Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let’s be honest, budgeting with credit cards can feel like walking a tightrope. One wrong move and you’re in a sea of high-interest debt. But what if I told you the secret isn’t to cut up your cards, but to treat them differently? Think of your credit card less like a magic source of extra cash and more like a tool—a convenient way to pay for things with money you already have.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

When you master this, your monthly statement stops being a source of dread. Instead, it becomes a powerful dashboard that shows you exactly where your money went.

Shifting Your Credit Card Mindset

For a lot of people, a credit card is just a temptation to spend money they don’t have. And with around 191 million American adults carrying at least one card, it’s no surprise that debt is a huge concern. To use a card effectively in your budget, you have to completely change how you see it.

Stop looking at your credit limit as “available money.” Instead, think of it as just a different way to access the funds sitting in your bank account right now.

That simple mental switch changes everything. The goal becomes spending only what you know you can pay off in full when the bill arrives. Your card transforms from a high-interest loan into a simple, convenient payment tool.

From Debt Risk To Financial Tool

When you get this right, you can finally use your credit card’s strengths to your advantage while sidestepping the risks. The benefits are real and totally achievable if you have a solid plan.

- Simplified Tracking: Forget juggling a dozen receipts. All your purchases are listed neatly on one monthly statement, making it a breeze to see where your money went.

- Serious Rewards: Why not earn cash back or travel points on the everyday spending you were going to do anyway?

- Better Security: Credit cards offer way more robust fraud protection than debit cards, which is a huge plus for online shopping or big purchases.

The biggest obstacle is almost always psychological. You have to get a handle on the urge to make that spontaneous purchase. For anyone who struggles with this, learning how to stop impulse buying is the single most important first step. Once you align your card swipes with a budget you planned ahead of time, you’re the one in control. Every purchase then becomes a step toward your financial goals, not away from them.

Building Your Credit Card Budgeting Framework

Before you can confidently swipe your card, you need a solid game plan. Let’s be clear: smart credit card use starts the day you get paid, not the day your bill is due. The trick is to align your card’s billing cycle with your paydays. This simple move helps you sidestep nasty cash-flow surprises and ensures the money is already sitting there, waiting to be paid.

When you plan ahead like this, your credit card stops being a potential liability and becomes something much more boring (in a good way): a simple payment tool for money you’ve already set aside.

A Quick Word of Caution: The strategies I’m sharing are based on years of experience and are meant for general guidance. This isn’t professional financial advice tailored to your specific situation. If you need personalized help, I strongly recommend connecting with a qualified financial adviser who can dig into the details with you.

Create Specific Spending Categories

Now for the fun part. You need to break down your spending into specific, realistic categories that you’ll consciously assign to your credit card. Think of these as little envelopes or mini-budgets. For instance, a family might decide to put all their grocery and fuel spending on a single card to rack up rewards in those specific areas.

Here’s a quick look at how you might set this up.

Sample Credit Card Budget Categories And Limits

The table below gives you a real-world example of how to decide which expenses go on the card and, more importantly, how to cap them.

| Budget Category | Assigned to Credit Card? | Monthly Limit | Tracking Method |

|---|---|---|---|

| Groceries | Yes | $600 | Weekly check-in via banking app |

| Subscriptions | Yes | $50 | Review monthly statement |

| Fuel | Yes | $200 | App alerts for every transaction |

| Dining Out | No (Use Debit) | $150 | Direct deduction from checking |

Setting firm limits—like that $600 for groceries—creates clear boundaries. This isn’t about feeling restricted; it’s about being intentional. You’re telling your money exactly where to go before the month even starts.

Use Technology To Stay Accountable

Your banking app is your best friend in this process. Seriously. Most apps let you set up automated alerts that act as your personal financial guardrails, and you should absolutely use them.

Here are the non-negotiables:

- Spending Threshold Alerts: Get a ping when you’re getting close to a category limit, like when you’ve hit 75% of your grocery budget. This is your cue to slow down.

- Due Date Reminders: Set an alert a few days before your payment is due. Life gets busy, and this simple reminder can save you from a costly late fee.

