Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Thinking about how to increase income? You’ve come to the right place. This isn’t just another list of generic tips; it’s a guide built on real-world strategies that actually work. We’re going to cover practical methods you can start using today, whether you need to make some extra cash this month or you’re playing the long game for serious financial freedom.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Laying the Foundation for Higher Earnings

Before we jump into the “how-to,” let’s get our mindset right. Simply wanting more money isn’t a plan. The real key to boosting your income is building a solid framework for growth. That starts with taking an honest look at where you stand right now—your finances, your skills, and how much time you can actually spare.

There’s no magic bullet for making more money. It’s a whole spectrum of opportunities, from quick cash grabs to long-term wealth-building strategies. What works for someone else might not work for you, and that’s okay. Your personal situation is what determines the best path forward.

Know Your Income-Generating Assets

The most powerful tools you have at your disposal are your time, your skills, and any capital you have. The goal is to use these resources more strategically.

Let’s break it down:

- Time: How many hours a week can you realistically commit to something new without completely burning out? Be honest.

- Skills: What are you genuinely good at? This could be a professional skill like coding or a personal talent like being an amazing home organizer or a whiz at planning events.

- Capital: Do you have any money—even a small amount—that could be put to work through investing?

Answering these questions gives you the clarity you need to pick the right strategy. For example, if you have a specialized skill but zero free time, high-value consulting might be your best bet. On the flip side, if you have more time than specialized skills, the gig economy could be a great place to start.

The best income strategies are the ones that actually fit your life. Trying to launch a complex online business when you only have three hours a week is a surefire way to get frustrated and quit.

Ultimately, learning how to make more money is an active process. It means shifting your mindset from being a passive earner to actively managing your own financial potential.

Generating Quick Cash with Side Hustles

When you need to boost your income fast, a side hustle is one of the most direct ways to make it happen. This isn’t about signing up for a second 40-hour workweek. It’s about being smart and monetizing the skills, time, and resources you already have to get some quick cash flowing in.

The great thing is, the modern economy has made this easier than ever. You can forget the old idea that you need a complex business plan or a pile of startup cash. Today, you can turn a hobby like photography, a professional skill like graphic design, or even just a few free hours on a weekend into a real source of extra money.

Tapping into the Digital Marketplace

Freelance platforms have exploded into bustling online marketplaces, connecting people with skills to clients who need them. Think of these sites as a bridge—they take away a lot of the headache of finding your first paying gig.

Places like Upwork and Fiverr are fantastic starting points for almost any skill imaginable. And you don’t need to be a world-class expert to get your foot in the door. Plenty of businesses and entrepreneurs are looking for reliable help with tasks like:

- Virtual Assistance: Managing inboxes, scheduling appointments, or handling data entry for busy professionals.

- Content Creation: Writing blog posts, whipping up social media captions, or proofreading documents.

- Creative Services: Designing simple logos, touching up photos, or putting together basic video clips.

The trick to succeeding here is building a killer profile that shows off what you do best. I always tell people to start with smaller, manageable projects to rack up good reviews and build credibility. Once your reputation grows, so will your ability to charge higher rates and land better clients.

A huge mistake I see people make is undervaluing their work when they’re new. Do a little digging to see what others with your skills are charging, and price yourself competitively—not just cheaply. Your time and expertise are valuable.

Joining the Flexible Gig Economy

If you’d rather not be parked behind a computer, the gig economy is overflowing with opportunities that can fit snugly around your current schedule. These app-based jobs offer incredible flexibility, letting you work when and where you want.

Just think about the services people in your area need every day. Companies like DoorDash, Uber Eats, and Instacart let you earn money simply by delivering food or groceries. If you’re more of a hands-on person, apps like TaskRabbit connect you with folks who need help with anything from assembling furniture to mounting a TV.

This is genuinely one of the fastest ways to increase your income because the barrier to entry is so low. You can often start earning within a week. The hourly rate can vary, sure, but the power to just switch on an app and make money is a game-changer for hitting short-term financial goals. For even more ideas, check out our guide on ways to make extra money from home.

