Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Deciding to open a savings account is one of the smartest first steps you can take in managing your money. It’s not just about stashing cash away; it’s about creating a dedicated space for your financial goals and making your money actively work for you. This simple action moves you from just holding money to intentionally building a more secure future.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your First Step Toward Financial Security

A savings account is more than just a bank account. Think of it as a fundamental tool for building financial stability. It draws a clear line in the sand between the money you spend day-to-day and the money you’re setting aside for what really matters.

Without that separation, it’s all too easy for money earmarked for a house deposit, an emergency fund, or that big trip to get eaten up by monthly bills. Your savings account is a safe house for your future, making it easy to see your progress and stay motivated.

The Power of a Dedicated Savings Space

I like to think of a savings account as the first solid block in your financial foundation. It gives you a buffer for life’s inevitable curveballs, meaning you won’t have to reach for a credit card when the car breaks down or the boiler gives up. The peace of mind that safety net provides is truly priceless.

Even better, a savings account puts your money to work by earning interest. It might not seem like much at first, but over time, your balance grows thanks to the magic of compounding—where you earn interest not just on what you put in, but on the interest you’ve already earned.

Opening a dedicated savings account is a conscious choice to put your financial well-being first. It’s a simple move with a huge impact on your ability to handle surprises and build wealth for the long haul.

In this guide, we’ll walk through every part of the process. I’ll show you exactly how to find and open a savings account that fits your goals, so you can feel confident and in control from day one.

Choosing the Right Savings Account for Your Goals

Let’s be clear: not all savings accounts are created equal. The “best” account is the one that fits your financial life—how you manage your money, what you’re saving for, and whether you prefer an app or a face-to-face chat. Picking the right one from the get-go makes a huge difference in how quickly your money grows.

And it’s a great time to be shopping around. The banking world is fiercely competitive right now. In 2024 alone, the global market for savings and checking accounts hit USD 407.9 billion, with projections soaring to USD 674.9 billion by 2033. For you, that competition translates into better rates, lower fees, and more features as banks fight for your business.

High-Yield Versus Traditional Accounts

Your first big decision is whether to go with a traditional, big-name bank or a newer online-only bank. This usually boils down to a trade-off between easy branch access and earning more interest.

- Traditional Savings Accounts: Think of the big banks you see on every street corner. They’re convenient, letting you walk in and talk to a teller anytime. The downside? Their interest rates are often so low they’re barely noticeable.

- High-Yield Savings Accounts (HYSAs): These are the workhorses of the savings world, typically offered by online banks. Because they don’t have the overhead of physical branches, they can pass those savings on to you in the form of much higher interest rates. The catch is you’ll manage everything through a website or mobile app. You can dig deeper into what a high-yield savings account is in our full guide.

My two cents? If your goal is to grow an emergency fund or a down payment as fast as possible, a high-yield account is almost always the way to go. The extra interest you’ll earn over a year can easily add up to hundreds of dollars.

To help visualize the options, here’s a quick rundown of what you’ll find out there.

Comparing Savings Account Types

| Account Type | Best For | Typical APY | Key Features |

|---|---|---|---|

| Traditional Savings | Everyday savers who value branch access and a relationship with a big bank. | 0.01% – 0.50% | Physical branches, in-person support, often linked to an existing checking account. |

| High-Yield Savings | Maximizing growth for goals like emergency funds or a house down payment. | 4.00% – 5.50%+ | Online-only access, high interest rates, excellent mobile apps, no/low fees. |

| Money Market Account | Savers who want a higher rate than traditional savings but need check-writing or debit card access. | 0.50% – 4.50% | Hybrid of savings/checking, may have higher minimum balance requirements. |

| Certificate of Deposit (CD) | Locking away a specific amount of money for a fixed term to earn a guaranteed rate. | 4.50% – 5.75%+ | Fixed term (e.g., 6 months, 1 year), penalties for early withdrawal, predictable returns. |

Choosing the right account type is the first step, but the devil is always in the details.

Understanding Key Account Features

Once you’ve narrowed down the type, it’s time to zoom in on the fine print. Three things can make or break your experience: the APY, hidden fees, and balance requirements.

- Annual Percentage Yield (APY): This is the number one thing to look at. It tells you how much interest you’ll earn in a year, including compounding. A higher APY simply means your money grows faster.

- Monthly Maintenance Fees: These are pure poison to your savings. A fee of $5 to $15 a month might not sound like much, but it can completely wipe out the interest you earn. Your goal should be to find an account with no monthly fees, or one where the fee is very easy to waive (like by setting up a direct deposit).

