Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Asking for a lower rent can feel a little awkward, but it's a completely normal business conversation that could save you hundreds—or even thousands—of dollars every year. Success really boils down to three things: knowing the market, picking the right moment, and proving you're a great tenant. When you walk in with the right information and a confident approach, you can turn a tricky talk into a major financial win.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Negotiating Your Rent Is a Smart Financial Move

A lot of renters never even think to ask for a better deal. They worry it'll create friction with their landlord. But here's the thing: landlords are running a business, and they know that keeping a reliable tenant is almost always more profitable than searching for a new one.

This is a powerful mindset shift. Once you get comfortable with this idea, you'll find these negotiation skills pop up everywhere. In fact, you can use a similar approach to boost your income—check out our guide on https://collapsedwallet.com/how-to-negotiate-salary-increase/ to see how.

Understanding the Landlord's Perspective

An empty apartment isn't just sitting there; it's actively costing the landlord money. Those costs can pile up fast, making your request for a small rent reduction seem like a pretty attractive alternative.

When a tenant leaves, a landlord is suddenly on the hook for a bunch of expenses:

- Turnover Costs: Think deep cleaning, a fresh coat of paint, and fixing any normal wear and tear.

- Lost Rent: Every month the unit sits empty is another month of $0 income. That hurts.

- Marketing and Showings: They have to pay to list the property and then spend their own time showing it to strangers.

- Screening Fees: Running credit and background checks on every promising applicant costs money.

By framing your request as a win-win, you’re not just asking for a discount. You're offering your landlord a way to bypass all that hassle and secure a steady, predictable income.

Your Value as a Tenant

Your track record as a fantastic renter is your biggest bargaining chip. A landlord who has a proven, low-maintenance tenant—someone who pays on time, every time, and doesn't cause trouble—is holding a golden ticket.

When you know how to negotiate lower rent, you're really just reminding them of your value. If you're dealing with a particularly tricky lease or just want an expert in your corner, getting professional guidance can be a game-changer. Services like Lease Review Negotiation offer that specialized help.

Building Your Case with Market Research

Walking into a rent negotiation without data is like showing up to a final exam without studying. You might get lucky, but you're probably not going to get the result you want. To have a real shot at lowering your rent, you need to build a solid, evidence-based case, and that starts with good old-fashioned market research.

The goal is simple: find undeniable proof that what you're asking for is fair and reflects the current rental landscape. You can start by checking out current rental listings in your town to get a feel for the average prices. This homework is the bedrock of a successful negotiation.

Finding and Analyzing Comparable Listings

The most powerful tool in your arsenal is the "comp"—a comparable rental listing in your area. You're looking for apartments or houses that are as close to yours as possible in a few key areas.

Fire up popular rental sites like Zillow or Apartments.com and start hunting. Be specific with your search filters to find the best matches:

- Location: Start with your own building or street, then slowly expand to a few blocks out. Proximity is key.

- Size and Layout: Look for the same number of bedrooms, bathrooms, and similar square footage. A one-bedroom is not a good comp for a two-bedroom.

- Amenities: Does the other unit have a dishwasher, in-unit laundry, a balcony, or included parking? Every little perk matters.

- Condition: Try to compare apples to apples. If your apartment has a dated kitchen, don't compare it to a brand-new luxury renovation.

Once you find a few solid comps, pop them into a simple spreadsheet. This makes it easy to spot trends and present your findings clearly to your landlord. Getting comfortable with organizing this kind of data is a great skill, and you can learn more from our guide on how to track expenses.

Pro Tip: Don't just look at the asking price. See how long a unit has been sitting on the market. If a similar apartment down the street has been vacant for 45 days and just dropped its price, that's a huge piece of leverage for you. It shows the market won't bear the landlord's original asking price.

Documenting Your Value and Choosing Your Moment

Your research shouldn't just be about other properties; it should also be about you. Your history as a tenant is one of your biggest bargaining chips. Before reaching out, pull together proof that you're the kind of tenant a landlord wants to keep. This means having records of on-time rent payments and maybe even a few photos showing how well you've cared for the place.

