Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

When we talk about cash flow management for a small business, we’re getting down to the nitty-gritty of tracking every dollar that comes in and goes out. It’s less about your profit and loss statement and more about the actual cash you have in the bank to pay your bills, cover payroll, and jump on growth opportunities.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Cash Flow Is Your Business Lifeline

It’s a tough pill to swallow, but many profitable businesses go under. The reason? It almost always comes back to cash. In fact, a widely-cited study found that a jaw-dropping 82% of small business failures happen because of poor cash flow management.

This highlights a fundamental truth that every business owner needs to burn into their brain: profit does not equal cash.

You could land a massive new client and have your best sales month ever, but if that client has 90-day payment terms, you still have to find the cash to pay your team and your rent next week. It’s this dangerous gap between invoicing and getting paid that can sink an otherwise healthy business.

The Real Cost of Poor Cash Flow

Letting your cash flow slip doesn’t just create financial stress; it causes a domino effect that can harm your entire operation.

- Damaged Supplier Relationships: Pay your vendors late one too many times, and you’ll find your favorable terms disappear. Or worse, they might just stop working with you altogether.

- Stunted Growth Opportunities: That perfect piece of equipment goes on sale? A-player wants to join your team? You can’t act on these moments if your bank account is empty.

- Increased Reliance on Debt: Putting payroll on a high-interest credit card is a band-aid solution. It’s a costly habit that can quickly become a threat to your company’s survival.

Cash flow is the oxygen for your business. You can survive for a while without profits, but you can’t survive a single day without cash. Mastering its movement is the difference between simply surviving and truly thriving.

Ultimately, getting a firm handle on your cash flow gives you more than just stability—it gives you freedom. It’s the freedom to make strategic moves, navigate unexpected challenges, and build a resilient business ready to chase its biggest goals.

Getting to Grips With Your Cash Flow Statement

Before you can start forecasting and improving your cash flow, you need to know where you stand right now. The best way to do that is by learning to read the story your business is telling through its cash flow statement.

This isn’t just another boring financial report. It’s far more practical than a profit and loss statement because it tracks the actual, hard cash moving in and out of your bank account. Profit on paper is nice, but cash pays the bills. Understanding this statement is the absolute foundation of solid cash flow management for small business.

Think of it as your business’s financial health report. It shows you what’s working well and, more importantly, flags potential problems before they spiral out of control. It’s entirely possible to be “profitable” but run out of cash because customers are taking too long to pay. This is the kind of critical insight the cash flow statement provides.

