Table of Contents

- 1. YNAB (You Need A Budget)

- 2. Monarch Money

- 3. EveryDollar (Ramsey Solutions)

- 4. Debt Payoff Planner (Official)

- 5. Undebt.it

- 6. Tiller (Debt Payoff Planner template)

- 7. Rocket Money (formerly Truebill)

- 8. Bright Money

- 9. Changed (formerly ChangEd)

- 10. Credible Debt Tracker

- 11. Unbury.me

- 12. Snowball Wealth

- Top 12 Debt Payoff Apps — Core Features Comparison

- Choosing Your Debt Payoff Partner for a Brighter Financial Future

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Navigating the journey to financial freedom can feel overwhelming, but the right technology can transform your strategy from guesswork into a clear, actionable plan. With countless tools available, finding the one that aligns with your specific goals is crucial. This guide cuts through the noise, analyzing the 12 best debt payoff apps to help you track progress, stay motivated, and accelerate your path to becoming debt-free in 2025. Whether you prefer the psychological wins of the snowball method or the interest-saving power of the avalanche approach, there's an app here designed to support your journey. We’ve done the heavy lifting to provide a comprehensive look at top-tier options like YNAB, Monarch Money, and Undebt.it, so you can make an informed choice.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

In this resource, we'll dive deep into each application, offering a detailed analysis of its core features, pricing, platform availability, and ideal use cases. You'll find honest assessments of pros and cons, step-by-step guidance for getting started, and direct links to download each app. Our goal is to equip you with the specific information needed to select the best debt payoff app that will serve as your digital partner in conquering debt for good.

1. YNAB (You Need A Budget)

YNAB, short for You Need A Budget, is more than just a debt-tracking tool; it's a comprehensive budgeting system built on a zero-based methodology. Its core philosophy is to give every dollar a job, which helps users find extra cash flow to accelerate debt repayment. YNAB stands out because it integrates debt payoff directly into your monthly budget, making it an active part of your financial plan rather than a separate, passive calculation. This hands-on approach positions it as one of the best debt payoff apps for those who want to overhaul their entire financial picture, not just track loan balances.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

YNAB's Loan Planner tool is its most powerful debt-focused feature. Once you link your loan accounts or add them manually, you can set payoff goals and simulate different scenarios. For instance, you can see how an extra £50 payment each month impacts your payoff date and total interest saved. This makes abstract financial goals tangible and motivational.

- Getting Started: Begin by setting up your budget categories and linking your bank accounts. Then, add your debts (student loans, credit cards, car loans) to the "Loans" section.

- Create a Goal: For each loan, set a target payoff date or a monthly payment goal. YNAB will then prompt you to budget that amount each month.

- Find the Money: Use the zero-based budget to identify areas where you can cut back, reallocating those funds directly to your debt goals.

Pricing and Availability

- Platform: Web, iOS, Android, Apple Watch, and Alexa.

- Cost: YNAB offers a generous 34-day free trial. After that, it costs $14.99 per month or $99 per year. College students can get a full year for free.

| Pros | Cons |

|---|---|

| Holistic approach finds money for debt | Steeper learning curve than simpler apps |

| Powerful Loan Planner tool | Higher price point |

| Excellent educational workshops and support | Requires consistent, manual engagement |

Learn more at YNAB.com

2. Monarch Money

Monarch Money is a modern, all-in-one financial dashboard designed to replace legacy apps like Mint with a clean, ad-free experience. While it functions as a comprehensive budgeting tool, its strength lies in visualising your entire financial picture, including debt. It integrates debt payoff into broader financial goals, such as saving for a down payment or retirement, making it one of the best debt payoff apps for users who want to see how their debt reduction efforts fit into their long-term wealth-building strategy.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Monarch’s Goals feature is central to its debt payoff capabilities. Unlike apps that only focus on debt, Monarch allows you to create a "Pay down credit card debt" goal alongside a "Save for a holiday" goal, helping you balance competing financial priorities. The visual progress bars and cash flow projections provide clear motivation and insight.

- Getting Started: Connect your financial accounts; Monarch boasts unlimited connections. Once synced, navigate to the "Goals" section to begin setting up your debt payoff plan.

- Track Progress Visually: Create a new goal for each debt you want to tackle. The app tracks your progress and projects your payoff timeline based on your contributions.

- Utilise Cash Flow Insights: Use the Sankey diagram and cash flow reports to spot spending trends and identify extra money that can be directed toward your debt goals each month.

Pricing and Availability

- Platform: Web, iOS, and Android.

