Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let’s be honest, utility bills can feel like a runaway train. But what if I told you the fastest way to slam on the brakes doesn’t cost a single cent? It’s true. The biggest initial wins come from a few smart, intentional tweaks to your daily routine. This is your guide to help you lower utility bills!

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your No-Cost Action Plan to Lower Bills Immediately

Real financial progress often starts with plugging the small, persistent leaks in your budget. High utility bills are a classic example. It’s easy to think of them as fixed costs, but you have more control than you realize, and it all starts with changing a few habits—no new gadgets required.

Think of this as building momentum. When you see your bill drop by $15 or $20 from these free adjustments, it’s a powerful motivator. It proves you can directly influence your monthly expenses, which is a huge step toward escaping financial worries and achieving financial freedom.

Master Your Thermostat for Maximum Savings

Your HVAC system is almost certainly the biggest energy hog in your home. The good news? It’s also one of the easiest places to find savings.

You can slash your energy use by as much as 10% a year just by turning your thermostat back 7°-10°F for eight hours a day. Seriously. Set it lower when you leave for work and have it kick back on 30 minutes before you get home. Do the same when you go to sleep. In the summer, the same principle works in reverse for your AC.

Unplug the Phantom Load

Did you know many of your electronics are still sipping electricity even when they’re “off”? It’s called phantom load (or standby power), and it can account for a shocking 5-10% of your total electricity bill. The main culprits are things like your TV, coffee maker, game consoles, and phone chargers.

Pro Tip: If a device has a remote control, a little clock display, or a chunky power adapter brick, it’s likely an energy vampire. Unplugging these things is a direct path to a lower electric bill.

An easy hack is to plug your entire entertainment center—TV, soundbar, gaming system—into a single power strip. Then, you can kill the power to everything with one flick of a switch before bed. Getting a handle on these details is just as crucial as knowing how to track your expenses when you’re building a clear financial picture.

Adopt Smarter Water Habits

Saving water is a double win because it lowers both your water bill and your energy bill (less hot water means less energy used). You can make a real dent here with a few simple habit changes.

A few no-brainers to start with:

- Run Full Loads Only: Your dishwasher and washing machine use nearly the same amount of water and power whether they’re half-full or packed. Always wait for a full load.

- Wash Clothes in Cold Water: Roughly 90% of the energy your washer uses goes to heating the water. Modern detergents work great in cold water, so make the switch and watch the savings pile up.

- Take Shorter Showers: Trimming just two minutes from your daily shower can save hundreds of gallons of hot water over a year.

To help you get started right away, here’s a quick checklist of the easiest wins you can tackle today without spending a dime.

Immediate No-Cost Utility Savings Checklist

This table summarizes the simple, free actions you can take right now to start lowering your utility bills. Pick a few to focus on this week and see what a difference they make.

| Action Item | Utility Impacted (Electricity/Gas/Water) | Estimated Monthly Savings |

|---|---|---|

| Lower thermostat 7°-10°F for 8 hours/day | Electricity / Gas | $5 – $15 |

| Unplug electronics & chargers when not in use | Electricity | $4 – $8 |

| Run only full loads of laundry & dishes | Electricity / Water | $3 – $7 |

| Wash laundry in cold water | Electricity / Gas | $4 – $10 |

| Shorten showers by 2-3 minutes | Water / Gas | $5 – $12 |

| Turn off lights when leaving a room | Electricity | $2 – $5 |

Implementing even a few of these behavioral tweaks doesn’t just trim your bills—it builds a powerful mindset of efficiency and resourcefulness. This proactive approach is exactly what you need to move from worrying about money to building real financial stability.

Working with Your Energy Company to Find Savings

Beyond turning off lights and taking shorter showers, one of the biggest moves you can make is to work with your utility company. So many people just see their energy bill as a fixed cost they have to pay, but that’s rarely the full story.

Think of it this way: being on the wrong rate plan is like overpaying for a cell phone plan with data you never use. Your provider often has options, and finding the right one can unlock serious savings.

Your first step is to play detective. Grab your last couple of bills or log into your provider’s online portal. You’re hunting for a chart or graph that shows your energy usage patterns, specifically when you use the most electricity. This is your key to everything.

