Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Knowing how to create a budget isn’t about restriction; it’s about freedom. It’s the single most powerful tool you have for taking control of your money and making it work for you. A great budget comes down to three things: knowing what comes in, knowing what goes out, and having a plan for the difference that aligns with your goals.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Most Budgets Fail (and How Yours Can Succeed)

Let’s be honest. If the word “budget” makes you cringe, thinking of penny-pinching and giving up everything fun, you’re not alone. That’s exactly why most budgets fall apart. People treat them like crash diets—totally unrealistic, punishing, and doomed from the start.

But a successful budget isn’t a financial straitjacket. Think of it as a roadmap. It’s the bridge that turns a vague dream, like achieving financial freedom or just feeling less stressed about money, into a concrete, achievable plan. It’s less about complicated spreadsheets and more about shifting your mindset from “I can’t” to “I can.”

The Real Reason Budgeting Feels So Hard

So why do so many people avoid it? Because budgeting forces you to look your finances straight in the eye. It can be jarring to see exactly where every dollar is going, especially on things like subscriptions you forgot you had or that daily coffee habit that adds up.

But that clarity is where the magic happens. Without it, you’re just guessing.

The numbers don’t lie. Data from the U.S. Bureau of Labor Statistics showed that in a recent year, the average consumer unit spent $78,535 out of an average pre-tax income of $104,207. That leaves a huge potential gap where money just… disappears. Even worse, while only 32% of families saw their income go up, 37% reported their spending increased, often thanks to inflation. You can dig into the full consumer expenditure data to see the trends for yourself.

This highlights a critical truth: without a plan, it’s incredibly easy for your expenses to quietly expand and eat up every last dollar. Your budget is your defense. It’s what ensures your money is working for your future, not just vanishing into thin air.

Gathering Your Tools for a Strong Start

Before you can draw your map, you need to know your exact coordinates. This first step isn’t about making any changes yet—it’s just about gathering intel, judgment-free. Grab a coffee and pull together a few key documents to get a clear, honest picture of where you stand today.

Here’s what you’ll need:

- Pay Stubs: At least two months’ worth. This will show your net income—the actual cash that hits your bank account after taxes and other deductions.

- Bank Statements: Pull the last three months for all your checking and savings accounts. This is where your spending habits will come to light.

- Credit Card Statements: Get the last three months of these, too. It’s crucial to see where you’re using credit versus cash.

- Bills & Loan Statements: Round up everything else—mortgage/rent, car payments, student loans, utilities, phone bills, you name it.

The point here is observation, not criticism. Don’t beat yourself up over last month’s impulse buys or takeout splurges. You’re simply collecting the data needed to build a plan that’s realistic and sustainable.

With these documents in hand, you’re officially ready to move from fact-finding to building a budget that actually works.

Let’s be honest: before you can tell your money where to go, you have to know where it’s actually going. This first step isn’t about feeling guilty over last month’s takeout orders or that impulse buy. It’s a judgment-free fact-finding mission.

Think of it like a detective gathering clues. You’re simply collecting the raw data on every dollar that comes in and every dollar that goes out. This clarity is what gives you the power to build a budget that actually works for you.

We’re going to break this down into two parts: adding up your income and getting a real handle on your spending.

Tallying Up Everything That Comes In

First, let’s get a clear picture of your total monthly income. For most people with a steady 9-to-5, this is pretty simple—it’s your take-home pay after taxes and deductions. But don’t stop there. To get the full picture, you need to account for every source of cash.

Your income audit should include:

- Your Main Paycheck: The net amount that hits your bank account.

- Side Hustle Income: Money from freelance projects, your Etsy shop, or that weekend dog-walking gig.

- Passive Income: Earnings from investments, rental properties, or anything else that brings in money without your daily effort.

- Other Sources: Any other regular income, like child support or government benefits.

If your income isn’t the same every month (hello, freelancers and commission-based workers!), don’t just guess. The best way to handle this is to calculate an average. Just look at your earnings over the last three to six months, add it all up, and divide by the number of months. That average is your baseline—a much more realistic number to build your budget around.