The Three Main Buckets of Cash Flow

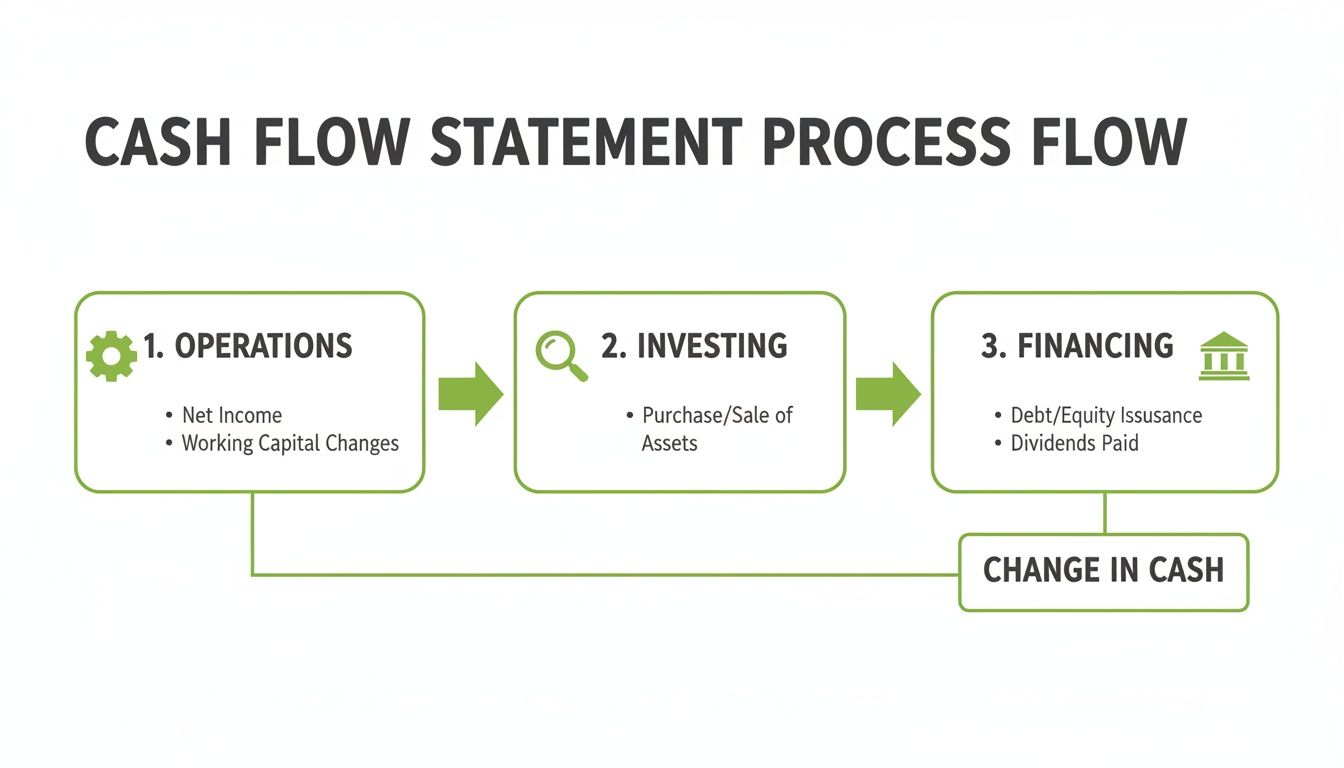

A cash flow statement neatly organizes all your cash movements into three distinct categories. I like to think of them as three different rivers all feeding into your company’s main cash reservoir.

- Operating Activities: This is your day-to-day. It’s all the cash that comes in from your core business—selling your products or services—minus the cash you spend to keep the lights on, like paying staff, buying inventory, and covering rent. A consistently positive cash flow from operations is a fantastic sign of a healthy, self-sustaining business.

- Investing Activities: This bucket is all about your long-term plays. It tracks the cash you spend on things to grow the business, like buying new equipment (a cash-out-the-door moment) or selling an old company vehicle (a cash-in-the-door moment). It shows how you’re putting your money to work for the future.

- Financing Activities: This part of the statement deals with cash flowing between your business and its owners or lenders. Taking out a bank loan is a cash inflow here. Making a loan payment is an outflow. If you inject your own savings into the business, that’s also a financing inflow.

Getting comfortable with these three areas gives you the complete story. It’s a lot like learning how to read a bank statement in minutes for your personal finances—once you know what to look for, you’re in control.

Key Terms You’ll See Again and Again

To really make sense of your statement, especially the operating activities part, you need to know two crucial terms.

Accounts Receivable (AR) is simply the money your customers owe you. You’ve delivered the service or product, sent the invoice, and now you’re waiting for the cash. If you’re a consultant who just finished a project, that outstanding invoice is part of your AR. A big AR number might look good under “sales,” but it’s not cash in your pocket yet.

Accounts Payable (AP) is the flip side—it’s the money you owe your suppliers. For a coffee shop, this would be the bill from the bean roaster or the milk supplier. Smartly managing your AP, like paying invoices right before they’re due instead of weeks early, is a simple trick to keep cash on hand for longer.

Tracking AR and AP isn’t just about bookkeeping; it’s active cash management. That gap between when you get paid and when you have to pay your own bills is where most cash flow nightmares begin for small businesses.

The latest Q4 2025 Small Business Index from the U.S. Chamber of Commerce paints a telling picture. While 74% of small businesses said they were comfortable with their cash flow, only 24% felt ‘very comfortable’. That signals a definite sense of caution in the air.

Even though a whopping 94% of businesses are optimistic about growth, more than half are running lean, with less than a month’s worth of cash in reserve. This just goes to show how crucial proactive management is. In fact, the report highlighted that businesses with better access to financing have seen 30% higher revenue growth.

