Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Trying to save money on food isn’t just about finding discounts; it’s about building a solid financial habit. The real wins come from a combination of smart financial planning, using tech to shop smarter, and making those savings part of your bigger financial picture. When you get this right, you’ll see a real difference in your bank account and feel a whole lot less stress about money.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your Financial Blueprint for Food Savings

Getting a handle on your food spending is one of the quickest and most powerful moves you can make for your financial health. Unlike fixed bills like your rent or mortgage, your grocery spend is something you have direct control over, week in and week out. That flexibility is a huge opportunity to accelerate your financial goals.

When you switch from reactive purchasing to proactive financial planning for your food, you can unlock some serious monthly savings. This isn’t about drastic lifestyle changes. It’s about being intentional and efficient to get the absolute best value for every pound you spend.

From Uncontrolled Expense to Financial Asset

For most people, the grocery bill is just a number that changes every month without much thought. The trick is to stop seeing it as a random expense and start treating it like a managed part of your financial strategy. A well-planned food budget does more than just lower your bills—it frees up cash.

Think about what you could do with that extra money. It can be redirected to goals that actually move the needle on your financial future.

- Tackle High-Interest Debt: Shifting even £50 a month from your food budget to a credit card bill can save you a surprising amount in interest over time.

- Build Your Emergency Fund: A few months of disciplined grocery savings could be all it takes to build a small but crucial financial safety net.

- Invest for Your Future: Imagine consistently investing the money saved on groceries. Even small amounts put into a simple ETF can grow significantly over the long haul, thanks to compounding.

When you start managing your grocery budget with the same focus you’d give an investment, you transform a weekly chore into a powerful tool for building wealth.

A Structured Path to Savings

Forget the vague tips you’ve heard a dozen times. This guide lays out a clear, actionable blueprint. We’ll dive into the core financial habits that make a real difference in managing food costs, helping you create a system that works for you long-term. We’re going to focus on strategic planning, using technology to your advantage, and budgeting methods that directly support your goal of financial freedom.

Master Your Grocery Budget with a Solid Meal Plan

If you want to get a real handle on your food spending, the most powerful move you can make happens long before you set foot in a grocery store. This revolves around financial planning. It’s the absolute bedrock of a smart food budget.

Without a plan, you’re just wandering the aisles, hoping for inspiration—which is a surefire way to overspend on impulse buys. With a plan, you’re in control, executing a strategy that puts money back in your pocket. It turns a chaotic, reactive expense into a predictable, manageable part of your finances, a key step towards achieving financial freedom.

The whole idea is to create a simple system that frees up not just your cash, but your mental energy too, allowing you to focus on bigger financial goals.

Start by Shopping Your Own Kitchen

Before you even think about what to buy next week, you need to know what you already have. Do a quick “pantry and freezer audit.” Seriously, this is the crucial first step. It stops you from buying an item when you already have three hiding in the back of the cupboard.

Set aside 30 minutes. Go through your pantry, fridge, and freezer and jot down everything you can use—proteins, grains, canned goods, frozen veggies. That forgotten bag of chicken breasts or half-full box of quinoa isn’t just food; it’s money you’ve already spent. Using it up is like getting a cash-back bonus on your finances.

By ‘shopping’ your pantry first, you’ll immediately shrink your next grocery list. This one habit can easily trim 10-15% off your bill before you even leave the house.

Create a Weekly Plan That Actually Works

Once you’ve got your inventory, it’s time to sketch out a meal plan. The secret ingredient here is flexibility. A super-rigid plan is doomed from the start because life happens. You’ll work late or plans will change.

A good plan anticipates your real-life schedule and energy levels. It’s a tool that serves you, not a strict set of rules. For a deeper dive into making this a sustainable habit, check out our complete guide on budget-friendly meal planning.

Here’s a simple financial approach to it:

-

Look at your calendar first. Got a late night at work on Tuesday? That’s a perfect night for a low-cost, quick meal or planned leftovers. Don’t schedule an elaborate recipe for a day you know you’ll be exhausted.

-

Think in categories, not specifics. Instead of writing “Chicken and Broccoli Stir-fry” for Monday, just put “Stir-fry Night.” This gives you the wiggle room to use up whatever protein and veggies you have on hand, preventing waste.

-

Optimise your purchasing. Plan to make double portions of one or two meals. A big batch of chili on Sunday easily becomes a fantastic, no-effort lunch for Monday and Tuesday. This is a game-changer for saving both time and money.