- Cost: Monarch Money offers a 7-day free trial. Afterwards, it costs $14.99 per month or $99.99 per year.

| Pros | Cons |

|---|---|

| Clean, visual interface and ad-free experience | No free tier after a short 7-day trial |

| Strong account connectivity and syncing | Primarily available in the US and Canada |

| Allows a collaborator (partner/advisor) at no extra cost | May be too feature-rich for simple debt tracking |

Learn more at MonarchMoney.com

3. EveryDollar (Ramsey Solutions)

EveryDollar is the budgeting app from personal finance personality Dave Ramsey and is built around his popular "Baby Steps" program. It uses a zero-based budgeting approach, similar to YNAB, but is heavily tailored to support the debt snowball method. This makes it one of the best debt payoff apps for those who are already following Ramsey's teachings or who want a straightforward, philosophy-driven tool to tackle debt by focusing on small wins to build momentum. The app’s strength lies in its simplicity and its direct integration of debt repayment into a monthly spending plan.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

EveryDollar's primary debt feature is its clear debt snowball tracking. It visually shows you how your extra payments are chipping away at your smallest debt first, which is a core tenet of the Ramsey method. The premium version enhances this by syncing with your bank accounts to automatically track spending and transactions, saving you from manual entry.

- Getting Started: Sign up and create your first monthly budget by allocating all your income to different spending categories, savings, and debt.

- Track Your Progress: List all your debts from smallest to largest. The app helps you focus all extra funds on the smallest balance while making minimum payments on the others.

- Stay Motivated: Use the "Baby Steps" tracker within the app to see your progress, from building an emergency fund to becoming debt-free.

Pricing and Availability

- Platform: Web, iOS, Android.

- Cost: There is a free version with manual transaction entry. The premium version, which includes bank syncing and other features, costs $79.99 per year after a 14-day free trial.

| Pros | Cons |

|---|---|

| Simple, snowball-centric philosophy | Mobile bank sync requires premium subscription |

| Free version is very functional for manual budgeting | Feature set is primarily focused on U.S. users |

| Clean, easy-to-use interface | Less flexible than other budgeting apps |

Learn more at EveryDollar.com

4. Debt Payoff Planner (Official)

For users who want a no-frills, dedicated tool focused purely on debt elimination, Debt Payoff Planner is an excellent choice. Unlike comprehensive budgeting apps, this platform is purpose-built to do one thing exceptionally well: create, track, and visualise a step-by-step debt repayment plan. Its streamlined approach makes it one of the best debt payoff apps for those who feel overwhelmed by complex financial software and simply want a clear, motivational roadmap to becoming debt-free. It excels at showing you the finish line and the exact steps needed to get there.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Debt Payoff Planner’s strength lies in its simplicity and powerful projection tools. The app supports the most popular repayment strategies, allowing users to see which method saves more money or time. Its visual progress charts provide a strong motivational boost as you see your balances shrink. For more tips on selecting a strategy, see our complete guide on how to pay off debt fast.

- Choose Your Strategy: Start by inputting all your debts manually. The app will then let you select your preferred method: Snowball (lowest balance first), Avalanche (highest interest first), or a custom order.

- Set Your "Snowball": Input your total monthly debt payment. The app automatically calculates how your extra payments (your "snowball") will be applied to accelerate your payoff date.

- Track Your Progress: As you make payments, update the app to see your payoff date get closer and watch your debt-free journey unfold through clear charts and reports.

Pricing and Availability

- Platform: Web, iOS, and Android.

- Cost: A functional free version is available. The Pro version, which adds more features, is a low-cost one-time purchase of $4.99 on mobile or a $12 annual subscription for web access.

| Pros | Cons |

|---|---|

| Quick setup, specifically for debt payoff | Narrower scope than full budgeting apps |

| Very low entry price with a free tier | Bank syncing options are limited |

| Supports multiple payoff strategies | Requires manual input for all debts |

Learn more at DebtPayoffPlanner.com

5. Undebt.it

Undebt.it is a powerful, web-based tool designed for users who want deep customisation over their debt repayment strategy. Unlike many simpler apps, it doesn't just offer the debt snowball or avalanche methods; it provides eight different payoff plans, including hybrid options, giving you granular control. This focus on strategic planning makes it one of the best debt payoff apps for individuals who want to analyse various scenarios and choose the mathematically optimal or most motivating path without being tied to a specific budgeting philosophy.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Undebt.it’s strength lies in its Payoff Plan Comparison tool. It allows you to instantly see how different strategies affect your debt-free date and the total interest you'll pay. The free version is incredibly robust, offering all core planning features, while the optional Undebt.it+ unlocks advanced capabilities like YNAB integration and bill management.

