Table of Contents

- Your Financial Firewall: How Much Emergency Fund Is Enough?

- Why an Emergency Fund Is Your Most Important Financial Goal

- Calculating Your Personalized Emergency Fund Target

- The Reality of Building Your Emergency Savings

- Actionable Strategies To Build Your Fund Faster

- Where To Keep Your Emergency Fund For Safety and Access

- Your Top Emergency Fund Questions, Answered

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

When it comes to your emergency fund, how much you need is the single most important question to answer on your journey to financial stability. The classic rule of thumb is to have 3 to 6 months’ worth of essential living expenses tucked away. This isn’t just a savings account; it’s your personal financial firewall, shielding you from the shock of a sudden job loss, unexpected medical bills, or urgent home repairs without forcing you to rack up high-interest debt.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your Financial Firewall: How Much Emergency Fund Is Enough?

So, what exactly is an emergency fund? It’s a dedicated stash of cash set aside specifically for life’s nasty surprises. It’s the money you hope you never have to touch, but it’s there to stop a minor setback from spiraling into a major financial crisis. Think of it as the ultimate shock absorber for your financial life.

Without this buffer, an unexpected expense can completely derail your goals. Research consistently shows that households without savings are far more likely to lean on credit cards or high-interest loans, turning a one-time problem into a long-term debt cycle. An emergency fund gives you control and options right when you need them most.

What Are Essential Living Expenses?

To figure out your target number, you first have to get brutally honest about what’s “essential.” These are the non-negotiable costs you have to cover every month just to keep the lights on and a roof over your head. Discretionary spending—like streaming subscriptions, gym memberships, or dining out—doesn’t make the cut.

Your essential expenses are the bare-bones costs of living. They typically include:

- Housing: Your monthly mortgage or rent payment.

- Utilities: Electricity, water, gas, and internet service.

- Food: Your baseline grocery budget (not your “nice-to-have” restaurant budget).

- Transportation: Car payments, insurance, fuel, or public transit passes.

- Insurance: Health, home, or renter’s insurance premiums.

- Minimum Debt Payments: The absolute minimum you must pay on student loans, credit cards, or other personal loans.

Add these up, and you’ll have a clear monthly survival figure. Multiplying that number by three to six gives you a tangible and, most importantly, personalized savings target.

An emergency fund is not an investment; it is insurance. It’s the critical barrier between you and the kind of financial disruption that can set you back for years.

A Quick Guide to Your Savings Target

While doing the math on your exact expenses is the best way to go, your job stability plays a massive role in deciding whether you should lean closer to three months of savings or aim for six (or even more). For example, a stable, dual-income household might feel perfectly secure with a smaller fund. On the other hand, a freelancer with a fluctuating income should really aim for a much larger cushion.

Here’s a quick table to help you get a practical estimate of your savings goal.

Emergency Fund Quick Reference Guide

| Your Situation | Recommended Savings Target (Months of Essential Expenses) | Example Goal (for $3,000/month expenses) |

|---|---|---|

| Highly Stable Job(s) Two consistent incomes in a secure industry. | 3 Months | $9,000 |

| Moderately Stable Job One reliable income or two incomes in a less stable industry. | 4-5 Months | $12,000 – $15,000 |

| Less Stable or Irregular Income Freelancer, gig worker, or commission-based sales. | 6+ Months | $18,000+ |

| Single Income with Dependents Sole provider for a household. | 6 Months | $18,000 |

This guide gives you a solid starting point. Your personal comfort level and risk tolerance are also key factors, so feel free to adjust these recommendations to whatever helps you sleep best at night.

Why an Emergency Fund Is Your Most Important Financial Goal

Think of an emergency fund less as a restriction and more as your financial bedrock. It’s the ultimate safety net, the one thing that stops an unexpected problem from snowballing into a full-blown crisis. Without that cash cushion, a sudden car repair or a surprise medical bill can send you straight into high-interest credit card debt, completely derailing your financial progress.

Even worse, you might be tempted to pull money from your long-term investments or, in a true moment of desperation, raid your retirement accounts. That’s a move that can absolutely devastate your future. This fund is the essential barrier standing between a manageable setback and a genuine financial catastrophe.

