Table of Contents

- 1. The 50/30/20 Budget Rule

- 2. Automated Savings Transfers

- 3. The Zero-Based Budget Method

- 4. The 24-Hour Rule for Impulse Purchases

- 5. Expense Tracking and the 'Money Leak' Audit

- 6. The Envelope System (Digital or Physical)

- 7. Adopt Energy-Efficient Habits and Technologies

- 8. Debt Consolidation and Refinancing Strategies

- 9. Subscription Audit and Cancellation Strategy

- 10. Side Hustle Income Optimization for Accelerated Savings

- Top 10 Ways to Save Money — Comparison

- Your Next Step Towards Financial Control

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Navigating the world of personal finance can feel overwhelming, but achieving financial stability often boils down to a few powerful habits. The journey to financial freedom isn't about drastic deprivation; it's about making smart, intentional choices that build wealth over time. This guide is designed to cut through the noise, offering the best ways to save money with clear, actionable strategies that you can implement today. Whether you're building an emergency fund, paying down debt, or investing for the future, these proven methods will empower you to take control of your money and build a more secure future.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

This comprehensive roundup moves beyond generic advice, providing prioritized and high-impact strategies across every area of your financial life. We will explore powerful frameworks like the 50/30/20 Budget Rule and the Zero-Based Budget Method to give you command over your cash flow. We'll also cover tactical moves like conducting a 'money leak' audit, automating your savings transfers, and implementing the 24-hour rule to curb impulse buys. The savings you generate can be redirected toward significant goals, from accelerating debt repayment to upgrading your home. For those aspiring to elevate their living spaces without overspending, learning how to achieve luxury home decor on a budget through smart shopping can be a game-changer. Each method in this listicle includes specific steps and common pitfalls to avoid, giving you a complete toolkit for financial success.