Peak vs. Off-Peak: Timing Is Everything

That usage data is your secret weapon because most utility companies now offer Time-of-Use (TOU) plans. With a TOU plan, the price of electricity isn’t static; it changes depending on the time of day.

- Peak Hours: This is prime time for energy use, usually from late afternoon into the evening (say, 4 PM to 9 PM). Everyone’s home and using electricity, so demand on the grid is highest. Electricity costs the most during this window.

- Off-Peak Hours: These are the quiet hours, typically late at night and into the early morning (like 10 PM to 6 AM). Demand is low, so power is at its cheapest.

- Shoulder Hours: These are the periods in between peak and off-peak, with a middle-of-the-road price.

If you look at your usage and see that you’re already a night owl, or if you have the flexibility to change when you run major appliances, a TOU plan could be a fantastic fit. For anyone with an electric vehicle, it’s often a no-brainer—charging overnight can slash your “fuel” costs.

Making a Time-of-Use Plan Work for You

Switching to a TOU plan means getting a little more strategic with your daily habits. The entire game is to shift as much of your power consumption as you can into those cheap, off-peak hours.

Look at your biggest energy hogs:

- Dishwasher: Easy. Just set it to run while you’re sleeping.

- Washer & Dryer: Try to do laundry on weekend mornings or later in the evening instead of right after work.

- EV Charger: Always program it to run in the middle of the night.

You aren’t using less energy, but you’re paying a lot less for the energy you do use. It’s about being smarter, not making sacrifices. This kind of behavioral shift is incredibly powerful; global energy consumption recently rose by 2%—faster than the 2010-2019 average—but data also shows that conscious changes at home can make a real dent. You can find more insights about global energy trends and see how small actions add up.

Get on the Phone and Ask for a Rate Review

Don’t sit around waiting for your provider to offer you a better deal. You have to be proactive. Pick up the phone, call customer service, and specifically ask for a “rate review” or an “account analysis.”

Tell them, “I’m looking for ways to lower my utility bill and want to make sure I’m on the most cost-effective plan for my family’s habits.” They have all your usage data and can often run a quick analysis to show what you would have paid on a different plan over the last year.

While you have them on the line, ask what other programs they offer. Many utilities have something called budget billing, which averages your estimated annual cost into twelve equal payments. It doesn’t lower your total bill, but it smooths out those shocking spikes in winter or summer, making your monthly budget way more predictable. That kind of stability is a huge win for managing your finances.

Finding the Hidden Energy Drains in Your Home

Before you can slash your utility bills, you have to play detective. The first move isn’t buying new stuff; it’s understanding where your money is actually going right now. Every home has its own unique energy vampires—hidden drafts, silent water leaks, and power-hungry appliances that quietly bleed your budget dry.

Think of it as moving from guesswork to a concrete action plan. A quick home energy audit lets you pinpoint the biggest offenders so you can focus your efforts where they’ll have the most impact. It’s not as complicated as it sounds. Mostly, it just takes a bit of time and a critical eye.

Uncovering Air Leaks and Drafts

Let’s start with the most common culprit behind a surprisingly high heating or cooling bill: air leakage. These are the tiny, invisible gaps where the air you just paid to heat or cool escapes, forcing your HVAC system to constantly work overtime.

An easy way to find them is to wait for a windy day. Walk around the inside of your house and hold a hand up to the edges of your windows and exterior doors. Feel a breeze? You’ve found a leak. For a more scientific approach, you can use a lit incense stick. If the smoke stream wavers or gets pulled sideways near a window frame or outlet, you’ve got a draft.

Be sure to check these common hideouts:

- Window and Door Frames: This is ground zero. Check the seals and caulk around the entire perimeter.

- Electrical Outlets & Switches: Especially on exterior walls, these are often-overlooked sources of major drafts.

- Recessed Lighting: Older “can” lights are notorious for letting conditioned air pour straight into the attic.

- The Attic Hatch: If your attic hatch isn’t sealed, it’s basically an open window to an unconditioned space.

Sealing these spots with caulk, weatherstripping, or foam gaskets is one of the cheapest and most effective fixes you can make. The payoff is immediate.