The True Cost of Being Unprepared

When an emergency hits and you have no cash to fall back on, the “solutions” are almost always painful and expensive. You might have to sell investments at the worst possible time, take out a personal loan with a punishing interest rate, or slap the expense on a credit card where the interest can quickly balloon the original cost. Each of these choices just digs the financial hole deeper, making it that much harder to climb back out.

But the most damaging move of all is tapping into your retirement savings. Fidelity Investments data paints a stark picture: workers who don’t have an emergency fund are twice as likely to raid their retirement plans to cover a surprise expense. We’re seeing a scary rise in hardship withdrawals and 401(k) loans, with nearly 6% of employees taking hardship withdrawals, a sharp jump from just 2.7% in 2018.

Think about this: if you pull out just $5,000 at age 40, you could be sacrificing over $38,000 in future growth by the time you retire. You can find more details on how this impacts retirement savings on asppa-net.org.

An emergency fund isn’t just about handling today’s problems; it’s about safeguarding tomorrow’s dreams. It ensures a short-term crisis doesn’t torpedo your long-term financial security.

More Than Money: The Psychological Benefits

Let’s look beyond the dollars and cents. The peace of mind that comes with a fully funded emergency account is priceless. It’s the quiet confidence of knowing you can handle a major life disruption without panicking. This sense of security dramatically lowers your stress and anxiety, which positively impacts every other part of your life.

- Clearer Decision-Making: When you’re facing something as stressful as a job loss, having savings lets you think clearly. You can make rational choices about your next move instead of desperate ones.

- Increased Confidence: Knowing you have a buffer gives you the confidence to take smart risks. You can negotiate for a better salary, walk away from a toxic job, or even pivot to a new career.

- Freedom from Fear: It frees you from the constant, nagging worry of “what if?” This allows you to shift your focus from mere survival to actual growth and opportunity.

At the end of the day, an emergency fund is the true foundation of financial independence. It gives you the stability you need to build wealth, take calculated risks, and truly live life on your own terms. It’s not just another savings goal—it’s the one that makes all the others possible.

Calculating Your Personalized Emergency Fund Target

The 3 to 6 months rule is a fantastic starting point, but let’s be real—your life isn’t a one-size-fits-all template. To build a financial firewall that truly protects your world, you need to figure out your unique ‘survival number.’ This is the bare-minimum amount you’d need to get by if your income suddenly stopped.

Getting this number right is the key to genuine peace of mind. It all starts with taking a close, honest look at where your money goes each month to separate the ‘must-haves’ from the ‘nice-to-haves.’

Identifying Your Essential Monthly Costs

Your essential expenses are the bills you simply can’t ignore. Think of this as the foundation of your financial life—the costs that keep the lights on and a roof over your head. The goal here isn’t to judge your spending habits but to get a clear, accurate total for your bare-bones monthly budget.

Start by listing out these non-negotiables:

- Housing: Your mortgage or rent payment is almost always the biggest piece of the puzzle.

- Utilities: Add up your average monthly bills for electricity, water, gas, and internet.

- Groceries: Be realistic. Look at past bank statements to find your baseline for food at home, not dining out.

- Transportation: Tally up car payments, insurance, gas, or public transit passes.

- Insurance Premiums: Don’t forget any health, life, or disability insurance payments.

- Minimum Debt Payments: This includes the minimum you must pay on student loans, credit cards, or personal loans.

Once you add all that up, you’ve got your monthly survival number. Getting this figure right is crucial, and if you need a deeper dive, our guide on how to track your expenses can walk you through it step-by-step.

Assessing Your Personal Risk Factors

Now that you have your monthly number, it’s time to decide how many months’ worth of expenses you need to save. This is where your personal situation comes into play. Are you closer to needing 3 months of savings, or should you be aiming for 6 months or even more?

A freelancer with unpredictable income faces a very different set of risks than a tenured government employee in a dual-income household.

Think about these factors to fine-tune your target:

- Income Stability: Is your paycheck the same every month, or does it fluctuate? If you’re a gig worker, freelancer, or work on commission, you’ll want to lean toward a larger fund—think 6 to 9 months.

- Number of Incomes: A two-income household has a natural safety net. If you’re the sole provider for your family, a bigger cushion is non-negotiable.

