Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Credit cards explained… Let’s be honest, credit cards can feel a little intimidating. Are they free money? A debt trap? A smart financial tool? The truth is, they can be all of those things, depending on how you use them.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of a credit card as a short-term loan you can dip into for purchases. When you get the hang of it, a credit card can be a fantastic way to build your credit history, earn rewards, and add a layer of security to your spending. But if you don’t understand the rules of the game, it’s easy to get into trouble.

This guide is designed to cut through the confusion. We’re going to break down exactly how credit cards work so you can turn them from a source of stress into a powerful tool for your financial life.

Your Guide to Understanding Credit Cards

So, what is a credit card, really? It’s simply a tool that lets you borrow money from a bank to buy things. This is the key difference from a debit card, which pulls money directly out of your checking account. When you swipe a credit card, you’re creating a small debt that you promise to pay back later.

That single difference—borrowing vs. spending your own money—is what makes credit cards both incredibly useful and potentially risky. Used the right way, they offer convenience, fraud protection, and a clear path to building a great financial reputation.

The Role of Credit Cards in the Economy

Credit cards aren’t just a big deal for individuals; they’re a massive engine for the entire economy. To give you some perspective, total spending on credit cards in the U.S. hit an eye-watering $5.83 trillion in 2022 alone. That number shows just how essential these little plastic cards have become to our daily lives.

In fact, credit card spending now accounts for more than 20% of the entire U.S. Gross Domestic Product (GDP). It’s a major force driving consumer spending and keeping the economic wheels turning.

Our goal here is to give you the confidence to make these powerful tools work for you. We’ll walk through everything, from the confusing jargon to the smart strategies, so you can take control.

Here’s a peek at what we’ll cover:

- The essential terms you’ll see on every statement, explained in plain English.

- How interest, fees, and those tricky minimum payments actually work.

- Simple strategies for using a card to build a strong credit score.

- Tips for picking the right card that actually fits your life and goals.

Learning the Language of Credit

Alright, let’s get started. Using a credit card without understanding the lingo is like trying to play a board game without reading the rules—you’re bound to make a few costly mistakes. The terms credit card companies use can feel intimidating, but they’re just names for simple ideas that have a real impact on your money.

Once you know what they mean, you’ll be able to look at any card offer or statement and know exactly what you’re getting into.