- Getting Started: Sign up for a free account and enter all your debts manually, including balances, interest rates, and minimum payments.

- Choose Your Method: Navigate to the "Debt Snowball" section (this is the default name, but it shows all methods) to compare the eight plans. Select the one that aligns with your financial goals, whether it’s the debt avalanche, snowball, or a custom hybrid.

- Track Your Progress: Log your payments each month. Undebt.it will update your payoff timeline and show you exactly how much progress you've made.

Pricing and Availability

- Platform: Web-based (works on any browser).

- Cost: The core service is completely free. The optional Undebt.it+ subscription is $12 per year.

| Pros | Cons |

|---|---|

| Highly customisable with eight payoff methods | Utilitarian interface is less polished than others |

| Powerful free version is sufficient for most users | Advanced features require a paid subscription |

| Strong community reputation for clarity and focus | Lacks a dedicated mobile app |

Learn more at Undebt.it

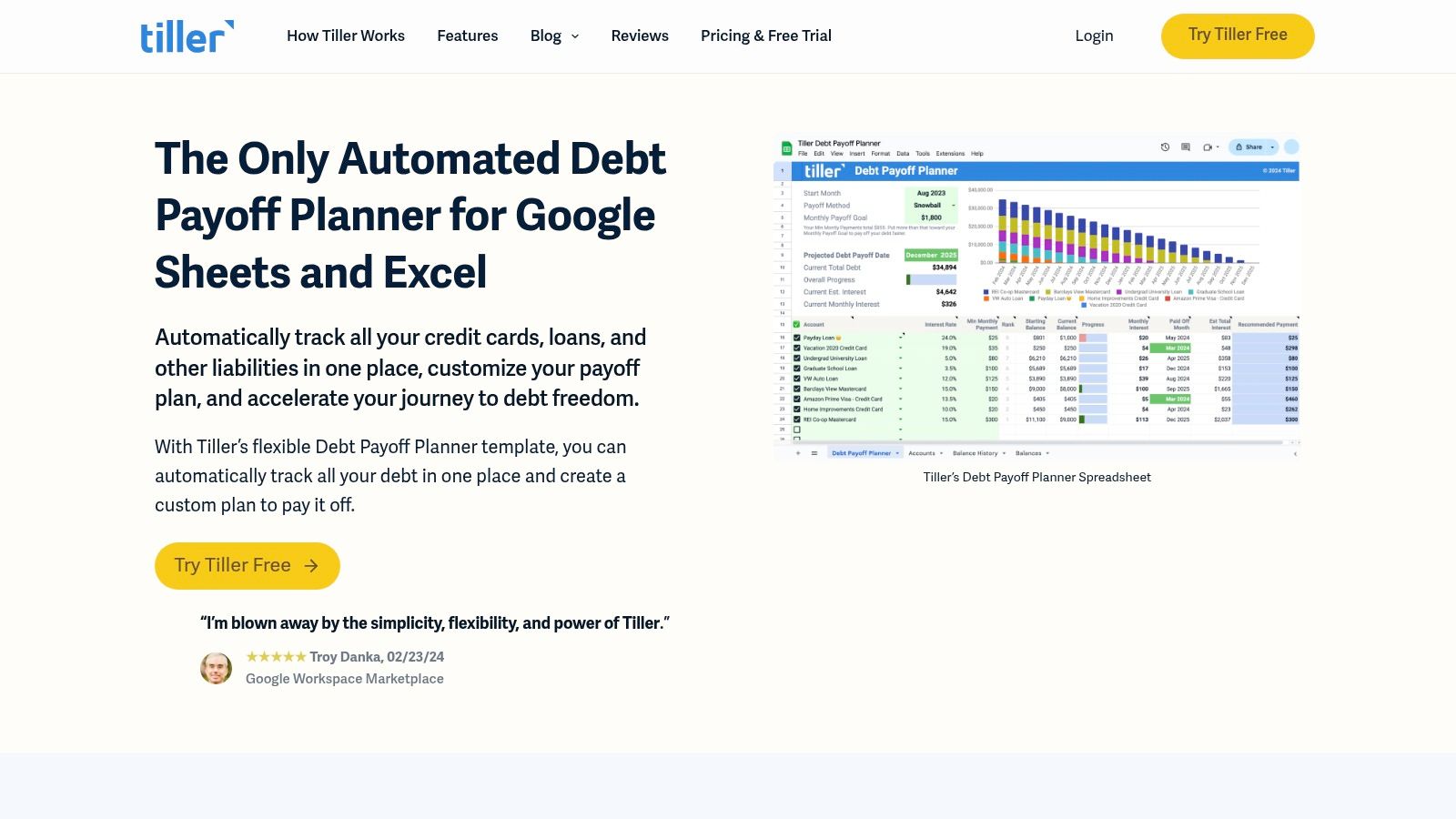

6. Tiller (Debt Payoff Planner template)

For those who love the flexibility of a spreadsheet but hate manual data entry, Tiller offers a powerful middle ground. It's a service that automatically pulls your daily transactions, balances, and loan information into Google Sheets or Microsoft Excel. Tiller isn't a standalone app but rather a data-feeding service combined with a suite of customisable templates, including a highly effective Debt Payoff Planner. This makes it one of the best debt payoff apps for spreadsheet enthusiasts who want maximum control and transparency over their numbers without the tedious task of updating them by hand.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Tiller’s Debt Payoff Planner template is its main draw for debt reduction. It allows you to model both the debt snowball and avalanche methods, showing you precisely how extra payments will affect your payoff timeline and interest costs. Since it's integrated with your full budget, you can easily find ways to free up cash. By reviewing your spending categories, you can identify opportunities to cut expenses and redirect those funds toward your debt.

- Getting Started: Sign up for Tiller, link your financial accounts, and choose to launch the Foundation Template in Google Sheets or Excel.

- Install the Template: From the Tiller Community Solutions add-on, install the Debt Payoff Planner. Your linked loan accounts will populate automatically.

- Model Scenarios: Enter your preferred payoff strategy (snowball or avalanche) and add an "extra payment" amount to the monthly budget column. The sheet instantly recalculates your payoff date and total interest saved.

Pricing and Availability

- Platform: Web-based (Google Sheets or Microsoft Excel). Mobile access via the respective spreadsheet apps.

- Cost: Tiller offers a 30-day free trial. After the trial, it costs a flat $79 per year, which includes linking unlimited accounts.

| Pros | Cons |

|---|---|

| Maximum customisation and control | Requires comfort working in spreadsheets |

| Automated data feeds save significant time | No dedicated native mobile application |

