Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Feeling like you’re drowning in credit card bills? If you’re juggling multiple payments every month, you’re in good company. High-interest debt often feels like a treadmill you can’t get off, but there’s a smart way to break the cycle: consolidation. Rolling all your balances into a single, lower-interest payment is a powerful first move toward regaining control of your finances. This guide cuts through the jargon to give you a real-world roadmap. We’ll walk through how to combine your debts, simplify your monthly budget, and potentially save a ton of money on interest.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Debt Consolidation Is a Powerful Financial Tool

Trying to keep track of different credit card payments—each with its own due date and interest rate—is a recipe for stress. It’s more than just a hassle; it’s a financial drain. Every payment feels like you’re just treading water against high-interest charges, never really getting ahead. Learning how to consolidate credit card debt is about turning that chaotic juggling act into a single, streamlined plan.

At its heart, consolidation is all about simplification. Instead of worrying about several bills, you have just one payment to one lender. This makes budgeting a whole lot easier and cuts down the risk of accidentally missing a payment and dinging your credit score.

Understanding the Financial Landscape

The reality is, a lot of people are in the same boat. Collective credit card debt in the U.S. is on track to hit $1.21 trillion by mid-2025. The average person with a card is carrying a balance of about $5,595. For some groups, like Gen X, that average jumps to $9,600. These credit card debt statistics from Academy Bank paint a clear picture.

In this kind of environment, consolidation isn’t just a last-ditch effort—it’s a proactive, strategic move to get your finances back on solid ground.

The Core Benefits of Consolidation

Beyond making your life simpler, the main prize of consolidation is locking in a lower interest rate. Those high APRs are the real trap. When a huge chunk of your payment is eaten up by interest each month, it’s incredibly difficult to make a dent in the actual principal.

By bundling your debts into a new loan or a balance transfer card with a better rate, you can hit several important goals at once:

- Slash Your Total Interest: A lower APR means more of your money attacks the debt itself. Over time, this can save you a serious amount of cash.

- Pay It Off Faster: With less interest piling up, you can get to zero debt much more quickly than if you were stuck making minimum payments on multiple cards.

- Boost Your Credit Score: Making consistent, on-time payments on a consolidation loan looks great on your credit report and can improve your score over the long term.

By turning multiple high-interest debts into one lower-interest payment, you shift from simply managing debt to actively eliminating it. This strategic move can provide immediate financial relief and create a clear path to financial freedom.

Taking Stock of Your Financial Situation

Alright, before you dive into consolidating your credit card debt, we need to get a crystal-clear picture of where you stand right now. This isn’t just about knowing the big, scary total you owe. It’s about digging into the nitty-gritty details that lenders will scrutinize. Think of it like a contractor inspecting a foundation before starting a renovation—you have to know what you’re working with to build something solid.

Skipping this step is like trying to navigate a new city without a map. You’ll just end up wasting time and getting frustrated. Lenders live and breathe data, so when you come to the table with all your numbers organized, you’re not just prepared; you’re in control.

Lay Out All Your Cards on the Table

First things first, grab the latest statements for every single one of your credit cards. No guesstimating. You need the exact figures. I find it easiest to open a simple spreadsheet or even just use a notepad and list out the following for each card:

- Creditor: Who you owe (e.g., Chase, Capital One, etc.).

- Current Balance: The precise amount you owe them today.

- APR (Annual Percentage Rate): This is the killer. High interest rates are what make this debt so hard to escape.

- Minimum Monthly Payment: What they require you to pay each month just to stay current.

Once you have this all laid out, add up the total balance. That’s your target number. Then, total up all the minimum monthly payments. This shows you the minimum cash outflow you’re committed to right now. This simple list is incredibly revealing and gives you a powerful snapshot of the challenge ahead.

Check In On Your Credit

Your credit score is the key that unlocks the best consolidation options. It’s a huge factor for lenders, determining not only if you get approved but, more importantly, what interest rate they’ll offer you. A better score almost always means a lower rate, which translates directly into saving money.

You can—and should—pull your credit reports for free from the main bureaus. Go through them with a fine-tooth comb. Look for any errors or accounts you don’t recognize. Spotting and disputing an inaccuracy is one of the fastest ways you might be able to nudge your score up before you start applying.

