Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

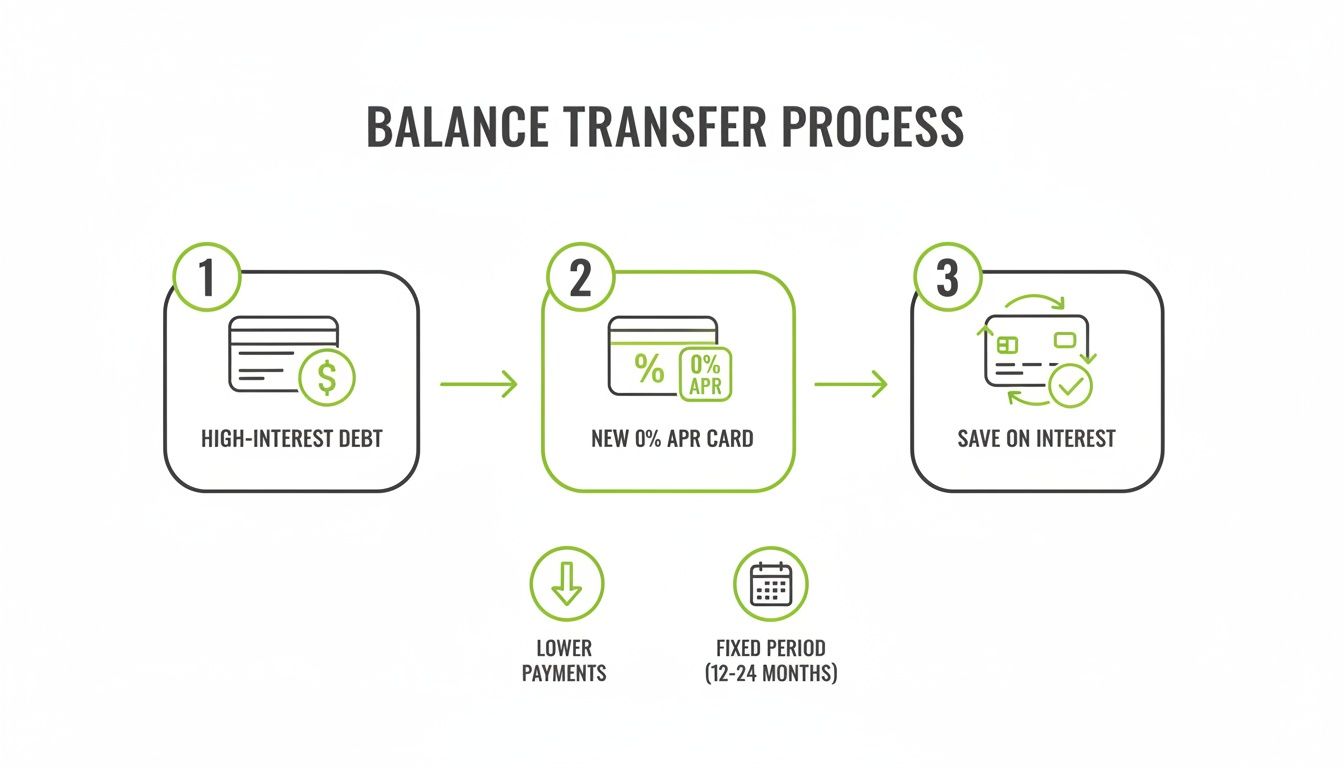

So, you’ve heard about transferring a credit card balance but aren’t quite sure how they work? Let’s break it down. Essentially, a balance transfer lets you move high-interest debt from one credit card over to a new one that has a temporary 0% or very low introductory Annual Percentage Rate (APR). It’s like refinancing your credit card debt, giving you a powerful window of time to attack the principal amount you owe without interest piling up on top.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

The Core Purpose of a Balance Transfer

At its heart, a balance transfer is a strategy to get a handle on expensive credit card debt. If you’re currently facing interest rates of 18%, 25%, or even higher, you know how frustrating it is to see most of your monthly payment get swallowed up by interest charges. It can feel like you’re running on a treadmill, working hard but getting nowhere.

A balance transfer is your chance to step off that treadmill. By shifting your debt to a card with a 0% introductory APR, you create a grace period where every single pound you pay goes straight toward reducing your actual balance. This can seriously speed up your journey to becoming debt-free and save you a ton of money in the process.

