Table of Contents

- Starting Your Financial Journey Together

- Choosing Your Financial Merging Strategy

- Creating Your First Joint Budget and Setting Goals

- How to Tackle Debt and Credit Scores Together

- Taking Care of the Nuts and Bolts

- Keeping Your Financial Harmony for the Long Haul

- Answering Your Top Questions About Combining Finances

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

So, you’ve tied the knot. Congratulations! Now comes one of the biggest, and sometimes trickiest, parts of building a life together: figuring out the money. Trying to Merge finances after marriage is so much more than just opening a joint bank account. It’s about mapping out a shared future and achieving financial freedom as a team. The whole process really boils down to three big conversations: getting everything out in the open about your financial histories and goals, deciding on a game plan (will you go fully merged, hybrid, or keep things separate?), and then getting practical about budgeting and tackling any debt.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of it less as a scary chore and more as your first big project as a married team. How you handle it sets the tone for everything else.

A Quick Heads-Up: The advice here is meant to get you started and point you in the right direction. It’s based on years of seeing what works for couples, but it’s for educational purposes. For a plan that’s truly customized to your specific situation, I always recommend chatting with a qualified financial adviser.

Starting Your Financial Journey Together

Deciding how you’ll handle your money as a married couple is a foundational step. It’s a huge milestone that requires trust, a bit of vulnerability, and a real commitment to working as a team. If you go into it with a positive, collaborative spirit, you can turn what feels like a stressful task into a seriously powerful bonding experience.

Let’s be honest, a lot of couples dread this conversation. Talking about money can feel personal and loaded with potential judgment. But the goal here isn’t to pick apart past spending habits. It’s about laying all the cards on the table to get a clear, shared picture of where you both stand right now. This honesty is what lets you streamline your financial life and get on the same page about everything from paying the electric bill to saving for your biggest dreams.

Why Does This Even Matter?

When you consciously decide to combine your financial lives—no matter what that looks like for you—it pays off in big ways for your partnership and your future.

- You Create a Unified Vision: It forces you to actually talk about and define what you want to achieve as a couple. Buying a house? Retiring early? Traveling the world? You can’t plan for it if you don’t talk about it.

- Things Get a Lot Simpler: Managing one set of household bills and savings goals is just more efficient. It helps you spot where your money is going and find opportunities to be smarter with it.

- It Fosters a “Team Us” Mindset: When you’re both working toward the same financial goals, it reinforces that feeling of being in it together. It’s no longer “my money” and “your money,” but our money and our future.

Setting the Stage for a Good Conversation

Before you even think about opening a spreadsheet, you need to understand each other’s relationship with money. We all have a unique “money story” that’s been shaped by how we were raised, our past experiences, and our core beliefs.

Maybe one of you is a natural saver who feels secure seeing a chunky emergency fund, while the other is more of a risk-taker who’s comfortable with investing. Neither approach is wrong; they’re just different.

The most important first step is radical transparency. You have to start by sharing everything—income, savings, student loans, credit card debt, credit scores, the works. This isn’t about judging each other. It’s about getting all the facts on the table so you can build a solid plan as a team.

Understanding these different perspectives is the key to finding common ground. The goal isn’t to prove one person’s method is “right,” but to create a brand-new approach that works for your marriage. This initial conversation is the bedrock for every single financial decision you’ll make from here on out.

Choosing Your Financial Merging Strategy

Alright, let’s get into the first big conversation you’ll have about money as a married couple: how are you actually going to combine your financial lives? There’s no single right answer here. The best system is the one that fits your personalities, financial histories, and how you view money as a team. It’s all about finding a rhythm that feels fair, transparent, and sustainable for both of you.

Before we dive in, a quick note: The tips and strategies here are based on years of experience helping couples navigate this, but they’re for educational purposes. Think of this as a guide to help you ask the right questions. For advice tailored to your specific situation, it’s always a good idea to chat with a qualified financial advisor.

It’s interesting to see how things have changed over the years. The old-school approach of dumping everything into one big pot isn’t the only way anymore—and for many, it’s not the preferred way.