Monetizing Your Personal Passions

Beyond the big platforms and gig apps lies another powerful income stream: your own hobbies and passions. It’s amazing how many people successfully turn what they love into a side business with almost no upfront investment.

Just look at these real-world examples:

- The Organizer: Someone with a natural talent for decluttering can offer their services to busy families or people getting ready to move.

- The Pet Lover: A passion for animals can easily become a dog-walking or pet-sitting service for your neighbors.

- The Photographer: A budding photographer can offer affordable portrait sessions for families, high school seniors, or professionals needing headshots.

This route takes a bit more hustle to find clients—think local social media groups, word-of-mouth, or community boards. But the work can be so much more rewarding because you’re getting paid for something you’d probably do for free. It all starts with identifying one thing you’re good at that solves a problem for someone else.

A Practical Look at Popular Side Hustles

Deciding where to start can feel overwhelming. This table breaks down a few popular options to help you see what might be the best fit for your skills, schedule, and how much you’re hoping to make.

| Side Hustle | Potential Monthly Earnings | Time Commitment (Hours/Week) | Required Skills |

|---|---|---|---|

| Freelance Writing | $200 – $1,500+ | 5-15 | Strong writing, grammar, research, and a niche (e.g., tech, health) |

| Food/Grocery Delivery | $150 – $600 | 5-10 | Reliable transportation, smartphone, good navigation skills |

| Virtual Assistant | $300 – $1,200+ | 10-20 | Organization, communication, proficiency in office software |

| Pet Sitting/Dog Walking | $100 – $500 | Flexible | Love for animals, reliability, physical stamina for walking |

| Social Media Mgmt. | $250 – $1,000+ | 5-10 | Knowledge of social platforms, basic marketing, content creation |

Ultimately, the “best” side hustle is the one that you can stick with. Whether you’re looking for a quick $200 this month or a consistent $1,000, aligning the work with your natural strengths is the key to making it a success.

Maximizing Your Salary Through Career Growth

While side hustles are great for some quick cash, don’t overlook the biggest income-generating tool you already have: your day job. It’s the engine of your financial life, and fine-tuning it can lead to some seriously impressive long-term gains. This isn’t about just working harder. It’s about working smarter to climb the career—and more importantly, the pay—ladder.

To turn your career into a genuine wealth-building asset, you need to start thinking like a business owner where you are the product. It’s a shift from just checking off tasks to strategically making yourself so valuable that a raise or promotion is the only logical next step for your boss.

Acquiring High-Impact Skills

First things first, you need to figure out which skills employers are willing to pay a premium for. A great way to do this is to play detective. Look at job descriptions for roles one or two levels above yours, both inside your company and at competitors. What skills, certifications, or software proficiencies pop up over and over again?

Those are your targets. They are the abilities directly tied to bigger paychecks in your field.

- Data Analysis: In nearly every industry, from marketing to manufacturing, the ability to read data and find actionable insights is pure gold.

- Project Management: Certifications like PMP or fluency in Agile methodologies show you can lead initiatives and get things done on time and on budget.

- Public Speaking & Communication: Never underestimate the power of strong presentation skills. They boost your visibility and can quickly position you as a leader.

Spending time developing these high-impact skills is a direct investment in your future paychecks. You can often learn them through affordable online courses, company-sponsored training, or even by just raising your hand for a project at work that pushes you out of your comfort zone.

Building a Bulletproof Case for a Raise

Let’s be honest, asking for more money can be nerve-wracking. But it’s just a business conversation, and the key to winning it is preparation. You can’t just walk in and say you “feel like you deserve more.” You have to build a rock-solid business case that proves your value.

This work starts months before you even think about scheduling that meeting. Create what I like to call a “brag file.” This isn’t about ego; it’s about collecting data. Every time you crush a project, solve a tricky problem, or get a glowing email from a client, document it.

Your manager is busy. They aren’t keeping a detailed list of all your wins. It’s up to you to track your contributions and present them in a way that clearly connects your work to the company’s success.

Get specific and quantify everything you can. Instead of “I improved a process,” try “I streamlined the invoicing process, which cut the average processing time by 15% and saved the team about 10 hours of admin work each week.” Numbers are your best friend here—they make your contributions tangible and hard to ignore.