Understanding the Key Players

To really get how a balance transfer works, it helps to know who’s involved. It’s a pretty straightforward idea, just moving money from one account to another to get a better deal.

There are always two main parties in this financial shuffle:

- Your Original Card: This is the credit card (or cards) where you’re currently carrying the high-interest debt. Think of this as the expensive locker you’re renting.

- The New Balance Transfer Card: This is the brand-new card you apply for, the one offering that sweet low or 0% promotional APR. This is your new, rent-free locker for a limited time.

What happens is the new card company pays off the balance on your old card for you. Once that’s done, your debt is now consolidated onto the new card, and your old card has a zero balance.

A successful balance transfer isn’t just about moving debt; it’s about creating a strategic window of opportunity. This period, often lasting 12 to 21 months, gives you the breathing room to make significant progress on your debt without the constant pressure of compounding interest.

The ultimate goal is to use this interest-free period to pay down as much of the balance as you can. Ideally, you want to clear it completely before that promotional rate disappears. Pull that off, and you’ll have escaped a high-cost debt trap and taken a massive step toward financial freedom.

The Step-by-Step Balance Transfer Journey

So, how does a credit card balance transfer actually work? It’s a lot less complicated than it sounds. Think of it as moving your high-interest credit card debt from an expensive neighborhood to a much cheaper one—giving you some much-needed breathing room to pay it down. The whole process has a few distinct stages, and knowing what to expect at each step is the key to making it work for you.

The journey really begins before you even fill out an application. It starts with a bit of detective work to find an offer that actually lines up with your goals.

Finding and Applying for the Right Card

Your first mission is to find a balance transfer card with the best possible terms. This means looking past the flashy “0% APR” headlines and digging into the details that will make or break your debt-payoff plan.

Here’s what you need to zero in on:

- The 0% APR Introductory Period: This is your golden opportunity—the window where interest charges are completely paused. Look for the longest period you can find. The more time you have, the more of your payments will go directly toward chipping away at the principal balance.

- The Balance Transfer Fee: Nothing in life is truly free, right? Most cards will charge you a one-time fee to move your balance over, usually 3% to 5% of the total amount. You’ll want to do some quick math to make sure the money you’ll save on interest is a lot more than this upfront cost.

- The Post-Introductory APR: Pay close attention to the interest rate that kicks in after the 0% deal expires. This is often called the “go-to” rate. If you still have a balance when the promo period ends, a sky-high regular APR can quickly erase all the progress you’ve made.

Once you’ve found a card that ticks all the boxes, applying is pretty straightforward, just like any other credit card application. The issuer will run a credit check to decide if you’re a good fit and determine your credit limit. To get the best offers with the longest 0% periods, you’ll generally need a solid credit score.

This is the basic idea in a nutshell: move your debt from a high-interest card to a 0% APR card and stop the interest from piling up.

The whole point is to give yourself an interest-free runway to aggressively pay down what you owe.

Initiating the Transfer of Your Balance

Okay, you’ve been approved for the new card—congratulations! The next step is to actually move the debt over. Most card companies make this pretty easy and give you a few ways to get it done.

You can typically kick off the transfer using one of these methods:

- Online Portal: The easiest way is usually right through your new online account. You’ll just need the account number of the old card and the exact amount you want to transfer.

- Over the Phone: If you prefer, you can simply call the customer service number on the back of your new card and have a representative guide you through the process.

- Convenience Checks: Some issuers still mail out “balance transfer checks.” You can fill one out and send it to your old credit card company to pay off the account.

Here’s a critical tip: The transfer is not instant. It can take anywhere from a few days to three weeks to fully process. Until you see a $0 balance on your old account, you absolutely must continue making at least the minimum payments. Missing one could lead to late fees and a hit to your credit score.

Understanding Key Timelines and Offers

Getting the timing right is crucial, as is picking the right card. The landscape of offers is always shifting, but in 2026, most balance transfer cards offer introductory 0% APR periods ranging from 12 to 21 months. You might see business cards at the lower end of that range, while personal cards can stretch to 15 months or even longer.

What really separates one offer from another isn’t just the 0% APR period, but also the deadline for making the transfer—you usually have just 60 to 90 days after opening the account to move your balance and lock in the promotional rate. You can check out some of the latest balance transfer offers on creditcards.com to see what’s currently available.