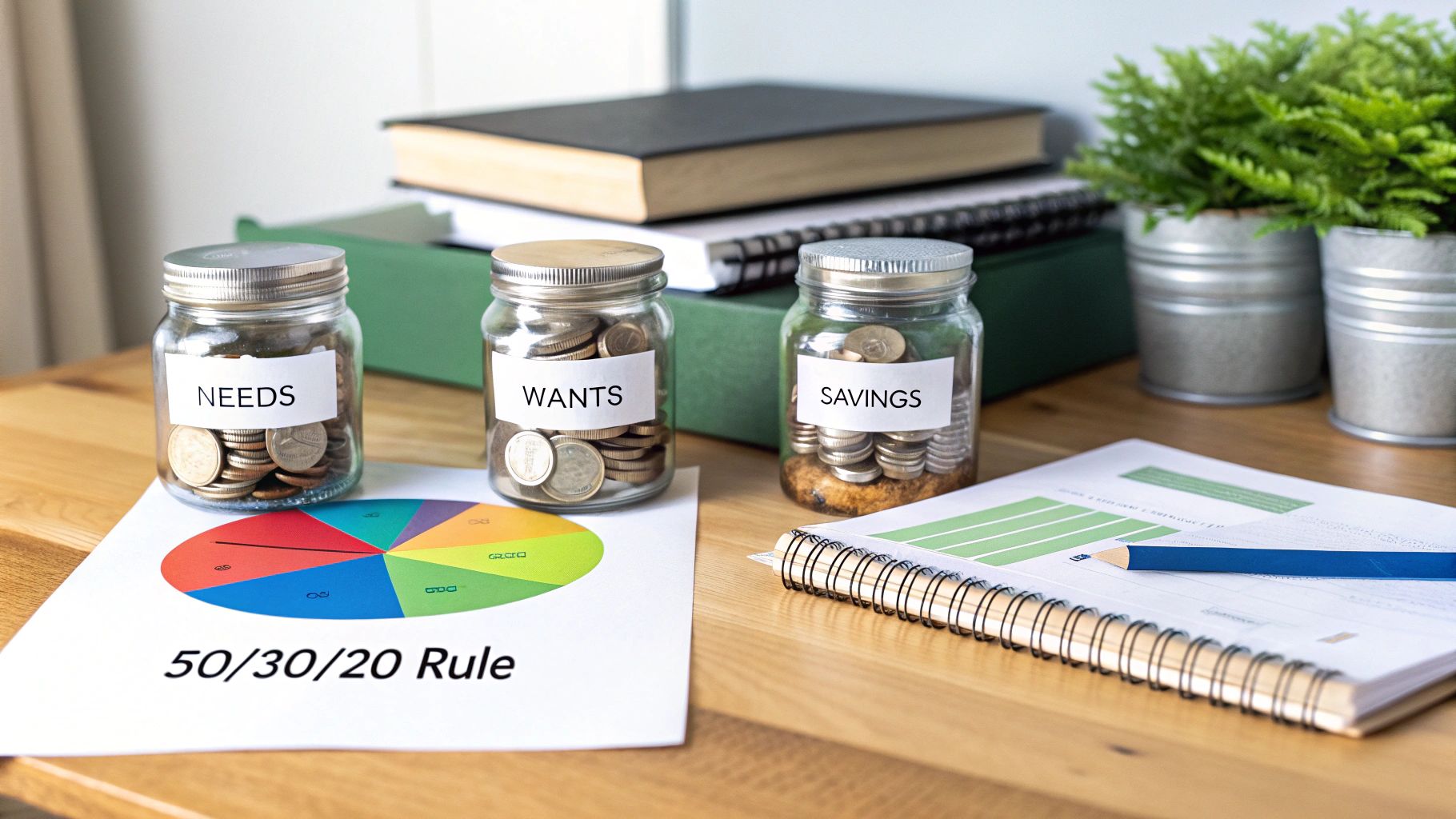

1. The 50/30/20 Budget Rule

The 50/30/20 rule is a powerful, yet simple, framework for managing your after-tax income and is one of the best ways to save money without complex tracking. Popularized by financial experts like Elizabeth Warren, this method removes the stress of line-item budgeting by allocating your money into three clear categories: 50% for Needs, 30% for Wants, and 20% for Savings and Debt Repayment. This structured approach provides clarity on where your money is going, creating a direct path toward achieving financial freedom.

How It Works in Practice

The rule's strength lies in its simplicity and flexibility. First, calculate your take-home pay. Then, divide it according to the percentages:

- 50% for Needs: This covers your essential living expenses. Think rent or mortgage payments, utilities, groceries, insurance, essential transportation, and minimum debt payments.

- 30% for Wants: This category is for non-essential lifestyle spending. It includes dining out, entertainment, hobbies, streaming subscriptions, and vacations.

- 20% for Savings & Debt: This crucial portion goes directly toward your financial goals, such as building an emergency fund, investing for retirement, or paying down high-interest debt beyond the minimum payments.

For instance, a young professional with a take-home pay of $3,500 per month would allocate $1,750 to needs, $1,050 to wants, and $700 to savings and aggressive debt repayment.

Actionable Tips for Implementation

To get started, track your spending for one month to see where your money currently goes. Be honest about distinguishing needs (e.g., essential groceries) from wants (e.g., gourmet coffee).

Pro Tip: Use budgeting apps like YNAB or Mint to automatically categorize your spending and monitor your 50/30/20 allocations in real-time. This tech-driven approach simplifies the process and keeps you accountable.

Review your budget quarterly to recalibrate for any changes in income or financial goals. For a more detailed guide on building a financial plan that works for you, here’s how to create a budget you will stick to.

2. Automated Savings Transfers

Automating your savings is a cornerstone strategy for building wealth and one of the most effective ways to save money consistently. This "pay yourself first" method involves setting up recurring, automatic transfers from your checking account to a savings or investment account. By making the process effortless and removing the manual step, you leverage behavioral psychology to prioritize your financial goals before you have a chance to spend the money elsewhere.

How It Works in Practice

The beauty of this system is its "set it and forget it" nature. You simply decide on a savings amount and schedule the transfer, typically to coincide with your payday. This ensures the money is moved to savings before it blends in with your spending funds.

- For an Emergency Fund: A professional sets an automatic transfer of $300 on the 1st of every month, effortlessly saving $3,600 in one year.

- For Long-Term Goals: A family automates a $150 monthly transfer into a 529 college savings plan, consistently building their child's education fund.