- Job Security: How stable is your company or industry? If you work in a field known for frequent layoffs, beefing up your savings is a smart move.

- Dependents: Supporting kids or other family members means more monthly essentials and, therefore, a greater need for a substantial fund.

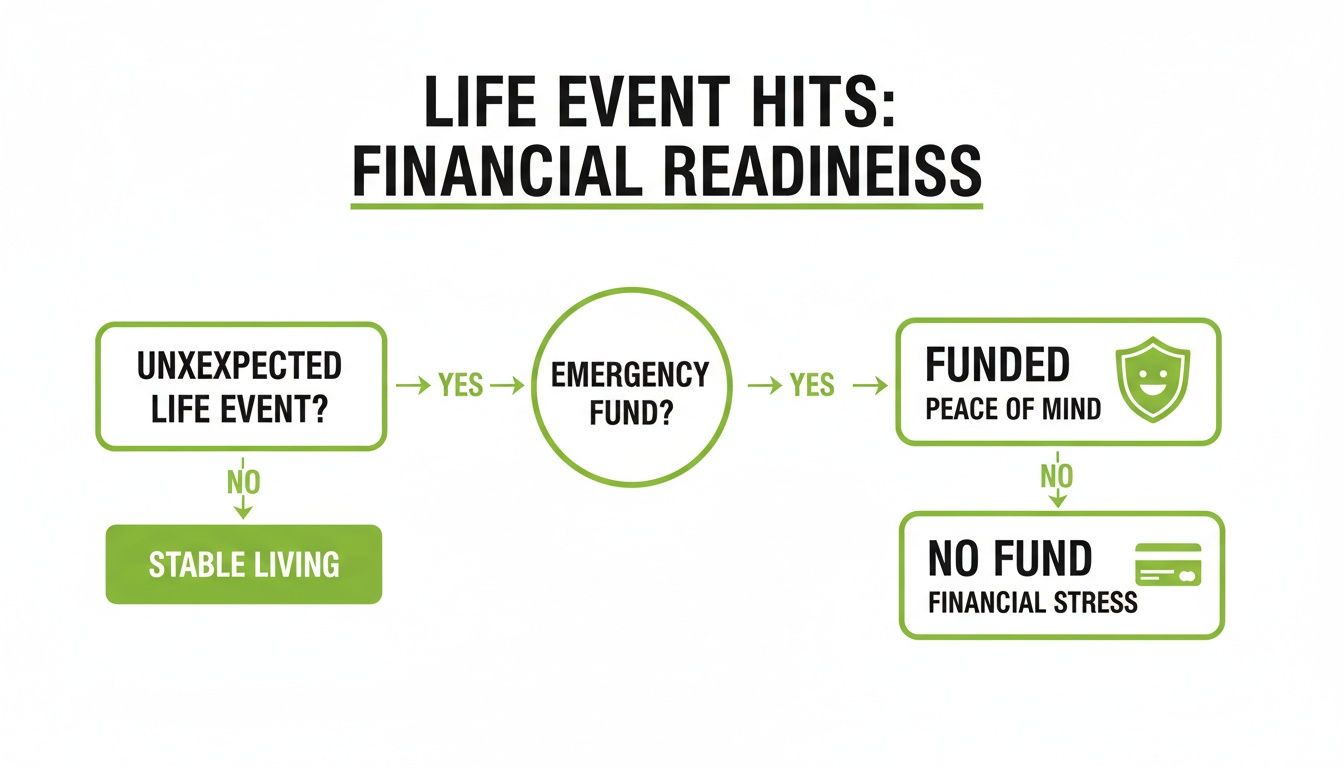

This flowchart shows just how differently things can play out when life throws you a curveball.

As you can see, a life event without a fund can easily spiral into debt. But with one, you have a shield that gives you stability and control over the situation.

Your emergency fund isn’t just a number; it’s a personalized insurance policy against your life’s unique risks. Aiming for a target that reflects your reality is the most powerful step toward financial resilience.

By combining your essential monthly costs with an honest look at your personal risks, you can turn a vague goal into a concrete, achievable number. This clarity makes the whole process feel less like a mountain to climb and more like a clear path with a finish line in sight.

