Table of Contents

- Your First Steps Into the World of Investing

- Start Early and Let <a href="https://www.royallondon.com/guides-tools/money-guides/everyday-money/understanding-compound-growth/">Compound Growth</a> Do the Heavy Lifting

- Choosing Your Investment Tools: Index Funds and ETFs

- Crafting a Diversified Portfolio to Keep Risk in Check

- Bringing Your Plan to Life and Sticking With It

- Answering Your Top Investing Questions

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Investing can feel like a huge, complicated world, but getting started is actually much simpler than you think. It really comes down to a few key things: figuring out what you’re investing for, making sure you have a solid financial cushion, and then picking straightforward, low-cost options like index funds. This is your guide to invest money for beginners!

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your First Steps Into the World of Investing

Jumping into investing is one of the most powerful things you can do for your future financial self. It might seem intimidating, but you don’t need to be a Wall Street wizard to make it work. The real secret is getting your own financial house in order before you put a single penny into the market.

This initial prep work has nothing to do with picking hot stocks or trying to time the market. It’s all about you, your goals, your savings, and your debts. Getting this groundwork right gives you the stability to ride out the market’s inevitable ups and downs without panicking.

Figure Out Your Goals and Timeline

Investing without a goal is like setting off on a road trip with no destination in mind. You’re moving, sure, but are you getting anywhere you actually want to be? Your goals are what give your investments purpose and shape every decision you make.

So, start there. What are you trying to accomplish? Are you saving up for a down payment on a house in five years? Or are you playing the long game and building a nest egg for a comfortable retirement in 30 years?

The timeline completely changes the game plan:

- Short-Term Goals (1-5 years): For goals this close, you’ll want to be more conservative. You just don’t have enough time to bounce back from a sudden market dip.

- Mid-Term Goals (5-10 years): With a bit more time on your side, you can start to take on a little more risk in the hopes of getting better returns.

- Long-Term Goals (10+ years): This is where you can really let compounding do its magic. With decades ahead, you can afford to aim for higher growth, knowing you have plenty of time to recover from any downturns.

A goal without a timeline is just a wish. Put a date on it. Saying you want to save £20,000 for a house deposit by 2030, or have £500,000 for retirement by 2055, makes it real. It turns a vague idea into a concrete target you can work toward.

Build Your Financial Safety Net First

Before you even think about investing, you absolutely must have your financial foundations sorted. This means two things: a fully-funded emergency fund and a clear plan to tackle any high-interest debt. This is non-negotiable.

Investing and saving are two very different beasts; investing always comes with risk. You can read more about the difference between saving and investing to see why this safety net is so important.

Think of your emergency fund as a financial force field. You need 3-6 months’ worth of essential living expenses tucked away in an easy-to-access savings account. This is the money that saves you from having to sell your investments at the worst possible time when life throws you a curveball, like a sudden job loss or a major car repair.

At the same time, high-interest debt will sabotage your progress. If you’re paying 20% or more on a credit card, that debt is costing you far more than you could reliably make in the market. The historical average stock market return is around 10% per year. Paying off that credit card is like getting a guaranteed 20% return on your money. You can’t beat that.

Before you start, it’s a good idea to run through a quick checklist to make sure you’re truly ready.

Investment Readiness Checklist

Here’s a quick summary of the essential financial pillars to have in place before you begin investing. Ticking these boxes ensures you’re building your investment portfolio on a strong, stable foundation.

| Financial Pillar | Why It Is Important | Recommended Action |

|---|---|---|

| Emergency Fund | Protects you from selling investments during a downturn to cover unexpected costs. | Save 3-6 months of essential living expenses in a high-yield savings account. |

| High-Interest Debt | Debt with high interest rates (like credit cards) can cost you more than you’ll earn from investing. | Create and follow a plan to aggressively pay down any debt with an interest rate above 7-8%. |

| Clear Financial Goals | Your goals determine your investment strategy, timeline, and how much risk you should take. | Define what you are investing for (e.g., retirement, house deposit) and set a specific target date. |

| Basic Budget | You need to know where your money is going to find the cash to invest consistently. | Track your income and expenses to identify how much you can comfortably set aside each month. |

Getting these pieces in place first isn’t the most exciting part of investing, but it’s what separates successful long-term investors from those who get derailed by life’s unexpected events.