Ultimately, this whole process is about giving yourself a strategic advantage. By picking the right card and handling the transfer correctly, you’re paving the way for a focused, effective debt repayment plan that could save you a ton of money.

Calculating the True Cost of a Balance Transfer

That 0% APR offer looks fantastic on paper, but a balance transfer is never completely free. To really know if it’s the right move, you have to look past the headline rate and get honest about the real costs involved. This is the only way to make sure your plan to get out of debt is built on solid ground.

Don’t Forget the Balance Transfer Fee

The first cost you’ll run into is the balance transfer fee. It’s a one-time charge, and almost every balance transfer card has one. You can expect it to be somewhere between 3% and 5% of the total amount you’re moving over.

This fee isn’t a separate bill you pay later. Instead, the bank adds it directly to your new balance right from the get-go.

Let’s make this real. Say you want to transfer a $5,000 balance to a new card that has a 3% transfer fee.

- The Math: $5,000 (your debt) x 0.03 (the 3% fee) = $150

- The Result: Your starting balance on the new card is immediately $5,150.

This upfront cost is a critical part of the equation. You have to be sure that the money you save on interest during the promotional period will be much more than this initial fee.

The Post-Introductory APR Cliff

The second, and potentially more costly, trap is what happens after your 0% introductory period ends. This is a make-or-break moment.

Any balance left on the card when that promotional window slams shut gets hit with the card’s standard, or “go-to,” APR. This rate is often just as high—or even higher—than the interest rate on your old card.

The real win with a balance transfer isn’t just pausing the interest. It’s using that pause to knock out the debt for good. If you don’t pay it all off in time, you can easily wipe out all your savings and get pulled right back into the cycle of high-interest payments.

This is exactly why you need a non-negotiable, disciplined repayment plan from day one. The 0% APR is a temporary tool, not a permanent fix. To see how this fits into a bigger picture, you can explore other powerful debt reduction strategies in our guide.

Running the Numbers: A Cost-Benefit Analysis

So, is the fee worth it? Let’s break it down. While paying a fee of 3% to 5% might feel counterintuitive, the value is in the interest-free runway you get—typically anywhere from 12 to 21 months.

To see just how much of a difference this can make, let’s compare paying off a $5,000 debt over 18 months on two different cards.

Cost Analysis: Balance Transfer vs. High-APR Card

| Metric | Standard Credit Card (18% APR) | Balance Transfer Card (0% Intro APR for 18 Months) |

|---|---|---|

| Starting Debt | $5,000 | $5,000 |

| Transfer Fee (3%) | $0 | $150 |

| New Starting Balance | $5,000 | $5,150 |

| Monthly Payment | ~$319 | ~$286 |

| Total Interest Paid | ~$740 | $0 |

| Total Amount Paid | $5,740 | $5,150 |

Even after paying the $150 upfront fee, the balance transfer saves you nearly $600. It’s a clear example of how a strategic one-time cost can prevent you from paying hundreds, or even thousands, in compounding interest. For a deeper dive, check out NerdWallet’s excellent guide on balance transfer mechanics.

By calculating the fee and having a solid plan to clear the balance before the regular APR kicks in, you can make sure your balance transfer is a successful leap toward financial freedom.

How a Balance Transfer Can Change Your Credit Score

It’s smart to ask how any new credit product will affect your score. After all, when you’re taking steps to get your finances in order, the last thing you want is a surprise that sends your score tumbling.

The good news? When you handle it right, a balance transfer is much more likely to give your credit score a healthy boost in the long run than to hurt it. Let’s walk through what really happens to your score, step by step.

First, the Small (and Temporary) Dip

Any time you apply for a new line of credit, the lender pulls your full credit report. This is known as a “hard inquiry,” and it’s a standard part of the process.

This hard inquiry will probably cause your score to drop by a few points right at the start. Don’t panic. This dip is minor, temporary, and usually bounces back within a few months. It’s just a normal blip on the radar and a small price to pay for the much bigger benefits to come.

Then, the Big Positive Impact

Once that initial inquiry is behind you, the real magic of a balance transfer starts to kick in. The positive effects are tied directly to one of the most important factors in your credit score: your credit utilization ratio.