- Minimum Balance Requirements: Some accounts look great on the surface but will sting you if your balance drops below a certain amount. If you don’t maintain that minimum, you could get hit with a fee or lose your high interest rate. If you’re just starting out, this can be a real trap.

Matching the Account to Your Goal

Theory is great, but let’s see how this works for real people.

Scenario 1: The New Graduate

- Goal: Build a $5,000 emergency fund in 18 months.

- Top Priority: Maximum growth with zero fees.

- The Right Choice: An online high-yield savings account. The beefy APY will help her hit that goal much faster. Since this money is strictly for emergencies, she doesn’t need instant access from a physical branch.

Scenario 2: The Young Family

- Goal: A small, flexible fund for kid-related expenses like sports fees or school trips.

- Top Priority: Convenience and the ability to move money instantly.

- The Right Choice: A traditional savings account at the same bank where they have their checking account. Even if the APY is low, the ability to transfer money over in seconds to cover an unexpected expense is what really matters for this particular goal.

Get Your Paperwork in Order

Walking into the application process prepared is the secret to a headache-free experience. Seriously, having your documents ready beforehand can turn what feels like a chore into a quick, ten-minute task. This applies whether you’re clicking through an online form or sitting down with a banker in person.

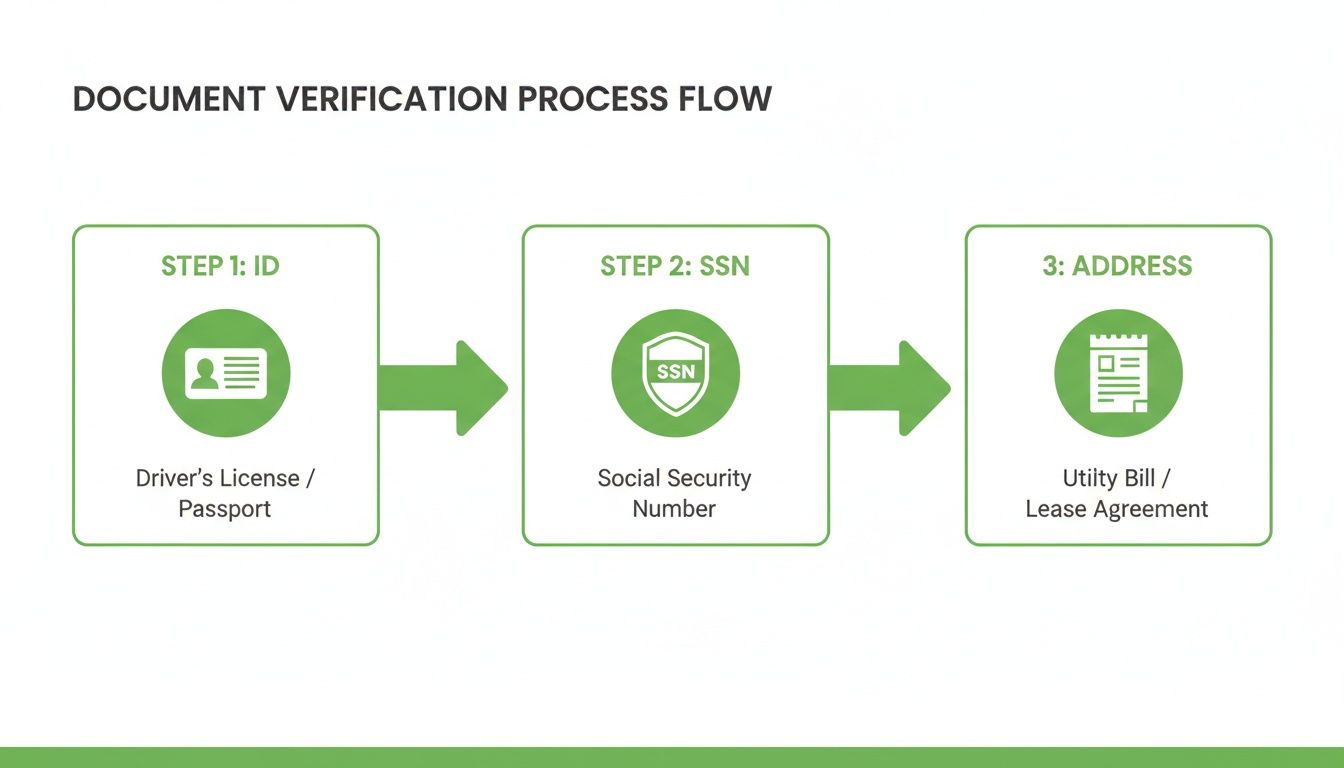

It might feel like banks are asking for a lot of personal info, but they’re not just being nosy. Federal law actually requires them to verify your identity. This is all part of a standard process known as Know Your Customer (KYC), which helps prevent fraud and protect everyone involved—including you.