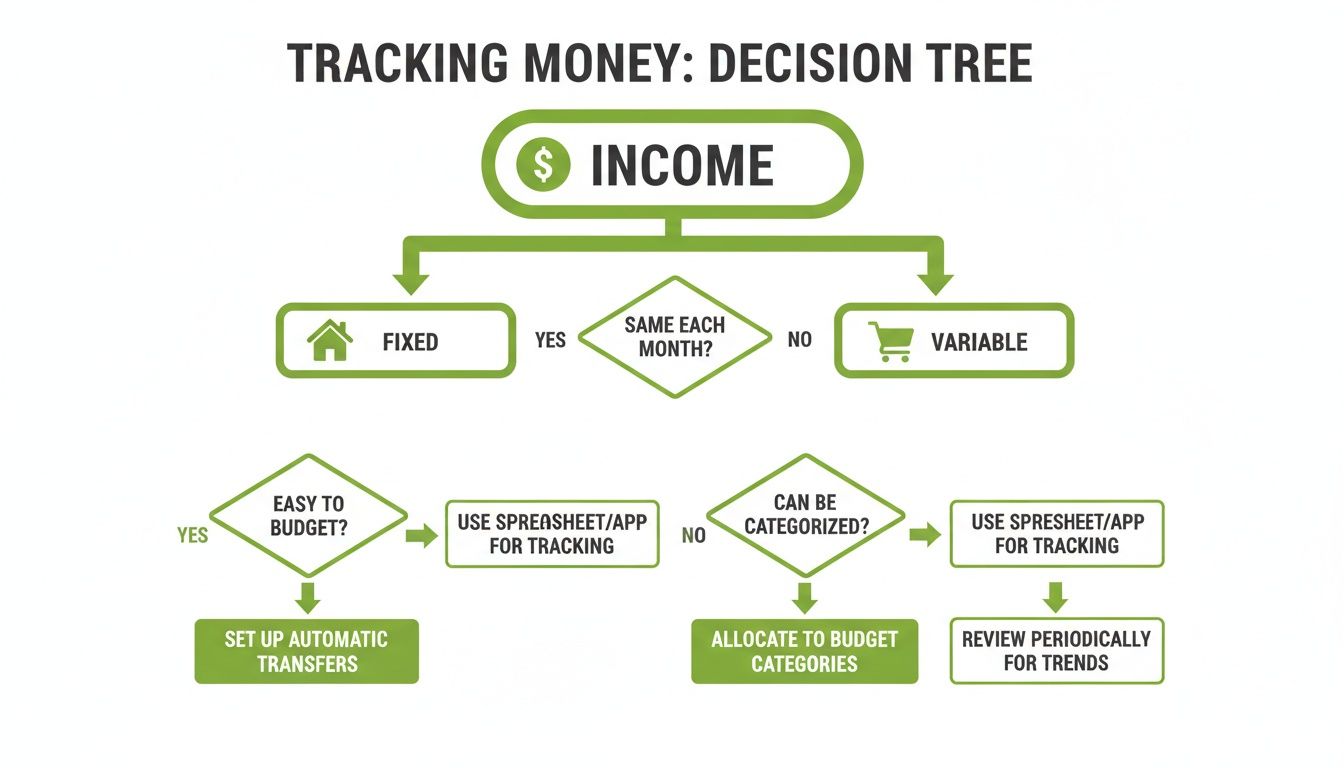

Fixed vs. Variable: Getting Real About Your Spending

Once you know what’s coming in, it’s time to track what’s going out. Every single thing you buy falls into one of two buckets: fixed or variable. Nailing this distinction is the key to finding flexibility in your budget.

Fixed expenses are the predictable costs that are the same every single month. These are your non-negotiables, the bills you have to pay no matter what.

- Rent or mortgage payments

- Car payments

- Insurance premiums (health, auto, renter’s)

- Loan repayments (student loans, personal loans)

- Set monthly subscriptions (like your gym or that streaming bundle)

Variable expenses, on the other hand, are the costs that fluctuate. This is where your daily choices make the biggest difference, and it’s usually the best place to find room to save.