Timing is everything, too. The rental market typically cools off in the winter when fewer people are looking to move. This slump in demand can work in your favor. Try to start the conversation between October and February, ideally 60-90 days before your lease is up for renewal.

Combining market data with your own value as a tenant is a knockout punch. I’ve seen renters in tough markets successfully argue for a rent reduction after finding comps renting for 10-15% lower than their renewal offer. This is especially effective when local vacancy rates are climbing.

To make sure you have everything in order, use this checklist as your guide.

Your Pre-Negotiation Research Checklist

Before you pick up the phone or draft that email, run through this checklist. Having this information organized and ready will make you feel confident and show your landlord you’ve done your homework.

| Research Task | What to Look For | Why It Matters |

|---|---|---|

| Gather 3-5 Comparable Listings | Similar size, location, amenities, and condition. Note the listed rent, address, and link to the listing. | Provides concrete, undeniable proof of the current market rate for a property like yours. |

| Check Vacancy Rates | Look for how long comps have been on the market. Note any recent price drops on those listings. | High vacancy or price drops show that demand is low, giving you more negotiating power. |

| Review Your Lease Agreement | Check the notice period required for non-renewal (usually 30, 60, or 90 days). Note the official end date. | Ensures you time your negotiation request correctly and professionally. |

| Document Your Tenant History | Gather bank statements showing on-time rent payments. Take photos of your well-maintained apartment. | Proves you are a reliable, low-risk tenant that the landlord will want to keep. |

| Define Your "Walk-Away" Number | Based on your budget and research, decide on the absolute maximum rent you are willing to pay. | Knowing your limit prevents you from agreeing to a deal that doesn't actually work for you. |

| Brainstorm Non-Rent Perks | Think about other valuable trade-offs: a longer lease term, included parking, or a minor upgrade (e.g., a fan). | If the landlord won't budge on price, you have a backup plan to still get more value. |

Completing this checklist puts you in the driver's seat. You're no longer just asking for a discount; you're presenting a logical, well-supported business case for a fair price.

Crafting Your Negotiation Pitch

You’ve done the legwork—surveyed nearby listings, noted comparable rents, and nailed down your target figure. Now comes the art of presenting that research without sounding demanding. A warm, confident tone goes much further than a stiff, formal request.

Think of this conversation as a small business deal. You’re offering your landlord a reliable tenant who pays on time, treats the place like home, and minimizes headaches. In return, you’re asking for a rent that reflects current market rates. Framing it this way shifts the dynamic from confrontation to collaboration.