The Must-Have Document Checklist

Think of these items as your fast pass to getting that account opened. Before you even start the application, make sure you have these on hand:

- A Government-Issued Photo ID: This is the big one. A valid driver’s license, state ID, or passport is what they’re looking for. Just double-check that it hasn’t expired!

- Your Social Security Number (SSN): You’ll need the full number. If you don’t have an SSN, some institutions will accept an Individual Taxpayer Identification Number (ITIN) instead.

- Proof of Your Physical Address: They need to confirm you live where you say you do. A recent utility bill, your lease agreement, or even another bank statement with your name and current address will do the trick.

The good news is that getting an account is more straightforward than ever, part of a global effort to make banking accessible to everyone. As of 2024, a record 79% of adults worldwide now have a bank account—a huge leap from just 51% back in 2011. It’s a clear sign that the old barriers are disappearing. You can dive deeper into these findings in the World Bank’s Global Findex Database 2025 report.

A Few Extra Things You Might Need

For most people, that core list is all it takes. But depending on your specific situation, you might be asked for a couple of extra documents. Knowing this ahead of time can save you from a stalled application or a second trip to the bank.

For example, if you’re not a U.S. citizen, you’ll likely need to provide your visa, foreign passport, or other immigration paperwork. It’s always a good idea to call the bank first and ask exactly what they need for your particular status.

My Two Cents: If you’re applying online, get your documents ready for their digital close-up. A clear, well-lit photo from your phone usually works perfectly. But if you’re going into a branch, always bring the originals, not copies.

And if you’re a student trying to open a special student account, you’ll probably need your student ID or proof of enrollment to snag those sweet perks, like waived monthly fees. A little bit of prep work makes all the difference.

The Application Process: Online vs. In-Branch

So, you’ve picked the perfect savings account. Now what? You’ve got two paths forward: applying online or walking into a physical branch. There’s no right or wrong answer here—it really just boils down to what you’re most comfortable with.

The online route is all about speed and convenience. Seriously, you can get it all done from your couch, often in less than 15 minutes. Digital-first banks have this down to a science, with slick, easy-to-follow applications.

On the other hand, nothing beats the personal touch of an in-branch visit. If you’re someone who likes to ask questions, feels a little unsure about the process, or just prefers a face-to-face conversation, this is the way to go. A banker can guide you through everything, making sure you understand all the details.

What to Expect When Applying Online

Opening a savings account online is designed to be as painless as possible. You’ll head to the bank’s website, find the “Open an Account” link, and dive into a straightforward digital form.

This is where you’ll enter the personal information you gathered earlier:

- Your full legal name and date of birth

- Current physical address and contact info (phone and email)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

After you’ve punched in your details, the bank will need to confirm you are who you say you are. This is usually pretty simple. You might have to upload a clear photo of your driver’s license or another government-issued ID. Some banks even have you snap a quick selfie with your phone to match your face to your ID photo for added security. The whole thing is surprisingly fast, and you can get approved almost instantly.

The In-Person Experience at a Branch

Going the traditional route and visiting a branch offers a more hands-on approach. You’ll get to sit down with a personal banker who will walk you through the very same application, but they’ll be right there to field any questions on the spot.

This is a huge plus if your situation is a little out of the ordinary—maybe you’re using an ITIN or want to talk through which savings account really makes the most sense for your specific goals. The banker can break down confusing terms, point out potential fees, and make sure you’re clear on the fine print before you commit.

No matter which path you take, the core requirements are the same, as you can see below.

As the chart shows, a valid ID, your social security number, and proof of your address are the non-negotiables for getting an account opened.

My Takeaway: It really is about personal preference. If you’re comfortable uploading documents and want the account opened now, online is your best friend. But if you value expert guidance and want your questions answered by a real person, heading to a local branch is the way to go.

If you already have a bank but are chasing a better interest rate, the sheer ease of online applications makes it simple to move your money. For more on that, take a look at our guide on the benefits of switching bank accounts to get a better deal.

Funding Your Account and Automating Your Savings

Congratulations, your new savings account is officially open! Getting the account set up is a huge first step, but the real journey begins now. An empty account won’t grow on its own, so the next move is to fund it and create a system to keep the momentum going.

Making that first deposit is usually the easy part. Banks give you plenty of flexibility here, so you can pick whatever works best for you.