- For Irregular Expenses: A gig worker schedules a weekly $100 transfer to a separate high-yield savings account designated for quarterly tax payments, avoiding last-minute financial stress.

This approach transforms saving from a disciplined chore into an invisible habit that works silently in the background to secure your financial future.

Actionable Tips for Implementation

Start by logging into your online banking portal or a dedicated finance app. Look for the option to set up recurring transfers between your accounts.

Pro Tip: Schedule your automatic transfer for the same day you get paid. This simple timing trick means you won't even "miss" the money because it never hits your primary spending balance.

Begin with a small, comfortable amount, like $25 or $50 per paycheck, and gradually increase it every few months. Consider opening a separate high-yield savings account at a different bank to house these funds, making them less accessible for impulse buys and allowing them to grow faster.

3. The Zero-Based Budget Method

The zero-based budget is a highly intentional approach to financial management where every single dollar of your income is assigned a specific job. This method forces you to account for all your money before the month begins, ensuring your income minus your expenses equals exactly zero. Popularized by financial experts like Dave Ramsey and platforms such as YNAB (You Need A Budget), this is one of the best ways to save money by eliminating mindless spending and gaining complete control over your cash flow.

How It Works in Practice

Unlike traditional budgeting that focuses on what you have left over, zero-based budgeting requires you to plan ahead. You list your total monthly income and then assign every dollar to a category until nothing remains.

- List Your Income: Calculate your total take-home pay for the month.

- List Your Expenses: Categorize all your spending, including fixed costs (rent, insurance), variable costs (utilities), savings contributions, and debt payments.

- Balance to Zero: Adjust your spending and saving allocations until your income minus all designated expenses equals zero.

For example, a freelancer earning $4,000 a month might allocate $1,500 for rent, $400 for utilities, $500 for taxes, $300 for savings, $300 for business supplies, and so on, until the full $4,000 is accounted for. This granular planning highlights exactly where your money is going.

Actionable Tips for Implementation

The key is proactive planning and consistent tracking. Start by listing all anticipated expenses for the upcoming month, from bills to coffee runs.

Pro Tip: Use a dedicated app like YNAB or a simple spreadsheet to set up your zero-based budget. This makes it easy to assign every dollar and adjust your plan in real-time if unexpected costs arise.

Create a small "miscellaneous" or "buffer" category for minor, unforeseen expenses to avoid breaking your budget. Review your plan weekly to stay on track, and don't be afraid to adjust categories month to month as your priorities and expenses change. For more on this method, consider exploring resources from You Need A Budget (YNAB).

4. The 24-Hour Rule for Impulse Purchases

The 24-hour rule is a behavioural finance strategy designed to curb impulse spending, making it one of the best ways to save money by regaining control over your purchasing decisions. This simple yet effective discipline requires you to wait a full 24 hours before buying any non-essential item that costs more than a predetermined amount. This mandatory cooling-off period interrupts the emotional high of an impulse buy, allowing logic and financial priorities to take over, significantly reducing buyer's remorse and unnecessary expenditure.

How It Works in Practice

The power of this rule lies in its ability to create friction between an impulse and an action. When you see something you want, instead of purchasing it immediately, you consciously pause the transaction. This simple delay allows the initial excitement to fade, forcing you to ask critical questions: "Do I truly need this?" and "Does this purchase align with my financial goals?"

- An online shopper who applies a $50 threshold to this rule might find they abandon over 70% of their "add to cart" items, saving hundreds of dollars annually.

- A parent could use this rule with their teenager for clothing purchases, teaching valuable financial discipline and potentially cutting spending by $40 or more per month.

Actionable Tips for Implementation

To successfully adopt the 24-hour rule, start by setting a personal spending threshold that triggers the waiting period, for example, any non-essential purchase over $30.

Pro Tip: Add the desired item to an online wishlist or leave it in your digital shopping cart. This action can satisfy the initial urge to "get" the item without actually spending any money. After 24 hours, revisit the cart and re-evaluate with a clearer mind.

Track your spending triggers, such as stress or social media influence, and be extra vigilant in those situations. For a deeper dive into managing these habits, our comprehensive guide on how to stop impulse buying offers more advanced strategies.