Mastering the Art of Salary Negotiation

Negotiation is a skill. And like any skill, you can get better at it with practice. So many people shy away from it, but avoiding this conversation can cost you dearly over your lifetime.

Think about it: according to the U.S. Bureau of Labor Statistics, workers who negotiate can see a major bump in their starting pay. That initial advantage compounds massively over a long career. For someone earning $50,000 a year, even a small negotiated raise can grow into hundreds of thousands of extra dollars by the time you retire. For more on the economic factors at play, you can see the latest Gross Domestic Product information from the Bureau of Economic Analysis.

To walk into a negotiation with confidence, you really only need three things:

- Market Research: Jump on sites like Glassdoor, Payscale, and LinkedIn Salary. Find out what the market rate is for your specific role, experience level, and city. This gives you a data-backed anchor for your request.

- Your Quantified Value: This is where your “brag file” becomes your secret weapon. You’ll present your specific, numbers-driven accomplishments as hard evidence of your top-tier performance.

- A Clear “Ask”: Know your number. Go into the meeting with a specific figure or a tight, well-researched salary range in mind. It shows you’re prepared and serious.

This approach turns what feels like an emotional plea into a logical business discussion. You’re no longer just asking for more money; you’re presenting a clear case that your performance justifies a salary that aligns with your market value. For a deeper dive into the exact scripts and tactics to use, check out our complete guide on how to negotiate a salary increase. Going in prepared is how you unlock the full earning potential sitting in your current job.

Building Wealth with Passive Income Streams

This is the long game. True financial freedom isn’t just about earning more—it’s about making your money work harder than you do. That’s the entire idea behind passive income: setting up systems that generate cash without you needing to constantly be on the clock. It’s how you break free from trading time for money.

Let’s get one thing straight, though. “Passive” does not mean “effortless.” Most of these income streams demand a serious upfront investment of time, money, or expertise. The payoff comes later, when these assets start earning for you around the clock with minimal maintenance.

Investing for Consistent Cash Flow

One of the most proven paths to passive income is through investments that pay you to own them. I’m not talking about high-risk day trading, but about owning small pieces of solid, profitable companies and getting your share of their success.

A fantastic way to get started is with dividend-paying Exchange-Traded Funds (ETFs). Think of an ETF as a basket holding stocks from hundreds—sometimes thousands—of established companies that regularly pay out dividends. When you buy a share of that ETF, you get a slice of the dividends from all those companies, usually paid out every quarter.

It works like this:

- You purchase shares in a dividend ETF, instantly diversifying your investment.

- The companies inside that fund make a profit and share it with their investors.

- The ETF collects all those payments and passes them along to you.

This approach gives you a steady, predictable cash flow and spreads your risk. The best part? You can reinvest those dividends to buy even more shares, letting your wealth snowball over time through the power of compounding.

Creating and Selling Digital Products

If you have a skill or deep knowledge in a specific area, you can package it into a digital product and sell it online forever. This takes a lot of work on the front end, but once your creation is live, the sales and delivery can be almost completely automated.

Some of the most popular options I’ve seen succeed are:

- E-books: Are you an expert on container gardening, budgeting for freelancers, or using a specific software? An e-book is a low-cost, high-margin way to monetize that knowledge.

- Online Courses: Platforms like Teachable or Udemy make it easy to build and sell video courses on pretty much anything you can imagine.

- Templates or Presets: Designers can sell website templates, photographers can sell photo-editing presets, and Excel pros can sell pre-built spreadsheet formulas. You’re selling a solution that saves people time.

The real advantage here is scalability. You build it once, and you can sell it a million times. Your expertise becomes a tangible asset that generates income while you sleep.

Building a Niche Digital Asset

Another powerful long-term strategy is to build a digital property that grows in value, like a niche blog or a YouTube channel. This route absolutely requires patience and consistency, but a single platform can eventually spin off multiple passive income streams.

You start by picking a topic you genuinely care about and creating content that helps or entertains a specific audience. As your following grows, so do your monetization options:

- Affiliate Marketing: Recommend products you actually use and love. When a reader or viewer buys through your unique link, you earn a commission.