- Groceries

- Dining out and entertainment

- Gas and public transportation

- Utilities (your electric bill probably isn’t the same in July as it is in January)

- Shopping, haircuts, and other personal care

Getting this clarity is often an eye-opening experience. We tend to think we know where our money goes, but the data can be surprising. For instance, recent analysis shows U.S. household spending on housing and utilities has held steady at 18% of total consumption for five years, while energy costs are a surprisingly low 3%. You can see more insights at NookMoney.

The best way to do this is to roll up your sleeves and go through your last two to three months of bank and credit card statements. Don’t rely on memory—the numbers don’t lie. If you need a good system for this, our guide on how to track expenses lays out several practical ways to get it done without the headache.

Putting Your Financial Snapshot on Paper

Now, let’s pull all this information together. Sometimes, just seeing the numbers laid out in a simple table can turn a jumble of transactions into a crystal-clear overview of your financial life. It instantly shows you where the money is flowing and flags areas where you might be able to make a change.

Here’s a simple template to help you organize your own spending. Use your three-month average to fill it in and get a personalized look at your finances.

Sample Monthly Budget Breakdown: Fixed vs. Variable Expenses

| Expense Category | Type (Fixed/Variable) | Example Monthly Cost | Notes/Tips |

|---|---|---|---|

| Housing (Rent/Mortgage) | Fixed | $1,500 | Your largest, most predictable expense. |

| Car Payment & Insurance | Fixed | $450 | Includes both the loan payment and your monthly insurance premium. |

| Utilities | Variable | $150 | Average this over three months to account for seasonal changes. |

| Groceries | Variable | $400 | Track this closely; it’s a key area for potential savings. |

| Gas/Transportation | Variable | $120 | Can fluctuate based on travel and gas prices. |

| Dining Out/Entertainment | Variable | $250 | Includes coffee, lunches, movies, and social events. |

| Subscriptions | Fixed | $45 | Review this list for any services you no longer use. |

| Student Loan Payment | Fixed | $200 | A consistent payment toward your debt reduction goals. |

| Personal Spending | Variable | $150 | A “fun money” category for hobbies, shopping, or personal items. |

Once you’ve done this, you’re no longer flying blind. You have an honest, clear map of your financial landscape. This is the solid foundation you need to choose the right budgeting method and start taking control of your money.

A quick heads-up: The information shared here is for educational purposes and general guidance. It’s not a substitute for professional financial advice. If you need help tailored to your specific situation, we always recommend chatting with a qualified financial adviser.

Choosing a Budgeting Method That Fits Your Life

Alright, you’ve tallied up your income and stared your expenses in the face. Now for the fun part: picking a system to manage it all.

Let’s be clear—there’s no single “best” budget. The right one is simply the one you’ll actually stick with. Think of it like a fitness plan; the most effective workout is the one you don’t skip. The goal is to find a framework that clicks with your personality and financial goals, turning budgeting from a chore into a powerful habit.

Some people geek out on spreadsheets and love tracking every penny. Others just want a simple set of guardrails to keep them on track. We’ll explore three of the most popular and effective methods out there to help you find your match.

The 50/30/20 Rule For Simple Guidelines

If you’re just dipping your toes into budgeting or you hate getting bogged down in tiny details, the 50/30/20 rule is your best friend. It’s less of a strict budget and more of a common-sense spending plan. It works by splitting your after-tax income into three buckets.

- 50% for Needs: This is the non-negotiable stuff. Think rent or mortgage, utilities, car payments, insurance, and groceries. Basically, if you have to pay for it to live, it goes here.

- 30% for Wants: This is your lifestyle fund. It covers everything that makes life more enjoyable but isn’t strictly necessary—eating out, concert tickets, hobbies, and that Netflix subscription you can’t live without.

- 20% for Savings and Debt Repayment: This is where you pay your future self. This slice is for building your emergency fund, saving for retirement, investing, or aggressively paying down high-interest debt (think beyond just the minimum payments).