How to Create a Simple Cash Flow Forecast

Managing your business finances effectively means looking forward, not just staring at last month’s numbers. A cash flow forecast is your financial radar—it gives you a clear picture of what’s coming down the road so you can make smarter decisions today. You don’t need fancy, expensive software to get started. Honestly, a simple spreadsheet is one of the most powerful tools you can have.

For most small businesses, the gold standard is the 13-week rolling cash flow forecast. Why 13 weeks? It gives you a full quarter of visibility. That’s long enough to spot trends and brace for big expenses but short enough that your estimates stay reasonably accurate and easy to manage.

Setting Up Your Forecast Spreadsheet

First things first, open a new spreadsheet. Your rows will list all your cash movements (money in, money out), and your columns will represent the next 13 weeks. This simple grid will quickly become your best friend.

The whole thing is a cycle. You start Week 1 with your current cash balance. Then you add all the cash you expect to receive and subtract all the cash you expect to spend. What’s left is your closing balance for Week 1, which becomes the opening balance for Week 2. And so on.

To give you a head start, here’s a simple template you can build. It covers all the essential moving parts you’ll need to track.

Simple 13-Week Cash Flow Forecast Template

| Category | Week 1 | Week 2 | Week 3 | … |

|---|---|---|---|---|

| Opening Cash Balance | ||||

| Cash Inflows | ||||

| Client A Payment | ||||

| Client B Payment | ||||

| Product Sales | ||||

| Total Cash Inflows | ||||

| Cash Outflows | ||||

| Rent | ||||

| Payroll | ||||

| Software Subscriptions | ||||

| Inventory Purchase | ||||

| Total Cash Outflows | ||||

| Net Cash Flow | ||||

| Closing Cash Balance |

This layout gives you a week-by-week snapshot of your financial health, making it much easier to spot a potential cash crunch before it happens.

Estimating Your Cash Inflows

Let’s be real—this is often the trickiest part because it involves a bit of educated guesswork. Start by digging into your past sales data. Do you see seasonal patterns? A coffee shop might see a big bump in iced coffee sales during the summer, while a landscaper’s work naturally slows down in the winter.

Next, think about your clients’ payment habits. You know the ones. If Client A is a rockstar who always pays on the dot, but Client B is consistently 15 days late, build that reality into your forecast. This isn’t about what you’ve invoiced; it’s about when you genuinely expect the cash to land in your bank account.

Your forecast is a living, breathing document. The goal isn’t to get it perfect on day one. It’s about getting a little smarter and more accurate with each weekly update. Reviewing and tweaking your numbers is how you build a truly reliable financial habit.

Projecting Your Cash Outflows

Predicting your expenses is usually much more straightforward since many of them are predictable. To get this right, I always suggest breaking them down into two buckets.

- Fixed Costs: These are the bills that show up like clockwork every month, no matter how busy you are. Think rent, insurance, salaried payroll, and software subscriptions. These are the easy ones to plug into your forecast.

- Variable Costs: These expenses ebb and flow with your business activity. We’re talking about things like hourly wages, inventory, shipping costs, and ad spending. You’ll want to base these estimates on how much you expect to sell each week.

Solid expense tracking is the bedrock of an accurate forecast. If you need a more structured way to get a handle on where your money goes, our guide on how to track expenses is a great place to start.

This diagram breaks down the three core areas that feed into your cash flow statement.

It’s a good reminder that cash doesn’t just come from sales—it’s also tied to long-term investments and financing decisions.

Putting It All Together: A Coffee Shop Example

Let’s say our coffee shop owner, Maria, is building her forecast. She knows a big summer festival is happening in Week 8, so she projects a 30% spike in sales that week. Awesome.

But to prepare, she has to order a mountain of extra cups, milk, and coffee beans in Week 6. She also needs to schedule an extra barista to handle the rush. Those are cash outflows that happen before the sales boom.

By mapping this out, Maria sees that her cash balance is going to dip dangerously low in Week 7. This is where the forecast becomes invaluable. Instead of getting caught off guard, she can be proactive. She could call her coffee supplier and ask to pay their invoice in Week 9 instead of Week 7. Or, she could plan a small draw from her business line of credit to cover the temporary gap.