Start Early and Let Compound Growth Do the Heavy Lifting

If there’s one secret weapon every new investor has, it’s not a huge pile of cash or some complex trading strategy. It’s time. The sooner you put your money to work, the more you unleash the power of compound growth—something so powerful it’s often called the eighth wonder of the world.

Compounding is simple, really. Your money earns a return. Then, that return starts earning its own return. It’s a slow-building snowball that, over many years, can turn into an unstoppable avalanche of wealth.

How a 10-Year Head Start Changes Everything

Let’s put this into perspective. A single decade can completely change your financial future. The data is clear: starting to invest in your 20s instead of waiting until your 30s can mean having 25% to 40% more money when you retire.

Think about this scenario:

- An investor starts at age 25, puts in £5,000 every year for just 10 years, and then stops completely. Assuming a 7% average annual return, their pot could grow to roughly £1.1 million by age 65.

- Another person waits until 35. They invest the same £5,000 every single year for the next 30 years. Despite investing three times as much money, they’d end up with only around £500,000.

That’s a staggering difference, and it hammers home a core principle of smart investing: ‘time in the market’ will always beat trying to ‘time the market.’ Don’t get stuck waiting for the “perfect” moment to jump in. It doesn’t exist. The best time to start was yesterday, but today is a very close second.

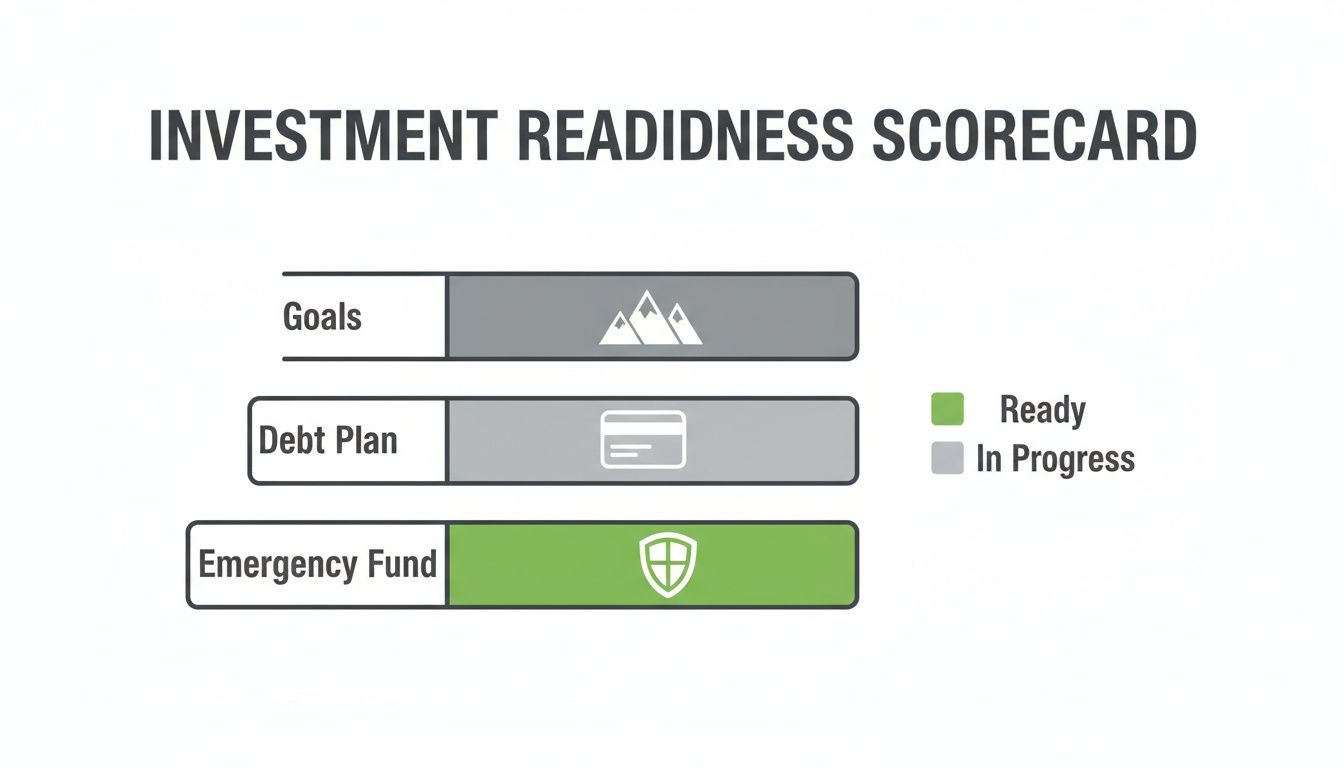

Are You Ready to Invest? A Quick Scorecard

Before you dive in, it’s smart to make sure your financial house is in order. You want to invest from a position of strength, not desperation. This simple scorecard is a great way to check if you have the right foundations in place.

Think of it as a pre-flight check. A solid emergency fund gives you a safety net, a debt plan keeps high-interest payments from eating into your returns, and clear goals give your money a purpose.

Small, Consistent Steps Win the Race

One of the biggest myths that stops people from starting is the idea that you need a lot of money. You don’t. Consistency is far more important than the initial amount. Whether you can spare £50 a month or more, the most crucial part is simply getting started.