-

Utilise theme nights. “Meatless Monday,” or “Soup & Sandwich Friday” aren’t just for fun; they simplify your financial planning. It narrows down your choices and lets you buy core ingredients like beans, tortillas, or pasta in bulk, which is always cheaper.

This isn’t about being a perfect planner. It’s about creating a simple, repeatable system that stops those last-minute, budget-busting takeaway orders. A little bit of financial planning upfront pays you back all week long, getting you that much closer to your financial goals.

Use Technology to Master Your Grocery Budget

Walking into a grocery store without a game plan is a financial risk. It’s so easy to get sidetracked by end-cap displays and impulse buys, completely blowing your food budget before you even hit the dairy aisle. To shop strategically, you need to bring in some backup. Thankfully, the tech in your pocket can turn your meal plan into a powerful, budget-friendly shopping list that keeps you focused.

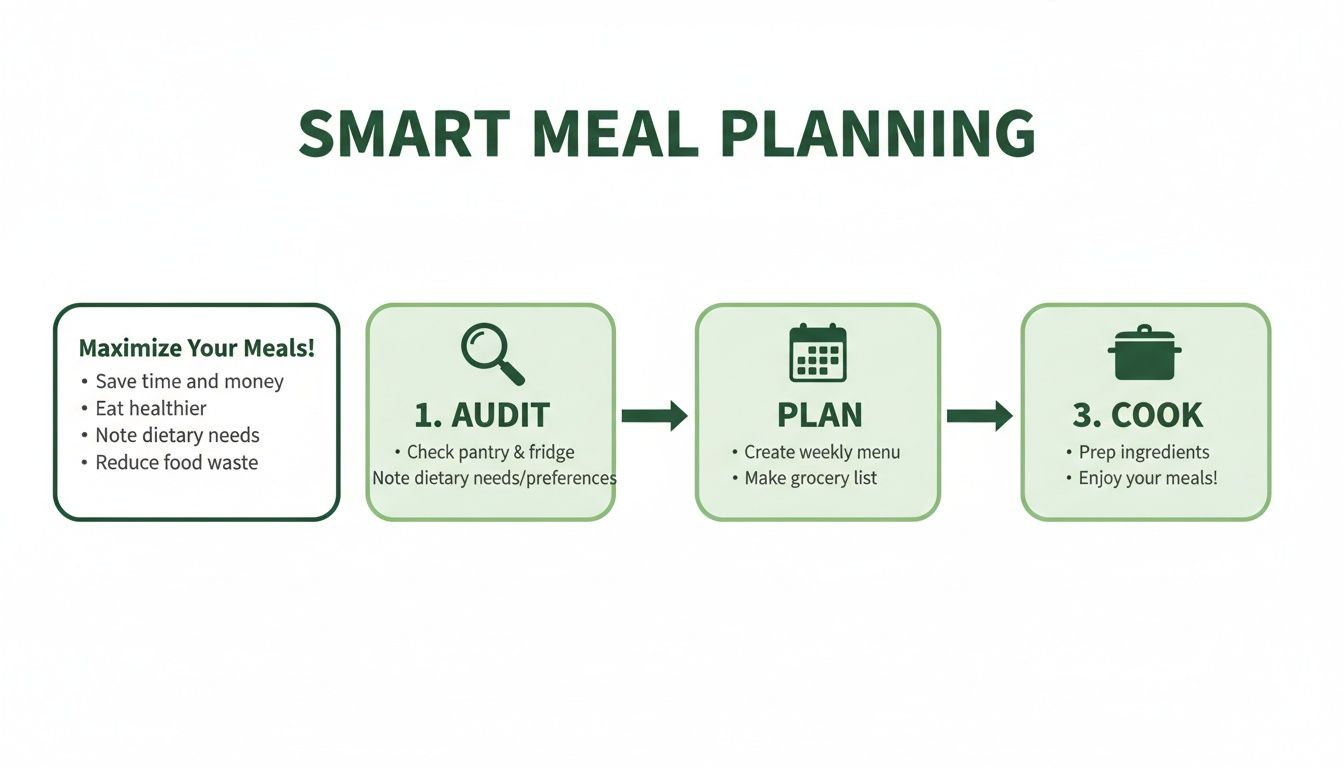

The infographic below outlines the basics of smart financial meal planning, which is the foundation for any cost-effective grocery trip.

As you can see, it all starts with knowing what you already have and building meals around that. This approach naturally shrinks your shopping list, which is the first and most important step to saving money and achieving financial freedom.