The most common way is a simple electronic funds transfer (EFT) from your existing checking account. It’s usually free and takes just a few minutes through your bank’s website or app. You can also typically use mobile check deposit with your phone’s camera, or if you chose a bank with physical locations, you can always stop by to deposit cash or a check.

The Power of Paying Yourself First

Once your account has some cash in it, the real secret to building wealth isn’t about sheer willpower. It’s about automation. This is where the old advice to “pay yourself first” becomes your most powerful tool.

Instead of trying to save whatever is left over at the end of the month, you flip the script. Treat your savings like a non-negotiable bill that gets paid before anything else.

The most effective way to save is to make it invisible. By automating your contributions, you remove the daily decision-making and turn saving into a powerful, effortless habit that works for you in the background.

This one simple shift in mindset turns saving from a chore into a consistent habit. You’ll be building wealth without even thinking about it, which is the key to long-term success.

Setting Up Your Automatic Savings Plan

Putting this strategy into action is surprisingly simple. Just log in to your online banking and find the option for recurring transfers. Here’s how to make it stick:

- Align with Your Paycheck: Time your automatic transfer to happen the same day you get paid, or the day after. That way, the money is whisked away to your savings before you even have a chance to spend it.

- Start Small, Then Grow: You don’t need to shock your budget. Even $25 or $50 per paycheck is a fantastic start. The goal is to build the habit first. You can always increase the amount later as you get more comfortable.

- Use Technology to Your Advantage: Many modern banking apps have cool features to help you save more. Some round up your debit card purchases and transfer the spare change, while others analyze your spending to find extra cash. To see what’s out there, check out our guide to the best savings apps that can help you hit your goals faster.

By making your savings automatic, you’re not just hoping you’ll save—you’re ensuring it. It’s the most reliable way I know to turn those big financial dreams into reality.

Got Questions? Let’s Get Them Answered

Even with a solid plan, a few questions always seem to pop up right when you’re about to pull the trigger on a new savings account. Don’t worry, that’s completely normal. Let’s tackle some of the most common ones I hear so you can move forward with confidence.

What if I Have Bad Credit? Can I Still Open a Savings Account?

Yes, you almost certainly can. This is a huge misconception. When you open a savings account, banks aren’t lending you money, so they don’t really care about your credit score. They won’t run a hard credit check like you’d see with a credit card or a loan application.

What they might do is look at your banking history through a service like ChexSystems. This report just shows if you have a history of things like bouncing checks, unpaid bank fees, or account fraud. As long as that record is relatively clean, a low credit score won’t stop you.

How Much Cash Do I Actually Need to Get Started?

This is another common worry that stops people before they even start, but the answer is often way less than you think. In fact, many of the best high-yield savings accounts today, especially from online banks, have no minimum deposit at all. You can literally open an account with $0 and set up your first transfer later.

Some of the big, traditional banks might still ask for an initial deposit, but it’s usually a pretty manageable amount, like $25 or $100. The trick is to just check the account details before applying—there are tons of fantastic no-minimum options out there.

The most important thing isn’t how much you start with, but that you start. Opening the account is the first and most critical step in building a savings habit.

Should I Just Stick With My Current Bank or Go Somewhere New?

This really boils down to convenience versus getting the best return on your money.

Opening a savings account at the bank where you already have a checking account is, without a doubt, the easiest option. You can link accounts instantly and see everything in one dashboard. It’s simple.

But—and this is a big but—your current bank is almost guaranteed to offer a rock-bottom interest rate. A separate online bank will almost always offer a much, much higher Annual Percentage Yield (APY). Over time, that difference adds up to a lot of free money. For a long-term goal, taking 15 minutes to set up an account at a new bank is one of the smartest financial moves you can make.

Is It a Good Idea to Have More Than One Savings Account?

There’s no magic number, but I’m a huge fan of having multiple savings accounts. It’s an incredibly effective way to organize your financial life. Think of it as giving every dollar a specific job.

This strategy is sometimes called the “sinking funds” method. You could open separate, dedicated accounts for different goals, like:

- Your Emergency Fund: The non-negotiable safety net.

- A Vacation Fund: So you can pay for your trip in cash.

- A Down Payment Fund: For a future car or home.

When you separate your savings like this, you know exactly how much you have for each goal. It keeps you motivated and stops you from accidentally dipping into your emergency fund to pay for a weekend getaway. It’s all about clarity and focus.

At Collapsed Wallet, our goal is to give you the clear, practical guidance you need to build a stronger financial future. To continue your journey with actionable tips and insights, visit us at https://collapsedwallet.com.