Those small, regular contributions add up faster than you’d think. Thanks to compounding, even modest amounts start to work for you, pulling their own weight and making your goals feel much more achievable. If you happen to receive a larger amount of cash, our guide on how to invest a lump sum for maximum growth can help you plan your next move.

The Takeaway: Don’t overthink it. The most impactful thing you can do on your investment journey is to take the first step. Your future self will thank you for the decision you make today, no matter how small that first investment feels. Just start, and let time and compounding work their magic.

Choosing Your Investment Tools: Index Funds and ETFs

When you’re just getting started, the world of investing can feel like a tidal wave of jargon and complex options. The good news? You don’t need to be an expert on every single stock or bond to build wealth.

For most beginners, the smartest move is to focus on two of the most powerful and straightforward tools out there: index funds and Exchange-Traded Funds (ETFs). They’re popular for a reason—they offer instant diversification at a very low cost, which is the perfect recipe for long-term success.

The Power of Owning the Whole Market

So, what’s an index fund? At its core, it’s a simple but brilliant idea. Instead of trying to pick individual winning stocks (a nearly impossible task), you buy a fund that holds all the stocks in a major market index, like the S&P 500.

This means with one purchase, you own a tiny slice of the 500 largest companies in the U.S. The fund isn’t trying to outsmart the market; it’s designed to be the market. This “passive” approach is what keeps the fees incredibly low and makes it a favorite of legendary investors.

ETFs: The Modern, Flexible Alternative

Exchange-Traded Funds, or ETFs, are built on the same foundation. In fact, many ETFs are index funds that track the very same market indexes. The main difference is how you buy and sell them.

ETFs trade on a stock exchange all day long, just like a share of Apple or Microsoft. Their price ticks up and down throughout the day, and you can place an order anytime the market is open. This flexibility has made them incredibly popular, especially with investors who use modern, app-based brokerage platforms.