Build Digital Lists That Stick to Your Budget

A paper list is better than nothing, but a good grocery app is a total game-changer for your finances. Apps like AnyList or Mealime let you build your list straight from your plan and then—this is the crucial part—organize it by store aisle. This simple trick stops you from wandering aimlessly and avoids the siren call of the snack aisle.

The real magic of these apps is the running total feature. As you add items, you can see the estimated cost climbing in real-time. This is huge for your financial control. It lets you make smart swaps before you even leave the house. Is your total creeping too high? Maybe swap out that pricey cut of steak for chicken this week. To see how this fits into your overall financial picture, check out our guide to the best free budgeting apps that can help you track every dollar.

By seeing your grocery bill add up before you shop, you gain complete control over the final amount. This single feature can prevent the average shopper from overspending by 15% to 20% on each trip.

Get Paid to Buy What You Need

Beyond just organizing your shopping trip, technology can put money directly back into your pocket. Cashback and rewards apps are non-negotiable if you’re serious about slashing your food bill and improving your financial situation. These aren’t gimmicks; they’re real savings.

- Receipt-Scanning Apps: Check services like Ibotta or Checkout 51 before you shop. They give you cash back for buying specific items and snapping a picture of your receipt. The trick is to only activate offers for things you were going to buy anyway.

- Loyalty Program Apps: Almost every grocery store has an app now. Make it a habit to open it up and digitally “clip” coupons before you head out. These exclusive discounts can be surprisingly good.

- Price Comparison Tools: Some apps let you scan an item’s barcode in-store to see if a nearby competitor has it for cheaper. It’s a quick way to know if you’re getting a decent deal.

This isn’t about spending an hour hunting for a 25-cent coupon. It’s about building a quick, consistent routine. Taking two minutes to check these apps before you shop can easily add up to hundreds of dollars a year—money you can put toward savings, debt, or investments.

The Financials of Online vs In-Store Shopping

Deciding whether to shop online or head to the store has real financial consequences. There’s no single right answer; it really comes down to your personality and shopping habits. Let’s break down the pros and cons from a financial perspective.

Here’s a closer look at how the two shopping methods stack up when it comes to your wallet:

Cost Savings Analysis In-Store vs Online Grocery Shopping

| Factor | In-Store Shopping | Online Grocery Shopping |

|---|---|---|

| Impulse Purchases | High risk of unplanned buys from displays and checkout temptations. | Virtually zero risk. You only see what you search for. |

| Budget Control | Difficult to track spending until you reach the checkout. | Excellent. You see a running total and can easily edit your cart. |

| Couponing | Requires clipping physical coupons or remembering to use the app. | Very easy. Digital coupons are often highlighted and applied with one click. |

| Fees & Surcharges | None. The price on the shelf is what you pay. | Potential delivery fees, service charges, or membership costs can add up. |

| Product Selection | You have full control to pick the freshest produce and best cuts of meat. | You're at the mercy of the shopper, which can lead to lower-quality items. |

| Time & Fuel Costs | Requires time for travel, shopping, and checkout, plus the cost of gas. | Saves significant time and fuel costs. |

Shopping online is fantastic for budget control. There are no tempting smells from the bakery or candy bars staring you down at checkout. You see your total before you pay, making it incredibly easy to stick to your limit. Plus, most online platforms have a dedicated "deals" section with digital-only coupons.

But watch out for delivery fees and service charges, which can wipe out your savings in a hurry. To make it work, you need to be strategic. Look for services that waive fees on orders over a certain amount (say, $35) or consider a subscription if you shop frequently.

On the other hand, shopping in person gives you total control over picking your produce and meat, which can cut down on food waste from getting a bruised apple or a not-so-fresh cut of fish. The best choice really depends on whether your bigger weakness is impulse spending or paying for convenience.

Turn Food Waste Reduction Into Financial Gain

Let’s be honest: throwing away spoiled food feels like shredding cash. Every time you toss a slimy bag of lettuce or a moldy block of cheese, you're literally throwing money in the trash. This isn't just a minor leak in your budget; for many of us, it's a huge, silent drain on our finances.

The problem is bigger than you might think. A staggering UN Food Systems Hub report revealed that about one-third of all food produced for us to eat is lost or wasted every year. For a typical family, this waste of 20-30% of their groceries adds up. We're talking about saving an average of $1,500-$2,000 annually just by using what you buy.

This isn't about extreme frugality. It's about smart resource management and getting every dollar of value from your grocery bill. By changing a few habits, you can plug this financial leak for good.