Decoding Your Card’s Core Features

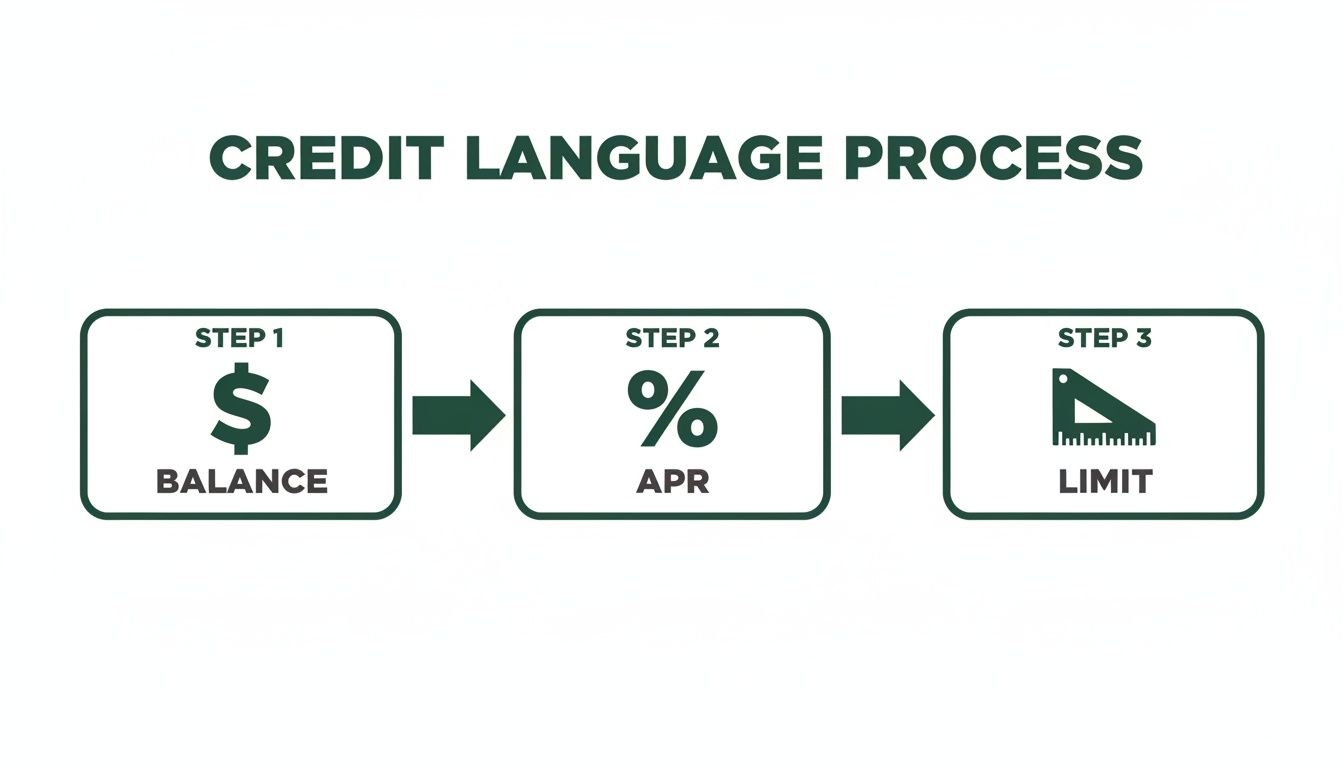

Think of your credit card agreement as that game’s rulebook. If you want to play well (and win), you have to know the three most important rules of the game.

-

Credit Limit: This is simply the maximum amount of money the bank has agreed to lend you. Picture it as a spending cap. It’s not an extra pile of cash for you to spend; it’s the total you’re allowed to owe at any given time.

-

Balance: This is your running tab—the total amount you currently owe. If you buy a coffee for $5, your balance is $5. Add a $50 tank of gas, and your balance climbs to $55. It’s the real-time total of your debt.

-

Annual Percentage Rate (APR): This is the cost of borrowing money, shown as a yearly interest rate. Consider it the “rental fee” you pay on any money you don’t pay back on time. The higher the APR, the more expensive it is to carry a balance.

These three pieces work together. You always want to keep your balance safely under your credit limit. And if you carry that balance from one month to the next, that’s when the APR kicks in and your debt starts to grow.

The Real Cost of Swiping

The sheer convenience of plastic has made credit cards king. They now account for a whopping 35% of all consumer payments in the U.S., a huge leap from just 18% back in 2016. That makes them the most popular way we pay for things today. With around 1.3 billion Visa and 1.1 billion Mastercard cards floating around the globe, it’s never been more critical to understand how they really work. You can dig into more credit card statistics to get the full story.

The biggest cost is, of course, the interest charged on your balance. But that’s not the only piece of the puzzle.

The Golden Rule: If you take away only one thing, let it be this: always try to pay your statement balance in full every month. When you do that, you generally won’t pay a dime in interest. It’s like getting a short-term, interest-free loan from the bank.

Here are a few other terms you’ll see on every statement:

- Minimum Payment: This is the smallest amount you have to pay by the due date to keep your account in good shape. Just paying the minimum is a classic trap—interest will pile up fast on the rest of your balance, keeping you in debt for much longer.

- Grace Period: Think of this as a “free pass” window. It’s the time between when your billing cycle closes and your payment is due. If you pay your entire balance within this period, you avoid interest charges on new purchases.

- Fees: These are extra charges for certain things. You might see a late payment fee if you miss your due date, an annual fee just for having the card, or a foreign transaction fee for using your card in another country.