Key Differences at a Glance

Both are fantastic choices for building a simple, diversified portfolio. But a few key differences might make one a better fit for your style.

| Feature | Index Fund (Mutual Fund) | Exchange-Traded Fund (ETF) |

|---|---|---|

| Trading | Priced just once per day after the market closes. | Trades like a stock, with prices changing all day. |

| Minimum Investment | Often has a minimum initial investment, sometimes hundreds of pounds. | Can be bought one share at a time, making it easy to start with small amounts. |

| Commissions | Many are commission-free if bought directly from the fund company. | Often trade commission-free on major brokerage platforms. |

| Tax Efficiency | Can occasionally create capital gains tax bills for investors. | Generally more tax-efficient due to their unique structure. |

Why Low Costs Are Your Best Friend

If there’s one thing to obsess over as a beginner, it’s cost. Both index funds and ETFs are famous for their low expense ratios—the small annual fee you pay to the fund manager.

Even a tiny difference in fees can compound into a huge sum over decades. Think about it: a 1% higher fee on a £100,000 portfolio could cost you around £40,000 in lost returns over 20 years. That’s a serious chunk of change.

The move toward low-cost investing is a massive global trend. It’s no surprise that global ETF flows shot past US$0.9 trillion by mid-2025, a 25% jump from the year before. Investors are voting with their wallets.

When you’re just starting, the single best thing you can do is control what you can control. You can’t control the market’s performance, but you can control your costs. Choosing a fund with a 0.05% expense ratio over one with a 0.50% fee is a guaranteed way to boost your long-term returns.

Crafting a Diversified Portfolio to Keep Risk in Check

You’ve probably heard the old saying, “don’t put all your eggs in one basket.” When it comes to investing, that’s not just folksy wisdom—it’s the bedrock principle for managing risk and building a portfolio that can weather any storm. The fancy term for it is diversification.

At its core, diversification is just about spreading your money across different kinds of investments. The goal is simple: to make sure the poor performance of any single investment doesn’t sink your whole ship. Markets are unpredictable, after all. One year, stocks might be on a tear while bonds are snoozing. The next, the tables could turn completely.

By owning a mix of assets, you build a natural buffer. When one part of your portfolio zigs, another might zag, which helps smooth out the ride and shield you from devastating losses. It’s the foundation of smart investing, whether you’re just starting out or have been at it for decades.

Getting a Grip on Asset Allocation

The way we put diversification into practice is through asset allocation. This is just the process of deciding what percentage of your money goes into different investment buckets, or “asset classes.” For most beginners, the main decision revolves around two key players: stocks and bonds.

- Stocks (Equities): Think of these as tiny slices of ownership in a company. They have the highest potential for growth over the long haul, but they also bring more volatility and risk to the table.

- Bonds (Fixed Income): These are basically IOUs. You’re lending money to a government or a corporation in exchange for interest payments. Bonds are generally much safer than stocks, offering stable returns but with less potential for explosive growth.

Make no mistake: your asset allocation will have a bigger impact on your portfolio’s performance than any attempt to pick the “next big thing.” It’s the most important decision you’ll make.

Finding Your Perfect Mix

So, what’s the right recipe for you? Your ideal mix boils down to your personal risk tolerance and your investment timeline.

Someone in their 20s with a 40-year horizon until retirement can afford to be aggressive. Their portfolio might be heavily tilted towards stocks—say, 90% stocks and 10% bonds—because they have plenty of time to ride out any market slumps.

On the flip side, someone just five years from retirement needs to focus on protecting what they’ve built. Their mix would look much more conservative, maybe 40% stocks and 60% bonds, to dial down the volatility.

A time-tested starting point for many is the classic 60/40 portfolio (60% stocks, 40% bonds). This blend has historically provided an excellent balance of growth and stability. In fact, research shows a 60/40 mix can slash volatility by about a third compared to an all-stock portfolio, while still capturing much of the upside.

Key Takeaway: Asset allocation isn’t about avoiding risk altogether—that’s impossible. It’s about managing it intelligently so you can stay the course, through good times and bad, and actually reach your goals.