- Large Purchase Notifications: An immediate text for any charge over a certain amount (say, $100) is your first line of defense against errors or fraud.

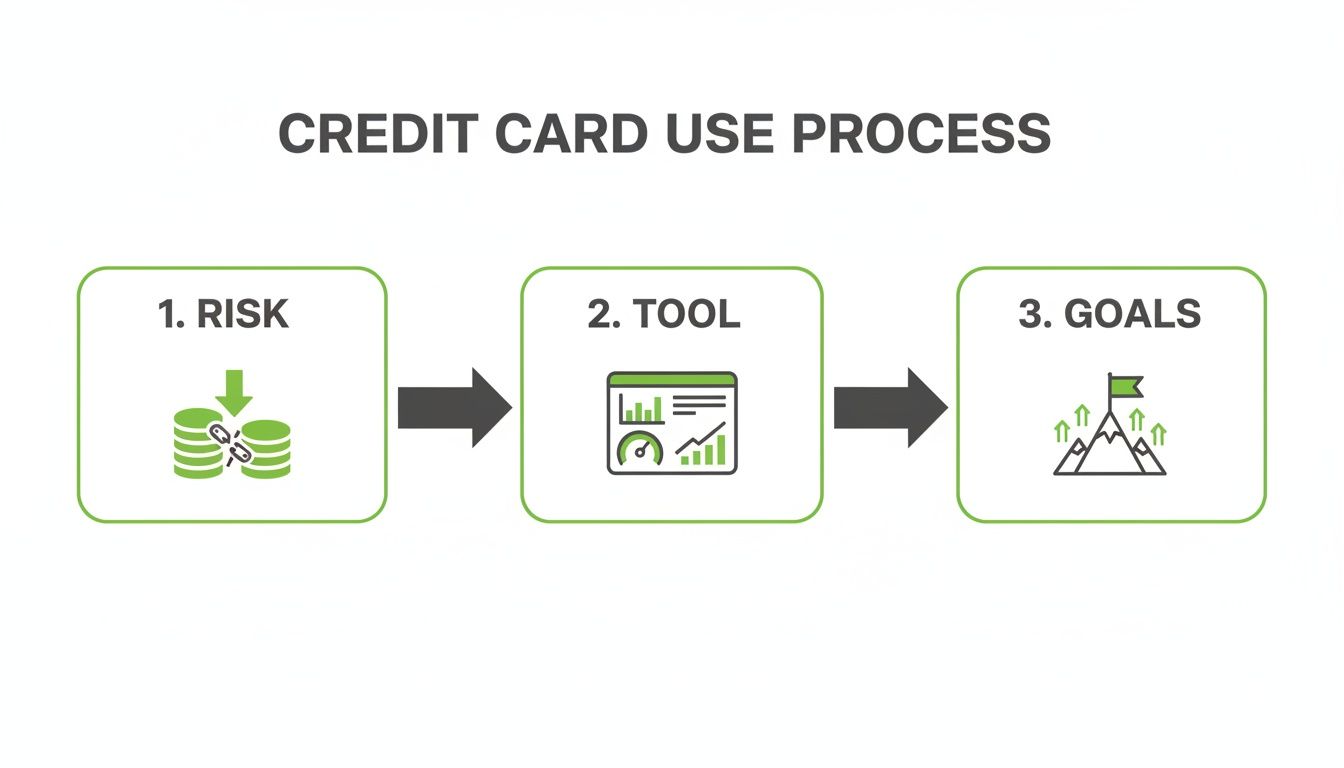

These alerts turn your phone into a real-time accountability partner. They help you stick to the plan and dodge the fees and interest that can completely derail your progress. The flowchart below really brings this entire process to life, showing how you move from managing risk to using your card as a tool to hit your goals.

This visual shows the journey from recognizing the potential pitfalls of debt to actually using your card as a dashboard for financial freedom. It’s a structured way to make sure your credit card works for you, not against you.