- Display Advertising: Once you hit certain traffic milestones, you can place ads on your site or channel and get paid based on views and clicks.

- Sponsorships: Brands in your niche may eventually pay you to feature their products in your content.

The key to success is patience. It can take a year or more of consistent effort to see significant returns, but you are building a valuable asset that can generate income for years to come. For long-term financial independence, exploring various passive income streams can allow your money to work for you.

History shows just how reliable long-term, passive investing can be. Since 1926, the S&P 500 has delivered average annual returns of 10.2%, far outpacing global economic growth. Someone who started investing just $200 a month at age 25 could potentially have $1.2 million by age 65, all thanks to compounding. With the world GDP hitting $117.2 trillion USD in 2025, that continued growth fuels market performance, making low-cost ETFs a smart choice for anyone looking to build wealth over time. You can learn more about the growth trends of the global gross domestic product on Statista.

Turning Your Expertise into a Business

If you’ve been freelancing or honing a skill for a while, you might be ready for the big leap: turning it into a real business. This isn’t just about being your own boss. It’s about building something that can grow beyond you—a scalable system, an actual asset, not just a job you created for yourself.

The first, and most important, change is in your mindset. You have to stop thinking like a freelancer who trades time for money. Instead, start thinking like an entrepreneur who builds value and creates processes that work even when you’re not there. It all starts with pinpointing a specific market that needs what you offer and sketching out a simple plan to get started.

Finding Your Profitable Niche

Before you even think about business cards or a website, you have to be sure your idea has legs. The most successful small businesses don’t try to be everything to everyone. They solve a specific problem for a specific group of people.

Think about it. “Marketing consulting” is a tough sell because it’s so vague. But “Social media marketing for local coffee shops”? Now you’re talking. You’ve got a clear audience with clear needs.

To find your own sweet spot, ask yourself a few direct questions:

- What problem am I actually solving? Be brutally honest about the pain point you eliminate for clients.

- Who, specifically, has this problem? Picture your ideal customer. What do they do? Where do they hang out?

- Will they pay to make this problem go away? This is the million-dollar question. You can find out by doing some quick market research, talking to potential customers, or even running a small, low-cost pilot of your service.

Doing this homework upfront can save you from pouring time and money into a business that nobody wants. It’s the groundwork that everything else is built on.

Creating a Lean Business Plan

Forget those dusty, 50-page business plans nobody ever reads. All you need to start is a lean plan—a one or two-page document that covers the essentials. Think of it as a living roadmap that you’ll update as you learn.

Your lean plan should nail down the basics:

- Your Service: A simple, clear description of what you’re selling.

- Your Target Market: Who you’re selling it to.

- Your Unique Edge: What makes you different or better than the competition.

- Pricing: How you’ll charge for the value you provide.

- Marketing & Sales: How you’ll find and win over customers.

- Key Numbers: A rough estimate of startup costs, monthly expenses, and what you aim to earn.

This keeps you focused on what really moves the needle. To get a handle on the financial side of things, our guide on cash flow management for small business provides some absolutely critical insights for staying afloat.

Pricing for Value and Marketing on a Budget

Figuring out what to charge can be paralyzing for new business owners. The biggest mistake is pricing based on what you think you’re worth. Instead, price your services based on the value and results you deliver for your clients. If your work saves them thousands of pounds or helps them land a massive new contract, your price should reflect a small piece of that huge win.

Once your pricing is set, you need to spread the word. Luckily, you don’t need a huge marketing budget to get clients anymore.

Building a business is a marathon, not a sprint. Start with a solid foundation by identifying a real need, create a simple plan, and focus on delivering immense value. Your income potential will grow as your reputation and systems do.

Digital tools have made it incredibly cheap and effective to build a client list from scratch. For instance, a consultant can get by with a simple Customer Relationship Management (CRM) tool to keep track of leads and conversations. You can even use social media schedulers to keep a steady stream of content going out, attracting new prospects while you focus on doing great work for your current clients.

And if you’re looking to share your expertise through new channels, it’s worth exploring how Can Podcasts Make Money. By combining a validated service with smart, low-cost marketing, you can methodically build a profitable business from the ground up.