A Simple, Powerful ETF Portfolio

Here’s the best part: building a globally diversified portfolio today is ridiculously easy. You don’t need a PhD in finance or a dozen different mutual funds. Thanks to low-cost Exchange-Traded Funds (ETFs), you can get the job done with just a handful of investments.

Here’s a blueprint for a simple, effective three-fund portfolio:

- A Total U.S. Stock Market ETF: Instantly own a piece of thousands of American companies, from the biggest names down to the small-caps.

- An International Stock Market ETF: This adds companies from both developed and emerging markets around the world, so your success isn’t tied to just one country’s economy.

- A Total Bond Market ETF: This is your stability anchor, giving you broad exposure to a wide range of government and high-quality corporate bonds.

With just these three funds, you can dial in any asset allocation you want. For that 60/40 split, you could put 30% into the U.S. stock ETF, 30% into the international stock ETF, and the final 40% into the bond ETF. It’s a beautifully simple, effective, and low-cost way to get started.

Bringing Your Plan to Life and Sticking With It

Having a plan on paper is one thing, but actually putting your money to work is where the magic happens. This is the moment your strategy stops being an idea and starts becoming a real, tangible asset. It’s time to open that account and make your first investment.

Let’s walk through the practical side of things. First, we’ll figure out the best type of account to hold your investments in, and then we’ll look at what makes a good brokerage platform for someone just starting out.

Choosing the Right Investment Account

The type of account you use is almost as important as the investments you pick. Why? In a word: taxes. The right account can shield your hard-earned money from the taxman, which makes a huge difference to your final returns over the long haul.

For anyone getting started in the UK, it usually comes down to two main choices: a Stocks and Shares ISA or a General Investment Account (GIA).

- Stocks and Shares ISA: Frankly, this is the best place for most UK investors to start. You can put in up to £20,000 each tax year, and every penny of profit—whether from growth or dividends—is completely tax-free. This is a powerful, government-backed perk you absolutely want to take advantage of.

- General Investment Account (GIA): Think of this as a standard, no-frills account. There are no limits on how much you can invest, which is great. The catch is that you might have to pay Capital Gains Tax on your profits or Dividend Tax on your income if you go over the annual tax-free allowances.

The game plan for most people should be simple: fill up your ISA allowance first. The benefit of tax-free growth is just too good to ignore.

Finding a Brokerage Platform That Works for You

Your brokerage platform is your gateway to the stock market. With so many options out there, from slick new apps to old-school brokers, it’s easy to feel a bit overwhelmed. But if you know what to look for, the choice becomes much clearer.

Here’s what really matters when you’re comparing platforms:

- Low Fees: Costs are a direct drag on your returns. Keep an eye out for platforms with low (or zero) trading commissions, reasonable account fees, and fair currency conversion charges if you plan on buying international stocks.

- Ease of Use: As a beginner, you want an interface that’s clean and intuitive. The last thing you need is a complicated platform that makes it difficult to find what you’re looking for or place a simple trade.

- Investment Selection: Make sure the platform has the low-cost index funds and ETFs you’ll be using to build your portfolio. The good news is that most of the big players offer a massive selection.

- Helpful Resources: Some platforms offer fantastic educational articles, videos, and tools. While not essential, they can be a big help as you build your confidence.

Don’t get stuck on finding the “perfect” platform. Most reputable brokers will do a great job for a beginner. The key is to pick one with low fees that feels right to you and just get started. You can always transfer your investments elsewhere down the line if you change your mind.

The Power of Automation: Pay Yourself First

If there’s one secret to building wealth over the long term, it’s consistency. The easiest way to be consistent? Automate it. Set it and forget it.

Set up a monthly direct debit or standing order to move money from your bank account to your investment account. Have it go out the day after you get paid. This is the classic “pay yourself first” strategy in action—you’re making your future self a priority before that money can get spent on something else.