Air leaks can account for 10% to 20% of your home’s heating and cooling costs. Finding and sealing these drafts is like plugging a hole in your wallet.

Assessing Your Insulation Situation

Think of insulation as your home’s winter coat and summer sun hat. Without enough of it, you’re just paying to heat and cool the neighborhood.

The attic is the most important place to start. Pop your head up there and take a look. Can you see the tops of the wooden floor joists? If so, you almost certainly need more insulation. A well-insulated attic should look like a thick, even blanket of fluff, completely covering those joists. If you see clumps, bare spots, or areas where it’s been squashed down, it’s not doing its job properly.

For a deeper dive into home efficiency improvements, explore our guides on housing, energy, and utilities.

Identifying Power-Hungry Appliances

Next up are the silent energy consumers—your appliances. Your mission is to figure out which ones are drawing the most electricity, especially if they’re older models.

The easiest method is to get a plug-in energy usage monitor. These simple gadgets measure exactly how much power an appliance is using. Plug it in and test your refrigerator, deep freezer, and entertainment center. You might be horrified to learn that the old extra fridge in the garage is costing you an extra $150 per year all by itself. Knowing these hard numbers helps you decide which appliances should be first on your list for an energy-efficient upgrade.

The Hunt for Silent Water Leaks

Water leaks are the sneakiest of all, wasting thousands of gallons without making a sound. The number one offender in most homes? The toilet.

Here’s the classic plumber’s trick: put a few drops of food coloring into the toilet tank. Don’t flush. Just walk away for 15-20 minutes. When you come back, check the bowl. If you see any color, you have a silent leak, which usually means the rubber flapper is worn out. That’s a five-dollar part that can save you a bundle.

Don’t forget to check under every sink and around faucet bases for any hint of moisture. A single faucet dripping just once per second can waste over 3,000 gallons per year. That’s water—and money—straight down the drain.

Smart Upgrades That Actually Pay You Back

Once you’ve figured out where your home is leaking energy and money, it’s time to make some strategic moves. I’m not talking about a full-blown, expensive renovation. Instead, we’re focusing on smart, affordable upgrades that deliver a real return on your investment, often surprisingly quickly.

It can feel counterintuitive to spend money to save money, but the math here is on your side. Think of these as small investments that start paying dividends right away by slashing your monthly utility bills. This is a core principle for getting your finances in order—making targeted choices that cut down recurring expenses.

Making the Financial Case for Simple Fixes

Let’s get practical and look at some of the highest-impact improvements you can make. These are the fixes that should be at the very top of your list after your home audit reveals the culprits behind your high bills. They require a small upfront cost but start generating savings from day one.

The goal is to zero in on things that have a clear, measurable effect on your energy or water usage. Here are a few of my favorite no-brainers:

- LED Lighting: Seriously, if you haven’t done this yet, stop what you’re doing and make the switch. LED bulbs use up to 90% less energy than old-school incandescent bulbs and can last an incredible 25 times longer. It’s the lowest-hanging fruit there is.

- Low-Flow Fixtures: Installing low-flow showerheads and faucet aerators is another easy win. You can cut your water use from these fixtures by 25% to 60%. This hits your budget in two ways: a lower water bill and a lower energy bill, since you aren’t paying to heat all that wasted water.

- Weatherstripping and Caulk: Remember those drafts you found around your doors and windows? Sealing them up with a bit of weatherstripping or a tube of caulk is one of the most effective things you can do. For just a few bucks, you stop paying to heat or cool the great outdoors.

A typical household can save $200 per year or more just by replacing their five most-used light fixtures with energy-efficient models. The payback on this simple switch is often less than a year.

How to Calculate the Payback

Understanding when an upgrade will pay for itself is key to making a smart decision. It’s not complicated. Just divide the total cost of the upgrade by how much you expect to save per year. This little calculation tells you exactly how long it’ll take to recoup your initial investment.

Real-World Example: A Low-Flow Showerhead

Let’s run the numbers on a simple, water-saving showerhead.

- Upfront Cost: You can get a great one for about $25.

- Estimated Savings: A family of four can easily save around $70 per year on water and water-heating costs.