Creating Your Personal Income Growth Plan

All the strategies in the world won’t make a difference until you turn them into a personal, actionable plan. This is where we bridge the gap between knowing what to do and actually doing it. Think of it as creating a custom roadmap that fits your life, your skills, and where you want to go financially.

The first move is a quick, honest self-assessment. Let’s figure out which path makes the most sense for you right now.

- Looking for Quick Wins? If you need cash to cover a surprise expense or just want to build up your emergency fund fast, a short-term hustle or a flexible side gig is probably your best bet.

- Ready to Climb the Ladder? Do you like your job and see a clear path upward? Then focusing your energy on career advancement—like a promotion or a well-timed salary negotiation—could deliver the most significant, lasting impact.

- Want to Be Your Own Boss? Got a skill people will pay for and a desire to call the shots? Starting a freelance service or a small business is your long-term play for unlimited earning potential.

There’s no single “right” answer here. The best strategy is always the one that you can realistically stick with, given your current time, energy, and resources.

Setting a Clear and Measurable Target

Once you’ve picked a general direction, it’s time to get specific. A goal like “make more money” sounds nice, but it’s too vague to be useful. It’s like trying to navigate without a destination. We need to create a clear, measurable target with a deadline.

A well-defined goal becomes your north star. It turns a fuzzy wish into a concrete objective you can chip away at every single day, keeping you focused and motivated when things get tough.

So, instead of a vague wish, try reframing it into something concrete:

- “My goal is to earn an extra $500 per month within the next three months by taking on two new freelance writing projects.”

- “I will negotiate a salary increase of at least 7% during my annual review in six months.”

- “I’m going to land my first paying client for my web design business within 60 days.”

See the difference? This framework gives you clarity, a sense of urgency, and a clear finish line to race toward.

Mapping Your First Three Steps

With a sharp target in your sights, the last piece is breaking it down into a few immediate actions. Don’t get overwhelmed trying to plan the next twelve months. Just ask yourself: what can I do this week to get started?

Maybe your first three steps are updating your LinkedIn profile, emailing five old colleagues, and blocking off two hours on Saturday to work on your portfolio. Simple. Actionable.