| Integrates debt planning with a full budget | Initial setup can be more involved |

Learn more at TillerHQ.com

7. Rocket Money (formerly Truebill)

Rocket Money, formerly known as Truebill, takes a unique approach to debt management by focusing on freeing up cash flow from your existing expenses. Instead of being a dedicated debt calculator, it acts as a financial assistant, identifying "money leaks" like forgotten subscriptions and overpriced bills. This makes it one of the best debt payoff apps for users who feel their budget is too tight to make extra payments, as it actively finds savings you can redirect towards your loans. Its strength lies in making debt reduction more manageable by increasing your available funds first.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Rocket Money's most impactful features are its Subscription Manager and Bill Negotiation service. The app automatically scans your transaction history to find all recurring charges, allowing you to cancel unwanted services with a single tap. The negotiation service works on your behalf to lower bills like cable and internet, giving you a powerful tool to reduce monthly overhead.

- Getting Started: Link your primary bank and credit card accounts to allow the app to analyse your spending and subscriptions.

- Cancel and Negotiate: Review the list of recurring payments in the "Recurring" tab. Use the one-click cancel feature for services you no longer need. Authorise Rocket Money to negotiate eligible bills for potential savings.

- Redirect Savings: Once you free up cash, manually apply those savings as extra payments to your highest-priority debt. Combining this with the many tips for paying off credit card debt can significantly speed up your journey.

Pricing and Availability

- Platform: Web, iOS, Android.

- Cost: The basic version is free. Premium membership operates on a "pay-what-you-think-is-fair" model, from $4 to $12 per month. The bill negotiation service takes a percentage (typically 30-60%) of the first year's savings.

| Pros | Cons |

|---|---|

| Finds money for debt you didn't know you had | Bill negotiation fee is a percentage of savings |

| Easy-to-use subscription cancellation tool | Mixed user reviews on negotiation success |

| All-in-one financial dashboard | Premium cost can be ambiguous |

Learn more at RocketMoney.com

8. Bright Money

Bright Money uses artificial intelligence to analyse your spending habits and find the smartest way for you to pay down debt. It creates a personalised payoff plan designed to save you the most money on interest, automatically adjusting as your finances change. The platform stands out by providing automated nudges and guidance, making it one of the best debt payoff apps for users who want a hands-off, AI-driven approach to tackling their balances without needing to manually shuffle numbers each month.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Bright Money's core feature is its Smart Pay system, which automatically makes debt payments for you from a linked bank account. It calculates the optimal amount to pay towards each debt to maximise interest savings, functioning like a set-it-and-forget-it system. The app also includes budgeting guidance and credit-building tools to provide a more holistic financial overview.