- Payback Period: $25 (cost) / $70 (annual savings) = 0.36 years, or just over 4 months.

Think about that. After only four months, that showerhead is no longer a cost—it becomes a tiny money-making machine, putting cash back in your pocket every single month.

Don’t Overlook Routine Maintenance

Sometimes, the best “upgrade” isn’t a new gadget at all. It’s just taking care of what you already have. Your HVAC (heating, ventilation, and air conditioning) system is the perfect example. It’s one of the biggest energy hogs in your home, and neglecting it is like setting money on fire.

Proper maintenance keeps it running at peak efficiency. The absolute easiest and most important thing you can do is clean or replace the air filters every few months. A clogged, dirty filter forces your system to work way harder, which wastes a ton of energy.

In fact, just swapping a dirty filter for a clean one can lower your air conditioner’s energy consumption by 5% to 15%. For an investment of a few dollars and five minutes, the return is immediate. It’s also a good idea to schedule an annual professional tune-up to keep the whole system in top shape, which helps prevent expensive breakdowns and ensures you’re not overpaying on your bills month after month.

Making Long-Term Investments in Your Home’s Efficiency

The quick wins and habit changes we’ve covered will definitely provide some relief on your utility bills. But if you’re looking for a serious, lasting impact on your monthly expenses, it’s time to think bigger. We’re talking about the major home upgrades—the kind of projects that not only slash your bills for years to come but also boost your home’s value.

It’s a mental shift, really. Stop seeing these as expenses and start viewing them as investments. Sure, there’s an upfront cost, but the whole point is to generate a return by freeing up your cash flow month after month. The best way to tackle these projects is to plan ahead. A dedicated savings account can make all the difference, and understanding how a sinking fund can help you save for big goals is a great place to start.

High-Impact Upgrades for Lasting Savings

When you’re ready to make a significant investment, a few key areas deliver the biggest bang for your buck. These projects target the systems that guzzle the most energy, transforming your home into a far more efficient, and less expensive, place to live.

- Energy-Efficient Windows: Think of old, single-pane windows as giant energy leaks. Upgrading to double- or even triple-pane windows with low-E coatings can slash your home’s energy loss by a staggering 25-50%. You’ll keep the warm air in during the winter and the hot air out during the summer, and your HVAC system will thank you for it.

- High-Efficiency Heat Pumps: Modern heat pumps are marvels of efficiency, handling both heating and cooling. Instead of burning fuel to create heat like a furnace, they simply move it from one place to another. This process uses a fraction of the energy, potentially cutting your heating and cooling costs in half.

- Proper Attic Insulation: We’ve said it before, but it bears repeating: heat rises. If your attic is under-insulated, you’re literally paying to heat the great outdoors. Bringing your attic insulation up to modern standards is one of the most cost-effective major upgrades you can make. The payback is quick, and the savings are year-round.