Key Credit Card Terms at a Glance

Getting comfortable with these terms is your first step toward mastering your finances. To make it even easier, here’s a quick-reference table that breaks down the essentials.

| Term | Simple Explanation | Why It Matters for Your Wallet |

|---|---|---|

| Credit Limit | The maximum amount you can borrow. | Going over it can trigger fees and hurt your credit score. |

| Balance | The total amount you currently owe. | This is the amount that interest (APR) will be charged on if you don't pay it in full. |

| APR | The yearly interest rate charged for borrowing money. | A high APR means carrying a balance gets very expensive, very quickly. |

| Minimum Payment | The smallest amount you must pay each month. | Paying only the minimum is the slowest and most expensive way to pay off debt. |

| Grace Period | The time you have to pay your bill without interest. | This is your window to pay in full and avoid all interest charges on purchases. |

| Annual Fee | A yearly fee for having the card. | Make sure the card's rewards and benefits are worth more than the fee you're paying. |

| Late Fee | A penalty for not paying on time. | An easy-to-avoid charge that also damages your credit history. |

Keep this table handy as you start comparing cards or reviewing your statements. Knowing what these terms mean is the difference between credit being a helpful tool and a financial burden.

The True Cost of Interest and Minimum Payments

It’s easy to swipe a credit card, but understanding the real, long-term cost of that convenience is absolutely critical to your financial well-being. The single most expensive mistake you can make with a credit card is falling into the minimum payment trap. It might feel like a lifeline, but it's a feature designed to keep you in debt for as long as possible while you rack up massive interest charges.

When you only pay the minimum, you’re mostly just covering the new interest that was added to your balance for that month. Only a tiny fraction of your payment actually goes toward paying down what you originally spent. This kicks off a slow, expensive cycle where your debt barely shrinks, even though you’re making payments every single month.

The flowchart below shows the three key pieces that work together to determine these costs.

Essentially, your balance gets hit with the APR, and your goal is to manage that debt within your overall credit limit. Understanding this relationship is the foundation for getting ahead.

A Tale of Two Payments: A Real-World Example

Let's look at a practical example to see just how destructive the minimum payment habit really is.

Imagine you have a $1,000 balance on a card with a pretty standard 21% APR. The bank calculates your minimum payment as 2% of the balance, which works out to just $20 for the first month.

Now, let's play this out in two different ways:

-

Scenario A (Minimum Payment Only): If you stick to paying just that $20 minimum each month, it would take you over 8 years to pay off the debt. By the end, you would have paid an extra $1,048 in interest—more than the original $1,000 you spent!

-

Scenario B (Adding a Little Extra): What if you decided to pay $50 a month instead? It's only an extra $30, but the results are dramatic. You'd pay off the entire balance in just 2 years and pay only $231 in interest.

That small change of paying an extra $30 per month saves you $817 and gets you out of debt 6 years sooner. This shows the incredible power of paying more than the minimum.

Want to see for yourself? A Canadian credit card minimum payments calculator can help you run your own numbers and see just how much you could save.

The Power of Compounding Interest Working Against You

So what's the force driving this expensive cycle? It's compounding interest. When you're investing, compounding is your best friend—your earnings start to generate their own earnings. But with credit card debt, it becomes a relentless enemy.

With debt, compounding interest means you start paying "interest on your interest." The interest charged last month gets rolled into your principal balance. The next month, the bank calculates interest on that new, slightly larger total.

This is exactly why it can feel like your debt is stuck in quicksand. Even as you make payments, the interest keeps piling on top of itself, putting you on a financial treadmill that's tough to escape.

The National Picture of Credit Card Debt

This isn't just a theoretical problem; it’s a massive issue affecting millions of people. U.S. consumers recently paid an estimated $160 billion in credit card interest and fees in a single year, a huge jump from $105 billion just two years earlier. This was driven by average APRs climbing to 21.3% as balances continued to grow.

