Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Feeling the pinch from rising food costs? You’re not alone. But getting a handle on your grocery spending is absolutely possible, and it doesn't mean you have to become an extreme couponer. The secret isn't one big trick; it’s about making a series of smart, intentional choices that add up to significant savings, freeing up capital for your journey towards financial freedom.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your Financial Game Plan for Slashing Grocery Costs

If you're looking to free up cash in your budget for savings or investments, your grocery spending is one of the best places to start. It’s one of the few major variable expenses where you have significant control each week. Many of us just accept rising prices as inevitable, but with a proactive financial strategy, you can take back control and reduce financial worries.

This isn't about a total overhaul overnight. It’s about building small, sustainable financial habits that work together. Think of it like this: by focusing on planning, smarter purchasing techniques, and cutting down on waste, you create a system that consistently keeps more money in your pocket to fuel your long-term goals.

To give you a bird's-eye view, here are the foundational strategies we’ll be covering. Mastering these pillars is the key to making a real, lasting impact on your grocery spending and, ultimately, your financial well-being.

Core Strategies to Reduce Your Grocery Bill

| Strategy Pillar | Key Actions | Potential Impact on Budget |

|---|---|---|

| Meal Planning & Budgeting | Create a weekly meal plan, set a firm budget, and track every dollar you spend. | High. This is the foundation for all other savings, easily cutting 15-25% off your bill. |

| Smart Shopping Tactics | Shop with a list, compare unit prices, leverage loyalty programs, and choose the right stores. | Medium to High. Combining these tactics can save an additional 10-20%. |

| Bulk Buying & Storage | Purchase non-perishables and frequently used items in bulk. Learn proper storage. | Medium. Can reduce costs on staple items by 20-30% over time. |

| Minimizing Food Waste | Use leftovers, understand expiration dates, and shop your pantry first to reduce sunk costs. | High. The average family wastes a lot of food; saving it can cut your bill by up to 25%. |

As you can see, these pillars aren't just isolated tips; they're parts of a complete system for managing your food expenses and achieving financial freedom.

A solid grocery plan doesn't just save you money—it reduces financial stress. When you eliminate daily spending uncertainty, you reclaim mental energy you can put toward other financial goals.

This guide will give you the tools to build that plan. As you put these ideas into practice, you’ll watch your grocery bill drop, building momentum toward your bigger financial goals. And to help you stock your pantry without breaking the bank, we've put together an inexpensive healthy grocery list to get you started on the right foot.

Master Your Meal Plan and Shop with Purpose

The battle against a sky-high grocery bill is won or lost long before you ever grab a shopping cart. Seriously. The most powerful weapon you have is a solid plan. This simple shift in thinking turns a dreaded weekly chore into a proactive financial strategy that saves you real money and cuts down on financial stress.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Build Your Financial Defense at Home

Having a vague idea of what you’ll consume this week just doesn't cut it. A real meal plan is your spending blueprint. It forces you to "shop" your own kitchen first—reviewing the pantry, freezer, and fridge for assets you already have before you even think about buying more. This one habit alone stops you from buying duplicates and drastically reduces food waste, which is a direct financial loss.

Start by sketching out your dinners for the week. Be realistic about your schedule. Planning ahead is what prevents those last-minute, wallet-draining convenience purchases. For some great, family-friendly ideas that are cost-effective, check out our guide on meals on a budget for 4.

This isn't about creating a rigid, joyless schedule. Think of it as a flexible financial framework. It gives every dollar a job, taking the guesswork out of your grocery trip and stopping overspending in its tracks.

From Meal Plan to Mission-Driven Shopping List

Once you know what you're making, the shopping list almost writes itself. This list is your shield against the temptation of impulse buys—all those little extras that stores are experts at getting you to grab. Did you know that unplanned purchases can bloat your grocery bill by as much as 23%? A focused list keeps you on mission.

This disciplined approach also tackles the massive problem of food waste. It’s shocking, but up to 40% of the food supply in the U.S. goes uneaten, which is like throwing cash directly into the trash. A tight list means you buy only what you need.

Here’s a pro tip: Organize your list by the store's layout—produce, dairy, meat, pantry aisles. This makes your trip more efficient and keeps you from wandering, which is when those unplanned items sneak into your cart and derail your budget.

The Art of Strategic Bulk Buying

Buying in bulk can be a game-changer for your budget, but you have to be smart about it. It’s not about buying a giant version of everything. It’s about being selective to maximize your return on investment.

Focus your bulk-buying power on items with a long shelf-life that you know you'll use:

- Pantry Staples: Items like rice, pasta, oats, and beans are perfect candidates.

- Household Necessities: You're always going to need paper towels, trash bags, and cleaning supplies.