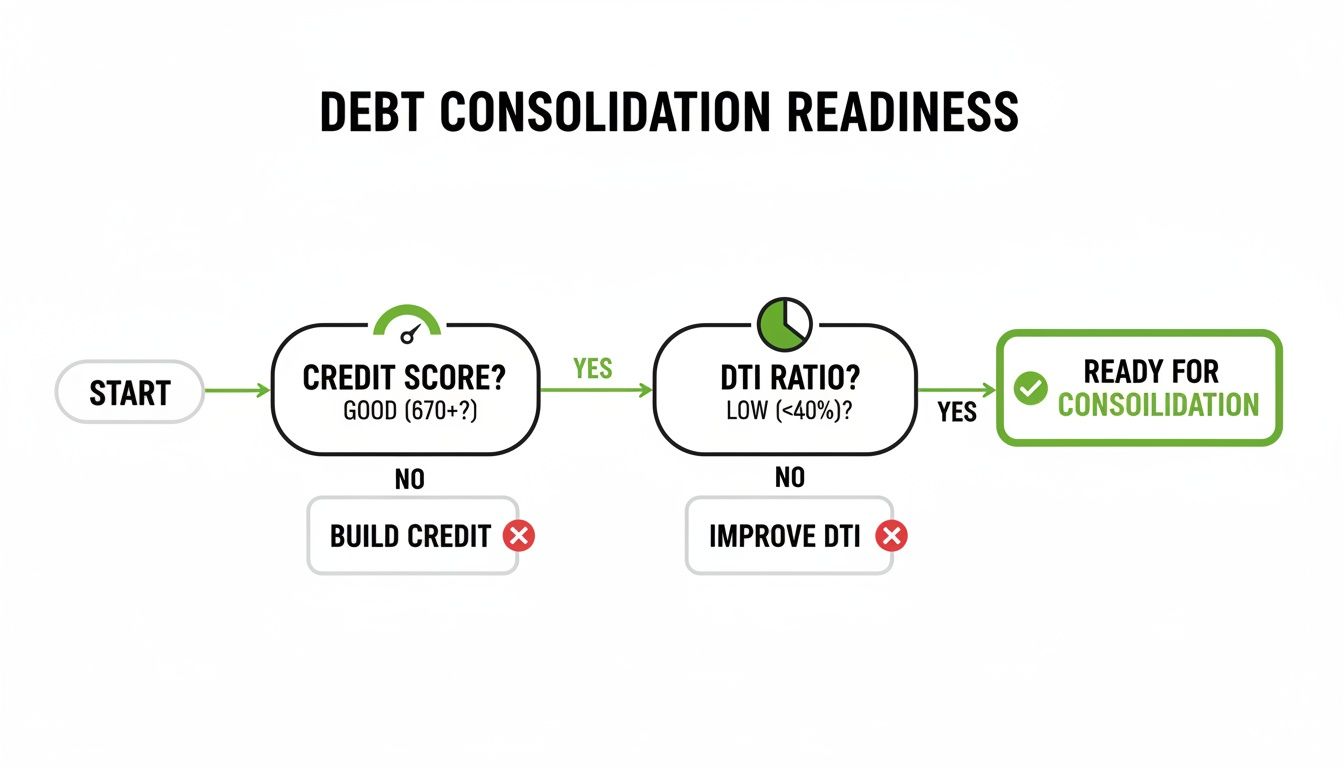

Knowing your credit score is like checking the weather forecast before a long road trip. It helps you prepare for what’s ahead. Generally, a score of 670 or higher is what you’ll need to qualify for the most attractive consolidation deals.

Figure Out Your Debt-to-Income Ratio

The last piece of this puzzle is your debt-to-income (DTI) ratio. It’s a simple but powerful metric that lenders use to see if you can realistically handle another payment. In short, it compares how much you owe each month to how much you earn. Most lenders want to see a DTI below 40%.

Here’s the simple math:

(Total Monthly Debt Payments ÷ Gross Monthly Income) x 100 = DTI

So, if all your monthly debts (your mortgage or rent, car payment, and those credit card minimums you just tallied) add up to $2,000, and your pre-tax monthly income is $5,000, your DTI is 40% ($2,000 / $5,000).

Putting in the work to gather this info is more important than ever. Data from the Federal Reserve Bank of St. Louis shows that late credit card payments have been climbing steadily since 2021. This trend makes it urgent for people to find a repayment plan that actually works before they fall behind.

Choosing the Right Debt Consolidation Method

Alright, you’ve taken a hard look at the numbers and have a clear picture of your debt. Now comes the part where you pick your tool for the job. There’s no single “best” way to consolidate credit card debt; the right path depends entirely on your credit score, how much you owe, and your own financial discipline.