This ratio is simply the amount of credit you’re using compared to your total available credit. For a healthy score, the goal is to keep this number below 30%. A balance transfer helps you do this in two powerful ways:

- It frees up your old cards. Moving a big balance from a card that was nearly maxed out instantly drops its utilization down to or near zero. That single change can give your score a significant lift.

- It increases your total credit limit. When you open the new balance transfer card, your overall available credit goes up. Now, your existing debt makes up a smaller percentage of a much larger credit pool, which helps lower your overall utilization ratio.

Here’s an easy way to think about it: Imagine you had a small bucket (your old card) filled to the very top with water (your debt). Your utilization was 100%. A balance transfer is like getting a brand-new, much larger bucket and pouring all that water into it. Suddenly, the water level looks way lower.

Building a Better Payment History for the Long Haul

The benefits don’t stop with your utilization ratio. Every single on-time payment you make on that new balance transfer card gets reported to the credit bureaus.

This creates a consistent record of responsible borrowing, showing future lenders that you know how to manage your finances. As you chip away at that balance during the 0% APR period, you’re not just getting out of debt—you’re actively building a stronger, more positive credit history. This is a crucial piece of the puzzle for achieving an excellent score.

If you’re looking for other ways to give your score a boost, our guide on how to improve your credit score fast has even more actionable tips.

So, while the application causes a tiny, short-term dip, the powerful combination of a lower credit utilization and a solid payment history almost always results in a much healthier credit score over time.

Common Balance Transfer Mistakes to Avoid

A balance transfer can be a fantastic tool for getting out of debt, but it’s not foolproof. A few common missteps turn a smart financial move into a frustrating trap. To really make this strategy work, you need to know the potential pitfalls just as well as the benefits.

Let’s walk through the most frequent mistakes so you can sidestep them and make real progress on paying down your debt.

Failing to Pay Off the Balance in Time

This is the big one. That 0% APR period feels like a lifeline, but it’s got an expiration date. If you still have a balance when that promotional window slams shut, the card’s regular, often sky-high, interest rate kicks in on whatever’s left. Just like that, all the interest you saved can evaporate.

And it happens more often than you’d think. Research shows that a staggering 40% to 60% of people who do a balance transfer don’t clear the debt before the promo rate ends. This means they get hit with standard interest rates—sometimes 25.74% or higher—and end up right back where they started. You can dig into the full findings on balance transfer challenges from Javelin Strategy & Research to see just how common this is.

Making New Purchases on the Transfer Card

It’s so tempting, isn’t it? You get a new card, maybe with a generous credit limit, and you think, “What’s the harm in using it for groceries?” This is a critical error.

Here’s why: that juicy 0% APR deal almost always applies only to the balance you transferred. Any new purchases you make will likely start racking up interest immediately at the card’s standard purchase APR. You end up muddying the waters, adding new, expensive debt while you’re still trying to slay the old beast.

Pro Tip: Treat your balance transfer card like it has one job and one job only: to hold that old debt while you pay it off. Put it in a drawer and use your debit card or a different credit card for everyday spending. Keep things simple.

Missing or Making a Late Payment

One little slip-up can derail the whole plan. If you miss a payment deadline—even by a day—you’re likely violating the terms of the agreement. The consequence? The issuer can, and often will, revoke your promotional 0% APR on the spot.

Suddenly, that high standard interest rate is applied to your entire remaining balance. Your brilliant debt-reduction strategy is toast.

Don’t let this happen. It’s easily avoidable:

- Set up automatic payments. At the very least, automate the minimum payment so you’re never late.

- Use calendar alerts. Pop the due date into your phone’s calendar with a reminder a few days beforehand.

- Try a budgeting app. Many apps track your bills and send you push notifications when a payment is coming up.

Ignoring the Details in the Fine Print

Finally, the devil is always in the details. Before you hit “submit” on that application, you absolutely have to read the terms and conditions. Not doing so is like signing a contract with your eyes closed.

Zero in on these key facts:

- The balance transfer fee: Know the exact percentage and do the math so you aren’t surprised by the upfront cost.

- The introductory period length: Pinpoint the exact date the 0% APR offer expires and mark it down.

- The “go-to” APR: Find out what interest rate you’ll be charged on any leftover balance after the promo period.

- Time limits for transferring: Most offers are only good if you make the transfer within the first 60-90 days of opening the account. Don’t drag your feet.

By keeping these common blunders in mind, you can use a balance transfer for what it’s meant to be: a powerful step toward getting out of debt for good.