This method, often called dollar-cost averaging, has another brilliant side effect: it takes emotion out of the equation. By investing the same amount regularly, you automatically buy more when prices are low and less when they’re high. It forces the discipline needed to stay in the market, which is absolutely critical for long-term success.

Answering Your Top Investing Questions

Diving into the world of investing can feel a bit like learning a new language. You’re bound to have questions, and getting good answers is what builds the confidence to stick with it. Let’s walk through some of the most common things new investors ask.

How Much Money Do I Actually Need to Get Started?

This is probably the biggest question that holds people back, but the answer is refreshingly simple: you can start with very little money. The old idea that you need a huge chunk of cash to be an investor is completely outdated.

Thanks to modern brokerage platforms and fractional shares, you can often get going with as little as £1. This isn’t a gimmick; it’s a fundamental shift that opens the doors for everyone. Whether you can set aside £25, £50, or £100 a month, the important part isn’t the initial amount—it’s building the habit of investing consistently.

Should I Clear All My Debt Before I Even Think About Investing?

This is a smart question, and the answer isn’t a simple yes or no. It really boils down to the kind of debt you’re carrying. The best way to think about it is to split your debts by their interest rate.

- High-Interest Debt (Credit Cards, Payday Loans): Focus on paying these down aggressively before you invest. Seriously. If your credit card is charging you 20% interest, wiping out that balance is like getting a guaranteed 20% return. No investment can promise that. We’ve got a full playbook on this in our guide on how to pay off debt fast.

- Low-Interest Debt (Mortgages, Student Loans): With debts that have a lower interest rate—think under 5-6%—the math often supports investing while you make your regular payments. Why? Because the stock market’s long-term average return has historically outpaced the interest you’re paying on those loans, meaning your money can work harder for you in the market.

What If the Stock Market Crashes Right After I Start?

Sooner or later, the market will take a nosedive. It’s a normal, unavoidable part of the economic cycle. It can feel terrifying, especially when you’re just starting out, but it’s not a signal to run for the hills. If you’re investing for the long haul, a market crash is actually an opportunity in disguise.

Think of it like this: when the market drops, all the quality investments you believe in are suddenly on sale. Your regular, automated contributions are now buying more shares for the same amount of money.

The single most destructive thing you can do during a downturn is panic and sell your investments. History shows us, time and again, that markets recover. By staying the course, you position yourself to benefit from the eventual rebound, which is where a huge chunk of long-term wealth is built.

Isn’t Investing Just a Fancy Form of Gambling?

Not at all. I get why people make the comparison—both involve risk and you don’t know the outcome for sure—but they are fundamentally different things.

Gambling is a zero-sum game rooted in pure chance. For you to win, someone else has to lose. The house always has a mathematical edge that works against you over time.

Investing, on the other hand, is about becoming an owner. When you buy a stock or an index fund, you’re buying a small piece of real businesses that create products, generate profits, and contribute to the economy. It’s a positive-sum game. As these companies grow and create value, the value of your ownership grows with them.

How Often Should I Be Checking My Investments?

Here’s one of the best pieces of advice I can give a new investor: check your portfolio as little as you can stand to. Constantly watching the daily market swings is a perfect recipe for stress and making emotionally-driven mistakes.

You’re a long-term investor, not a day trader. Your strategy is designed to work over years and decades, not minutes and hours.

A more practical rhythm looks like this:

- Monthly: A quick peek to make sure your automatic deposits went through is perfectly fine.

- Annually: Once a year, set aside some time for a proper portfolio review. Check if your asset mix has strayed from your target and rebalance it if needed. This keeps you on track without getting sidetracked by short-term noise.

By tuning out the daily chatter and focusing on the long game, you give yourself the power to make smart, rational decisions that will actually move you toward your financial goals.

At Collapsed Wallet, our mission is to provide you with the clear, practical guidance needed to navigate your financial journey with confidence. We turn complex topics into simple, actionable steps. To continue building your financial knowledge, explore more of our resources at https://collapsedwallet.com.