- Getting Started: Connect your bank accounts and add your credit card and loan details. The app’s AI will then analyse your financial data.

- Activate Your Plan: Bright Money will present a personalised debt payoff plan. Once you approve it, the app will begin making automated payments based on what it determines you can afford.

- Monitor Progress: Use the dashboard to track your debt-free date and see how much you're saving in interest over time.

Pricing and Availability

- Platform: iOS.

- Cost: Bright Money offers membership tiers, often with free trial periods or introductory discounts. Standard plans range from $6.99 to $14.99 per month, depending on the features selected.

| Pros | Cons |

|---|---|

| AI-driven automation simplifies payments | Monthly fee may not be worth it for all users |

| Customised plan to maximise interest savings | Bright Credit line product is closed to new customers |

| Automated nudges keep you on track | Primarily available on iOS |

Learn more at brightmoney.co

9. Changed (formerly ChangEd)

Changed offers a unique "set it and forget it" approach to debt repayment, making it one of the best debt payoff apps for those who want to accelerate their journey without actively thinking about it. The app works by rounding up your everyday purchases to the nearest dollar and applying that spare change directly to your chosen debt, such as a student loan or credit card. This micro-payment strategy helps chip away at your principal balance faster, saving you money on interest over time and turning your daily coffee run into a productive financial move.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Changed's core function is its automated Round-Ups feature, which makes saving effortless. You can also supplement these round-ups with scheduled transfers or on-demand "Boosts" when you have extra cash. The app supports popular debt-payoff strategies, allowing you to direct funds using the snowball or avalanche method, or you can create a custom plan.

- Getting Started: Download the app, link the bank account or credit card you use for daily spending, and then link the loan account you want to pay down.

- Automate Savings: The app automatically tracks your spending and accumulates round-ups. Once your round-up balance hits a certain threshold (e.g., $5), it transfers the money to your Changed account.

- Send Payments: Changed bundles these savings and sends an extra payment directly to your loan servicer on your behalf, reducing your principal balance.

Pricing and Availability

- Platform: iOS and Android.

- Cost: Changed offers a free 30-day trial. After the trial, a subscription is required, typically costing a few dollars per month.

| Pros | Cons |

|---|---|

| Effortless, set-and-forget automation | Requires regular spending to generate round-ups |

| Clear visual progress tracking is motivational | Subscription fee is required for full use |

| Gamified incentives and perks | Payments are bundled, not sent instantly |

Learn more at gochanged.com

10. Credible Debt Tracker

Credible Debt Tracker is less of a hands-on budgeting app and more of a strategic dashboard for monitoring your loans and identifying savings opportunities. It excels at consolidating all your debts, from student loans to credit cards and mortgages, into a single, clean interface. By leveraging data from TransUnion, it provides a 360-degree view of your liabilities and tracks your payoff progress automatically. This makes it one of the best debt payoff apps for users who want a high-level overview and actionable insights on how to reduce interest rates without the daily grind of manual budget management.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Credible’s standout feature is its ability to surface potential savings by scanning the market for refinancing or consolidation offers. It benchmarks your existing loans against current market rates and alerts you if a better deal is available, helping you lower payments or accelerate your payoff timeline. This is all done without impacting your credit score.

- Getting Started: Sign up for a free account and securely link your loan information. The platform uses TransUnion data to automatically pull in most of your existing debts.

- Consolidate Your View: Review the central dashboard to see all your loan balances, interest rates, and monthly payments in one place.

- Discover Savings: The tool will automatically analyse your profile and present personalised refinancing or consolidation offers if you are eligible, showing potential interest savings.

Pricing and Availability

- Platform: Web-based.