Is a Balance Transfer the Right Move for You?

So, you’ve got the nuts and bolts of how a balance transfer works. Now for the million-dollar question: is it actually the right move for you? This isn’t just about shuffling money around; it’s a strategic play that requires a solid game plan.

Think of it as a tool. In the right hands, it can help you build your way out of debt. But if you’re not careful, you can end up right back where you started. Let’s figure out if this is the right tool for your specific job.

A Quick Self-Assessment

Before you even start looking at offers, take a minute for an honest check-in. Getting real with yourself about these three things will tell you if a balance transfer makes sense.

-

Is Your Credit Score Strong Enough? Let’s be blunt: the best deals are reserved for people with good to excellent credit. We’re talking long 0% APR periods and low fees. If your score is on the lower side, you might still get approved, but the offer could be less attractive, potentially eating into your savings.

-

Is Your Debt Amount Right? Balance transfers shine when you’re tackling a substantial amount of high-interest debt. The interest you save needs to be way more than the one-time transfer fee you’ll pay. If you only owe a few hundred bucks, the fee might just cancel out any benefit. Do the math first.

-

Are You Committed to a Repayment Plan? This is the most critical piece of the puzzle. A 0% APR offer is a lifeline, not a magic wand. If you don’t have a disciplined plan to attack that balance and pay it off before the promotional period ends, you’ll be hit with the regular high APR, and the cycle continues.

Exploring Your Alternatives

A balance transfer is a fantastic option for many, but it’s not the only one. It’s smart to know what else is out there to make sure you’re picking the best path for your financial situation.

A balance transfer provides a temporary pause on interest, giving you a strategic window to pay down debt. However, it’s just one of several tools available for managing what you owe.

Here are a couple of other popular routes to consider:

-

Debt Consolidation Loans: Think of this as a personal loan with a fixed interest rate and a predictable monthly payment. You know exactly when the debt will be gone, which brings a lot of peace of mind.

-

Credit Counseling: Non-profit credit counseling agencies can be a huge help. They’ll work with you to build a budget and can even negotiate with your creditors through something called a debt management plan.

Each strategy has its own pros and cons. If you’re juggling multiple debts, it’s worth checking out our complete guide on how to consolidate credit card debt to compare all the different methods side-by-side.

In the end, it all comes down to your credit, how much you owe, and—most importantly—your commitment to becoming debt-free. When you weigh these factors carefully, you can confidently choose the strategy that will finally put you back in control of your finances.

Got Questions? We’ve Got Answers

Even after you’ve done your research, a few nagging questions can pop up before you pull the trigger on a balance transfer. Let’s clear up some of the most common ones so you can move forward with confidence.

How Long Does a Balance Transfer Actually Take?

This is where a little patience comes in handy. A balance transfer isn’t an overnight process. From the moment your new card is approved, it can take anywhere from five days to three weeks for the money to move and your old balance to be paid off. The exact timing really depends on how quickly the two banks communicate.

Here’s the crucial part: keep making at least the minimum payments on your old card until you see that balance drop to zero. If you miss a payment while the transfer is in limbo, you could get hit with a late fee and a ding on your credit score. Don’t let that happen.

Can I Just Transfer a Balance to a Card I Already Own?

In most cases, that’s a no. Those juicy 0% APR offers are a classic way for credit card companies to win over new customers. They aren’t typically offered to existing cardholders for balances you already have with them.

Think of it this way: you can’t transfer a balance between two cards issued by the same bank (or its affiliates). The whole point is to move debt from an external bank to your new card.

What Should I Do With My Old Card After the Transfer?

Once the transfer is complete, you’ll have an old credit card with a $0 balance. Your first instinct might be to close it and cut it up. My advice? Don’t.

Keeping old credit accounts open (with a zero balance, of course) is actually one of the smartest things you can do for your credit score. It preserves the average age of your credit history and keeps your total available credit high, which helps your credit utilization ratio stay low.

Closing an account, especially one you’ve had for years, can shorten your credit history and shrink your available credit, which might cause your score to dip. The best move is to just tuck that old card away somewhere safe and forget about it.

At Collapsed Wallet, our goal is to give you clear, practical advice to help you master your money. For more real-world tips on crushing debt and building a stronger financial future, check out all our resources at https://collapsedwallet.com.