Recent data from the U.S. Census Bureau’s latest findings really backs this up. In 1996, 53% of married couples had only joint bank accounts. Fast forward to today, and that number has dropped to just 40%. At the same time, the number of couples using a mix of joint and separate accounts has nearly doubled, jumping from 9% to 17%.

This shift tells us that more and more couples are looking for a balance between shared goals and personal autonomy. Let’s break down the three main ways you can structure your finances.

The “All-In” Strategy

This is the classic, most straightforward method. You and your partner pool all your income into a single, shared checking account. Every dollar from every paycheck goes into this one account, and everything—from the mortgage and groceries to your morning coffee—comes out of it.

- Why it works: It’s the ultimate picture of financial unity. It makes bookkeeping simple and promotes total transparency. You’re truly operating as a single financial unit, which can build a powerful “we’re in this together” mindset.

- Where it can get tricky: This approach requires a massive amount of trust and very similar spending habits. If one of you is a saver and the other is a spender, or if one person feels like they’re being “monitored,” it can cause a lot of friction.

This model often clicks for couples with similar incomes, shared financial philosophies, or when one partner manages the household full-time. Communication is non-negotiable here to ensure both people feel they have an equal voice, no matter who earns more.

The “Totally Separate” Approach

On the complete opposite end of the spectrum, some couples keep their finances entirely separate. You each maintain your own bank accounts, credit cards, and savings. From there, you work out a system to handle shared expenses.

This could mean one person pays the mortgage while the other covers all utilities and groceries. Or maybe you split the big, shared bills right down the middle, 50/50. This is a popular choice for couples who marry later in life, already have established careers and assets, or are bringing significant personal debt into the marriage.

The “Yours, Mine, and Ours” Hybrid Model

This has become the go-to for so many modern couples, and for good reason. The hybrid model offers the perfect blend of teamwork and independence. You each keep your own personal bank accounts but also open a new joint account for all shared household expenses.

The magic of this system is often in how you fund the “ours” account. Many couples contribute a percentage of their income, not a flat dollar amount. This feels much fairer, especially if there’s a big income gap.

That joint account becomes the hub for the mortgage, utilities, groceries, and joint savings goals. Meanwhile, your personal “yours” and “mine” accounts are for your individual spending—guilt-free. As long as the shared account is funded, nobody needs to explain why they bought a new video game or went on a weekend trip with friends.

