so they need to see a stable history.

For someone like Maya, they’ll almost always ask for the last two years of tax returns to find an average. Let’s say her net income (after writing off business expenses) was $72,000 last year and $84,000 the year before.

First, the bank will average her annual income:

($72,000 + $84,000) ÷ 2 = $78,000 Average Annual Income

Next, they’ll turn that into a monthly figure:

$78,000 ÷ 12 = $6,500 Average Gross Monthly Income

Now we can tally up her monthly debts:

- Student Loans: $500

- Car Loan: $375

- Credit Card Minimums: $150

- Business Loan: $200

Her total monthly debt comes out to:

$500 + $375 + $150 + $200 = $1,225 Total Monthly Debt

With that, we can calculate her DTI based on her averaged income:

($1,225 ÷ $6,500) x 100 = 18.8% DTI

Important Takeaway: If you’re self-employed, documentation is king. Lenders will put your income under a microscope. Having perfectly organized tax returns, P&L statements, and business bank records is the only way to prove your income is consistent enough to rely on.

What This Means: Maya’s DTI of 18.8% is very strong. Even with an unconventional income, her two-year average proves she can manage her finances and debts effectively. A lender would see her as a responsible applicant, making her a solid candidate for a new loan.

Actionable Strategies to Improve Your DTI

So you’ve run the numbers and your DTI is higher than you’d like. Don’t panic. This figure isn’t a permanent stain on your financial record; it’s simply a snapshot in time—and you have the power to change the picture.

Improving your DTI really comes down to tweaking the two parts of the equation: either your debt goes down, or your income goes up. It’s that simple.

Let’s move past the generic advice and get into a real game plan. Here are some tactical steps you can take to tackle debt, boost your earnings, and make your financial profile much more appealing to lenders.

Choose Your Debt Reduction Strategy

When it comes to paying down your balances, there are two tried-and-true methods. The “best” one really depends on your personality and what keeps you motivated.

- The Debt Snowball: This is all about psychology. You attack your smallest debts first, knocking them out one by one, regardless of the interest rate. Every time you pay one off, you get a quick win that builds momentum. You then roll that payment into the next-smallest debt, creating a powerful “snowball” effect.

- The Debt Avalanche: This is the purely mathematical approach. You focus all your extra cash on the debt with the highest interest rate while making minimum payments on everything else. By targeting that high-interest debt, you’ll save the most money over time, even if it feels like a slower start.

So, which one is better? The avalanche saves you more in interest, but the snowball often has a higher success rate. Why? Those early psychological wins are incredibly powerful for keeping people in the game. Pick the strategy you know you’ll actually stick with.

Boost Your Income

The other side of the DTI coin is, of course, your income. Even a small bump in what you bring home can make a noticeable difference in your ratio. “Earn more money” is easy to say, but here are a few tangible ways to make it happen.

Position Yourself for a Raise

Don’t just wait for your annual review to roll around. Start now. Document your wins, volunteer for high-visibility projects, and research salary data for your role in your city. When you can walk into your manager’s office with a clear, data-backed case for why you deserve more, you’ve already won half the battle.

Explore a Side Hustle

The gig economy has made it easier than ever to earn extra cash on your own terms. Whether it’s freelance work using your professional skills, driving for a rideshare app, or turning a hobby into an online store, a side hustle can give you the extra funds to either hammer away at debt or simply increase your total income.

Consider Debt Consolidation or Refinancing

If you’re juggling several high-interest debts, like a few different credit card balances, consolidation could be a game-changer. This basically means taking out one new loan to pay off all the others.

The Pros:

- You simplify your life with just one monthly payment to track.

- You can often lock in a lower interest rate, which means more of your payment goes toward the principal.

The Cons:

- You’ll need a decent credit score to get a rate that makes it worthwhile.

- Watch out for origination fees—some loans have them, and they can eat into your potential savings.

If this sounds like a path you want to explore, our guide on how to consolidate credit card debt walks you through the entire process. Similarly, refinancing a big loan like a mortgage or auto loan can lower your monthly obligation and improve your DTI, but always do the math to make sure the long-term interest costs are worth the short-term breathing room.

Common DTI Questions Answered

Even when you’ve got the basics down, a few questions always seem to pop up about DTI. When you’re trying to figure out how to calculate your debt to income ratio the right way, the details really matter. Let’s tackle some of the most common points of confusion so you can be totally confident in your numbers.

Gross or Net Income?

This is easily the question I hear most often, and the answer is straightforward: always use your gross monthly income. That’s your total earnings before a single dollar is taken out for taxes, health insurance, or 401(k) contributions.

Why gross? Lenders use it to keep things consistent. Everyone’s tax situation and benefit deductions are different, so using pre-tax income creates a standard baseline to compare all loan applicants fairly. It shows your full earning capacity, which is what they care about most when assessing risk. If you use your take-home (net) pay, you’ll end up with a DTI that’s artificially high and not what a lender will see.

How Often Should I Calculate My DTI?

Your DTI ratio isn’t something you calculate once and then forget about. Think of it as a living number that reflects your financial health in real-time. Because of that, it’s a good idea to check in on it from time to time.

As a general rule, running the numbers once a year is a great financial habit. It acts as an annual check-up, letting you see how you’re tracking with debt repayment or how a recent pay raise has improved your standing.

But here’s the most important tip: always recalculate your DTI right before you make a big financial move. If you’re thinking about applying for a mortgage, a car loan, or even a new credit card, you need to know your current DTI. It gives you a preview of what lenders will see and a chance to clean things up before you submit that application.

Can a Co-signer Help if My DTI Is Too High?

Sometimes, a co-signer can be the key to getting a loan approved when your DTI is on the high side. When you bring someone else onto the application, the lender considers their income and debts right alongside yours. If they have a solid income and very little debt, their strong financial profile can balance out your higher ratio and help push the application over the finish line.

But this isn’t a decision to take lightly. It’s a huge commitment for the co-signer.

- They’re Fully on the Hook: Your co-signer is 100% legally responsible for the loan. If you miss a payment, the lender can—and will—come to them for the money, and their credit score will get damaged right along with yours.

- It Impacts Their DTI, Too: That new monthly payment gets added to the co-signer’s list of debts, which in turn raises their own DTI. This could make it much harder for them to qualify for a car loan or mortgage of their own down the road.

A co-signer can be a real lifeline, but it requires a serious conversation and a massive amount of trust. Make sure everyone involved understands exactly what they’re signing up for.

At Collapsed Wallet, our goal is to give you the clear, straightforward advice you need to feel confident about your money. We turn complicated financial topics into simple, actionable steps. Discover more guides and tools to help you on your journey to financial freedom at https://collapsedwallet.com.