5. Expense Tracking and the 'Money Leak' Audit

An expense audit is a powerful diagnostic tool for your finances, making it one of the best ways to save money by revealing exactly where your cash is going. The process involves meticulously tracking every single expense for 30 to 90 days to identify "money leaks," which are the small, often forgotten recurring charges and unconscious spending habits that invisibly drain your budget. By creating a detailed record of your actual spending, you can uncover and eliminate wasteful outflows, redirecting that money toward your most important financial goals.

How It Works in Practice

The goal of a money leak audit is to move from guessing where your money goes to knowing with certainty. For a set period, you document every purchase, no matter how small. This data reveals patterns you might not be aware of, like daily coffee runs or multiple unused streaming subscriptions.

- A professional auditing their statements might discover $47 per month in forgotten subscriptions (old gym memberships, redundant apps), saving $564 annually by cancelling them.

- A family's 30-day audit could reveal they spend $180 per month at coffee shops. By halving this, they can redirect $90 each month straight into savings.

The audit provides the hard evidence needed to make informed, impactful changes rather than relying on memory or assumptions about your spending habits.

Actionable Tips for Implementation

To conduct your own audit, commit to tracking your expenses for at least one full month. Scrutinise your bank and credit card statements line-by-line to catch every charge.

Pro Tip: Utilise a free app like Mint or PocketGuard to automatically categorise your transactions. This automates the heavy lifting and provides clear visual reports, making it easier to spot where your money leaks are concentrated.

When reviewing, pay close attention to recurring charges under $20, as these are the easiest to overlook. For each subscription, ask yourself, "Would I sign up for this service again today?" If the answer is no, it's time to cancel. Schedule a quarterly re-audit to catch new leaks and ensure your spending stays aligned with your goals.

6. The Envelope System (Digital or Physical)

The envelope system is a tactile and highly effective method for controlling spending and is one of the best ways to save money by creating hard limits. Popularized by financial guru Dave Ramsey, this system involves allocating cash (or digital funds) into designated “envelopes” for various spending categories. When an envelope is empty, spending in that category stops for the month, forcing you to become more mindful of every purchase and preventing budget blowouts. This tangible approach creates a powerful psychological barrier against overspending.

How It Works in Practice

The system works by making your spending limits visible and finite. You decide how much to allocate to variable spending categories like groceries, dining out, and entertainment for the month.

- Physical System: Withdraw the total allocated cash and physically divide it into labeled envelopes. When you shop for groceries, you pay using only the cash from the "Groceries" envelope.

- Digital System: Use apps like GoodBudget or set up separate fee-free checking accounts that act as digital envelopes. You transfer the allocated amounts into each account and use the corresponding debit card.

For instance, a household might create envelopes for groceries ($500), dining out ($150), and entertainment ($100). If the dining out envelope is empty by the third week, they know they must wait until the next month to eat out again.

Actionable Tips for Implementation

To start, focus on the variable spending categories where you tend to overspend. Fixed bills like your mortgage or insurance should continue to be paid from your main account.

Pro Tip: Embrace the digital version if carrying cash feels impractical. Apps like GoodBudget and Qapital sync across devices, making it easy for couples or families to track shared envelope balances in real-time and stay accountable together.

Start with just 3 to 5 key categories to avoid overcomplicating the system. Review your envelope allocations after the first month and adjust them based on your actual spending patterns to ensure your budget is realistic and sustainable.

7. Adopt Energy-Efficient Habits and Technologies

Making your home more energy-efficient is a powerful, long-term strategy for saving money. From simple behavioural changes to technological upgrades, reducing your energy consumption directly lowers your utility bills, freeing up significant funds over time. This proactive approach not only benefits your wallet but also supports a more sustainable lifestyle, making it one of the best ways to save money while contributing to a greener future.

How It Works in Practice

This strategy involves a two-pronged approach: adopting cost-free habits and making smart investments in energy-saving technology. By combining these, you can compound your savings and reduce your home's financial and environmental footprint.

- Behavioral Changes: Unplug electronics when not in use, wash clothes in cold water, and adjust your thermostat by a few degrees. These small actions add up to noticeable savings.