This is the real power of forecasting. It shifts you from being a reactive owner putting out fires to a strategic one who sees what’s coming and has a plan to navigate it. No more last-minute panic.

Get Cash in the Door Faster

Controlling your expenses is only half the battle. The other, arguably more critical, half is accelerating how quickly money comes into your business. A proactive approach to getting paid can seriously shorten your cash conversion cycle, giving you the breathing room you need to run things smoothly and jump on new opportunities.

Let’s be blunt: the longer your money is tied up in accounts receivable, the less useful it is. The goal is simple—shrink the time between finishing a job and seeing that cash hit your bank account. It all starts by taking a hard look at how you invoice.

Overhaul Your Invoicing System

Stop waiting until the end of the month to send a stack of invoices. The moment a project is complete or a product is delivered, that invoice should be on its way. This simple habit starts the payment clock ticking immediately and shows your clients you’re on the ball.

Next, make it ridiculously easy for people to pay you. If you’re still relying solely on paper checks, you’re adding friction to the process. Modern accounting software makes it a breeze to offer multiple payment routes.

- Online Payments: Let clients pay directly from the invoice with a credit card or bank transfer.

- Mobile Payments: If you’re out in the field, a mobile card reader means you can get paid on the spot.

- Recurring Billing: For retainers or subscriptions, set up automatic billing. It’s a set-it-and-forget-it solution for both you and your client.

Finally, get crystal clear with your payment terms. Ambiguity is your enemy. Don’t just put “Net 30.” State the exact date: “Due by October 25, 2025.” And be sure to outline any late payment policies right on the invoice so there are no awkward conversations later.

The easier you make it for people to pay you, the faster they will. Every barrier you remove, from offering online payments to sending instant invoices, directly contributes to a healthier cash flow.

The Great Debate: Early Discounts vs. Late Fees

When you want to motivate prompt payment, you’ve got two classic tools: the carrot and the stick.

The early payment discount (the carrot) can be surprisingly effective. Offering a small incentive, like 2% off if an invoice is paid within 10 days instead of the usual 30, often nudges your most organized clients to pay right away. Getting cash in the door weeks ahead of schedule is often well worth that small discount.

On the flip side, you have late payment fees (the stick). This penalizes clients for dragging their feet and can help cover the cost and hassle of chasing them down. You just need to handle this one with care to avoid souring a good relationship. Always spell out your late fee policy clearly in your contracts and on every invoice.

Diversify Your Revenue Streams

Relying on one major client or a single service is a recipe for sleepless nights. A smart cash flow management for small business strategy involves building multiple streams of income for greater stability.

Think of a personal trainer whose income depends entirely on one-on-one sessions. If they aren’t actively training, they aren’t earning.

To build a more resilient business, that same trainer could:

- Develop digital products: Create and sell workout plans or nutrition guides online. This is mostly a one-time effort that can generate passive income for months or years.

- Offer group classes: Launch smaller group sessions, either online or in-person, at a more accessible price point to attract a wider audience.

- Create a subscription model: Build a library of on-demand workout videos that members can access for a monthly fee.

This isn’t just about adding more revenue; it’s about creating a business that can weather the inevitable ups and downs without sending you into a panic.

Recent data from the full OnDeck report on small business trends really drives this home. A Q3 2025 survey found that while over 73% of small businesses had enough cash to cover a month of expenses, managing cash flow remains a top headache for 29% of them. To cope, 59% lean on a business line of credit, and 53% end up delaying their own paychecks—a clear sign that having solid cash-generating strategies is non-negotiable.

Smart Tactics for Managing Cash Outflow

Controlling cash flow is a two-way street. We’ve talked a lot about getting cash in the door faster, but that’s only half the battle. Now, let’s flip the script and focus on intelligently managing what goes out.

The goal here isn’t to just slash costs across the board—that’s a rookie move that can easily stunt your growth. Instead, we’re going to get deliberate and strategic about every single dollar that leaves your business bank account.

Find and Plug the “Cash Leaks”

The first thing you need to do is figure out exactly where your money is going. This means a simple, no-fuss expense audit to spot what I call ‘cash leaks’—those small, often-forgotten recurring costs that quietly drain your bank account month after month.