And this structured approach is more important than ever. According to the Federal Reserve, credit cards now make up 35% of all consumer payments in the U.S., pulling ahead of both debit cards (30%) and cash (14%). This shift is huge. While a single monthly statement can make expense tracking seem simple, it can also easily hide how much you’re really spending day-to-day if you aren’t checking in regularly. You can dig into the data yourself in the full report from the Federal Reserve.

How To Track Spending And Stay On Course

Relying on your monthly credit card statement to gauge your spending is a bit like driving while only looking in the rearview mirror. It tells you exactly where you’ve been, but it’s not much help for what’s ahead. Real financial control happens in the moment, and that’s the secret to making credit cards work for you in a budget, not against you.

This proactive approach is what stops small, impulsive buys from spiraling into a real problem by the end of the month.

Don’t worry, this doesn’t have to be some time-consuming chore. A quick check-in a few times a week, or even daily, can completely change the game. The goal here is to build a habit of financial awareness, transforming your credit card from a simple payment tool into a live dashboard of your spending.

Turn Your Smartphone Into A Financial Ally

For real-time tracking, budgeting apps are your best friend. Modern apps like YNAB or Mint are designed to connect directly and securely to your credit card accounts. The second you swipe your card for a coffee, that transaction pops up in the app, waiting for you to give it a home.

This immediate feedback is incredibly powerful. You’re no longer operating on a vague guess of what’s left in your grocery budget; you know the exact number down to the penny. The most effective way I’ve found to do this is to categorize each purchase right after it happens or, at the very least, take five minutes every evening to sort through the day’s charges.

This habit of immediate categorization is the single biggest difference between people who master credit card budgeting and those who are constantly surprised by their statement. It’s about making conscious choices with every single swipe.

Practical Scenarios For Proactive Tracking

Let’s see what this looks like in the real world. Say you’ve budgeted $150 for dining out this month. Halfway through the month, you open your app and see you’ve already spent $120. That real-time data gives you the power to pivot. You can decide to make your own meals for the next couple of weeks instead of grabbing takeout, and just like that, you’ve avoided blowing your budget.

Here are a few other ways this habit keeps you on track:

- Catching Zombie Subscriptions: You spot a $14.99 charge from that streaming service you swear you cancelled. Catching it right away means you can dispute it and make sure it doesn’t haunt you again next month.

- Spotting Spending Creep: You might notice your “Coffee” or “Miscellaneous” category is consistently eating up more cash than you realized. This insight lets you decide if that spending truly aligns with your financial goals.

- Instant Fraud Detection: An odd charge from a store you’ve never heard of appears in your app. You can call your bank immediately to freeze the card, stopping a thief in their tracks long before a paper statement would have even been mailed.

Ultimately, you need a system that feels easy enough to stick with. Whether you’re an app person or prefer a simple spreadsheet, the core principle is the same. The very act of tracking builds financial discipline and awareness. For a closer look at different methods, our guide on how to track your expenses is a great resource. By keeping a close eye on your spending, you give yourself the power to fix small mistakes before they ever become big headaches.

Paying Your Balance And Winning The War On Interest

This is it. The golden rule. If you take only one thing away from this guide, let it be this: always pay your statement balance in full, on time, every single month. This isn’t just a suggestion; it’s the non-negotiable foundation of using credit cards responsibly.

Sticking to this one commitment is the only thing standing between your credit card being a powerful financial tool and it becoming a debt-generating nightmare. All those rewards you’re chasing—the cash back, the points, the airline miles—become completely worthless the second you start paying interest. The math is brutally simple, and it always favors the bank.

The Real Cost Of Carrying A Balance

Let’s play this out with a real-world scenario. Say you’ve got a $5,000 balance on a card with a pretty standard 22% Annual Percentage Rate (APR). If you just make the minimum payment, a huge chunk of that money gets eaten by interest before it even makes a dent in what you actually owe.

Within a few months, you could easily be out hundreds of dollars in interest charges alone. That 2% cash back you were so proud of? It’s been wiped out, and then some. This is exactly how credit card debt spirals out of control, quietly siphoning money from your budget while you feel like you’re chipping away at it.