- Technological Upgrades: Install a smart thermostat to optimize heating and cooling, switch to LED light bulbs, and consider investing in energy-efficient appliances or solar panels.

A household that upgrades to a smart thermostat, for example, could see a 10-15% reduction in their heating and cooling costs, potentially saving over $100 annually. Switching to renewable energy sources like solar panels can eliminate electricity bills entirely after the initial investment is recouped.

Actionable Tips for Implementation

Start with a home energy audit, often offered for free by local utility companies, to identify your biggest areas of energy waste. This will help you prioritize the most impactful changes.

Pro Tip: Utilise technology to automate your savings. Smart power strips can automatically cut power to devices in standby mode, and smart home apps allow you to control lighting and thermostats remotely, ensuring you're never wasting energy on an empty house.

When it's time to replace appliances, look for the ENERGY STAR label, which certifies high energy efficiency. While these models may have a slightly higher upfront cost, the long-term savings on your utility bills often make them a more financially sound investment.

8. Debt Consolidation and Refinancing Strategies

High-interest debt is a significant barrier to saving money, as large portions of your payments go toward interest rather than principal. Debt consolidation and refinancing are powerful strategies to lower your interest rates, combine multiple payments into one, and accelerate your journey to becoming debt-free. By restructuring your obligations, you can significantly reduce the total amount paid over time, freeing up cash flow that can be redirected toward your savings goals.

How It Works in Practice

This strategy involves taking out a new, single loan to pay off several existing high-interest debts, like credit cards or personal loans. The new loan ideally has a lower interest rate and a fixed repayment schedule, simplifying your finances and making your debt cheaper. To effectively manage your finances and free up money for savings, it's essential to first understand what is debt consolidation.

- Balance Transfer Card: Transferring high-interest credit card balances to a new card offering a 0% introductory APR for a set period (e.g., 12-21 months).

- Personal Loan: Securing a fixed-rate loan from a bank or credit union to pay off all other debts, leaving you with one predictable monthly payment.

- Home Equity Line of Credit (HELOC): Using the equity in your home to secure a low-interest line of credit to pay off unsecured debts, though this puts your home at risk if you default.

For example, consolidating three credit cards totalling $15,000 at a 22% average APR into a personal loan at 9% APR could save you over $2,000 in interest in the first year alone.

Actionable Tips for Implementation

Before committing, carefully compare the total cost of the new loan, including any fees, against the interest you would pay on your current debts. Ensure the new payment fits comfortably within your budget.

Pro Tip: Check your credit score before applying for consolidation loans. A higher score qualifies you for better interest rates. Use free services like Credit Karma or your credit card provider to monitor your score and address any errors on your report.

Once you consolidate, it is crucial to stop accumulating new debt. Close old credit card accounts or store them away to avoid temptation. The goal is to eliminate debt, not just move it around.

9. Subscription Audit and Cancellation Strategy

A subscription audit is a systematic review of all your recurring payments to identify and cancel services you no longer use or value. From streaming platforms and software to gym memberships and subscription boxes, these small, often forgotten charges can accumulate into a significant monthly expense. Performing a regular audit is one of the best ways to save money, offering immediate financial relief by eliminating "subscription creep" and ensuring you only pay for services that add genuine value to your life.

How It Works in Practice

The process involves cataloging every recurring charge, evaluating its necessity, and taking decisive action. By meticulously combing through your bank and credit card statements, you can uncover hidden subscriptions that have been draining your account unnoticed.

- For Individuals: A household might discover they are paying for multiple music streaming services or have duplicate cloud storage accounts. By consolidating to one service in each category, they can achieve instant monthly savings.

- For Professionals: A freelancer might realize they have seven unused software subscriptions totaling over $150 per month. Canceling these can result in annual savings of nearly $2,000, money that can be redirected toward debt repayment or investments.

This strategy empowers you to take control of your automated payments rather than letting them control your budget.

Actionable Tips for Implementation

Start by listing all your subscriptions. Go through your last three months of bank and credit card statements to catch everything, including annual renewals.