The beauty of this approach is its flexibility. It gives you a bird’s-eye view of your finances without demanding you track every last coffee purchase, making it much easier to maintain over the long haul.

Zero-Based Budgeting For Total Control

For anyone who wants to know exactly where every single dollar is headed, zero-based budgeting offers an incredible level of precision. The idea is simple but powerful: give every dollar a job. At the start of the month, you allocate all of your income to expenses, savings, and debt until the amount left over is zero.

This is definitely a more hands-on approach. You have to account for everything, which can be eye-opening. With household savings rates dipping as low as 4.6% in recent years, this level of intentionality can be the difference-maker in avoiding the paycheck-to-paycheck cycle. It’s especially powerful if you’re laser-focused on crushing debt or saving for a big goal like a down payment.

Key Takeaway: With zero-based budgeting, there’s no “leftover” money. Any surplus is intentionally allocated to a goal, whether it’s boosting your savings, investing in an ETF, or making an extra loan payment.

This method is a game-changer for people with variable incomes or anyone who thrives on details. It forces you to make conscious choices with your money each and every month. This diagram shows the kind of thinking it encourages by making you categorize every dollar.

Ultimately, every budget forces you to sort your money into different buckets. This just makes you do it with purpose.

The Envelope System For Hands-On Spending

The envelope system is a classic for a reason—it works. It’s a very tangible, psychology-backed way to control your spending. The old-school method is to withdraw cash at the beginning of the month and physically stuff it into envelopes labeled with your variable spending categories: “Groceries,” “Gas,” “Fun Money,” etc.

Once an envelope is empty, that’s it. You’re done spending in that category until the next month. It’s a hard stop that a credit card swipe just can’t replicate.

Thankfully, you don’t need to carry wads of cash anymore. Many of the best free budgeting apps have digital “envelopes” that serve the exact same purpose, creating clear and immediate spending limits right on your phone.

Comparison of Popular Budgeting Methods

Choosing the right system is a personal decision, depending on what motivates you and what feels sustainable. To make it a bit easier, here’s a quick breakdown of how these three popular methods stack up against each other.

| Budgeting Method | Best For | Pros | Cons |

|---|---|---|---|

| 50/30/20 Rule | Beginners and those who prefer a simple, big-picture approach. | Easy to set up and maintain; promotes balanced financial habits. | Can be too broad; may not catch small spending leaks. |

| Zero-Based Budgeting | Detail-oriented individuals, people with variable income, or those with aggressive financial goals. | Provides total control over every dollar; highly effective for debt reduction. | Time-consuming; can feel restrictive if not managed well. |

| Envelope System | Visual learners and anyone who struggles with overspending in specific categories. | Excellent for building spending discipline; prevents impulse purchases. | Can be difficult with online/automated payments; cash can be inconvenient. |

Don’t be afraid to experiment. You might even find that a hybrid approach works best for you. The most important thing is to just start.

Bringing Your First Budget to Life

Alright, this is where the rubber meets the road. You’ve laid the groundwork—you know your goals, you’ve tallied your income and expenses, and you’ve picked a budgeting method that feels right for you. Now, let’s put it all together and build your first real, working budget.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

A Real-World Example: Putting the 50/30/20 Rule to Work

Let’s meet Alex and Sam. They bring in a combined $4,500 after taxes each month. Alex has a predictable salary, but Sam’s freelance income can be a bit of a rollercoaster, so they use a three-month average to get a reliable number. They’ve decided to go with the 50/30/20 rule because it gives them structure without requiring them to track every single penny.

Here’s how their $4,500 breaks down:

- 50% for Needs ($2,250): This bucket is for the essentials. We’re talking rent, utilities, car insurance, and groceries—the things they absolutely have to pay.

- 30% for Wants ($1,350): This is the fun money for their lifestyle. It covers everything from dining out and grabbing coffee to streaming subscriptions and hobbies.

- 20% for Savings & Debt ($900): This slice goes straight toward their future, funding their emergency savings and chipping away at student loans.