Even more concerning, 15% of cardholders are now making only the minimum payments—the highest that number has been since 2015. With the average unpaid balance sitting at $7,886 per household, total U.S. credit card debt has soared past $1.2 trillion.

These numbers aren't just statistics; they represent a real financial burden for families across the country. Breaking free from the minimum payment trap is one of the most powerful steps you can take toward financial freedom. If you're dealing with high-interest debt, our guide on https://collapsedwallet.com/transferring-a-credit-card-balance/ can show you how to move it to a lower-rate card and start making real progress.

How to Read Your Credit Card Statement

That credit card statement that shows up every month? It’s more than just a bill. It's a monthly report card on your spending, and learning how to read it is one of the most powerful money skills you can build.

At first, it might just look like a wall of numbers and tiny print. But once you know what to look for, that confusing document becomes an incredible tool for managing your budget, catching costly errors, and actually hitting your financial goals. Let’s break it down.

Finding the Critical Information

When you first open your statement, there are a few key numbers that need your immediate attention. These are the details that drive your next steps and help you avoid fees and interest.

- Payment Due Date: This is the big one—the absolute deadline. Your payment has to land in their account by this date to sidestep a late fee and protect your credit score. Circle it, set a reminder, do whatever it takes.

- Minimum Payment Due: This is the smallest amount the card issuer will accept to keep your account in good standing. But as we've talked about, only paying this is a fast track to long-term, expensive debt.

- Statement Closing Date: This date officially ends the billing period. Any transaction you make after this day will simply roll onto your next statement.

- New Balance: Here it is—the total amount you owe for the billing cycle. Paying this off completely by the due date is the #1 way to make sure you never pay a penny in interest on your purchases.

If you can build one habit, make it this: Pay your New Balance in full by the Payment Due Date every single month. Doing this turns your credit card from an expensive loan into a simple, convenient payment tool. It’s a move that can save you hundreds, if not thousands, in interest over the years.

Decoding the Transaction Details

Once you get past the summary box, you’ll find a detailed log of every swipe, tap, and click. This is where you can see exactly where your money went and make sure everything adds up correctly.

Take a few minutes to scan this list every month. Do you recognize every single charge? If something looks unfamiliar, it could be a simple mistake or a red flag for fraud. Also, keep an eye out for duplicate charges or amounts that seem wrong. If you spot an error, call your credit card company right away to get it sorted out.

Understanding Fees and Interest Charges

For anyone who carries a balance from one month to the next, this part of the statement is essential reading. It shows you the real cost of borrowing money.

- Fees Charged: This section is a line-by-line breakdown of any fees you were charged. You'll see things like late fees, an annual fee, or foreign transaction fees listed here.

- Interest Charged: This shows the exact dollar amount of interest that was added to your balance this month. You'll also see the different APRs your card has, since the rate for purchases is often different from the one for cash advances.

Checking these numbers gives you a clear picture of what your debt is costing you. It's a powerful motivator to pay down your balance as quickly as you can and to avoid the actions that trigger extra fees in the first place.

Using Credit Cards to Build a Strong Credit Score

Think of your credit score as your financial reputation. It’s the three-digit number that lenders—from mortgage brokers and car dealerships to cell phone companies—use to quickly size up how you handle debt. A good score tells them you’re a reliable borrower. And one of the simplest, most direct ways to build a great score is by using a credit card responsibly.

Your credit report is basically a running history of how you manage borrowed money. When you use a credit card and pay it back on time, you're creating a positive track record. Each successful payment is like a gold star, showing future lenders that you can be trusted. This makes it much easier to get approved for bigger loans down the road and, just as importantly, secure lower interest rates.

The Two Pillars of a Healthy Credit Score

Credit scores seem mysterious, but they're largely built on two fundamental habits you have complete control over. Nail these two, and you’re well on your way to excellent credit.