And this isn’t a small problem. In the United States, total revolving credit debt has ballooned to about $1.18 trillion. With average APRs for cards carrying a balance now over 22%, that means a typical consumer pays around $220 in interest each year for every $1,000 of debt they carry. To make matters worse, recent data from consumer credit trends at SellersCommerce.com shows that people are paying off a smaller share of their balances each month, which means more households are letting that interest machine run wild.

Your Best Defense Is Automation

So, how do you win this war on interest? Simple. You take human error out of the equation.

Go into your credit card account right now and set up autopay for the full statement balance. I’m not talking about the minimum payment—I mean the full amount.

By automating your full payment, you make avoiding interest and late fees your default setting. It becomes an effortless habit that protects your budget and your credit score without you having to think about it.

This one small action guarantees you never miss a due date and never accidentally let a balance roll over. It’s the ultimate set-it-and-forget-it move for achieving financial peace of mind.

Strategies For Tackling Existing Debt

Okay, but what if you’re already carrying a balance? First, don’t panic. The goal now is to shift from playing defense to going on offense with a clear payoff plan. Two of the most effective and popular strategies are the debt avalanche and the debt snowball.

- The Debt Avalanche Method: With this approach, you throw every extra dollar at the card with the highest interest rate first, while making minimum payments on everything else. This method saves you the most money on interest in the long run.

- The Debt Snowball Method: Here, you focus on paying off the card with the smallest balance first, no matter the interest rate. This strategy is all about psychology—scoring quick wins to build momentum and keep you motivated.

Choosing between them is personal. Are you motivated by pure numbers (saving money) or by the feeling of progress (quick wins)?

For anyone fighting high-interest debt, looking into a smart credit card debt transfer to a 0% APR card can be a game-changer. It gives you critical breathing room to attack the principal without interest compounding against you every month.

Earning Rewards Without Overspending

Credit card rewards are an incredible perk, but let’s be honest—banks design them to get you to spend more. That’s their whole game. The real trick to budgeting with credit cards is to think of rewards as a nice bonus for spending you were already planning to do, not a reason to go out and buy something new.

Think of rewards as the cherry on top, not the whole sundae. If you find yourself changing your spending habits just to chase points or miles, you’re falling into the exact trap the credit card companies set for you. True financial control means your card usage follows your budget, not the other way around.

Calculating A Rewards Card’s True Value

Before you jump on a premium card with a big annual fee, you need to run the numbers. It’s so easy to get dazzled by a huge welcome bonus, but the long-term value is what really counts. Many of these cards are only a good deal if your natural spending habits already fall into their high-value rewards categories.

A quick cost-benefit analysis will tell you whether a card is a smart financial tool or just an expensive piece of plastic in your wallet. You have to weigh the annual fee and any potential interest charges against the actual cash value of the perks you’ll really use.

To illustrate, let’s compare two common types of cards.

Rewards Card Cost-Benefit Analysis

| Feature | Card A (No Fee) | Card B ($95 Annual Fee) |

|---|---|---|

| Annual Fee | $0 | $95 |

| Rewards Rate | 1% on all purchases | 2% on all purchases |

| Break-Even Spending | $0 (No fee to cover) | $4,750 per year ($95 / 0.02) |

| Annual Rewards on $10,000 Spend | $100 | $200 |

| Net Value on $10,000 Spend | $100 | $105 ($200 rewards – $95 fee) |

| Net Value on $20,000 Spend | $200 | $305 ($400 rewards – $95 fee) |

As you can see, the card with the annual fee only starts to pull ahead once your spending crosses a certain threshold. You have to be realistic about whether your budget supports that level of spending.

The Break-Even Point

Let’s stick with that travel card with a $95 annual fee and a flat 2% cash back rate. To just break even on that fee, you’d need to put $4,750 on the card throughout the year ($95 / 0.02). Any spending above that is where you actually start to make a profit.

This simple calculation is a reality check. It forces you to be honest with yourself about whether your normal, budgeted spending is high enough to make paying the fee worthwhile.