- Freezer-Friendly Foods: When you see a great sale on meat or bread, buy extra and freeze it to lock in the lower price.

The trick is to know a true bargain from a future food-waste problem. Always, always check the unit price (the cost per ounce, pound, or item) to make sure the bigger package is actually cheaper. When you combine a clear meal plan with a strategic shopping list, your kitchen becomes a well-oiled, money-saving machine.

Use Technology to Outsmart the Supermarket

Your smartphone is one of the most powerful tools you have for cutting down your grocery bill. Think of it less as a distraction and more as your secret weapon for turning a weekly chore into a precise, money-saving mission. A little bit of tech can help you stick to your budget and find savings you might have otherwise missed, helping you escape financial worries.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Apps That Keep Your Budget in Check

Let's be honest, it's easy to lose track of spending once you're in the store. This is where a good budgeting app can be your financial guardrail. Before you even walk out the door, you can plug your total spending limit for that trip right into the app.

As you move through the aisles and place items into your cart, you simply scan the barcode or input the price. The app keeps a running total in real-time, so you always know exactly where you stand. No more sticker shock at the register. Some apps will even notify you when you're approaching your limit, giving you a chance to reassess your purchases.

Using an app to track your spending as you shop takes all the guesswork out of it. Your budget is no longer just a number you hope to hit; it becomes a concrete tool you're using in the moment to make smarter financial decisions.

The Financial Upside of Shopping for Groceries Online

If you haven't tried online grocery shopping yet, you might be surprised at how much it can help your budget. Physical stores are masterfully designed to get you to spend more—from the tempting displays at the end of every aisle to the impulse items in the checkout line. Shopping from your couch strips all of that away.

It also makes comparing prices ridiculously easy. You can flip between different brands or check the weekly ads for several stores without burning gas driving all over town. That kind of transparency is key to making sure you're getting the best deal on everything on your list.

This isn't just a small trend, either. Online platforms have totally changed the game. It’s a hugely effective way to reduce grocery bills, which is why in the U.S., about 61% of households are now buying groceries online. Sales are on track to blow past $300 billion by 2025. This digital shift makes it simple to apply digital coupons, compare retailer prices, and dodge those in-store impulse buys. If you're curious, you can dig into more online grocery shopping statistics on wavegrocery.com.

By planning your online orders to hit the free delivery minimum, you're not just getting convenience—you're making a smart financial move. It shifts grocery shopping from a reactive chore to a proactive part of your financial strategy, putting you firmly back in control.

Become a Smarter Shopper by Choosing Your Store Wisely

Where you do your grocery shopping can make or break your budget. It's a detail many of us overlook, but the store you choose can be just as impactful as the items you put in your cart. Making a conscious decision about where you shop is a powerful, foundational step in your plan to reduce grocery bills.

The difference between a discount grocer and the big-name supermarket down the street isn't just about the logo on the sign; it's about two completely different business models that directly impact your final receipt.

Discount Chains Versus Traditional Supermarkets

Discount grocery stores are built for pure efficiency. You'll typically find a more limited selection, a heavy focus on their own store brands, and sometimes you even bag your own groceries. This no-frills approach cuts their overhead, and those savings get passed directly to you. For pantry staples and everyday items, their value is tough to beat.

Traditional supermarkets, in contrast, offer a massive variety of brands, more prepared food options, and a full-service experience. It’s convenient, but that convenience comes with higher operational costs. In the end, you’re the one paying the premium for all that choice and ambiance at the checkout.

By simply switching my primary grocery store to a discount chain for staples like pasta, canned goods, and produce, I can consistently cut 10-15% off my total bill. I still visit a traditional store occasionally for specific items, but the bulk of my shopping is done where the prices are lowest, freeing up capital for other financial goals.

Understanding Global Trends and Local Prices

The prices on the shelves aren't just pulled out of thin air; they're influenced by major economic forces happening around the globe. Keeping a loose pulse on these trends can help you make smarter financial choices.

For example, global trade and inflation are always shaping food costs. The FAO Food Price Index saw a 7.6% year-on-year jump in July 2025, mostly because of rising meat and vegetable oil prices. An experienced shopper sees that and knows to lean more heavily on categories with stable pricing, like fresh vegetables, which are expected to hold steady. Being aware of these shifts is a huge part of building financial resilience. You can dive deeper into global grocery sector trends on expoworldfood.com.

The right store for you depends entirely on what you're buying. Here’s a quick breakdown to help you decide where to go for what.