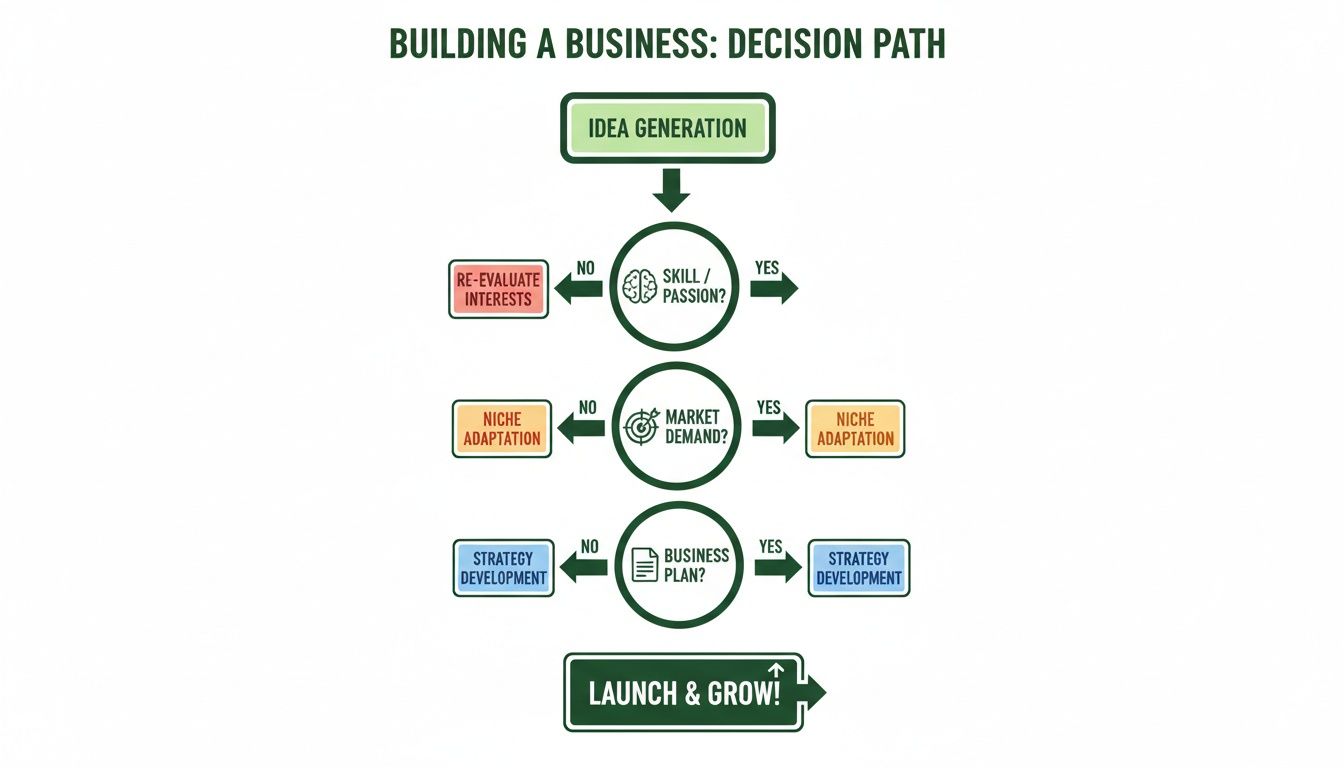

The flowchart below shows this kind of thinking applied to starting a business—from identifying your core skill to planning how you’ll enter the market.

This illustrates a key point: a successful venture always starts with a solid skill, finds a market that needs it, and follows a clear plan. Your own journey to a higher income is built on the same foundation of small, consistent, and intentional actions. It starts with that very first step.

Your Top Questions About Increasing Income, Answered

Thinking about how to bring in more money always sparks a lot of questions. Let’s tackle some of the most common ones I hear, with practical answers to help you get started.

How Can I Start Making More Money if I Have Nothing to Invest?

This is a common roadblock, but it’s easier to get around than you think. The key is to forget about money and focus on what you do have: your skills and your time.

Platforms like Upwork or Fiverr are completely free to join. If you can write, handle basic admin tasks as a virtual assistant, or manage social media, you can start bidding on jobs today. There’s no upfront cost, just the time it takes to build a solid profile.

The gig economy is another fantastic, zero-investment option. Think about apps for food delivery or local handyman tasks. All you need is a smartphone and some free time; you’re essentially turning your effort directly into cash without needing any startup capital.

What’s the Absolute Fastest Way to Boost My Income?

For pure speed, you can’t beat active side hustles that pay out quickly. We’re talking about things that can put money in your pocket this week, not next year.

- Sell stuff you don’t need. Go through your closet, garage, or storage. Listing items on Facebook Marketplace or eBay can bring in cash within days.

- Pick up a short-term gig. Look for one-off freelance projects or sign up for a rideshare or delivery service. The earnings are almost immediate.

These are your best bets for a quick financial injection. Just remember they’re a short-term fix, not a long-term wealth strategy.

A quick win from a side gig can give you some much-needed breathing room. But don’t lose sight of the bigger picture. A meaningful salary increase or a new passive income stream is what truly builds wealth over time.

Should I Focus on Getting a Raise or Starting a Side Hustle?

This isn’t an either/or situation—the real answer is, why not both? They serve two very different, but equally important, purposes.

A side hustle is about diversification and flexibility. It gives you an income stream that you control, separate from your employer. This reduces your financial risk and can provide a quick cash buffer when you need it.

Asking for a raise, however, is about boosting your core income. This is a powerful move because it has a compounding effect on your entire financial life. A higher base salary means more for retirement contributions, bigger future raises, and stronger financial stability. Your best bet is to start with whichever feels more within your reach right now, and then tackle the other one next.

Here at Collapsed Wallet, our goal is to give you the straightforward, no-fluff advice you need to own your financial future. For more practical strategies on building wealth, explore everything we have to offer at https://collapsedwallet.com.