Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Staring down high-interest credit card debt can feel like running on a treadmill that’s stuck on a steep incline. You’re putting in the effort, making payments month after month, but the balance just doesn’t seem to shrink. A smart credit card debt transfer is a strategy that lets you step off that treadmill and onto a flat, clear path, giving you a real shot at crossing the finish line to being debt-free.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

How a Debt Transfer Can Tame High Interest

So, how does this actually work? A credit card debt transfer, or balance transfer, is pretty straightforward: you move the outstanding balance from one or more high-interest credit cards to a new card. The magic is that this new card almost always comes with a special introductory offer—typically a 0% or very low Annual Percentage Rate (APR) for a set amount of time.

This promotional period, often lasting anywhere from 12 to 21 months, is your golden opportunity. Instead of a big chunk of your payment getting gobbled up by interest charges each month, nearly every penny you pay goes directly toward chipping away at the actual debt. This can dramatically speed up your repayment timeline and save you a serious amount of money.

The Power of a 0% APR Window

Let’s put some numbers to it. Say you’re carrying a £5,000 balance on a card with a punishing 22% APR. With an interest rate that high, it’s easy to feel like you’re just paying to keep the debt afloat.

By moving that £5,000 over to a new card with a 0% APR offer, you effectively hit the pause button on interest.

A credit card debt transfer is a strategic pause button on interest. It provides a crucial window of opportunity where your payments can make a meaningful impact on the actual debt you owe, not just the cost of borrowing.

This breathing room is where you can get aggressive. Every payment you make during this period lands a direct hit on your principal balance. Your repayment plan shifts from a defensive game against ever-growing interest to a full-on offensive strategy to wipe the slate clean.

What to Look For in a Balance Transfer Offer

Not all balance transfer cards are created equal, and it’s vital to read the fine print to make sure the move is actually going to save you money.

When you’re comparing offers, you’ll want to have a clear understanding of a few key components. The table below breaks down the most important terms you’ll encounter.

Key Components of a Smart Credit Card Debt Transfer

| Feature | What It Means For You | Typical Range or Example |

|---|---|---|

| Introductory APR | This is the headline rate, ideally 0%. It’s the interest-free period you get to pay down your debt. | 0% APR |

| Introductory Period | The length of time your special APR lasts. The longer, the better—it gives you more time to pay off the balance. | 12, 18, or 21 months |

| Balance Transfer Fee | A one-time fee charged for moving the debt. It’s usually a percentage of the amount you’re transferring. | 3% to 5% of the transferred amount. (e.g., £150 fee on a £5,000 transfer) |

| Standard APR | The interest rate you’ll pay on any remaining balance after the introductory period ends. This is often high. | 19.9% to 29.9% or higher |

Getting a handle on these four elements—especially that standard APR—is critical. You need a solid plan to pay off the balance before that promotional rate disappears and the high interest kicks in.

With the cost of carrying debt on the rise, these transfers have become a go-to strategy for many. For instance, in the U.S., the average APR on new credit card offers climbed to 23.96% in 2025, which really shows how much you can save with a 0% offer. You can find more credit card debt statistics on LendingTree.com. The bottom line: success depends on having a clear payoff plan before that introductory clock runs out.

Your Step-By-Step Plan to Transfer Debt

Making a balance transfer happen is a huge step toward getting out of debt, but you need a solid game plan. Let’s break it down into simple, manageable steps. This isn’t about some complicated financial magic trick; it’s about following a clear path to move your debt from a high-interest card to an interest-free one. That breathing room is exactly what you need to start making real progress.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Step 1: Take Stock of Your Financial Situation

Before you even think about applying for a new card, you have to get a crystal-clear picture of where you are right now. First, pull out all your credit card statements and add up the total debt you want to move. This number is your North Star—it tells you how high of a credit limit you’ll need on the new balance transfer card.

Next, you need to know your credit score. Lenders look at this number first when deciding whether to approve you for the best balance transfer cards, especially those with long 0% APR periods. You can usually find your score for free through your bank or current credit card company. A score of 670 or higher will generally give you the best shot at the top-tier offers.

Step 2: Research and Compare Balance Transfer Cards

Okay, you’ve got your total debt amount and your credit score. Now the hunt begins. There are a ton of offers out there, so you have to know what to look for when comparing cards for a credit card debt transfer.