Pro Tip: Leverage technology to simplify the audit. Apps like Trim and Truebill can automatically scan your accounts to identify recurring charges, presenting a clear list for you to review and cancel directly from the app.

Once you have your list, ask yourself for each item: "If I didn't have this today, would I sign up for it again?" If the answer is no, it's time to cancel. Remember to screenshot cancellation confirmations and set calendar reminders for any annual subscriptions you decide to keep, so you can re-evaluate them before they auto-renew.

10. Side Hustle Income Optimization for Accelerated Savings

Starting a side hustle is a powerful strategy to supplement your primary income, but its true potential is unlocked when the earnings are strategically optimized. This method involves dedicating 100% of your side income directly to specific financial goals, such as debt repayment or investments, rather than letting it get absorbed into daily spending. This targeted approach transforms extra earnings into a high-impact tool, making it one of the best ways to save money and accelerate your journey toward financial freedom.

How It Works in Practice

The core principle is to treat side hustle income as separate from your regular budget. Instead of viewing it as a lifestyle upgrade, you earmark every dollar for a specific purpose, preventing lifestyle inflation and maximizing its impact.

- Create a Separate Account: Funnel all side hustle earnings into a dedicated high-yield savings or investment account, separate from your primary checking account.

- Define a Clear Goal: Assign a single, clear objective for this money, whether it's paying off a high-interest credit card, building a six-month emergency fund, or funding a retirement account.

- Automate Transfers: As soon as you receive payment from your side work, immediately transfer the full amount to its designated account.

For example, a marketing professional who earns an extra $400 per month from freelance projects can pay off a $4,800 credit card balance in just one year, potentially saving hundreds in interest. A teacher tutoring online for 5 hours a week at $15/hour could build a $3,600 emergency fund in the same timeframe.

Actionable Tips for Implementation

To start, choose a side hustle that aligns with your existing skills to minimize the learning curve and maximize your hourly rate. Platforms like Upwork, Fiverr, or TaskRabbit can be great starting points.

Pro Tip: Immediately set aside a portion of your side hustle income for taxes (typically 20-30%) to avoid a surprise bill. Use a separate savings account for this so the funds are ready when you need to make quarterly estimated payments.

Track your hours and income to ensure your effective hourly rate is worthwhile. For more ideas on how to get started, explore these ways to make extra money from home.

Top 10 Ways to Save Money — Comparison

| Strategy | 🔄 Implementation Complexity | ⚡ Resource Requirements (time / money / tools) | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| The 50/30/20 Budget Rule | Low — simple percentage allocations 🔄 | Low — basic tracking or app; works with gross/net income ⚡ | Moderate — clearer spending boundaries, steady savings 📊 | Beginners, steady-income households, quick structure 💡 | Easy to adopt; reduces decision fatigue; enforces savings ⭐ |

| Automated Savings Transfers | Very low — one-time setup then automatic 🔄 | Low — bank account; optional high-yield savings or app ⚡ | High — consistent contributions; habit formation 📊 | Those who struggle to save manually; payroll environments 💡 | Removes willpower, reliable progress, low maintenance ⭐ |

| Zero-Based Budget Method | High — detailed monthly allocations per dollar 🔄 | Medium — spreadsheet/app + regular planning time ⚡ | High — full accountability; waste identification 📊 | Variable-income earners, goal-focused planners 💡 | Eliminates mystery spending; aligns money with priorities ⭐ |

| 24‑Hour Rule for Impulse Purchases | Very low — behavioral waiting period 🔄 | Minimal — time and discipline; no tools required ⚡ | Moderate — fewer impulse buys; less buyer's remorse 📊 | Impulse/online shoppers; households with emotional spending 💡 | Cost-free, simple, effective at reducing impulse purchases ⭐ |

| Expense Tracking & "Money Leak" Audit | Medium — 30–90 days of recording and review 🔄 | Medium — time or tracking apps; access to statements ⚡ | High — reveals hidden recurring costs; sizable savings potential 📊 | Pre-budgeting, those unaware of small recurring charges 💡 | Uncovers invisible drains; builds realistic baseline budget ⭐ |