After they crunch the numbers, they realize their “Needs” actually add up to $2,400. That’s $150 over their target. This isn’t a disaster; it’s a completely normal part of the process.

How to Adjust Your Budget Without Feeling Punished

That $150 gap isn’t a sign of failure. It’s just a signal that a few tweaks are needed. The goal isn’t to slash and burn everything you enjoy, but to make small, smart adjustments.

Alex and Sam look at their variable “Needs” to see where they can find that $150. They quickly spot two opportunities: they figure they can save $100 on groceries by being more mindful of spending and knock off another $50 just by being more conscious of their electricity use.

Just like that, their “Needs” are back in line with their 50% target. This is the real magic of budgeting. It’s a living document that you adjust until it works for you.

Your first draft of a budget is never the final one. Think of it as a starting point. The real power comes from tweaking the numbers until they reflect both your financial reality and your personal priorities.

Let Technology Do the Heavy Lifting

Let’s be honest: tracking every dollar manually can be a drag. This is where a good budgeting app becomes your best friend. Instead of wrestling with spreadsheets, you can let technology automate the process and give you a clear, real-time picture of your finances.

Apps like YNAB (You Need A Budget) or Mint are designed for this. They securely sync with your bank accounts and credit cards, automatically pulling in your transactions and categorizing them for you. It takes the guesswork out of the equation.

For example, this is what a YNAB dashboard looks like:

You can see instantly how much you’ve allocated, how much you’ve spent, and what’s left in each category. This makes it so much easier to make informed decisions on the go, like whether that impulse buy fits into your “Wants” for the month.

These tools shift you from being reactive to proactive. Instead of finding out you overspent at the end of the month, you can get alerts that help you course-correct along the way. By using these tools, you’re not just creating a budget—you’re building a sustainable habit that paves the way for financial confidence.

Making Your Budget Last for the Long Haul

A budget isn’t a one-and-done document you create and then file away. Think of it as a living, breathing tool that needs to evolve right along with your life. The real secret to long-term financial success isn’t just knowing how to set up a budget; it’s building the habits that make it flexible and strong enough to last for years.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

The Power of Regular Check-Ins

Consistency is what turns budgeting from a dreaded chore into a simple, almost automatic routine. You don’t need to spend hours buried in spreadsheets. Instead, get into a rhythm with two simple habits: the weekly check-in and the monthly review.

- The Weekly Check-In: This is just a quick, 15-minute sync-up with your money. The goal is simple: catch any overspending before it snowballs. Did you go a little overboard on takeout? No big deal. You can just pull back on that category for the rest of the week. These tiny course corrections are what prevent small slip-ups from wrecking your entire month.

- The Monthly Review: At the end of the month, it’s time to zoom out and look at the bigger picture. This is your chance to celebrate what went right—maybe you hit a savings goal or finally paid off a nagging debt. It’s also the perfect time to spot patterns and make bigger adjustments for the month ahead.

This steady cadence of frequent, low-effort check-ins is the key to making a budget stick. It keeps you connected to your plan without ever feeling overwhelming.

Handling Financial Surprises Without the Panic

Life happens. That’s a guarantee. Your budget needs to be able to roll with the punches, whether it’s a surprise car repair or a leaky pipe. Without a plan, these moments can feel like a total catastrophe, but building resilience into your budget turns them into mere inconveniences.

An emergency fund is your first line of defense, of course. But what about those expenses that aren’t quite emergencies but aren’t part of your regular monthly bills either? Think new tires, annual insurance premiums, or holiday gifts. For these, you need a different strategy. It’s worth exploring what is a sinking fund and how it can help you prepare. By setting aside a little money each month for these specific future costs, you transform a potential crisis into a manageable, planned expense.

A resilient budget doesn’t just account for today’s bills; it anticipates tomorrow’s surprises. Building in buffers like an emergency fund and sinking funds transforms financial anxiety into a feeling of preparedness and control.

Adapting Your Budget for Major Life Milestones

Your financial reality isn’t static. A budget that was perfect for you as a single person simply won’t work for a growing family. The budget you had for a stable 9-to-5 job will need a complete overhaul if you jump into freelancing.