Master Your Fridge with the FIFO System

One of the most powerful, pro-level tricks comes straight from the retail playbook: the 'First In, First Out' (FIFO) system. Grocery stores use it to make sure older products sell before they expire, and it works wonders for your personal finances.

It’s simple. When you unload new groceries, just slide the older items to the front of the shelf and tuck the new stuff in behind them. This one small action puts the food that needs to be used sooner right in your line of sight, preventing that forgotten yogurt from becoming a financial loss.

To take it a step further, create an "Eat Me First!" bin. This is my secret weapon. It’s a designated box or a spot on a shelf for anything nearing its expiration date, half an onion, or leftovers from last night. When you're hungry, you check that bin first. It’s a constant visual cue that turns potential waste into your next meal, saving you money.

Decode Date Labels to Save Money

So much perfectly good food gets tossed because of confusion over date labels. Knowing what they actually mean is a game-changer for your wallet.

- 'Best By': This is all about quality, not safety. The manufacturer is just suggesting when the product will taste its absolute best. Many products are perfectly fine well past this date.

- 'Use By': Pay more attention to this one. It's related to safety and is usually on perishable things like fresh meat or dairy. It's best to stick closely to this date.

- 'Sell By': This date is for the store, not for you. It tells the retailer how long to keep the item on the shelf. You almost always have more time at home to use it.

Just internalizing the fact that 'Best By' isn't a strict expiration date can save a surprising amount of food. It's a simple mindset shift that keeps food you paid for out of the landfill and in your kitchen.

Practical Food Storage for Financial Gain

How you store your food directly impacts how long it lasts, which in turn impacts how often you have to buy more. A little bit of know-how here protects your grocery investment and stretches your budget further.

Here are a few go-to techniques:

- Preserve Herbs Effectively: Keep cilantro and parsley fresh for weeks, not days. Trim the stems and stand them up in a jar with a little water in the fridge.

- Practice Strategic Separation: Some fruits, especially bananas and apples, release a gas that makes other produce ripen (and spoil) faster. Keep them away from sensitive items like your leafy greens, broccoli, and carrots.

- Make Your Freezer Your Best Friend: The freezer is the ultimate pause button for food. Freeze extra bread, overripe bananas for smoothies, or extra portions of meals. You can even freeze milk and blocks of cheese if they're about to expire.

These habits might feel like a small effort upfront, but the payoff is continuous. Every carrot you save and every leftover you eat is real money that stays right where it belongs: in your pocket, helping you towards your goal of financial freedom.

Turn Grocery Savings Into Real Wealth

Saving money on food is about so much more than just having a little extra cash at the end of the month. It's about turning those everyday savings into a powerful engine for building long-term wealth. When you get strategic, you stop seeing your food budget as a simple expense and start treating it like a tool to reach your biggest financial goals, whether that's financial freedom or just finally getting ahead.

This isn't just about simple budgeting. It's about adopting an investor's mindset at the grocery store. You'll learn to spot trends, stack rewards, and create a system that automatically captures your savings and puts them to work.

Ride the Market Waves for Deeper Discounts

Here’s a pro-level strategy that most people miss: paying attention to food price trends. The cost of things like grains, produce, and meat goes up and down just like any other commodity. If you understand these cycles, you can time your bulk purchases to lock in much lower prices for months at a time.

For instance, keeping an eye on global food price data can be a total game-changer. The FAO Food Price Index (FFPI) recently sat at 127.2 points, but the real story was that cereal prices had tanked by 4.9%. Rice, in particular, saw a big drop. For a family, buying staples like rice and grains in bulk when these dips happen can easily knock 10-20% off your bill for those items. You can find more insights on these global food price trends online to inform your purchasing strategy.

Master Your Rewards and Loyalty Programs

Beyond watching the market, you can create your own discounts by being smart with store loyalty programs and credit card rewards. The goal isn't to carry a wallet full of plastic; it's to find one or two power-players that give you the biggest kickback on groceries.

- Credit Card Rewards: Some cards offer a fantastic 3% to 6% cash back on grocery spending. If your family spends $800 a month on food, a 5% cash-back card puts $480 back in your pocket over a year. That’s a serious chunk of change you can move straight into an investment account.

- Store Loyalty Programs: Sticking to one or two main grocery stores helps you climb their loyalty ladders much faster. This unlocks better discounts, personalized coupons, and even fuel points that cut costs elsewhere.

The real secret is to treat these rewards like a paycheck. Don't just let that cash back disappear into your regular spending. Have a plan to immediately transfer it to your savings or investment account.