- Cost: Completely free to use. Credible earns a commission from lenders if you choose to take out a product through their platform.

| Pros | Cons |

|---|---|

| Free to use and simple to set up | Primarily a lead-generation tool for loans |

| Excellent for spotting refinance opportunities | Not a full budgeting or expense-tracking app |

| Provides a clear, consolidated loan dashboard | Limited features beyond loan monitoring |

Learn more at Credible.com

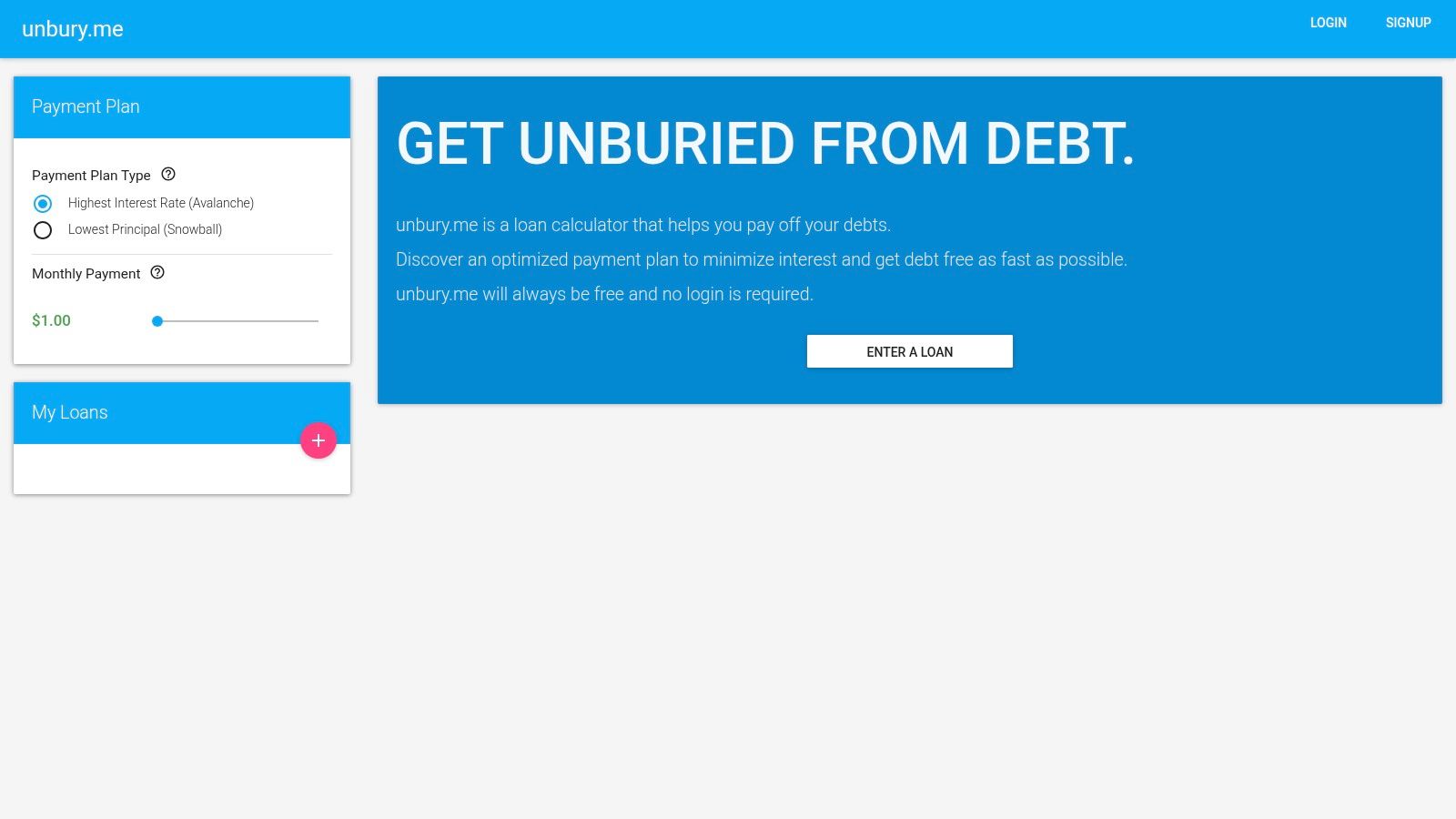

11. Unbury.me

Unbury.me is not an app in the traditional sense, but a powerful, free web-based calculator that excels at one specific task: helping you visualize and compare debt payoff strategies. Its strength lies in its simplicity and focus. By stripping away complex budgeting features, it provides a clear, interactive way to see the impact of the debt snowball versus the debt avalanche methods. This makes it an ideal starting point for anyone feeling overwhelmed and wanting to model different payoff plans before committing to a full-featured tracking app. It’s one of the best debt payoff tools for pure strategic planning.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

The core of Unbury.me is its interactive comparison tool. Users input their debts (balance, interest rate, minimum payment) and their total monthly debt payment. The site then instantly generates graphs showing the payoff timeline and total interest paid for both the avalanche and snowball methods, making the choice between them crystal clear.