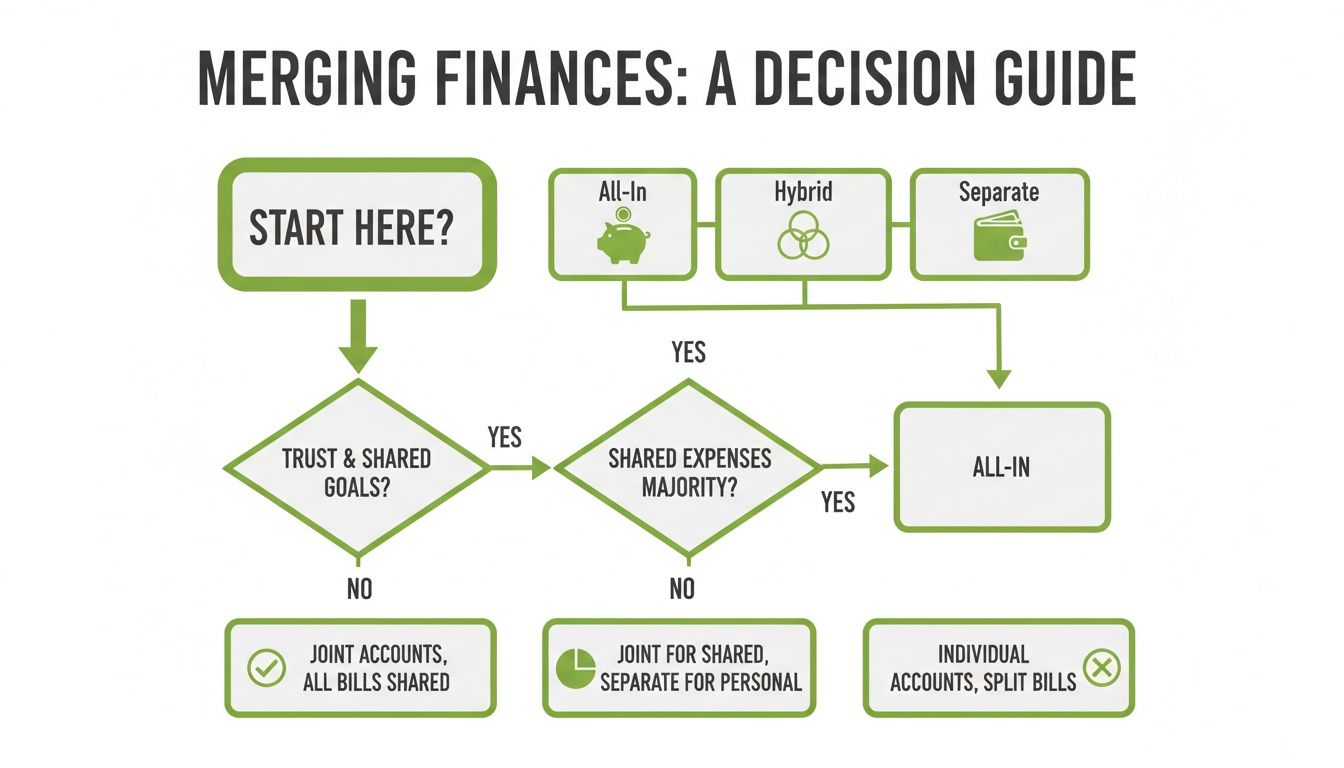

This simple decision tree can help you visualize which path feels right for your relationship.

As you can see from the flowchart, asking a few key questions about trust, income, and how much independence you each need can point you in the right direction. There’s no “best” model—only the one that works best for you as a couple. This choice is the foundation for everything else you’ll build together.

To help you compare these options side-by-side, here’s a quick breakdown.

Comparison of Financial Merging Models

| Model | How It Works | Best For | Potential Pitfalls |

|---|---|---|---|

| All-In (Joint Only) | All income is deposited into one shared account. All expenses, savings, and personal spending come from this single account. | Couples with similar incomes and spending habits. Those who value simplicity and complete financial transparency. | Can cause friction over personal spending. May lead to a loss of financial autonomy if not managed with open communication. |

| Separate | Each partner maintains their own accounts. A system is created to split shared bills (e.g., 50/50, one pays mortgage, etc.). | Couples who marry later, have complex assets/debts, or highly value financial independence. | Can feel like you’re just “roommates” financially. Requires diligent tracking to ensure bills are split fairly. |

| Hybrid (Yours, Mine, Ours) | Partners keep their separate accounts but also open a joint account for shared expenses, funded proportionally or equally. | Couples with different incomes or spending styles. Those who want both teamwork and personal financial freedom. | Requires a bit more setup and account management. Deciding what counts as a “shared” vs. “personal” expense can be a gray area. |

Ultimately, choosing a model isn’t a one-and-done decision. It’s a starting point. The most successful couples are the ones who are willing to check in, talk about what’s working and what’s not, and adjust their system as their lives change.

Creating Your First Joint Budget and Setting Goals

Alright, you’ve talked through the big picture and decided how you’ll structure your finances—all-in, separate, or a hybrid. Now comes the fun part: turning that decision into a real-world, day-to-day plan. This is where the theory ends and the action begins.

Creating your first budget as a couple isn’t about restriction; it’s about empowerment. It’s about designing the life you want to live, together.

A quick note before we dive in: The information here is for general guidance and educational purposes. Think of it as a starting point, not professional financial advice. For a plan tailored specifically to your situation, I always recommend chatting with a qualified financial adviser.

Getting a Clear Financial Snapshot

Before you can map out where you’re going, you need to know your starting point. That means getting an honest look at your combined net worth. It sounds like a big, scary term, but it’s really just adding up what you own (assets) and subtracting what you owe (liabilities).

First, list out your assets:

- Cash: Everything in your checking and savings accounts.