Think of it like this: you wouldn’t use a hammer to saw a piece of wood. The same logic applies here. Let’s walk through the most common strategies so you can find the perfect fit for your situation.

Comparing Debt Consolidation Methods

To get a quick overview, this table breaks down the key features of each consolidation option. It’s a great starting point to see which methods might align with your financial profile before digging into the details.

| Method | Best For | Typical Interest Rate | Primary Pro | Primary Con |

|---|---|---|---|---|

| Balance-Transfer Card | Good to excellent credit (670+); smaller debt amounts. | 0% for 12-21 months, then variable. | Interest-free payoff period. | Requires discipline; high standard APR after the intro period. |

| Personal Loan | Fair to excellent credit; desire for a fixed payment. | 6% – 36%, depending on credit. | Predictable monthly payments and a clear end date. | Higher rates for fair or poor credit. |

| HELOC / Home Equity Loan | Homeowners with significant equity and stable income. | Typically lower than unsecured loans (5% – 12%). | Very low interest rates. | Extremely risky; your home is collateral. |

| Debt Management Plan (DMP) | Those struggling to qualify for loans; need structure. | Negotiated lower rates (around 8%). | Professional guidance and reduced interest. | Must close credit accounts; takes 3-5 years. |

| Debt Settlement | Severe financial hardship; as a last resort before bankruptcy. | N/A (fees are a % of forgiven debt). | Can significantly reduce the principal owed. | Devastating to your credit score; forgiven debt is taxed. |

Each of these paths has its place. The key is to be honest with yourself about your credit, your budget, and your ability to stick to a plan.

Balance Transfer Credit Cards

This is a classic go-to for anyone with a solid credit score, usually 670 or higher. The concept is simple: you move your high-interest balances onto a new card offering a 0% introductory APR for a specific period, often between 12 and 21 months.

Your goal is to attack the principal balance aggressively while it’s not growing from interest. But watch out for the details. Most cards have a balance transfer fee, typically 3% to 5% of the total amount you move, which gets added to your new balance immediately.

The real trap is what happens when that intro period ends. The interest rate skyrockets to the card’s standard APR, so you absolutely need a plan to pay it off in time. For a deeper dive on how to make this work, check out our guide on making a smart credit card debt transfer.

Personal Loans for Debt Consolidation

If you crave predictability, a personal loan is probably your best bet. It cuts through the complexity. You get a lump sum of money with a fixed interest rate and a fixed repayment term—usually two to five years.

This structure is its biggest advantage. You’ll have one single monthly payment, and you’ll know the exact date your debt will be gone. No more juggling due dates or variable interest rates. It makes budgeting so much easier.

While you don’t need perfect credit, your score is the single biggest factor in determining your interest rate. A strong credit profile unlocks the lowest rates, which is what makes consolidation a money-saving move in the first place.

As you can see, getting a handle on your credit score and debt-to-income ratio is the essential first step before even applying for these products.

Home Equity Loans and Lines of Credit (HELOCs)

Homeowners often see this as a golden ticket. By using your home as collateral, you can access loans with much lower interest rates than any unsecured option. This is because you’re reducing the lender’s risk.

You have two main choices here:

- A home equity loan provides a lump sum payment with a fixed rate and term.

- A HELOC (Home Equity Line of Credit) acts like a credit card; it’s a revolving line of credit you can draw from as needed.

A Word of Caution: This is, without a doubt, the riskiest way to consolidate debt. The low rates are tempting, but if you fall behind on payments, you could lose your home. Only consider this if your income is rock-solid and you have unshakable payment discipline.

Debt Management Plans (DMPs)

What if your credit score isn’t high enough for a good loan or balance transfer card? Don’t lose hope. A Debt Management Plan (DMP) from a non-profit credit counseling agency is a fantastic, structured alternative.

This isn’t a loan. Instead, the agency negotiates with your creditors on your behalf to lower your interest rates. You then make one single monthly payment to the agency, and they handle distributing the funds to your various creditors.

These plans typically last three to five years, and you’ll usually have to agree to close the credit cards included in the plan. It’s a supportive path designed for people who need help re-establishing control, especially when debt piles up from unexpected life events.

Putting Your Consolidation Plan Into Action

Okay, you’ve done the hard work of assessing your debt and picking a consolidation strategy. Now it’s time to actually make it happen. This is the part where all that planning starts to pay off, turning a jumble of credit card bills into one single, manageable payment.