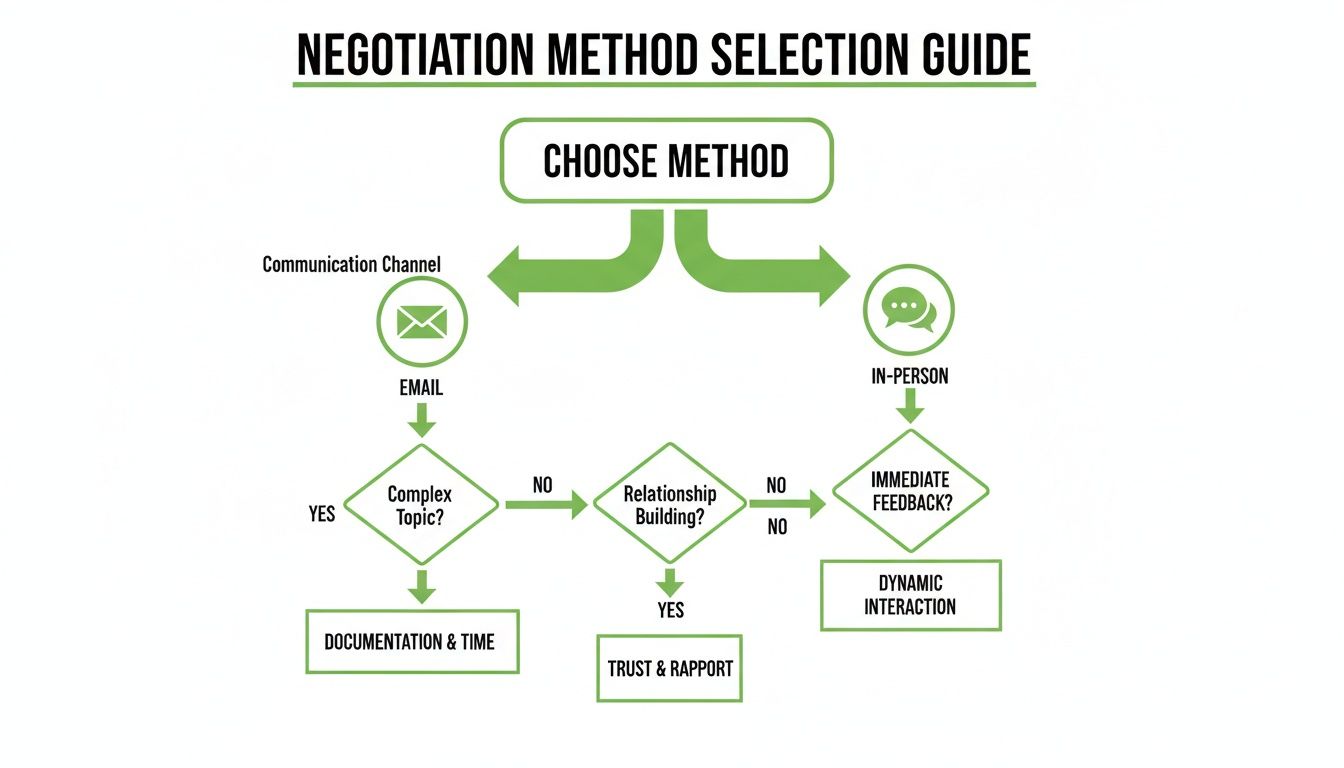

Choosing Your Communication Method

When it’s time to reach out, weigh these options:

Email:

• Perfect for laying out your data in clear bullet points.

• Gives your landlord time to review without feeling pressured.

• Creates a written record you can refer back to.Phone Call or In-Person Chat:

• Feels more personal and allows you to read tone and body language.

• Opens the door for immediate back-and-forth, but can get tense if you’re unprepared.

Many renters opt for a hybrid approach—send a friendly, detailed email first, then suggest a brief call to iron out details.

Sample Email Template For Lease Renewal

Below is a straightforward, adaptable message. It opens with gratitude, presents your comps, and ends by inviting dialogue.

Subject: Lease Renewal Discussion for [Your Address], Unit [Your Unit Number]

Dear [Landlord's Name],

I hope this note finds you well. I’m reaching out because my lease expires on [Lease End Date], and I’ve really enjoyed living here for the past [Number] year(s). Your responsiveness and fair management have made this place feel like home.

I’ve done some market research and found similar apartments listing between [Lower Price] and [Higher Price] per month. Here are a couple of examples:

- [Address of Comp 1], listed for [Price]

- [Address of Comp 2], listed for [Price]

Given this data and my track record as a dependable tenant, I’d like to propose a new monthly rent of [Your Proposed Rent], paired with a [Lease Length, e.g., 12-month] agreement. I’m eager to continue calling this place home and hope we can find a fair middle ground.

Would you be open to discussing this adjustment? I’m happy to chat over the phone or meet at your convenience.

Thank you for considering my request, and I look forward to your response.

Best regards,

[Your Name]

This structure works because it balances respect, facts, and a clear call to action. Once you’ve mastered this approach, similar tactics apply to other negotiations—like when you need to talk with creditors. Check out our guide on how to negotiate with creditors for more tips.

Key Takeaway: A respectful, data-backed pitch turns a tense request into a win–win conversation.