- Length of the 0% APR Period: This is the big one. Your goal is to find the longest interest-free runway possible, giving you more time to pay down the principal. Anything in the 18 to 21 month range is fantastic.

- The Balance Transfer Fee: Nothing in life is free, right? Most cards charge a fee of 3% to 5% of the amount you transfer. While you might find a rare no-fee card, it will likely have a much shorter 0% APR period. Do the math to make sure the interest you’re saving is way more than this one-time fee.

- The Standard APR: This is the interest rate that kicks in the second your introductory offer ends. Knowing this number should be all the motivation you need to wipe out that balance before the clock runs out.

A successful balance transfer isn’t just about finding a 0% APR offer; it’s about securing a long enough interest-free runway to completely pay off your debt. The length of the promotional period is your most valuable asset in this strategy.

Step 3: Apply and Initiate the Transfer

Once you’ve found the perfect card, it’s time to apply. You can usually do this online in a few minutes. If you get approved, check the credit limit immediately. Make sure it’s high enough to cover both the debt you’re moving and the transfer fee.

You can often start the transfer right on the application. If not, you’ll just call the new card issuer once your account is active. You’ll need the account numbers for your old cards and the exact amounts you want to transfer from each. To keep everything organized, you might want to explore some of the best debt payoff apps on Collapsed Wallet—they can be a lifesaver for staying on track.

Don’t stop paying your old bills just yet! It can take a few days or even a couple of weeks for the transfer to go through. Keep making at least the minimum payments on your old cards until you get confirmation that the transfer is complete. This will save you from late fees and a hit to your credit score. Once the new card shows the balance and the old ones show zero, your plan is officially a go.

Crunching The Numbers: Will A Balance Transfer Actually Save You Money?

A balance transfer can feel like a life raft when you’re drowning in high-interest debt, but it’s not a free ride. Before you jump in, you need to answer one crucial question: is this move truly going to save you money in the long run?

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

A Quick Calculation Example

Let’s break it down with a common scenario. Imagine you’re carrying a $5,000 balance on a credit card that’s hammering you with a 22% APR. The interest charges are piling up fast, and it feels like you’re barely making a dent in the actual debt.

Then, you spot a great offer: a balance transfer card with 0% APR for 18 months and a one-time 3% transfer fee.

Here’s how you’d figure out if it’s worth it:

- Your Upfront Cost: The fee to move your debt is 3% of $5,000, which comes out to $150. This gets added to your balance, so your new card will start with a balance of $5,150.

- Your Interest Savings: If you left that $5,000 on the old card, you’d rack up roughly $1,650 in interest over those 18 months (assuming you only made minimum payments).

- Your Net Savings: Now, just subtract the fee from the interest saved. $1,650 (interest saved) – $150 (fee paid) = $1,500.

In this case, paying a $150 fee to save $1,500 is an absolute no-brainer. This simple math shows just how powerful a well-planned balance transfer can be.

To help you visualize this, here’s a side-by-side comparison.

Cost vs. Savings Calculation Example

| Scenario | Total Interest Paid (18 Months) | Balance Transfer Fee (3%) | Total Cost | Net Savings |

|---|---|---|---|---|

| Keeping Debt on Original 22% APR Card | ~$1,650 | $0 | ~$1,650 | $0 |

| Transferring to 0% APR Card | $0 | $150 | $150 | ~$1,500 |

As you can see, the choice is clear. The transfer fee is a small price to pay for escaping nearly two years of crushing interest charges.