Set Up a Dedicated "Food Fund"

To make your savings real, you have to get them out of your main checking account. This is where a dedicated "food fund" comes in. Think of it as a special savings bucket, or a sinking fund, built just for capturing the money you save on groceries. You can set this up easily with budgeting apps like YNAB or Mint, or even just by opening a separate high-yield savings account. You might want to check out our deep dive on what is a sinking fund to see how powerful this concept can be.

It works like this:

- First, set your monthly food budget (let's say $600).

- Then, at the end of the month, see what you actually spent (maybe $520).

- Immediately move the difference—in this case, $80—into your dedicated food fund.

This simple act makes your savings tangible and keeps you from accidentally spending that extra cash. It’s a powerful psychological win that reinforces your good habits.

Put Your Savings to Work for You

Once your food fund starts to build up, it's time for the final, most important step: putting that money to work. This is the moment you directly connect your grocery wins to your wealth-building plan. Having a clear destination for this money will keep you motivated.

Here’s a simple plan you can adapt for your own goals. By strategically allocating the money you save, you can accelerate your progress toward financial freedom.

Monthly Food Savings Allocation Plan

| Savings Goal | Monthly Allocation Percentage | Example Action |

|---|---|---|

| High-Interest Debt | 50% | Make an extra payment on a credit card with the highest APR. |

| Emergency Fund | 25% | Transfer to your high-yield savings account until it's fully funded. |

| Investing | 25% | Contribute to a low-cost ETF or a tax-advantaged retirement account. |

The best part? You can automate this. Set up recurring transfers from your food fund to these different goals, and you’ll have a self-sustaining system. Your smart shopping will actively fuel your investments, turning every good decision in the grocery aisle into another step toward a secure financial future.

Got Questions? We’ve Got Answers

Putting a new food budget into practice always brings up a few questions. It’s one thing to read the advice, but another to make it work in your own financial life. Let’s tackle some of the most common hurdles people face when they start getting serious about cutting their grocery bills.

This is where the rubber meets the road. We’ll cover real-world financial concerns, from time management to staying motivated, giving you the confidence to lock in these habits for good.

How Much Time Does This Really Take?

I get it—the biggest worry is that saving a few pounds on groceries will cost you hours you don’t have. But here’s the reality: it’s about shifting your time, not adding more chores.

When you’re first starting, expect to spend about 30-60 minutes a week mapping out your financial plan and building a smart shopping list. It feels like a lot at first, but once you find your groove, that time shrinks. Soon, the time you save by avoiding last-minute “what’s for dinner?” stress and making fewer, faster trips to the supermarket more than pays you back.

Think of it this way: every minute spent planning is an investment. It directly translates into pounds saved—money that can then go toward your savings or investment goals.

What If I Have Specific Dietary Needs?

Having to eat gluten-free, vegan, or manage allergies doesn’t mean you’re locked out of saving money. In fact, for you, planning isn’t just helpful—it’s essential for your financial wellbeing.

Your dietary needs actually give you a head start by narrowing your focus. Instead of seeing it as a limitation, use it as your guide.

- Lean into whole foods. Things like beans, lentils, rice, potatoes, and fresh produce are the cheapest items in any store and naturally fit into many specialized diets.

- Get creative with swaps. If your plan calls for a pricey specialty product, a quick search for a cheaper alternative before you shop can save you a bundle.

- Utilise your freezer. Spot a great deal on a compliant staple? Buy it in bulk and freeze portions for later.

A solid financial plan is your best defense against the high cost of pre-packaged specialty foods, which are often the biggest budget-killers.

How Do I Stay Motivated When I Feel Like Quitting?

Let’s be honest, motivation can fade, especially when your big financial goals feel miles away. The trick is to make your progress impossible to ignore and to celebrate every small victory.

First, track what you save. Use a simple spreadsheet or a budgeting app to see the difference between your old spending and your new, lower grocery bills. Seeing that number grow—£50, £100, even £150 a month—is incredibly powerful. It’s hard evidence that your hard work is paying off.

Then, give that saved money a specific job. You aren’t just “saving money”; you’re saving money for something important. Whether it’s to kill off credit card debt, buy another share of an ETF, or finally build up your emergency fund, tying your savings to a goal turns a chore into a mission.

Here at Collapsed Wallet, our entire mission is to give you clear, no-nonsense advice to help you get ahead with your money. We truly believe that with the right game plan, anyone can build a more secure financial life. Keep exploring our guides and tools to take the next step.

Find out more at https://collapsedwallet.com