- Investments: Balances from retirement accounts like a 401(k) or IRA, plus any brokerage accounts or ETFs.

- Property: The current market value of your home, cars, or any other big-ticket items.

Next, tally up the liabilities:

- Debt: This includes student loans, credit card balances, car loans, personal loans, and your mortgage.

Subtract your total liabilities from your total assets. That final number is your combined net worth. Don’t panic if it’s negative—many couples start out in the red thanks to student loans or a new mortgage. What matters is that you now have a baseline you can work to improve together.

Choosing Your Budgeting Method

With a clear financial picture, you can pick a budgeting method that actually fits your life. The goal isn’t to create a rigid system that makes you miserable; it’s to find something that helps you manage your money without feeling suffocated. Learning https://collapsedwallet.com/how-to-track-expenses/ is the foundation for any of these approaches.

Two of the most popular methods for couples are:

- The 50/30/20 Rule: A fantastic, straightforward framework. You earmark 50% of your take-home pay for “needs” (rent/mortgage, utilities, groceries), 30% for “wants” (dinners out, hobbies, travel), and the remaining 20% goes straight to savings and paying down debt.

- Zero-Based Budgeting: This one is more hands-on but incredibly powerful. At the beginning of the month, every single dollar of income gets a specific job. Apps like YNAB (You Need A Budget) are brilliant for this, making it a seamless and collaborative process.

The key takeaway isn’t which method you choose, but that you choose one together. A budget is your roadmap. It tells your money where to go instead of you wondering where it went.

The Power of Proportional Contributions

When it comes to covering shared bills, ditching the 50/50 split can be a total game-changer, especially if there’s a gap in your incomes. A proportional contribution strategy is often a much fairer, more modern way to handle things.

Here’s how it works: You add up your total household income and figure out what percentage each of you brings in. For instance, if you earn $60,000 and your partner earns $40,000, your combined income is $100,000. You contribute 60% of the shared expenses, and they contribute 40%. This approach ensures both of you have a similar amount of “fun money” left over and prevents one person from feeling constantly squeezed.

This method really reflects how much marriage has changed. The old model of a single primary breadwinner is becoming less and less common. In fact, Pew Research found that in 2022, 29% of U.S. opposite-sex marriages were ‘egalitarian’—where each spouse earns between 40-60% of the combined income. That’s a huge leap from just 11% back in 1972. Proportional budgeting is simply a practical strategy that acknowledges this reality.

Setting Exciting Shared Goals

Budgeting isn’t just about paying the electric bill. It’s the tool you use to build the life you’re both dreaming of. This is where it gets exciting! Setting shared goals turns budgeting from a monthly chore into a team sport.

Sit down together and start dreaming. What do you really want to accomplish?

- Short-Term Goals (1-3 years): Finally building a real emergency fund, crushing that high-interest credit card debt, or saving for an amazing anniversary trip.

- Mid-Term Goals (3-10 years): Saving up a down payment for a house, upgrading your cars without taking on a huge loan, or planning for a family.

- Long-Term Goals (10+ years): Paying off the mortgage ahead of schedule, aggressively investing for retirement, or even reaching financial independence.

Put a dollar amount and a target date on each goal. Suddenly, they feel real and achievable. Every time you stick to your plan, you’re not just moving numbers around—you’re one step closer to the future you’re building together.

How to Tackle Debt and Credit Scores Together

Let’s be honest: talking about debt and credit scores can be incredibly awkward. Bringing up old financial baggage or a mountain of student loans feels vulnerable, and for many couples, it’s the elephant in the room. But trust me, avoiding this conversation is a recipe for disaster down the road.

When you decide to tackle debt as a team, something shifts. It stops being a source of stress and starts feeling more like a shared mission—a journey toward financial freedom you’re taking together.

(Before we jump in, a quick note: The tips I’m sharing here are for educational purposes. Think of this as guidance from a seasoned pro, not professional financial advice. If you need a plan tailored to your specific situation, I always recommend sitting down with a qualified financial adviser.)