And this all assumes you’re paying your balance in full every month. The moment you carry a balance, the math changes drastically. Average credit card APRs for accounts carrying a balance are hovering around 22.8%. That 2% cash-back rate gets you $20 for every $1,000 you spend, but carrying that same $1,000 balance for a year at a 22% APR will cost you about $220 in interest. As you can see from these insights on credit card statistics, interest charges will wipe out your rewards in a heartbeat.

The best rewards card for you is the one that complements your existing budget, not the one that tempts you to create a new one. Choose a card that rewards you for the life you already live.

Smart Ways To Redeem Your Rewards

Okay, so you’ve earned the rewards. Now what? The final piece of the puzzle is using them strategically to help you get ahead financially. Don’t let them just sit there, and please, don’t redeem them for low-value stuff like merchandise from the card’s shopping portal.

Here are a few practical ways to put those rewards to work:

- Fund a Savings Goal: Set up an automatic transfer for your cash back directly into a high-yield savings account. Earmark it for something specific, like your vacation fund or a down payment.

- Pay Down Debt: This is a great one. Apply your rewards as a statement credit. It acts as an extra payment, helping you knock down your principal balance a little faster.

- Boost Your Investments: If you rack up a few hundred dollars in cash back over the year, why not move it over to a brokerage account? It’s a fantastic, low-effort way to buy into a low-cost ETF.

When you integrate your rewards back into your budget like this, you create a powerful cycle. You’re using planned spending to generate a bonus, and then using that bonus to build your wealth.

Common Questions About Credit Card Budgeting

Even with the best-laid plans, you’re going to have questions once you start using credit cards as part of your budget. That’s completely normal. Let’s walk through some of the most common sticking points I see, so you have a clear game plan.

This isn’t about getting it perfect on day one. It’s about building a system that actually fits your life and makes your cards work for you, not the other way around.

What Should I Do If I Overspend One Month?

First off, take a breath. It happens to everyone. The important thing isn’t that you went over budget; it’s what you do next. The moment you see you’ve overspent, your only goal is to contain the damage and dodge those interest charges.

Here’s how to handle it:

- Freeze the card. Stop all non-essential spending on that card immediately. Don’t let a small overage snowball into a bigger problem.

- Borrow from another category. That extra money has to come from somewhere. Look at next month’s budget and decide where you can pull back. Can you slash your “Dining Out” or “Entertainment” fund to make up the difference?

- Pay it off before the due date. This is non-negotiable. You have to get that balance back to zero before the statement closes to avoid interest, which just makes the original slip-up more costly.

How Many Credit Cards Should I Have In My Budget?

When you’re just getting started, keep it simple: use one primary credit card. Seriously. This makes tracking your spending a breeze and lets you build the habit of paying your balance in full without juggling multiple due dates and statements.

After you’ve successfully managed that one card for a few months (and by “successfully,” I mean you’ve paid it off in full every single time), then you can start thinking strategically. Maybe you add a second card that gives you better rewards on groceries or gas. The trick is to only add a new card when it serves a specific purpose, not just because an offer looks good.

The point is to make your financial life simpler, not more complicated. Master one card before you even think about adding a second.

Is It Smart To Use A Credit Card For All My Expenses?

Putting every single purchase on a credit card can be a great way to maximize rewards and simplify tracking, but it demands a ton of discipline. One or two impulsive buys can easily derail your whole budget.

For most people, a hybrid approach is much more effective.

Use your credit card for predictable, budgeted expenses like groceries, gas, and monthly subscriptions. You’ll earn rewards without much risk of overspending.

For categories where you’re easily tempted—like dining out, shopping, or entertainment—try using your debit card instead. There’s a powerful psychological effect when you see the money leave your checking account right away. It forces you to stick to what you actually have, which is the whole point of budgeting in the first place.

At Collapsed Wallet, we’re committed to giving you the clear, practical guidance you need to take charge of your finances. Explore more of our no-jargon articles and money-saving tips at https://collapsedwallet.com.