Whether you’re applying for a loan or enrolling in a program, being methodical here will save you a ton of headaches.

Gathering Your Application Essentials

Before you even think about filling out an application, get your paperwork in order. Trust me, having everything ready to go makes the whole process smoother and shows lenders you mean business. It’s a small step that prevents big delays.

Here’s what you’ll almost always need:

- Proof of Identity: Your driver’s license, passport, or another government-issued ID. Make sure it’s a clear copy.

- Proof of Income: Grab your last few pay stubs, your W-2s from the past two years, or your recent tax returns if you’re self-employed. Lenders want to see you have a steady income.

- Proof of Address: A recent utility bill or bank statement with your name and current address will do the trick.

- Debt Information: Have the latest statements for every credit card you want to consolidate. You’ll need the creditor’s name, the full account number, and the exact payoff balance.

With your documents in hand, you’re ready to move forward.

Executing the Balance Transfer

If you went with a personal loan, it’s pretty simple. The lender will either drop the funds into your bank account—and then it’s on you to pay off each card—or they might offer to send the payments directly to your creditors for you.

For a balance transfer card, you’ll give the new card company the account details for your old cards when you apply. They’ll take it from there and handle the transfers.

Here’s a crucial tip: Do not stop making the minimum payments on your old cards until you see that the balance has been completely paid off. This process isn’t instant; it can take a few weeks. A single missed payment during that waiting period can ding your credit score, which is the last thing you want.

Engaging with a Credit Counseling Agency

If a Debt Management Plan (DMP) felt like the right fit, your next move is to find a reputable, non-profit credit counseling agency. I always recommend looking for one accredited by a major organization like the National Foundation for Credit Counseling (NFCC).

Your first session will be a deep dive into your finances—income, expenses, and debts. A counselor will help you build a budget that actually works for you. Then, they’ll get to work contacting your creditors to try and negotiate lower interest rates. It’s a team effort, but their expertise can be a game-changer. They’re pros at this, and knowing how to negotiate with creditors is their specialty.

Managing Your Old Credit Card Accounts

So, your old cards now have a zero balance. What next? The temptation to close them all and say “good riddance” is strong, I get it.

But hold on. From a credit score perspective, closing those accounts can actually backfire.

Keeping them open is usually the smarter play. Here’s why:

- Your Credit Utilization Ratio: When you close a card, you lose its credit limit. This makes your total available credit shrink, which can push your credit utilization ratio up and pull your score down.

- Your Length of Credit History: The age of your accounts matters. Closing a card you’ve had for a decade can shorten your credit history, which isn’t great for your score.

The best approach? Tuck the old cards away somewhere you won’t be tempted to use them. Maybe make one tiny, planned purchase on each one every six months or so and pay it off in full immediately. This keeps the accounts active, preserving your credit history and helping your score rebound as you knock out that new consolidated debt.

Building Lasting Financial Health After Consolidation

You did it. You consolidated your credit card debt, and that’s a massive win. The single, lower-interest payment probably feels like a huge weight has been lifted. But here’s the thing I always tell people: consolidation is the fix, not the cure.

The real work—and the biggest reward—starts now. It’s all about building new habits to make sure you stay out of debt for good. This is your chance to shift your mindset from just treading water to actively building a secure financial future. Without this follow-through, it’s surprisingly easy to slide back into old spending patterns.

Crafting a Budget That Actually Works

Let’s be honest, the word “budget” can make you want to run for the hills. But it doesn’t have to be a financial straitjacket. Think of it as a game plan that puts you in control, telling your money exactly where to go. If complicated spreadsheets aren’t your thing, don’t use them. Find what works for you.

- The 50/30/20 Rule: This is a fantastic, simple starting point. 50% of your take-home pay covers your needs (rent, bills, transport), 30% is for your wants (eating out, hobbies), and 20% goes toward savings and debt repayment. Your new consolidated payment fits perfectly into that final 20%.

- Zero-Based Budgeting: This one is for those who love detail. Every single pound you earn gets a specific “job” for the month. Your income minus all your expenses, savings, and debt payments should equal zero. It’s more hands-on, but the level of control you gain is incredible.

Identifying and Managing Spending Triggers

High-interest debt rarely comes from one single catastrophic purchase. It’s usually the result of hundreds of small, almost unconscious spending decisions that add up over time. The key is to figure out what sets off those decisions.