- On-Time Payments: This is the big one. Nothing impacts your score more than your payment history. Lenders need to know you'll pay back what you owe, and a long history of on-time payments is the best proof you can offer.

- Credit Utilization Ratio (CUR): It sounds complicated, but it's not. This is just the percentage of your available credit that you're currently using. Keeping this number low shows lenders that you aren’t maxing out your cards and relying too heavily on debt.

You don't need a PhD in finance to build a good score. It really just boils down to being consistent with these two things.

Actionable Strategies for Building Credit

So, how do you turn this knowledge into action? Here are a few simple strategies to make your credit card work for you.

-

Set Up Autopay: Life gets busy. The single best way to ensure you never, ever miss a payment is to automate it. Set it up to pay at least the minimum amount each month. Think of it as a safety net—you can always log in and pay more, but you’ll never be late.

-

Follow the 30% Rule: As a rule of thumb, try to keep your balance below 30% of your total credit limit. If you have a $5,000 limit, that means keeping your statement balance under $1,500. This keeps your utilization ratio in a healthy range. If you want to get into the nitty-gritty, our guide explains in more detail what is a good credit utilization ratio.

-

Pay More Than the Minimum: Paying only the minimum is a recipe for long-term debt and high interest charges. The best habit is to pay your statement balance in full every month. Not only does this save you from paying a dime in interest, but it also helps keep your reported utilization at or near 0%.

The table below breaks down how your everyday habits can either boost your score or drag it down.

Credit Card Actions and Their Impact on Your Credit Score

| Action | Positive Impact (How it Helps) | Negative Impact (How it Hurts) |

|---|---|---|

| Paying Your Bill | Paying on time, every time, builds a strong payment history, the most important factor in your score. | A single late payment (30+ days) can drop your score significantly and stays on your report for 7 years. |

| Managing Your Balance | Keeping your balance low (below 30% of your limit) lowers your credit utilization ratio, which lenders like to see. | High balances signal risk to lenders and can quickly lower your score, even if you pay on time. |

| Applying for New Cards | Having multiple cards (and managing them well) can increase your total available credit, lowering your overall utilization. | Each application creates a "hard inquiry," which can temporarily dip your score. Applying for too many cards at once is a red flag. |

| Closing Old Cards | There's very little positive impact here. Keeping old accounts open is usually better for your score. | Closing a card reduces your available credit (raising your utilization) and can shorten your average account age. |

Ultimately, consistent, positive actions are what build a great credit score over time.

By reframing your credit card from a simple payment method to a strategic financial tool, you take control. Each on-time payment and low reported balance is another positive mark on your financial record, paving the way for future goals like buying a home or starting a business.

The small choices you make with your card today directly shape your financial opportunities for tomorrow.

Finding the Right Credit Card for You

Choosing a credit card can feel like a high-pressure sales pitch, with flashy offers and slick marketing coming from all directions. The secret is to tune out all that noise. The best card for you has everything to do with your personal financial goals and almost nothing to do with the hype.

A card that’s a game-changer for a frequent traveler could be a total disaster for someone working hard to pay down debt. By lining up a card’s features with what you actually need, you can make sure it’s a helpful financial tool, not just an expensive piece of plastic. Let’s break it down by a few common goals.

For the Debt Crusher

If your main mission is to wipe out existing high-interest credit card debt, your strategy is laser-focused. You’re on the hunt for one specific feature: a 0% introductory APR on balance transfers.

This is a powerful tool. It lets you move that nagging, high-interest debt onto a new card that won’t charge a penny of interest for a set period, usually 12 to 21 months. This gives you a crucial window of opportunity where every single dollar you pay goes straight to chipping away at the principal. You can get out of debt so much faster this way.

- What to Look For: The longest 0% intro APR period you can find on balance transfers.

- What to Watch Out For: Don’t forget about balance transfer fees. They’re typically 3-5% of the amount you move, which can add up. Most importantly, have a solid plan to pay off the entire balance before that intro period ends and the regular, often high, APR kicks in.