Grocery Retailer Format Comparison

| Retailer Type | Primary Advantage | Best For | Potential Drawback |

|---|---|---|---|

| Discount Grocers | Lowest overall prices | Pantry staples, produce, private-label goods | Limited brand selection, fewer services |

| Traditional Supermarkets | Wide variety & convenience | Specialty items, specific brands, one-stop shopping | Higher prices on everyday items |

| Warehouse Clubs | Lowest unit price (bulk) | Non-perishables, household supplies, large families | Requires membership fee, large quantities |

| Farmers Markets | Fresh, local, high-quality | In-season produce, specialty artisanal goods | Can be more expensive, limited hours |

Ultimately, many people find a hybrid approach works best—hitting up a discount store for the basics and a traditional supermarket for everything else.

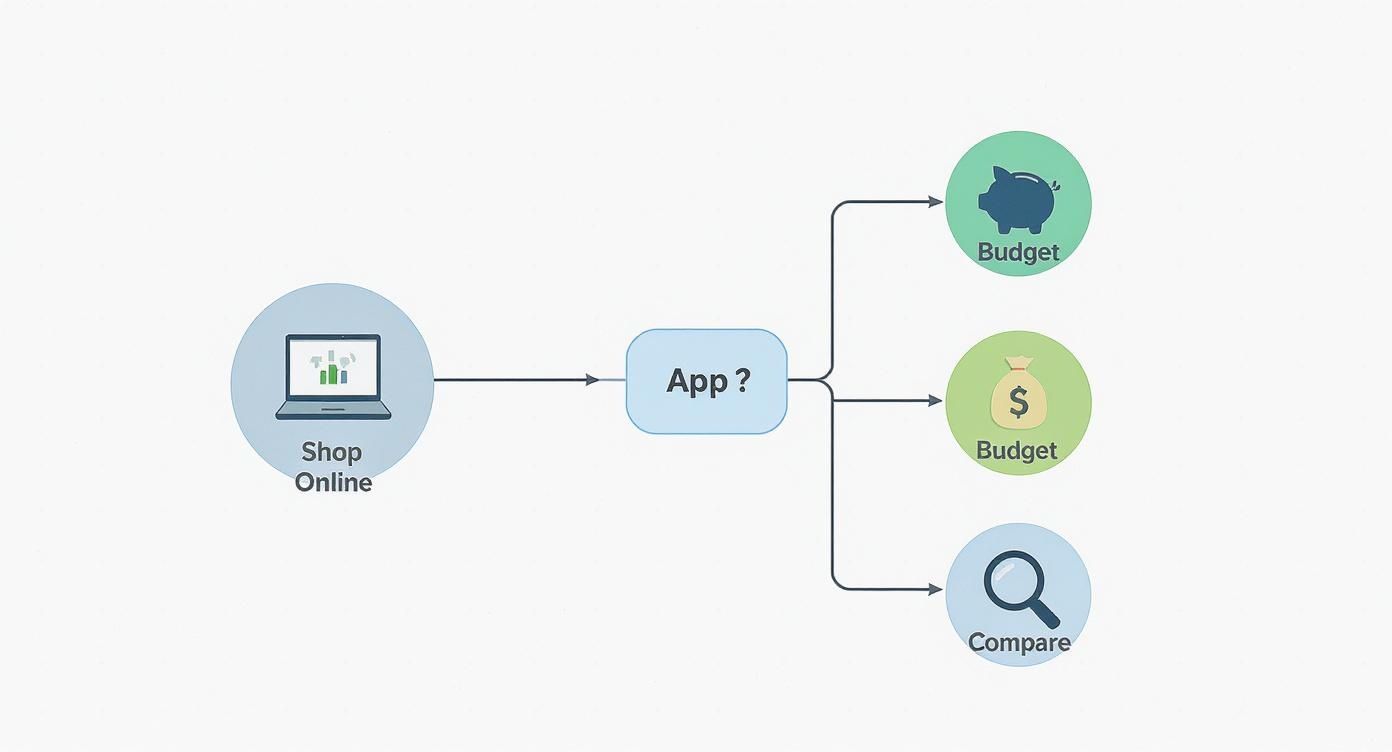

This decision tree shows how you can use technology, like budgeting apps or online comparison tools, to guide your shopping choices and stay on track.

Whether you’re using an app on your phone or comparing prices on a website, the takeaway is the same: technology gives you powerful tools to stick to your budget. An informed shopper is an empowered one, well on the way to achieving financial freedom.

Make Your Grocery Savings Work for You

https://www.youtube.com/embed/NrBGpHkRYe4

Chopping your grocery bill is a fantastic start, but the real power move is allocating those saved funds with intention. The money you save isn't just "extra cash" floating around in your account; it’s the raw material for hitting your biggest financial goals. This is how you turn a simple household habit into a serious wealth-building engine.

Calculate and Redirect Every Penny

First things first: you need to see the savings to believe them. At the end of the month, sit down and compare your new, leaner grocery spending with your old average.