A Framework for Making Your Decision

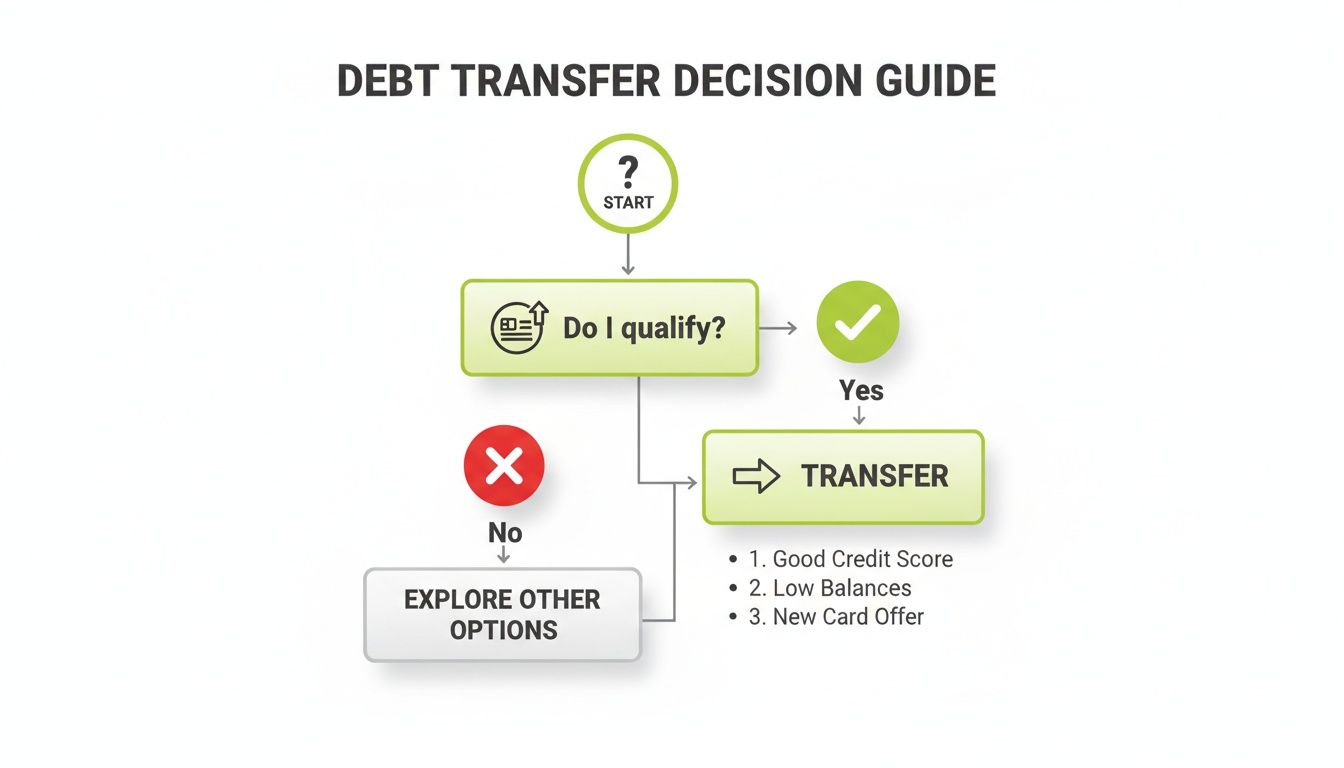

So, how do you decide what’s right for your situation? The first step is figuring out if you can even get approved for the best offers, which almost always requires a good credit score.

If your score isn’t where it needs to be, you might want to work on that first. For some practical tips, check out our guide on how to improve your credit score fast.

This flowchart breaks down the basic thought process, starting with whether you’re likely to qualify.

As the chart shows, your credit score is the key that unlocks the door to the most valuable balance transfer deals.

The goal of a balance transfer isn’t just to pause interest—it’s to create a clear, affordable path to becoming completely debt-free. Your calculations should always confirm that you can realistically pay off the entire balance before that promotional 0% APR period ends.

This strategy is more important than ever. With average credit card APRs hovering around 22%, the motivation to escape high interest is stronger than ever. In fact, 46% of American cardholders carried a balance into mid-2023, and a staggering 60% of them had been carrying that debt for at least a year. That’s a massive amount of money going straight to interest payments.

A successful transfer all comes down to having a solid payoff plan and a firm grasp of the numbers.

Common Mistakes and How to Avoid Them

A credit card debt transfer can be an incredible tool for getting ahead, but it’s not a magic wand. A few simple missteps can turn this powerful strategy into a financial trap, wiping out all your potential savings and leaving you right back where you started. Knowing what to watch out for is the key to making your transfer a true success.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Honestly, the single biggest mistake is not having a rock-solid repayment plan from day one. Seeing that 0% APR can create a false sense of security, making it tempting to coast along with just the minimum payments. This is a critical error. It lets the debt hang around until the promo period ends and the high standard APR suddenly kicks in.