The Reality of Building Your Emergency Savings

If the thought of saving three to six months of expenses makes your stomach drop, you’re in good company. For most people, building an emergency fund feels like a steep, uphill climb, especially when it seems like rising costs gobble up every spare pound. It’s incredibly easy to look at that big, final number and feel defeated before you even begin.

The truth is, struggling to save isn’t a personal failure—it’s a widespread reality. Millions of us are in the same boat, trying to navigate economic headwinds that make putting money aside a real challenge. This isn’t about a lack of willpower; it’s about the tough financial world we’re all living in.

The Broader Savings Picture

Let’s zoom out and look at the data, because it really helps to see you aren’t alone in this. Recent findings from Bankrate’s Annual Emergency Savings Report paint a pretty stark picture: a whopping 80% of people haven’t managed to increase their emergency savings at all since the start of the year. Even with some economic bright spots, many are still stuck in that paycheck-to-paycheck cycle, finding it impossible to get ahead. You can dig into the full findings on emergency savings habits at Bankrate.com.

This isn’t just a vague trend, either. It hits different generations in different ways, exposing a real gap in financial readiness:

- Gen Z (18-28): A full 34% have no emergency savings whatsoever.

- Millennials (29-44): 28% are starting from zero.

- Gen X (45-60): 24% are living without a safety net.

- Boomers (61-79): Even in this group, 16% have no emergency funds stashed away.

These numbers aren’t meant to be discouraging. They’re meant to normalize the struggle. If you feel like you’re behind, just remember you’re running the same race as millions of others.

The most important step in building an emergency fund isn’t saving a huge amount overnight. It’s shifting your mindset from “I can’t” to “How can I start?” Progress, no matter how small, is the real victory.

Progress Over Perfection

The secret to getting past that feeling of being overwhelmed is to change the goal. Forget about that intimidating final number for a minute. Your first mission isn’t to have six months of expenses saved by next Tuesday; it’s simply to start the habit of saving.

Think of it like building a brick wall. You wouldn’t try to lift the whole thing at once, right? You lay one brick. Then another. And another. Each brick feels small and insignificant on its own, but over time, they come together to form a solid, protective wall. Your savings account works the exact same way.

Even tucking away £5 or £10 a week can create incredible momentum. It gets the habit started and proves to yourself that you can make progress. This “start small” approach turns a daunting mountain into a series of small, manageable hills, paving the way for real, lasting financial security. The strategies that follow will show you exactly how to lay those first few bricks.

Actionable Strategies To Build Your Fund Faster

Knowing your magic number is the first step. Actually saving it? That’s where the real work begins. It’s time to roll up our sleeves and turn that savings goal into a reality, using practical strategies that make building your fund feel less like a grind and more like a game you’re winning.

The secret isn’t some complicated financial wizardry. It’s consistency. Finding a method that clicks with your lifestyle and sticking to it is what builds that financial firewall, brick by brick. Let’s look at a few powerful ways to get started.

Automate Your Savings with ‘Pay Yourself First’

This is hands-down the most effective trick in the book: get your own decision-making out of the way. The “pay yourself first” strategy is exactly what it sounds like. Before you pay rent, bills, or even think about your weekly grocery shop, you move money into your emergency fund. It becomes a non-negotiable expense, just like any other bill.

The easiest way to do this is to set up an automatic transfer from your current account to your emergency savings account. Schedule it for the day you get paid. That way, the money is moved before you even see it, let alone get tempted to spend it. Even starting small, with £20 or £50 per paycheck, builds a powerful habit and guarantees your fund grows without you lifting a finger.

Aim for a Quick Win with a Starter Fund

Staring at a goal of six months’ worth of expenses can feel completely overwhelming. It’s like trying to climb a mountain in one leap. So, let’s not do that. Instead, focus on a much smaller, more manageable first goal: a starter emergency fund of £1,000. This is a fantastic first milestone because it’s big enough to handle common curveballs—a boiler repair, a new set of tyres—but small enough that you can actually see yourself hitting it.

A £1,000 starter fund isn’t just about the money. It’s a massive psychological boost. It proves to yourself that you can save, and it provides just enough breathing room to break that stressful paycheck-to-paycheck cycle.

Once you’ve hit that £1,000 target, you’ll have the confidence and momentum to keep going and build it up to your full three-to-six-month goal.