Let's say you spent £400 this month instead of your usual £550. That £150 difference isn't just a number—it's capital. You earned that.

Now, give that £150 a mission. If you just leave it in your current account, it will get swallowed up by other random expenses. You need to move it. This is a perfect use case for a sinking fund, which is just a fancy name for a pot of money set aside for a specific goal. If you're new to the idea, you can learn more about what is a sinking fund and see how simple it is to set up.

By physically moving the money, you're making a conscious choice to pay your future self first.

Put Your Savings to Work

Once you've captured your savings, you have some powerful options. Where you send the money depends entirely on your personal situation and what financial goals are your top priority.

Here are a few high-impact strategies for that extra cash:

- Attack Your Debt: Throwing an extra £150 a month at a credit card, car loan, or mortgage principal can be game-changing. It can literally shave years off your repayment time and save you a fortune in interest.

- Feed Your Investments: Consistently adding that saved money to a low-cost, diversified ETF (Exchange-Traded Fund) puts compound interest on your side. It’s the closest thing to magic in finance—your money starts making its own money.

- Build a Financial Firewall: If you don't have three to six months of living expenses tucked away, your grocery savings should go straight into an emergency fund. This buffer is what stands between an unexpected bill and total financial panic.

The Staggering Power of Compounding

Let’s zero in on the investing option for a second. It's easy to dismiss small amounts, but investing just £150 a month is a bigger deal than you think.

Picture this: you take that £150 saved from your groceries each month and invest it in an ETF that averages a 7% annual return. After 10 years, you would have put in £18,000, but your account could be worth over £26,000. Stick with it for 20 years, and your £36,000 investment could balloon to over £78,000. That's the compounding engine firing on all cylinders.

This shows how a small, consistent change in your shopping habits can directly build significant wealth over time. You're not just saving £150 a month; you're building a more secure, prosperous future for yourself. It reframes the whole effort—you’re no longer just trying to reduce grocery bills, you’re actively funding your financial freedom, one shopping trip at a time.

Answering Your Top Questions About Slashing Grocery Costs

As you start using these strategies, you're bound to have a few questions. That's totally normal. Getting those questions answered is the key to turning a good idea into a long-lasting habit that saves you real money and helps you escape financial worries. Let's tackle some of the most common things people ask when they get serious about cutting their grocery bills.

How Much Can I Realistically Expect to Save?

This is always the first question, and the honest answer is: it really depends. If you're coming from a place of zero financial planning and just winging it at the store every week, you could easily see a 20-30% drop in your spending pretty quickly. For those who are already pretty mindful but want to optimize, a 10-15% reduction is a solid, sustainable goal.

Of course, your household size, where you live, and any special dietary needs will shape the final numbers. A family of five will save a much larger dollar amount than a single person, even if the percentage is the same.

The most important thing is consistency over perfection. Don't feel like you have to do everything perfectly from day one. Just applying a few of these ideas week in and week out will add up to a huge difference over the year in your journey to financial freedom.

What Are the Best Apps for Grocery Budgeting?

The best app is always the one you'll actually use. It’s less about the specific brand and more about finding a tool that fits your financial management style. Most of these apps fall into three main camps.

- Simple Budget Trackers: These are great for building awareness. You set a spending limit and log what you spend. It’s a straightforward way to see where your money is going and stop yourself from going over budget at the checkout.

- Meal Planners with Shopping Lists: If you like to plan, these are fantastic. They help you organize your week and automatically generate a shopping list, taking a ton of the grunt work out of the process.

- Cashback and Loyalty Apps: These tools do the deal-hunting for you. They pull in digital flyers, store loyalty points, and find cashback offers, which can automate a big chunk of your savings without much effort.

Think about your personality. If planning is your jam, go for a meal planner. If you just need to stick to a number, a simple tracker will do the trick.

Is It Better to Shop Weekly or Monthly?

There’s no magic answer here—it’s all about what works for your lifestyle and financial discipline. Both have their pros and cons.

Shopping every week is perfect for keeping fresh produce on hand and helps you avoid buying more than you can use before it goes bad. The downside? More trips to the store mean more temptations and more chances for impulse buys if you're not super disciplined with your list.

Big monthly or bi-weekly hauls are a planner's dream, especially if you have a deep freezer or a big pantry. You save time and gas, and it forces you to be incredibly organized. The risk is misjudging what you’ll need and either running out of something critical or buying way too much of an ingredient you won't use up. The right rhythm is whatever helps you stick to your meal plan and stay in control of your budget.

Here at Collapsed Wallet, our entire mission is to give you clear, no-nonsense advice for mastering your money. To keep learning and find more ways to make your money work harder for you, check out our other guides and resources. You can find out more at https://collapsedwallet.com.

1 thought on “how to reduce grocery bills: Smart savings tips”