Think Beyond the Monthly Rent Check

What if your landlord just won't budge on that monthly rent figure? Don't walk away just yet. This is where the real art of negotiation comes into play. A successful outcome isn't always about a lower price tag; it's about finding creative alternatives that put money back in your pocket and improve your living situation.

Getting creative shows you're a flexible and reasonable tenant, which can often turn a hard "no" on a rent discount into a "yes" on something else just as valuable. These non-rent concessions are your secret weapon.

Offer a Longer Lease for a Better Deal

Landlords hate vacancies. They're a costly nightmare of cleaning, advertising, showing the unit, and screening new applicants. This is your leverage. By offering to sign a longer lease—say, for 18 or 24 months instead of the typical 12—you’re offering them something they value immensely: stability.

You're guaranteeing them a reliable, steady income stream with zero hassle. In exchange for that peace of mind, asking for a modest rent reduction or even just a promise to freeze the rent for the entire term is a perfectly reasonable trade.

Ask for Perks That Add Up

If the landlord is firm on the base rent, it's time to pivot. Shift the conversation to the other costs that come with renting the place. These perks might seem small individually, but they can add up to hundreds, or even thousands, of dollars over the year.

Think about asking for one of these valuable trade-offs:

- A Free Month: This is a classic move-in special, but why not ask for it as a renewal bonus? On a 12-month lease, one free month is the same as an 8.3% discount on your annual rent.

- Waived Fees: Target those pesky add-on costs. Ask them to waive the amenity fee, pet rent, or that monthly parking charge. A $100/month parking spot costs you $1,200 a year—getting that for free is a huge win.

- Bundled Utilities: See if they'll roll a utility like water, gas, or internet into the rent. This not only saves you money but also makes your monthly budget more predictable.

Figuring out whether to ask for these things over email or face-to-face is a strategic choice. Here’s a quick guide to help you decide which approach fits your situation and personality best.

Choosing the right communication channel can make a real difference in how your proposal is received, helping you make your case as effectively as possible.

Suggest Upgrades for Mutual Benefit

Here’s another angle: the 'renovation offset.' Are you handy? Offer to tackle some minor upgrades yourself. Maybe you could paint the living room, install a new ceiling fan, or update the ancient kitchen cabinet hardware. Proposing this in exchange for a rent discount or a freeze saves the landlord from hiring a contractor and improves their property value. It's a true win-win.

This idea of tenants creating value isn't new. Historically, tenant groups have organized to secure better terms, and you can apply that same principle as an individual. For example, offering a long-term commitment of 3-5 years could easily justify an 8-12% rent reduction because it dramatically lowers the landlord's risk of having an empty, non-earning unit. If you're curious about the history behind these power dynamics, this international review of housing rights is a fascinating read.

What to Do When They Respond: Counteroffers and Your Rights

Alright, you’ve made your pitch. Now comes the hard part: waiting for the reply. Your landlord’s response will almost always land in one of three buckets: a clean yes, a hard no, or—most commonly—a counteroffer.

A "yes" is fantastic, but don't hold your breath. A counteroffer is actually the best signal you can get. It means they’re willing to play ball, and you’ve successfully opened the door to a real negotiation.

If they come back with a figure that’s not quite what you asked for but is still less than what you’re currently paying, pause. Don't feel rushed to say yes on the spot. Run the numbers again. Does this new rent still feel like a win for your budget? Thank them for considering your request and tell them you’d like a day to think it over. It’s a completely reasonable thing to ask.

When They Say "No"

Hearing a flat-out "no" stings a bit, but it’s rarely the end of the line. The trick is to not get discouraged. Keep the conversation going, but pivot.

Try a simple, non-confrontational follow-up. Something like, "Thanks for getting back to me. I understand a rent reduction isn’t in the cards right now. To help me plan, would you be able to share any insight into the decision?"

Their answer can be pure gold. Maybe their property taxes skyrocketed, or they're locked into a mortgage payment. Knowing why they said no gives you the intel you need to shift the negotiation toward those non-rent concessions we talked about earlier.