Are you an emotional spender who hits “add to cart” after a rough day at work? Do you feel pressure to keep up with friends who have more disposable income? Be brutally honest with yourself. Look at your past bank statements and try to connect the dots between your purchases and how you were feeling.

Once you know your triggers, you can plan for them. Unsubscribe from tempting marketing emails. Be the one to suggest a potluck dinner instead of an expensive night out.

True financial health isn’t about restriction; it’s about mindful spending. The goal is to align your spending with what you truly value, cutting back ruthlessly on the things that don’t bring you lasting joy or utility.

The Absolute Necessity of an Emergency Fund

An emergency fund is your firewall against future debt. So many debt stories I’ve heard started with an unexpected car repair or a surprise medical bill. Without cash on hand to absorb that shock, a credit card often becomes the only option, and the cycle begins again.

Your first mission is to build a “starter” emergency fund of £500 to £1,000. You’d be amazed how many common emergencies that small amount can cover.

Once you’ve hit that milestone, work toward saving three to six months’ worth of essential living expenses in a separate, high-yield savings account. This is the ultimate peace of mind. It breaks the cycle of borrowing for good.

This post-consolidation period is also the perfect time to focus on rebuilding your financial profile. Making every payment on your new loan on time will give your credit score a serious boost, but there’s more you can do. For extra tips, check out our guide on how to improve your credit score fast, which can open up even better financial opportunities down the road.

Got Questions About Debt Consolidation? Let’s Clear Things Up.

Taking on debt consolidation is a big move, so it’s completely normal to have a few questions swirling around. Getting straight answers is the best way to feel confident about your decision. Let’s tackle some of the most common things people ask.

Will Consolidating My Debt Tank My Credit Score?

This is usually the first thing on everyone’s mind, and the answer isn’t a simple yes or no. It really breaks down into the short-term and the long-term effects.

In the beginning, you might notice a small, temporary dip. When you apply for a new loan or a balance transfer card, the lender runs a hard inquiry on your credit, which can knock a few points off your score. Opening a new account also lowers the average age of all your credit lines, another small factor.

But stick with it, because the long-term picture is much brighter. As soon as you pay off those old credit card balances, your credit utilization ratio—the amount of debt you have compared to your total credit limit—drops dramatically. Lenders love to see low utilization, and it can give your score a serious boost.

The real magic happens over time. Making steady, on-time payments on your new consolidated loan builds a rock-solid payment history, and that’s the single biggest ingredient in a great credit score.

Can I Consolidate Debt if I Have Bad Credit?

A less-than-perfect credit score can make things tougher, but it absolutely does not lock you out of consolidation. You might not qualify for those flashy 0% APR cards or the personal loans with the lowest interest rates, but you still have some very effective options.

Here are a few paths to consider:

- Secured Personal Loans: With these, you offer up collateral—like your car or a savings account—to secure the loan. This makes you a much safer bet for lenders, which significantly improves your chances of getting approved.

- Bring in a Co-signer: If you have a trusted friend or family member with a strong credit history, asking them to co-sign can open the door to loans and terms you couldn’t get on your own.

- Debt Management Plans (DMPs): Offered by non-profit credit counseling agencies, DMPs are a fantastic alternative. Your credit score isn’t the main factor. Instead, the agency works directly with your creditors to lower your interest rates and create a single, manageable monthly payment for you.

Even with a few bumps in your credit history, these routes can help you get back on solid ground.

What Are the Biggest Mistakes People Make?

Knowing what not to do can be just as important as knowing what to do. A few common missteps can easily derail your progress, so keep an eye out for these.

The first temptation is to close your old credit card accounts as soon as you pay them off. It feels like a fresh start, but it can actually hurt your credit score by reducing your total available credit and shortening your credit history. The smarter move is to keep the accounts open—just tuck the cards away in a drawer.

Another classic blunder is treating your newly paid-off cards as a green light for more spending. Racking up new debt on those zero-balance cards is the fastest way to wind up right back where you started.

Finally, you have to read the fine print. This is especially crucial for balance transfer cards. Look for the transfer fee (usually 3% to 5% of the balance) and, most importantly, know exactly what the interest rate will become once that introductory period is over. A little bit of homework now can save you from a huge financial headache down the road.

At Collapsed Wallet, our goal is to provide clear, practical guidance to help you master your money. To find more expert advice on budgeting, paying off debt, and building a secure financial future, explore all our resources at https://collapsedwallet.com.

1 thought on “How to Consolidate Credit Card Debt A Practical Guide”