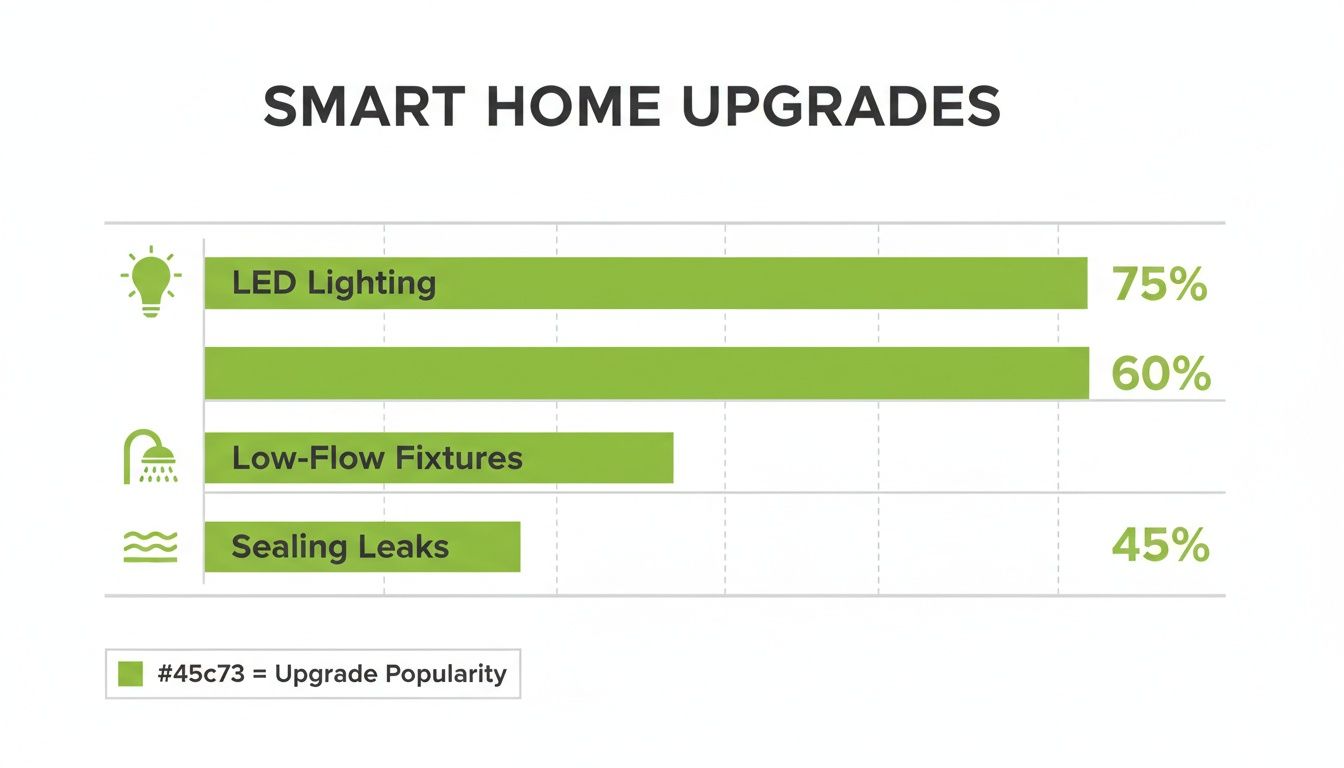

The chart below shows where most homeowners start when making smart upgrades. It’s clear that the fundamentals—lighting, water use, and sealing leaks—are the most popular first steps.

Is Renewable Energy Within Reach?

For the ultimate move toward energy independence, solar panels are a game-changer. They don’t just reduce your energy consumption; they turn your home into a mini power plant, locking in your electricity costs for 25 years or more.

If solar felt out of reach in the past, it’s time to look again. A global push toward renewables has made solar more affordable than ever. In fact, clean power recently supplied over 40% of global electricity generation, with solar leading the charge. This growth means better tech, more competition, and more programs to help homeowners make the switch.

Key Takeaway: Going solar is less of an environmental statement and more of a powerful financial strategy. You’re essentially pre-paying for decades of electricity at a fixed rate, shielding yourself from the unpredictable price hikes that have become the norm with traditional utilities.

Understanding the Payback Period

It’s natural to wonder how long it will take for these big investments to pay for themselves. The table below gives a realistic look at typical costs, savings, and payback periods for some of the most common major upgrades.

Cost vs. Payback for Major Energy Upgrades

| Upgrade Type | Average Upfront Cost | Estimated Annual Savings | Typical Payback Period (Years) |

|---|---|---|---|

| High-Efficiency Heat Pump | $5,000 – $12,000 | $500 – $1,500 | 5 – 10 |

| Energy-Efficient Windows | $8,000 – $20,000+ | $300 – $700 | 10 – 20 |

| Attic Insulation | $1,500 – $3,500 | $200 – $600 | 3 – 7 |

| Solar Panel System | $15,000 – $25,000 | $1,000 – $2,400 | 6 – 12 |

Note: These are estimates. Your actual costs, savings, and payback period will depend on your home’s size, location, existing efficiency, and available incentives.

As you can see, while the initial investment can be significant, the long-term savings are substantial. The key is to choose the upgrades that make the most sense for your home and climate.

Don’t Forget to Look for Tax Credits and Rebates

Here’s the best part: the sticker price for these upgrades is almost never what you actually end up paying. Governments and utility companies are eager to help you improve your home’s efficiency, and they offer a ton of incentives to prove it. These programs can dramatically reduce your out-of-pocket cost.