First, let’s bust a huge myth. When you get married, your credit scores do not merge. You both keep your own separate credit histories and scores. The game changes, however, the moment you apply for something jointly, like a mortgage or a car loan. At that point, lenders are looking at both of you, and your financial lives become officially intertwined.

Talking About Your Credit Scores

Getting a clear picture of where you both stand financially is your first move. It’s not about judgment; it’s about strategy. If one of you has an amazing score and the other is still building theirs up, that’s critical information.

Why? Because a lower score can directly impact the interest rates you’re offered on joint loans. Suddenly, it’s not just one person’s problem—it’s a team problem that can cost you real money.

The good news is that you can work on this together. If one person’s score needs a lift, you can team up on the fundamentals. I’ve actually put together a guide on how to improve your credit score fast that walks through strategies you can start using right away. Tackling this as a shared goal is a fantastic way to strengthen both your finances and your relationship.

Forging a Debt Repayment Plan

For a lot of couples, the debt conversation starts right after the wedding—sometimes to figure out how to pay for the wedding. It’s a modern reality. U.S. couples spent an average of $30,000 on their weddings in 2023, and a staggering 53% of them had to borrow money to make it happen. This trend, highlighted in wedding spending reports on FoxBusiness.com, shows just how vital a joint debt-repayment plan is from day one.

So, how do you actually do it? Once you’ve laid all the cards on the table—student loans, car payments, credit cards, everything—it’s time to pick your strategy. Two of the most effective methods I’ve seen couples use are the Snowball and the Avalanche.

- The Debt Snowball: You list all your debts from smallest to largest, ignoring interest rates for now. You’ll make minimum payments on everything except the smallest debt. Throw every extra dollar you have at that one until it’s gone. Then, you roll that payment amount into the next-smallest debt. This method is all about momentum and quick wins, which can be incredibly motivating.

- The Debt Avalanche: This one is for the number-crunchers. You list your debts by interest rate, from highest to lowest. You’ll make minimum payments on everything but funnel all your extra cash to the debt with the highest interest rate. This approach will save you the most money in interest over the long haul.

Here’s the thing: The best plan is the one you’ll actually stick with. If seeing progress and getting those quick wins keeps you both fired up, the Snowball is your friend. If your main goal is to save every possible dollar on interest, then the Avalanche is the clear winner.

Should You Consolidate Your Debt?

You might also hear about debt consolidation. This is where you take out one new, larger loan to pay off several smaller ones. The idea is to simplify everything into a single monthly payment, hopefully at a lower interest rate.

Here’s a quick breakdown of what to consider:

The Upside of Consolidation:

- You only have one payment to track.

- You could snag a lower interest rate, saving you money.

- It gives you a clear finish line for paying everything off.

The Downside of Consolidation:

- You’ll likely need a good credit score to get a good rate.

- It doesn’t address the spending habits that might have caused the debt.

- Some loans come with origination fees that can eat into your savings.

Ultimately, deciding whether to consolidate, keep your debts separate, or even have one spouse help pay down the other’s loans is a deeply personal choice. There’s no single right answer. What truly matters is that you make the decision together, with total transparency and a shared goal of becoming debt-free.

Taking Care of the Nuts and Bolts

Alright, you’ve talked through the big picture, chosen an approach, and even sketched out a budget. Now for the nitty-gritty: the actual administrative tasks that make your financial merger a reality. This part can feel like a mountain of paperwork, but it’s what turns your good intentions into a smooth, functioning system.

Think of it as setting the foundation. Getting these details sorted out now saves you from massive headaches down the road and ensures you’re both on solid ground.

Setting Up Your Banking Hub

If you’re going with a “Yours, Mine, and Ours” or “All-In” model, opening a joint bank account is your first move. This account becomes the central hub for all your shared expenses, savings goals, and daily financial life together.

Don’t just walk into the nearest bank. Take a moment to shop around for the right fit.

- Fees are a killer: Look for accounts with zero or low monthly fees. There’s no reason to pay a bank just to hold your money.

- Make your savings work: For a joint savings account, a high-yield option is a must. Even a small difference in interest rates adds up significantly over time.