Failing to Pay Off the Balance in Time

The end of that introductory period can sneak up on you fast. If you haven’t cleared the full amount by then, the remaining balance gets hit with the card’s standard APR—which is often 20% or even higher. Suddenly, all the interest you worked so hard to save can be wiped out in just a few months.

You absolutely have to treat your repayment plan with a sense of urgency. Here’s how:

- Calculate Your Monthly Goal: Take your total transferred balance (don’t forget the fee!) and divide it by the number of months in your 0% APR period. That number is the absolute minimum you must pay each month to be debt-free on time.

- Automate Your Payments: Go into your bank account and set up automatic monthly transfers for that exact amount. This takes willpower out of the equation and ensures you stay on track without even thinking about it.

Using the New Card for Purchases

This one trips a lot of people up. It’s so easy to start using your new balance transfer card for everyday spending. Many people assume new purchases also qualify for the 0% APR, but that’s almost never the case. Most of the time, new spending gets slapped with the card’s standard, sky-high interest rate from the moment you swipe.

What’s worse is how payments are applied. Card issuers typically apply your payments to the lowest-interest balance first, which is your transferred debt. That means your new, high-interest purchases just sit there, racking up interest until the entire original balance is gone.

Think of a balance transfer card as having one single job: to eliminate existing debt. Using it for anything else actively works against that goal. You’re basically trying to put out a fire while starting a new one in the next room.

The fix is simple: put that card away. Keep it somewhere safe and use it only for paying down the transferred balance. For daily expenses, stick to your debit card or a different credit card that you pay in full every month.

Missing a Payment and Voiding Your Offer

Read the fine print. The terms and conditions on these offers are incredibly strict. Missing even one payment—or just paying a day late—can have serious consequences. For many cards, a single late payment will void your promotional 0% APR immediately.

When that happens, the standard variable APR gets applied to your entire remaining balance. You don’t just lose your interest-free period; you’ll probably get hit with a late fee, too.

The solution is non-negotiable: always pay on time. Your best defense is setting up automatic payments for at least the minimum amount due. It’s a simple safety net that guarantees you never miss a deadline and protects that valuable promotional rate. Avoiding these common mistakes is what turns a balance transfer from a temporary patch into a genuine step toward financial freedom.

Exploring Alternatives to a Balance Transfer

A balance transfer can be a fantastic tool for getting ahead of high-interest debt, but it’s definitely not the only game in town. The right move for you really depends on your financial habits and specific situation, so it’s smart to look at all the angles before you commit.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Personal Loans for Debt Consolidation

One of the most common alternatives is using a personal loan to consolidate your debt. Instead of juggling multiple credit card payments with dizzying interest rates, you take out one loan to wipe them all out at once.

What’s the appeal? Simplicity and predictability. You’re left with a single monthly payment, a fixed interest rate, and a firm end date for your debt. That kind of structure makes budgeting a breeze and removes the temptation of having a bunch of zero-balance credit cards sitting around.

If you’ve got a decent credit score, you can often lock in an interest rate that’s much lower than what your credit cards are charging you. This move not only simplifies your financial life but can also save you a good chunk of change in interest.

Motivational Repayment Strategies

For many people, getting out of debt is more about psychology than pure math. This is where strategies like the debt snowball and debt avalanche come in. They provide a clear, motivating roadmap to follow.

- The Debt Snowball Method: You start by making minimum payments on all your debts, then you throw every extra dollar you have at your smallest balance. Once that one is gone, you “roll” its payment over to the next-smallest debt. Those early victories feel great and build momentum.

- The Debt Avalanche Method: This is the most efficient way to save money. You still make minimum payments on everything, but you focus your extra cash on the debt with the highest interest rate first. By tackling your most expensive debt, you pay less in total interest over time.

Choosing between the snowball and avalanche is a personal call. The snowball gives you quick psychological wins to keep you going, while the avalanche is the number-cruncher’s choice for saving the most money. Both are excellent ways to create an actionable plan.

Negotiating with Your Creditors

Before you even think about applying for new credit, have you tried simply talking to your current credit card companies? A lot of people don’t realize that interest rates aren’t always set in stone.

If you have a solid history of paying on time, you’ve got some bargaining power. Give them a call, explain that you’re trying to pay down your balance, and ask if they can offer you a lower APR. You might be surprised by what they say. To get the full script, check out our guide on how to negotiate with creditors.