Pull up your bank and credit card statements from the last three to six months. Go through every single line item and sort each expense into a category. You can keep it simple with buckets like Rent, Payroll, Marketing, Software, and Inventory.

I guarantee you’ll find some surprises. Remember that free trial for a project management tool that quietly turned into a $50 per month charge? Or that industry magazine subscription you signed up for but never actually read? These are your cash leaks. On their own, they seem tiny, but they can easily add up to thousands of dollars over a year.

Once you have that clear picture, you can start making much smarter decisions.

Separate Your Must-Haves from Your Nice-to-Haves

Not all expenses are created equal. To make clear-headed decisions, especially when cash is tight, you need to separate your spending into two basic categories.

- Essential Expenses: These are the non-negotiables, the costs required to simply keep the lights on. Think rent for your shop, payroll for your core team, and the raw materials for your products. You can’t operate without them.

- Nice-to-Have Expenses: This bucket is for everything else. It could be the premium software subscription with a bunch of bells and whistles you never use, those fancy team lunches, or a top-tier marketing campaign when a more modest one would do the job for now.

This isn’t about cutting out all the “nice-to-haves” forever. It’s about creating a simple roadmap for where to trim the fat first when you absolutely need to preserve cash.

Smart spending isn’t about being cheap; it’s about being intentional. By understanding the difference between what’s essential and what’s optional, you gain the power to direct your cash where it will have the greatest impact on your business’s health and growth.

Use Your Supplier Relationships to Your Advantage

Your relationships with your vendors are a powerful—and often overlooked—tool for managing cash flow. Don’t be afraid to start a conversation about payment terms. If you have a solid track record of paying on time, many suppliers will be perfectly happy to extend your payment window from Net 30 to Net 45, or maybe even Net 60.

This one simple change doesn’t actually reduce what you owe, but it gives you an extra 15 to 30 days to hold onto your cash. That extra breathing room can be a real lifesaver, helping you cover payroll or bridge a gap while you’re waiting for a big customer payment to land.

While you’re at it, look for opportunities to buy in bulk. If you use a particular material all the time, ask your supplier if they offer a discount for a larger order. Just be smart about it—don’t tie up a ton of cash in inventory that’s just going to sit on a shelf for months. It’s all about finding that sweet spot.

Master the Art of Paying on Time (Not Early)

This might be one of the easiest ways to immediately improve your liquidity: stop paying your bills the second they arrive. I know, it feels responsible, but when you pay an invoice early, you’re basically giving your supplier an interest-free loan with your money.

A much savvier approach is to schedule your payments to go out on their actual due dates. This simple discipline keeps cash in your account for the maximum amount of time, boosting your working capital without ever hurting your good standing with suppliers. Most accounting software, like QuickBooks or Xero, has bill pay features that can automate this for you, so you never miss a payment but also never pay a day sooner than you have to.

Cash Outflow Management Techniques

To help you decide which tactics are right for you, I’ve put together a quick comparison of these outflow management strategies. Each has its place, and the best approach often involves a mix of all three.

| Strategy | Best For | Potential Impact | Considerations |

|---|---|---|---|

| Negotiate Longer Payment Terms | Businesses with strong supplier relationships and predictable expenses. | Gives you more time to pay, improving short-term liquidity. | Can strain relationships if not handled carefully. |

| Leverage Bulk Discounts | Companies that use specific materials or products consistently. | Lowers the per-unit cost of goods, improving profit margins. | Ties up cash in inventory; risk of overstocking. |

| Strategic Payment Timing | All businesses, especially those with tight cash flow cycles. | Maximizes the cash you have on hand at any given time. | Requires diligent tracking to avoid late payments and fees. |

By combining these tactics—auditing your spending, talking with your suppliers, and timing your payments—you can take firm control of your cash outflow. It’s about building a more resilient financial foundation, one smart decision at a time.

Building a Cash Reserve for Financial Resilience

Sooner or later, every business gets hit with something unexpected. A critical piece of equipment dies without warning. A key client suddenly pulls back on a huge contract. These things happen. Without a financial safety net, these speed bumps can easily turn into a full-blown crisis, derailing your operations and even threatening your business’s survival.