- Good tech is a game-changer: A great mobile app with easy budgeting tools and automatic transfer features can make life so much easier.

Many banks offer cash bonuses for new customers, so it literally pays to compare your options. Exploring resources on bank account switching can give you a clear breakdown of what different institutions offer.

Updating Your Legal and Financial Lifeline

Getting married is a huge life event, and the law sees it that way, too. You absolutely must update your paperwork to reflect your new relationship status. This isn’t just about bureaucracy; it’s about protecting each other.

First on the list: review and update the beneficiaries on every single one of your accounts.

- Retirement accounts (401(k)s, IRAs)

- Life insurance policies

- Investment accounts

Skipping this step can cause unimaginable heartache. I’ve seen situations where assets accidentally went to an ex-partner or a parent because the paperwork was never updated after the wedding.

This is also the perfect time to tackle basic estate planning. It doesn’t need to be complex or expensive. At the very least, you should both have updated wills and powers of attorney for finances and healthcare. This ensures your wishes are known and that your spouse has the legal authority to make critical decisions if you’re unable to.

Handling Taxes and Automating Daily Life

Your tax situation changes the moment you say “I do.” You can now file as “married filing jointly” or “married filing separately.” For the overwhelming majority of couples—well over 95%—filing jointly is the way to go, as it usually leads to a lower tax bill. It’s smart to sit down with a tax professional for the first year to make sure you’re taking advantage of all the credits and deductions you’re now entitled to.

Once your joint account is up and running, put your finances on autopilot. Set up direct deposits or automated transfers from your personal accounts into the joint one. Then, schedule all your shared bills (rent/mortgage, utilities, car payments) to be paid automatically from that account.

This “set it and forget it” system is a lifesaver. It cuts down on the mental load and prevents bills from slipping through the cracks. If you’re using a joint credit card, agree on the rules for its use and make a pact to pay it off in full every month.

To help you keep track of everything, here’s a simple checklist of the key tasks you’ll need to tackle.

Financial Merge Implementation Checklist

| Task | Action Required | Key Considerations |

|---|---|---|

| Open Joint Bank Account | Research and choose a bank. Complete the application together. Fund the account. | Compare fees, interest rates, and mobile banking features. Look for sign-up bonuses. |

| Update Beneficiaries | List all retirement, investment, and insurance accounts. Log in or fill out forms to name your spouse as the primary beneficiary. | Confirm the changes have been processed. This supersedes what’s in a will. |

| Set Up Direct Deposit | Contact your HR/payroll department to split your direct deposit between personal and joint accounts, if applicable. | Decide on the exact amounts or percentages to transfer each pay period. |

| Automate Bill Payments | Log into all shared bill accounts (utilities, rent, etc.) and update the payment method to the new joint account. | Create a calendar of due dates to ensure there are no gaps during the transition. |

| Review Insurance Policies | Contact your auto, home/renters, and health insurance providers. | Bundling policies can often lead to significant discounts (10-25%). |

| Discuss Estate Planning | Schedule a meeting to create or update wills, and establish financial and healthcare powers of attorney. | Choose an executor and decision-makers you both trust. Store documents in a safe, accessible place. |

| Consult a Tax Advisor | Schedule an appointment to discuss your new tax situation and filing status. | Understand how your combined incomes affect your tax bracket. Adjust W-4 withholdings if necessary. |

Working through this checklist might take a few weekends, but once it’s done, your financial foundation will be solid, allowing you to focus on building your future together.

Keeping Your Financial Harmony for the Long Haul

Getting your finances merged and organized isn’t a one-and-done task you can check off the wedding to-do list. Think of it more like tending a garden; it needs regular attention to flourish. Your financial partnership has to be a living, breathing thing that adapts as your lives change, careers shift, and goals come into focus.

The secret to making this work for years to come? Building sustainable habits that keep you both connected and on the same page. This is where a simple, yet incredibly powerful, routine comes in: the ‘money date’.

The Game-Changing Power of a Regular Money Date

A money date is exactly what it sounds like: a dedicated time for you and your partner to talk about money. But here’s the key—it’s meant to be a relaxed, non-confrontational check-in. This isn’t about grilling each other over every last receipt. It’s a positive, forward-looking conversation to make sure the system you’ve built is still serving you both.