- Getting Started: Navigate to the website and start entering your loan details directly on the homepage. There is no signup or login required.

- Compare Strategies: Input your total monthly payment amount. The tool automatically calculates and displays visual graphs comparing the two main payoff strategies.

- Model Scenarios: Use the slider to see how increasing your monthly payment affects your payoff date and interest savings. You can export your plan to a CSV file to save it.

Pricing and Availability

- Platform: Web only.

- Cost: Completely free. The site is supported by donations and does not have ads.

| Pros | Cons |

|---|---|

| Completely free and incredibly simple to use | Web-based only, no mobile app |

| Excellent for modeling strategies and what-if scenarios | Not a tracker; requires manual updates |

| No account or personal information required | Does not sync with bank accounts |

Learn more at unbury.me

12. Snowball Wealth

Snowball Wealth is a specialised platform laser-focused on one of the most significant debt burdens for many: student loans. Instead of being a general-purpose budgeter, it offers targeted tools and educational resources designed to help borrowers create an optimal repayment strategy. The platform excels at demystifying complex student loan options, from income-driven repayment plans to refinancing. This specific focus makes it one of the best debt payoff apps for anyone feeling overwhelmed by student debt and looking for a clear, actionable path forward.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Key Features & How to Use Them

Snowball Wealth's core strength lies in its free student loan planning tools. The platform guides you through understanding your loans and explores how different payment amounts or strategies could affect your payoff timeline and total interest paid. It also provides valuable community resources and courses to improve financial literacy.

- Getting Started: Sign up on their website and link your student loan accounts to get a clear overview of your total debt.

- Analyse Your Options: Use the planner to see projections for standard repayment versus strategies like making extra payments. The tool helps you understand the long-term impact of your choices.

- Explore and Learn: Take advantage of the articles and courses to learn more about loan forgiveness programs, refinancing, and other student-debt-specific topics.

Pricing and Availability

- Platform: Web (mobile-friendly).

- Cost: The core student loan planning tools are free. The platform also offers courses and other resources which may have associated costs.

| Pros | Cons |

|---|---|

| Highly specialised for student loans | Not a comprehensive debt management tool |

| Free core planning and analysis tools | Focus is primarily on the web platform |

| Strong educational and community focus | Fewer third-party reviews than larger apps |

Learn more at SnowballWealth.com

Top 12 Debt Payoff Apps — Core Features Comparison

| Product | Core features ✨ | UX ★ | Price/Value 💰 | Best for 👥 | Standout 🏆 |

|---|---|---|---|---|---|

| YNAB (You Need A Budget) | Zero-based budgeting, loan-payoff simulator, multi-region bank sync ✨ | ★★★★☆ | Subscription (higher) 💰 | Hands-on monthly budgeters 👥 | Robust budget methodology & education 🏆 |

| Monarch Money | Visual goal planning, unlimited accounts, subscription calendar ✨ | ★★★★☆ | Subscription; short trial 💰 | Mint replacers & planners 👥 | Clean visuals + collaborator access 🏆 |

| EveryDollar (Ramsey) | Zero-based + snowball-friendly, free web, Premium sync ✨ | ★★★☆☆ | Freemium; Premium for auto-sync 💰 | Ramsey snowball followers 👥 | Simple, snowball-centric workflow 🏆 |

| Debt Payoff Planner (Official) | Snowball/avalanche/custom plans, payoff date projections ✨ | ★★★★☆ | Free + low-cost Pro 💰 | Users wanting a focused payoff tool 👥 | Fast setup; payoff-focused value 🏆 |

| Undebt.it | Eight payoff methods, Debt Blaster, calendar & integrations ✨ | ★★★☆☆ | Strong free tier; + for advanced 💰 | Power users customizing payoff strategies 👥 | Deep customization of payoff methods 🏆 |

| Tiller (Debt Planner template) | Automated bank/loan feeds into Sheets/Excel; custom templates ✨ | ★★★★☆ | Annual subscription (competitive) 💰 | Spreadsheet-savvy planners 👥 | Maximum flexibility & transparency 🏆 |

| Rocket Money (Truebill) | Subscription discovery, bill negotiation, savings automations ✨ | ★★★★☆ | Choose-your-price Premium; negotiation fees 💰 | Users wanting practical cash-saving tools 👥 | Finds real cash to free for debt payoff 🏆 |