For the Rewards Maximizer

So, you’re the type who pays your balance in full every single month? Great. You should absolutely get something back for your spending, and a rewards card is the way to do it. These cards come in a few different flavors, so you can pick one that matches where your money actually goes.

- Cash Back Cards: These are beautifully simple. You earn a percentage back on your purchases, either as a flat rate on everything (like 1.5% or 2%) or in special categories (like 5% on groceries and 1% on everything else).

- Travel Rewards Cards: These are for the adventurers. You’ll earn points or miles that can be redeemed for flights, hotel stays, or other travel goodies. The best ones also come with valuable extras like trip insurance or free checked bags.

The Golden Rule of Rewards: Your points and cash back are only a real benefit if you aren’t paying interest. If you carry a balance, the interest fees will almost always gobble up any rewards you’ve earned. For a deeper look, check out our guide on budgeting with credit cards to make sure your spending habits support your rewards goals.

For the Credit Starter

If you’re just starting out and have a thin credit file (or no file at all), your goal is different. You need a card that’s easy to get approved for and simple to manage. This is about laying a foundation.

Look for a basic, no-frills card with no annual fee and a low credit limit. Your focus right now isn’t on earning awesome rewards; it’s on building a rock-solid history of making on-time payments. A student card or a secured credit card—which just requires a small, refundable security deposit—are fantastic starting points. Once you’ve proven you’re responsible, you can easily upgrade to a card with more perks down the road.

Answering Your Top Credit Card Questions

Even after you get the hang of the basics, some specific questions always seem to come up. Let’s tackle some of the most common ones you might be wondering about. Think of this as your go-to reference for those lingering “what if” scenarios.

Is It a Bad Idea to Have a Lot of Credit Cards?

Not at all, if you can handle it. Having more than one card can actually give your credit score a little boost. It increases your total available credit, which helps lower your credit utilization ratio—a key factor in your score.

The real challenge is discipline. Juggling multiple due dates and resisting the urge to spend more than you have can be tough. For most people, starting with one or two cards you can manage perfectly is the smartest way to build credit without getting in over your head.

What’s the Quickest Way to Get Rid of Credit Card Debt?

The single fastest way is to throw as much money as you can at it—always pay more than the minimum. Two classic strategies that really work are the “debt avalanche” and the “debt snowball.”

- The Avalanche Method: You attack the card with the highest interest rate first, making minimum payments on everything else. This approach saves you the most money in the long run.

- The Snowball Method: You focus on paying off your smallest balance first. Nailing that first debt gives you a huge motivational boost to keep going.

Both methods work—it just depends on what motivates you more: saving money or scoring quick wins. Of course, if the debt feels completely unmanageable, some people end up exploring more drastic options like clearing your credit card debt through bankruptcy.

How Does a Secured Credit Card Actually Work?

A secured card is a fantastic tool for anyone just starting out with credit or trying to repair a damaged score. It’s pretty straightforward: you give the bank a cash security deposit, and that deposit usually becomes your credit limit.

So, if you put down $300, you get a credit limit of $300. You use it like any other credit card—buy gas, grab groceries, pay online—and the bank reports your payment habits to the credit bureaus. It’s a low-risk way for you to prove you can be trusted with credit.

Think of a secured card as credit with training wheels. By using it for small, manageable purchases and paying it off in full every month, you’re building a track record of reliability that will help you graduate to a regular, unsecured card down the line.

What Do I Do if My Card Gets Lost or Stolen?

First, don’t panic. But you do need to act fast. Call your credit card company immediately using the number on their website or an old statement.

They’ll instantly freeze your account to block any more purchases and will mail you a new card. The good news is that federal law limits your liability for fraudulent charges to just $50, and most major card issuers have $0 liability protection as long as you report the problem right away.

At Collapsed Wallet, our mission is to provide clear, actionable financial guidance that empowers you to build a secure future. Explore more of our resources and take the next step on your financial journey at https://collapsedwallet.com.