Here’s a quick rundown of how these options stack up.

| Strategy | Primary Benefit | Best For |

|---|---|---|

| Balance Transfer | 0% interest period to aggressively pay down principal. | Disciplined individuals with good credit who can pay off the debt within the promo period. |

| Personal Loan | A single, fixed monthly payment and a clear payoff date. | Those who want simplicity and a predictable repayment schedule. |

| Debt Snowball | Motivational “quick wins” from paying off small debts first. | People who need to see progress quickly to stay motivated. |

| Debt Avalanche | Saves the most money on interest charges over time. | Individuals who are driven by numbers and long-term savings. |

Each of these strategies provides a different path to becoming debt-free. While a balance transfer is a powerful option, taking the time to review the alternatives will help you land on the most sustainable plan for your wallet.

Your Debt Transfer Questions, Answered

It’s completely normal to have a few questions when you’re looking into a balance transfer. Getting the details straight is what makes this strategy work, so let’s walk through some of the most common things people ask. We want you to feel totally confident before you make a move.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

How Does a Debt Transfer Affect My Credit Score?

This is the big one, and it’s a two-part answer. In the short term, you’ll likely see a small, temporary dip in your credit score. That’s because when you apply for the new card, the lender does a hard inquiry on your credit report, which usually knocks off a few points.

But the long-term impact is often incredibly positive. One of the biggest factors in your score is your credit utilisation ratio—basically, how much of your available credit you’re actually using.

By moving a high balance to a new card (especially one with a higher limit), you instantly lower your overall utilisation. This can give your credit score a serious boost over time. Making your new payments on time, every time, will only help build a stronger credit history.

Think of it like this: If you owe £5,000 on a card with a £6,000 limit, you’re using a scary 83% of your available credit. But if you move that same £5,000 to a new card with a £10,000 limit, your utilisation on that card drops to 50%, and your overall ratio improves dramatically.

Can I Transfer a Balance to a Card I Already Own?

Almost certainly not. Balance transfer deals are designed to do one thing: win over new customers. You generally can’t transfer a balance between two cards from the same bank.

A bank isn’t interested in helping you shuffle debt around between its own products; it wants to poach business from its competitors. So, you’ll need to shop around and find a card from a completely different bank or provider to make a credit card debt transfer work.

What Happens If I Don’t Pay Off the Balance in Time?

This is the single biggest trap of a balance transfer, and you have to be disciplined to avoid it. The moment that 0% APR promotional period ends, any debt left on the card gets hit with the card’s standard interest rate.

This “go-to” rate is almost always high—we’re talking 20% or more. Suddenly, that interest you were avoiding comes roaring back. This is why having a solid plan to clear the entire balance before the intro offer expires is non-negotiable. If you don’t, you could wipe out all the savings you worked so hard to gain.

What’s the Difference Between a Balance Transfer and a Money Transfer?

They sound alike, but they’re two different tools for two different jobs. It’s crucial to know which is which.

- Balance Transfer: This is purely for moving debt from one credit card to another. Its whole purpose is to consolidate high-interest card balances onto a new card with a low or 0% introductory rate.

- Money Transfer: This is a feature that lets you move cash from your credit card’s limit straight into your bank account. You could then use that money for things that you can’t pay for with a credit card, like clearing an overdraft or paying off a personal loan.

Be careful here—money transfers often have different fees and interest rates than balance transfers, even on the same card. Always read the fine print for the specific transaction you’re making.

Is There a Limit to How Much Debt I Can Transfer?

Yes, absolutely. The amount you can move is capped by two things. First, the card issuer itself might limit transfers to a certain percentage of your new credit limit, often up to 95%.

More importantly, your transfer is limited by the credit limit you’re actually approved for. If you need to transfer £7,000 but only get approved for a card with a £6,000 limit, you won’t be able to move the whole balance over. This is another reason why a good credit score is so helpful—it gives you a better shot at securing a high enough limit to cover all the debt you want to consolidate.

Ready to take the next step toward financial freedom? At Collapsed Wallet, we provide the clear, practical guidance you need to make sense of your money and build a more secure future. Explore our guides and tools to start your journey today.

2 thoughts on “Your Ultimate Guide to a Smart Credit Card Debt Transfer”