This is exactly why having a healthy cash reserve is one of the most important parts of smart cash flow management for a small business. Think of it as your business’s shock absorber, ready to soften the blow from surprise expenses or a sudden drop in revenue.

How Much Should You Save?

A great first goal is to build a reserve that can cover one full month of your essential operating expenses. We’re talking about the absolute must-pays: rent, payroll, and core utilities. Just enough to keep the lights on and the doors open.

Once you’ve hit that milestone, don’t stop there. The next target should be a buffer that covers three to six months of those same essential costs. I know that can sound like a huge number, but you don’t have to get there overnight. Start small by setting up an automatic transfer to a separate, high-yield savings account. Even a modest, consistent amount moved over each week or month will grow into a powerful safety net over time. The principle is similar to a personal finance strategy you can explore by understanding what is a sinking fund, where you’re putting money aside for a specific purpose.

A cash reserve isn’t just money sitting there doing nothing; it’s a direct investment in your business’s stability. It gives you the breathing room to navigate tough times without having to make desperate choices or take on expensive debt.

When Your Reserve Is Not Enough

Sometimes, an emergency is just too big for even a well-funded cash reserve. When that happens, having an emergency financing option, like a business line of credit, can be a real lifesaver. The trick is to get this set up before you’re in trouble. Lenders are much more likely to approve you when your financials look strong, not when you’re already in a crunch.

Just be careful. A line of credit is for true emergencies, not for papering over routine operational gaps. If you find yourself constantly dipping into it to cover predictable shortfalls, that’s a red flag signaling a deeper problem in your cash flow system that you need to fix.

Recent industry data really highlights how vulnerable many businesses are. A 2025 survey found that almost 4 in 10 (39%) small businesses are operating with less than a month of cash reserves. The situation is even more precarious for newer companies. A staggering 20.7% of businesses less than two years old reported having less than a week’s worth of cash on hand. You can dig into the full report to see how business age correlates with financial resilience.

Common Cash Flow Questions (and Straight Answers)

Even the most seasoned business owners run into cash flow questions. When you’re in the thick of it, things can get confusing. Here are a few of the most common puzzles we see, along with some practical advice.

How Do I Survive Seasonal Cash Flow Swings?

If you run a seasonal business—think landscaping in the summer or a pop-up shop during the holidays—you know the feeling of feast or famine. Your survival depends entirely on how you manage those dramatic highs and lows. The secret isn’t complicated: you have to plan for winter while it’s still summer.

The first step is building a cash flow forecast that covers the full 12 months. Don’t just look at the next quarter. This annual view shows you precisely how much cash you need to stockpile during your peak season to get through the lean times. It’s also smart to secure a business line of credit while you’re profitable and don’t need it. That way, it’s there when you do.

Should I Pay Down Debt or Build Up My Cash Reserve?

Ah, the classic tug-of-war. The “right” answer really hinges on the kind of debt you’re carrying. If you’ve got high-interest debt, like a nagging credit card balance, it’s actively eating away at your cash every single month. Tackling that debt aggressively is almost always a good move.

But running your cash reserves down to zero is a huge risk. I usually advise a more balanced approach. Maybe you split your extra cash 70/30—70% goes to aggressively paying down that expensive debt, while the other 30% steadily builds up your emergency fund.

For a small business, liquidity is freedom. While reducing debt is crucial for long-term health, having a cash reserve provides the immediate flexibility needed to navigate unexpected challenges without taking on more debt.

What’s the Real Difference Between Profit and Cash Flow?

Getting this right is probably the single most important financial concept for any owner to grasp. They are not the same thing.

Profit is just an accounting number on paper. It’s what’s left after you subtract your expenses from your revenue (Revenue – Expenses = Profit). But that “profit” doesn’t mean the money is actually in your bank account.

Positive cash flow is the real deal. It means more hard cash came into your business than went out over a certain period. You can have a record-breaking, “profitable” month but still go under because your clients haven’t paid their invoices yet. You have no cash to pay your suppliers, your rent, or your team. Always, always focus on the cash first.

At Collapsed Wallet, our whole mission is to help you swap financial stress for financial confidence. Our blog is filled with straightforward, practical advice to help you get a real handle on your money.

For more tips sent straight to your inbox, subscribe to our newsletter at Collapsed Wallet.