| Bright Money | AI-driven personalized payoff plans, budgeting & credit tools ✨ | ★★★☆☆ | Monthly membership tiers 💰 | People wanting automated guidance 👥 | Automated nudges & AI planning 🏆 |

| Changed (formerly ChangEd) | Round-ups, scheduled boosts, micro-payments toward debt ✨ | ★★★★☆ | Subscription for full automation 💰 | Set-and-forget payers (student loans) 👥 | Automated micro-payments accelerate payoff 🏆 |

| Credible Debt Tracker | 360° loan dashboard, TransUnion updates, refinance discovery ✨ | ★★★☆☆ | Free 💰 | Loan-focused borrowers seeking rate options 👥 | Consolidated loan view + refinance leads 🏆 |

| Unbury.me | Snowball vs avalanche comparison, interactive payoff graphs ✨ | ★★★★☆ | Free 💰 | Quick what-if modelers & planners 👥 | Fast, no-login strategy modeling 🏆 |

| Snowball Wealth | Student-loan planning, community resources & courses ✨ | ★★★☆☆ | Free core tools 💰 | Student-loan borrowers 👥 | Student-loan–focused planning & education 🏆 |

Choosing Your Debt Payoff Partner for a Brighter Financial Future

Navigating the landscape of financial technology can feel overwhelming, but you've just explored some of the best debt payoff apps available to help you reclaim control of your money. The journey to becoming debt-free is a marathon, not a sprint, and the right digital tool acts as your personal pacer, coach, and cheerleader all in one. We've seen how comprehensive budgeting systems like YNAB and Monarch Money integrate debt repayment into a holistic financial plan, forcing you to be intentional with every pound. For those who follow specific financial philosophies, EveryDollar provides a clear, structured path based on Dave Ramsey's proven principles.

The key takeaway is that there is no single "perfect" app for everyone. Your ideal financial partner depends entirely on your personality, your specific debt structure, and the level of hands-on engagement you're prepared to commit to. A visual learner who needs to see the impact of extra payments might find a dedicated tool like Undebt.it or the Debt Payoff Planner incredibly motivating. Conversely, someone who thrives on automation and wants to "set and forget" their progress might gravitate towards the innovative approaches of Bright Money or Changed, which leverage AI and micro-payments to chip away at balances with minimal daily effort.

How to Select the Right App for Your Journey

Making the right choice is crucial for long-term success. A tool that feels clunky or misaligned with your habits will quickly be abandoned. Before you commit, ask yourself a few critical questions to narrow down the options:

- What is my primary goal? Is it simply to track my payoff progress and experiment with strategies like the snowball or avalanche method? If so, a free or low-cost calculator like Unbury.me or the Credible Debt Tracker might be all you need. Or is my goal to fundamentally change my spending habits to free up more cash for debt? In that case, an all-in-one budget and debt app like YNAB or Tiller is a more powerful choice.

- How much am I willing to spend? Many of the most robust apps come with a subscription fee. While this can seem counterintuitive when you're trying to save money, the cost can often be justified if the app's features help you save hundreds or even thousands in interest over time. Start with free trials to determine if the value provided is worth the investment.

- What is my tech-comfort level? Are you someone who loves digging into spreadsheets and customizing every detail? Tiller offers unparalleled flexibility for the data-driven user. Or do you prefer a sleek, user-friendly interface that does most of the heavy lifting for you? Apps like Rocket Money and Snowball Wealth are designed for simplicity and ease of use.

Taking the First Step Towards Financial Freedom

Selecting one of the best debt payoff apps is a significant and empowering first step, but the real magic happens when you pair technology with consistent, intentional action. The app is your map and compass, but you are still the one steering the ship. The goal isn't just to find a piece of software; it's to find a system that reduces financial anxiety, provides clarity, and keeps you motivated when the journey feels long.

Remember that the ultimate aim is to escape financial worries and build a more secure future. Each extra payment you make, tracked and celebrated by your chosen app, is a victory. It’s a direct investment in your peace of mind. Don't be afraid to experiment. Try a free tool, sign up for a trial of a premium service, and see which one clicks. The app that makes your goals feel tangible and achievable is the right one for you. Start today, and take that first confident step on your path to financial freedom.

As you embark on your journey to eliminate debt, managing your physical wallet can be just as important as managing your digital one. To complement your new debt-fighting app, consider the minimalist and secure wallets from Collapsed Wallet. A streamlined wallet helps you be more mindful of your cash and card usage, reinforcing the positive financial habits you're building. Check out the collection at Collapsed Wallet to find a tool that helps you carry only what you need.

1 thought on “best debt payoff apps: discover top picks for 2025”