A Quick Word on Tenant Rights

This isn't legal advice, but walking into any negotiation is easier when you feel empowered. Landlord-tenant laws are a patchwork that changes dramatically from state to state, and even city to city. These laws govern everything from how much notice a landlord must give for a rent increase to whether your city has rent control.

A great place to start is the U.S. Department of Housing and Urban Development (HUD) website. It can point you toward your local tenant rights organizations, which are often fantastic, free resources for understanding the specific rules where you live.

Key Takeaway: Get everything in writing. A verbal agreement is as good as the paper it’s written on—which is to say, it’s not. Whether you agree on lower rent, a waived pet fee, or a longer lease, insist on a new lease or a written addendum that both you and your landlord sign.

This simple step protects everyone and prevents any "misunderstandings" later on. The rental market is always in flux, and savvy tenants know how to use that to their advantage. For instance, when vacancy rates hit a national average of 6.6% in 2023, many renters successfully argued for better terms. Reading up on a few of these rental housing economic facts can give you that extra bit of confidence.

At the end of the day, being polite, persistent, and prepared is what will turn this negotiation into a win for your wallet.

Got Questions About Negotiating Rent? You're Not Alone.

Even with the best game plan, it's completely normal to have some last-minute jitters or questions pop up before you dive into a rent negotiation. Let's walk through some of the most common things people worry about so you can approach the conversation with total confidence.

Getting these specific situations straight in your head can be the difference-maker.

Is It a Bad Idea to Ask for a Lower Rent?

Not at all. Think of it this way: this is a business transaction. Most landlords, especially private owners who are more hands-on, actually expect a good tenant to at least try to negotiate. It doesn't come across as rude—it shows you’re on top of your finances, which is a trait every landlord wants in a renter.

As long as you keep it polite, professional, and have the market research to back up your number, you’re not going to ruin your relationship. The absolute worst thing that can happen is they say no. But more often than not, they’ll be willing to talk.

What’s a Realistic Rent Reduction to Ask For?

Generally, you'll be in a good position asking for a reduction somewhere in the 5% to 15% range. The sweet spot really depends on what’s happening in your local market, how much demand there is for units like yours, and frankly, how good of a tenant you’ve been.

If you’ve found a handful of comparable apartments nearby that are renting for 10% less than your proposed renewal, you've got a fantastic, data-driven starting point for the conversation.

Insider Tip: I always suggest asking for a little more than you actually want. If your goal is a $100 reduction, maybe ask for $150. This gives the landlord room to counter with a number like $125, and you both walk away feeling like you got a good deal.

What if My Landlord Flat-Out Refuses to Negotiate?

If you get a hard "no" and they won't budge on any of the other perks we talked about, it’s time to take a step back and look at the big picture. First, always thank them for their time. Keeping things positive is key, no matter the outcome.

Now, you have a choice. Is staying put worth the higher rent? Or could you genuinely save money by moving, even when you account for the hassle and cost of a new place?

- If you stay: No problem. Just keep being the great tenant you are. You can always gear up to negotiate again when the next renewal comes around.

- If you move: Make sure you give proper written notice according to the terms of your lease.

Can I Negotiate with a Big Property Management Company?

You absolutely can, but you might need to shift your strategy a bit. The person you’re talking to at a large corporation probably has less wiggle room on the monthly rent itself because they’re following corporate pricing rules.

But here’s what you need to remember: their job performance is measured by two big things—keeping apartments full and keeping turnover costs low. This is your leverage.

Instead of getting hung up on the monthly rent number, try negotiating for things they do have control over. You could have a lot more luck asking for a free month's rent on a new lease, getting them to waive the amenity fees for a year, or securing an included parking spot. Those concessions add up quickly and can save you just as much money in the long run.

Here at Collapsed Wallet, we’re firm believers that managing your money is about taking smart, practical steps. Negotiating your rent is one of the most powerful moves you can make, freeing up hundreds or even thousands of dollars for your other goals. For more real-world guides on budgeting, saving, and building a more secure financial life, check out the resources at https://collapsedwallet.com.