| The Envelope System (Digital or Physical) | Low–Medium — initial setup and regular refill 🔄 | Low — cash or envelope app; routine maintenance ⚡ | Moderate — hard category limits prevent overspending 📊 | Households with variable discretionary spending; family budgets 💡 | Strong behavioral control; immediate visual feedback ⭐ |

| Adopt Energy-Efficient Habits | Medium — research and habit formation 🔄 | Medium — time, possible initial investment for tech ⚡ | High — consistent long-term utility savings 📊 | Homeowners looking for sustainable cost-cutting 💡 | Reduces monthly bills; environmental benefits; home value increase ⭐ |

| Debt Consolidation & Refinancing Strategies | Medium–High — applications, qualification work 🔄 | Variable — good credit, possible fees, lender interaction ⚡ | High — lower interest, simpler payments, long-term savings 📊 | Holders of high-interest unsecured debt seeking relief 💡 | Significant interest savings and cash-flow improvement ⭐ |

| Subscription Audit & Cancellation Strategy | Low — short systematic review 🔄 | Low — bank/cc statements, optional apps to detect subscriptions ⚡ | Moderate — typical $50–$200+/mo reclaimed 📊 | Anyone with many subscriptions or hidden recurring bills 💡 | Quick implementation, minimal lifestyle impact, repeatable ⭐ |

| Side Hustle Income Optimization | Medium — sourcing and scaling side work 🔄 | Variable — time, skills, possible small startup costs ⚡ | High — accelerates savings/debt payoff; income diversification 📊 | People with spare time/marketable skills aiming to speed goals 💡 | Fastest way to increase savings rate; scalable and skill-building ⭐ |

Your Next Step Towards Financial Control

You've just navigated a comprehensive roadmap detailing some of the best ways to save money, moving from foundational budgeting frameworks to advanced strategies for income optimization. The journey from financial stress to financial control is not a sprint; it is a marathon built on consistent, deliberate choices. The power of the methods we've explored, such as the 50/30/20 Rule and Zero-Based Budgeting, lies in their ability to provide structure and clarity to your financial life. They transform abstract goals into a concrete, daily practice.

From Knowledge to Action: Your Implementation Plan

Information alone doesn't build wealth; action does. The most common pitfall is "analysis paralysis," where the sheer number of options prevents you from starting. To avoid this, your immediate goal is to select just one or two strategies that resonate most with your current situation and commit to them for the next 30 days.

Consider these starting points based on common financial pain points:

- If you feel like your money just disappears: Start with the Expense Tracking and 'Money Leak' Audit. You cannot fix what you cannot see. This single act will provide the data you need to make every other decision more effective.

- If you struggle with impulse spending: Implement the 24-Hour Rule for Impulse Purchases immediately. This simple behavioral hack creates a crucial buffer between desire and action, saving you from countless regrettable buys.

- If you know you have high-interest debt: Your priority should be exploring Debt Consolidation and Refinancing Strategies. Reducing your interest rates can free up significant cash flow that can then be redirected toward your savings goals.

- If saving feels like a chore you always forget: Set up Automated Savings Transfers today. This "pay yourself first" method is arguably one of the most powerful and best ways to save money because it removes willpower from the equation.

The Cumulative Power of Small, Consistent Wins

It is essential to understand that these are not just isolated tips; they are interconnected systems that amplify each other's effects. An effective subscription audit frees up cash, which can then be automatically transferred to a high-yield savings account. Optimizing your income through a side hustle provides the fuel to accelerate your debt repayment or investment contributions. Each positive action creates momentum, making the next step easier.

The ultimate goal is to shift your mindset from one of scarcity and restriction to one of empowerment and control. Saving money isn't about depriving yourself; it's about consciously directing your resources toward what truly matters to you, whether that's achieving financial freedom, eliminating debt-related anxiety, or building a secure future for your family. By mastering these financial habits, you are not just managing your money; you are designing your life. You are making a definitive statement that you are in charge of your financial destiny.

Ready to put these strategies into practice with a tool designed for clarity and control? Collapsed Wallet helps you track your expenses, manage your budgets, and visualize your progress towards financial freedom, making it easier than ever to implement the best ways to save money. Take the first step and see how our platform can simplify your financial journey at Collapsed Wallet.