Be sure to hunt for these opportunities:

- Federal Tax Credits: The federal government often provides tax credits that directly reduce your tax bill for installing solar, efficient windows, heat pumps, and more.

- State and Local Rebates: Many states, counties, and even cities have their own cash-back rebate programs. You can often stack these on top of federal incentives.

- Utility Company Programs: Call your electric or gas company! They frequently offer their own rebates for buying efficient appliances or weatherizing your home.

By doing a little research and stacking these incentives, you can turn a major project into an incredibly savvy financial move with a much shorter payback period.

Got Questions About Slashing Your Utility Bills?

When you start digging into how to save money on utilities, a lot of questions pop up. It’s totally normal. Are you making the right call with the thermostat? Is a “smart” gadget really worth the money? Let’s clear up some of the most common questions I hear all the time.

Getting straight answers is the first step. It helps you make smart moves, avoid expensive mistakes, and keep more of your hard-earned money where it belongs—in your pocket.

Should I Turn My AC Off or Just Turn It Up When I Leave?

This is the age-old debate, right? The answer really depends on how long you’ll be out of the house.

If you’re just popping out for an hour or two to run errands, it’s actually more efficient to just bump the thermostat up a few degrees. Turning the whole system off and on for a short trip makes it work harder than it needs to.

But if you’re gone for the whole workday or a long weekend, go ahead and turn the AC off or set it to a “vacation” temperature like 85°F (29°C). The energy it takes to cool the house down when you get back is almost always less than what it would have spent running all day just to keep an empty house cool.

Realistically, How Much Can I Expect to Save?

This is a “your mileage may vary” situation, because so much depends on your starting point—the age of your home, your climate, and your family’s daily habits. That said, it’s not unrealistic for most families to cut their total utility costs by 10% to 25%. The key is to stack small, smart changes on top of each other.

- Zero-Cost Tweaks: Simply adjusting your thermostat settings and unplugging devices that sip “phantom power” can easily knock $10-$25 off your monthly bill.

- Small Upgrades: Swapping out old lightbulbs for LEDs and installing a water-saving showerhead? That could be another $15-$30 per month.

It might not sound like a fortune at first, but that adds up to hundreds of dollars a year. That’s a car payment, a holiday gift fund, or a nice boost to your savings account.

A recent poll revealed that a whopping 76% of U.S. adults are worried about their electricity bills. With over a third of them calling it a “major” financial concern, it’s clear that every dollar saved really counts.

Are Smart Thermostats Actually Worth the Hype?

For most homeowners, the answer is a definite yes. A basic programmable thermostat is good, but a smart one is a game-changer. These devices actually learn your family’s routine, let you make adjustments from your phone (even when you’re not home), and give you data on where your energy is going.

All those features work together to fine-tune your heating and cooling without you having to think about it. Plus, many utility companies offer rebates that can seriously slash the upfront cost. Most people find that a smart thermostat pays for itself in savings within just one or two years, making it one of the best energy-efficiency investments you can make.

I’m a Renter. Can I Do Anything to Save Money?

Absolutely! You might not be able to install new windows or a high-efficiency furnace, but you still have a ton of control over your utility bills. Every single no-cost habit—from managing the thermostat to using less hot water and unplugging electronics—works just as well in an apartment as it does in a house.

And you can make some simple, non-permanent upgrades, too:

- Swap in LED bulbs: Just hang on to the old ones and switch them back before you move out.

- Install a low-flow showerhead: It’s a five-minute job, and you can easily put the original back on later.

- Seal up drafty windows: Use removable caulk or peel-and-stick weatherstripping. They seal leaks effectively without leaving a mark.

- Hang blackout curtains: They’re fantastic for blocking solar heat in the summer and adding a layer of insulation in the winter.

Don’t ever feel like your hands are tied just because you rent. You have plenty of ways to cut your energy and water use and see real savings on every bill.

Here at Collapsed Wallet, our entire mission is to provide clear, practical advice to help you gain control over your finances and build a more secure future. To keep learning, check out our other guides at https://collapsedwallet.com.