Use Financial Windfalls to Your Advantage

Every now and then, a bit of unexpected cash comes your way. Think of these “windfalls” as a secret weapon for your savings. Instead of seeing them as a bonus to splurge with, immediately redirect that money to your emergency fund. This is one of the best ways to save money fast and can shave months off your timeline.

Keep an eye out for common windfalls like:

- Tax Refunds: This isn’t free money; it’s your money. Pay your future self by putting it straight into savings.

- Work Bonuses: Got a bonus? Awesome. A great rule of thumb is to save at least half of it before you celebrate with the rest.

- Cash Gifts: Birthday or holiday money can go a long way. Funnel it directly into your fund.

- Selling Unused Items: That old tablet or bike gathering dust? A quick clear-out and a few online listings can easily translate into cash for your fund.

Plug ‘Cash Leaks’ by Tracking Your Spending

Think about all the small, almost invisible expenses that add up. That daily coffee, the subscription you forgot about, the little impulse buys—they’re like tiny leaks in a bucket, slowly draining your finances. These “cash leaks” can easily siphon off hundreds of pounds a year without you even noticing.

The best way to find them is to track your spending for a month. A good budgeting app can do the heavy lifting for you, sorting your transactions into categories and showing you exactly where your money is going. Once you spot the leaks, you can plug them and redirect that cash straight into your emergency fund. It feels like finding money you never knew you had.

To help you decide which approach is right for you, let’s compare these strategies.

Emergency Fund Building Strategies Comparison

Choosing the right strategy—or a combination of them—depends entirely on your personality, income, and how quickly you want to reach your goal. Here’s a quick breakdown to help you compare the options.

| Strategy | Best For | Potential Speed | Effort Level |

|---|---|---|---|

| Pay Yourself First | Anyone wanting a consistent, “set-it-and-forget-it” method. | Slow but steady | Low |

| Starter Fund First | People feeling overwhelmed by a large savings goal. | Fast initial win | Medium |

| Using Windfalls | Seizing opportunities for big, occasional savings boosts. | Varies (can be very fast) | Low |

| Plugging Cash Leaks | Detail-oriented people who want to optimise their budget. | Slow to moderate | Medium |

| Temporary Side Hustle | Those needing to build their fund as quickly as possible. | Very fast | High |

Ultimately, the best strategy is the one you’ll actually stick with. Many people find success by combining a few—like automating savings while also looking for cash leaks and committing any windfalls.

Consider a Temporary Side Hustle

If your goal is to build your fund as fast as humanly possible, a temporary side hustle is a game-changer. The crucial part of this strategy is to commit 100% of the earnings from this extra gig directly to your emergency fund.

Whether you’re doing freelance work online, pet-sitting for neighbours, or driving for a delivery service, just a few extra hours a week can generate hundreds of extra pounds a month. Think of it as a short-term sprint to get your financial safety net built quickly.

Where To Keep Your Emergency Fund For Safety and Access

Figuring out how much to save is a huge step, but the next question is just as critical: where do you actually put the money? Your emergency fund has two competing jobs. It needs to be there for you at a moment’s notice, but it also needs to be just out of reach so you aren’t tempted to raid it for a weekend getaway or a new gadget.

Finding the right home for this cash is all about striking that perfect balance between safety, easy access, and maybe even earning a little interest.

The Top Choice: High-Yield Savings Accounts

For most of us, the best place for an emergency fund is a High-Yield Savings Account (HYSA). Think of it as a regular savings account, but on steroids. These accounts, usually offered by online banks, come with a game-changing feature: much, much higher interest rates. Your local brick-and-mortar bank might be paying you next to nothing, while an HYSA can offer rates that are 10 to 25 times higher.

This is a big deal. It means your safety net isn’t just sitting there losing value to inflation; it’s actually growing. The money is still liquid—you can typically get it within a few business days via a simple transfer. Plus, as long as the bank is FDIC or NCUA insured, your cash is protected up to $250,000. It’s about as safe as it gets.

Other Smart Places For Your Fund

While HYSAs are my go-to recommendation, they aren’t the only solid choice. Another great option is a Money Market Account (MMA). These are a bit of a hybrid, blending features of both savings and checking accounts, and they often pay competitive interest rates that are right up there with HYSAs.