The real goal here is to shift money talks from a source of stress into a normal, routine part of your partnership, just like figuring out weekend plans.

Try to put one on the calendar once a month. Make it a real date! Grab your favorite takeout, pour a drink, and create a comfortable, judgment-free zone where you can connect.

Here’s what a typical money date might look like:

- Start with the Wins: Always begin on a positive note. Did you crush a savings goal this month? Finally pay off that pesky credit card? Acknowledge the progress you’re making and give each other a high-five.

- Glance at the Budget: Take a quick, high-level look at your spending. Did any category get out of hand? Were there any surprises, good or bad? This is just about awareness, not blame.

- Check on Your Big Goals: How’s the down payment fund looking? Are you on track with your retirement contributions? See how you’re progressing toward the future you’re building together.

- Look Ahead: Chat about any big expenses coming up next month. A car repair? A friend’s wedding? Getting these things on your shared radar prevents last-minute financial stress.

Handling Disagreements and Life’s Curveballs

Let’s be real: you’re going to disagree about money sometimes. Even the most in-sync couples do. The trick isn’t to avoid conflict, but to learn how to handle it constructively. When a disagreement pops up, the best thing you can do is take a breath and a step back. Try to genuinely understand where your partner is coming from and the feelings driving their point of view.

The single most important ingredient for long-term success is flexibility. The financial plan you set up right after the wedding is not meant to be set in stone. Life will inevitably throw new things your way—a new house, a baby, a career change, or an unexpected setback. Each of these milestones is a signal to revisit your budget, goals, and your overall strategy together.

One of the biggest risks to your financial teamwork is financial infidelity—when one partner hides debt, keeps secret accounts, or isn’t truthful about their income or spending. The antidote is radical transparency.

By making these money dates a safe space where you can both be completely honest without fear of judgment, you build a powerful defense against secrecy. You’re not just managing money; you’re building a rock-solid partnership that can handle any financial storm and, more importantly, work as a team to achieve your biggest dreams.

Answering Your Top Questions About Combining Finances

Even with the best-laid plans, the nitty-gritty of merging your financial lives can bring up some tricky questions. Let’s walk through some of the most common hurdles I see couples face.

Should We Really Share All Our Financial Details Before Getting Married?

Absolutely, yes. Think of this as laying the foundation for your financial house. You wouldn’t start building on shaky ground, right?

Being completely open about everything—your salary, how much you have saved, any debt you’re carrying, and even your spending quirks—isn’t about passing judgment. It’s about getting ahead of any potential surprises and starting your life together as a true team. This conversation builds a powerful sense of trust that you’ll lean on for years to come.

How Do We Split Bills if One of Us Earns a Lot More?

This is a classic dilemma, and a 50/50 split often doesn’t feel right in this situation. A much fairer approach is to contribute proportionally. Instead of splitting every bill down the middle, you each chip in a percentage of your income to cover shared expenses.

For instance, if your income makes up 65% of the household total, you’d cover 65% of the joint bills. This way, both of you are left with a similar amount of your own money to spend each month. It’s a simple shift that can head off a lot of resentment and financial stress down the road.

Key Takeaway: The goal is equity, not equality. A fair contribution is about what’s reasonable for each person’s situation, not just an equal dollar amount.

Do We Actually Need a Joint Credit Card?

It’s not a must-have, but a joint credit card can be an incredibly useful tool for handling shared costs like groceries, utilities, and date nights. It also helps you build your credit history together. The key is to set clear rules for how it will be used right from the start.

If you’re not quite ready for a joint account, a great middle step is adding your partner as an authorized user on one of your existing cards. This gives you the convenience of a shared card for spending, but the primary cardholder is still the one responsible for the bill. It’s a fantastic way to test the waters.

At Collapsed Wallet, we’re dedicated to providing the clear, actionable advice you need to build a strong financial foundation. For more tips and guides on managing your money with confidence, visit us at https://collapsedwallet.com.