Your budget is meant to grow and change with you. Here’s how you can adapt it for some of life’s biggest moments:

- Career Change or Promotion: A pay raise is fantastic, but it’s also a critical moment to fight “lifestyle creep”—that all-too-common tendency for spending to rise right alongside income. Before you upgrade your car or apartment, update your budget. Earmark a big chunk of your new income for your big goals, like maxing out your retirement savings or wiping out debt.

- Growing a Family: A new baby means new expenses, from childcare and diapers to a much larger grocery bill. It’s time to sit down, revisit your budget, and reallocate funds to cover these new priorities. Your savings goals will likely need to shift to reflect your new reality, too.

- Becoming a Freelancer: When your income becomes unpredictable, your entire budgeting strategy has to change. Instead of a fixed monthly plan, you’ll need a system built around your baseline expenses. In a great month, you can use the extra cash to build a buffer for slower months and set aside what you’ll owe for taxes.

The trick is to see these changes not as headaches, but as opportunities to realign your budget with your new life. When you learn to adapt, your budget remains a relevant and powerful tool that serves you every step of the way.

Got Budgeting Questions? Let’s Get Them Answered.

Jumping into a budget for the first time—or the fifth time—is bound to bring up some questions. Life isn’t always a neat and tidy spreadsheet, and it’s completely normal to wonder how to handle the messy parts. Let’s dig into some of the most common sticking points I see, so you can build a budget that actually works for you.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

“What If My Income Is All Over the Place?”

This is a big one for freelancers, folks who work on commission, or anyone with a side hustle. When your paycheck isn’t predictable, how can your budget be? The trick is to build your plan around your lowest estimated monthly income.

Think of it as your financial baseline—the absolute minimum you can count on. This conservative approach guarantees your core expenses (rent, utilities, groceries) are always covered, no matter what.

Then, in the months when you have a windfall and earn more than that baseline, you have a plan for the extra cash. First, funnel it into your emergency fund until you have a solid three to six months of living expenses saved up. After that, you can aggressively tackle high-interest debt or start earmarking it for bigger savings goals. The zero-based budget method is a fantastic tool here because it forces you to consciously decide where every extra dollar goes.

“I’ve Tried Budgeting Before and Failed. How Do I Make It Stick This Time?”

If you’re nodding along to this, you’re not alone. Most budgets fail because they’re way too restrictive right out of the gate. We create these perfect, idealized plans that don’t account for, well, being human.

So, let’s try something different.

For one full month, just track your spending. Don’t change a thing. Your only job is to be an observer and see where your money is actually going. Once you have that real-world data, build your budget based on that reality, not a fantasy.

And here’s the most important part: you must build in room for fun. A “personal spending” or “guilt-free” category isn’t a weakness; it’s a critical feature of a budget that lasts. Giving yourself permission to enjoy your life is what makes the whole thing sustainable. The goal isn’t perfection overnight—it’s consistent progress. Celebrate staying on track for a week or hitting a small savings goal. Those little wins are what keep you going.

“How Long Until I Actually See Results?”

The very first result you’ll feel is clarity, and it happens almost instantly. Just the act of tracking your money and seeing where it goes lifts a huge weight. That feeling of control is a massive psychological win and the first sign you’re on the right track.

As for seeing tangible changes in your bank account, you can expect to notice a real difference within the first one to three months.

This might look like:

- Finally paying off a nagging credit card balance.

- Having a fully funded emergency cushion for the first time ever.

- Just not feeling that all-too-familiar panic as payday gets closer.

Remember, budgeting is all about building momentum. Every single month you stick with it, you’re laying another brick in a stronger financial foundation. It’s that consistency that leads to real, lasting success and gets you closer to the financial freedom you’re working for.

At Collapsed Wallet, we’re all about giving you clear, actionable advice to help you get a handle on your money. To keep your journey going, explore more of our guides and tools.

1 thought on “How to Create a Budget You Will Actually Stick To”