What sets them apart is that some MMAs come with a debit card or even check-writing privileges. That can give you an extra layer of immediate access in a true crisis. Just be sure to check for any limits on monthly withdrawals. Like HYSAs, they’re also insured, so your principal is secure. And if you need a hand with the saving process itself, some of the best savings apps can help you automate everything and watch your fund grow.

Think of your emergency fund as your personal financial insurance policy. Its primary job is to be safe and accessible, period. Chasing high returns is what your investment portfolio is for, not your safety net.

Where Not To Keep Your Emergency Fund

Knowing where to park your fund is half the battle. Knowing where not to park it is just as important. The wrong spot can make your money too easy to spend or nearly impossible to get when you actually need it.

Here are a couple of places to steer clear of:

- Your Primary Checking Account: This is a recipe for disaster. When your emergency cash is mixed in with your everyday spending money, the line gets blurry. It’s far too easy to “borrow” from it for things that aren’t real emergencies.

- The Stock Market: Investing is crucial for building wealth, but the market is no place for your emergency fund. It’s simply too volatile. The last thing you want is for a market crash to slash your savings in half right when your car breaks down.

Your emergency fund needs to be your rock—stable and dependable. By choosing a dedicated account like an HYSA or MMA, you can rest easy knowing it’s safe, accessible, and ready to go when life happens.

Your Top Emergency Fund Questions, Answered

Once you get serious about building an emergency fund, a lot of “what if” questions naturally pop up. What really counts as an emergency? How do you juggle saving with paying off debt? And what happens after you actually have to use the money?

Let’s walk through some of the most common questions people have. Getting these details right is what turns a good idea into a practical, life-saving financial tool.

What Counts As a True Emergency?

A true emergency is something you didn’t see coming that you absolutely have to deal with now. It’s a non-negotiable expense that could destabilize your finances if you don’t have the cash to cover it.

Here’s what we’re talking about:

- Sudden job loss: You need money to live on while you hunt for a new position.

- Urgent medical or dental bills: A surprise expense that insurance doesn’t fully cover.

- Critical home repairs: Think a burst pipe, a dead furnace in January, or a seriously leaking roof.

- Major car trouble: The kind of repair you need to get done just to get to work.

What isn’t an emergency? Planned purchases like a holiday, splurges like a new TV, or even a down payment on a car you’ve been eyeing for months. The fund is for true, unexpected crises only.

Should I Pay Off Debt or Build My Fund First?

This is the classic chicken-and-egg question of personal finance. The truth is, you don’t have to choose one over the other. A hybrid approach almost always works best.

Most experts agree on this practical, two-step strategy:

- Build a ‘starter’ emergency fund of £1,000. This small buffer is surprisingly powerful. It stops a minor hiccup, like a flat tyre, from forcing you to whip out a high-interest credit card and dig yourself deeper into debt.

- Aggressively pay down high-interest debt. Once that starter fund is safely tucked away, pivot your focus to knocking out expensive debt like credit card balances. After you’ve gotten that under control, you can turn your attention back to building your emergency fund up to the full 3-6 month target.

This method gives you a crucial safety net while you make real headway on your debt.

What Should I Do After I Use My Emergency Fund?

The moment you have to dip into your fund, your single most important financial goal becomes refilling it. It’s like a firefighter refilling their water tank after a call—you have to be ready for the next one.

After using your fund, pause any extra debt payments (beyond the required minimums) and halt additional investment contributions. Redirect every spare pound you can find back into rebuilding your savings until it’s back at your target level.

Treat the rebuilding process with the same intensity you had when you first started saving. The data shows just how critical this is. A recent SHED survey from the Federal Reserve found that only 55% of US adults could cover three months of expenses with cash. Many are forced to take on loans or, worse, raid their retirement accounts for unexpected hits, like an average car repair of $838. You can find more eye-opening stats on financial preparedness in the St. Louis Fed’s detailed report.

At Collapsed Wallet, we’re committed to giving you clear, straightforward advice to help you build a more secure financial life. Our guides are designed to give you the confidence to take control of your money. Explore more resources on collapsedwallet.com to keep learning and growing.

1 thought on “Emergency Fund: How Much You Really Need for Financial Safety”