Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

If you want to really know how to save money on groceries, the secret isn’t just about chasing sales or clipping coupons. The real magic happens when you get a handle on your spending with a solid financial plan. A dedicated grocery budget is your best tool for this, turning a wild, unpredictable expense into something you can actually control. It’s the foundation that makes every other money-saving trick work.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Build Your Financial Foundation with a Grocery Budget

Most people jump straight to deal-hunting when they think about cutting grocery costs. But the real power move? It starts with your budget. Without a clear plan, those little “I’ll just grab one thing” trips to the store add up fast, silently sabotaging your financial goals.

A grocery budget isn’t about depriving yourself; it’s about empowerment. You’re telling your money where to go, instead of wondering where it went. This single step allows you to consciously funnel cash toward what truly matters, whether that’s crushing debt, building up an emergency fund, or investing in your future.

Uncovering Your True Grocery Spending

First things first: you need to know what you’re actually spending. Most of us have a number in our head, but it’s often a wild underestimate. We remember the big weekly shop but conveniently forget the mid-week runs for milk, the last-minute pizza ingredients, or the pricey corner store snacks.

To get the real story, you have to play detective with your own finances. Pull up your bank and credit card statements from the last one to three months. Add up every single purchase from supermarkets, local grocers, and farmers’ markets. The final number might be a bit of a shock, but that’s okay. This is your baseline—the starting line for making real change.

Getting comfortable with this process is key. If you’re new to this, learning how to track your expenses is a game-changer for building good financial habits.

Setting a Realistic and Actionable Budget

Now that you have your number, it’s time to set a new, achievable target. If you set your budget too low, you’re setting yourself up to fail. You’ll get frustrated and give up.

A great place to start is aiming for a 10-15% reduction from your current average. So, if you’re spending around $600 a month, a new goal of $510-$540 is totally doable without feeling like you’re surviving on ramen noodles.

You can break this down weekly or monthly—whatever fits your pay schedule and brain best. I find that a weekly budget feels less overwhelming and easier to stick to.

A budget isn’t just about limiting spending; it’s about giving every dollar a job. When you assign a specific role to your grocery money, you’re actively choosing to prioritize your long-term financial well-being over short-term impulse buys.

To stay on track, you don’t need fancy software. Simple tools work wonders:

- A basic spreadsheet: Just put your budget at the top and subtract every grocery purchase. Simple and effective.

- Budgeting apps: Apps like YNAB or Mint can automatically sync with your bank and do the tracking for you.

- The envelope system: The old-school classic. Withdraw your grocery cash for the month and put it in an envelope. When it’s gone, it’s gone.

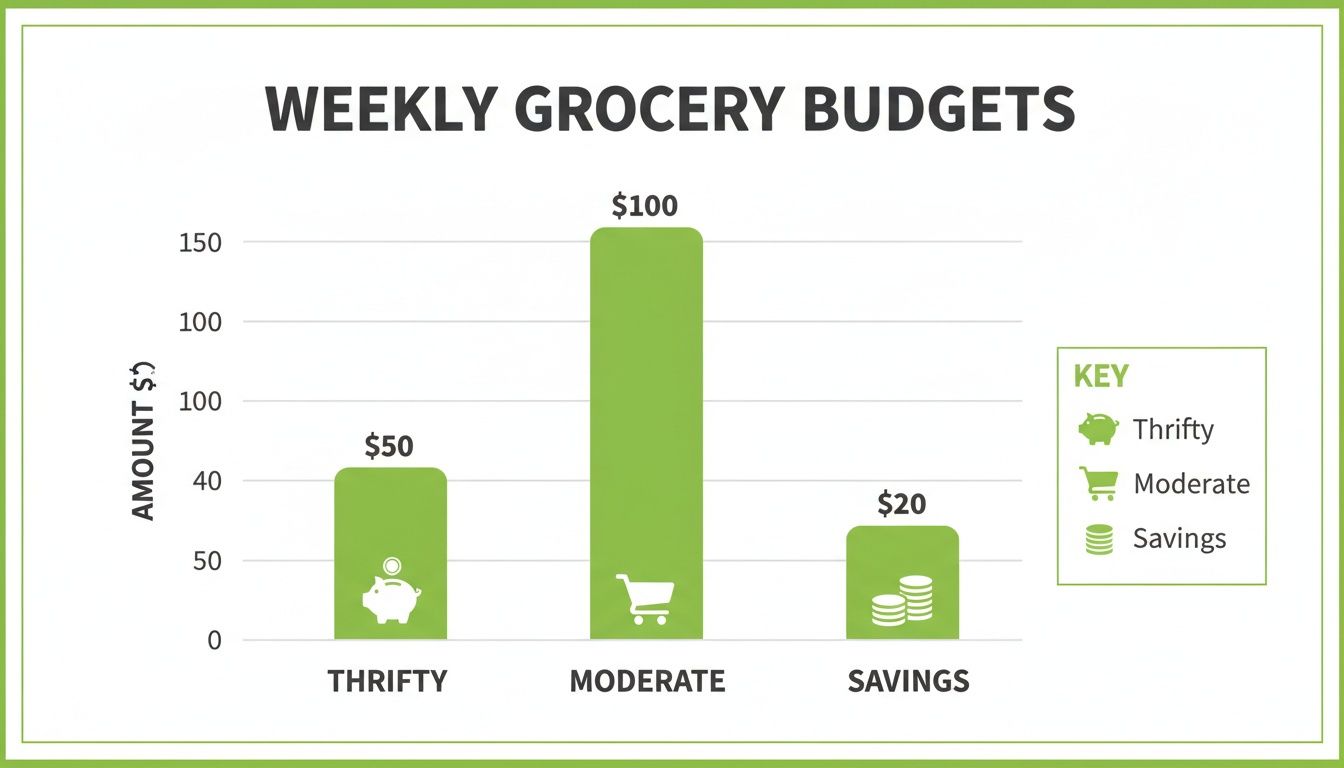

To give you a clearer picture, I’ve put together a table with some sample budgets. Think of these as a starting point to help you find what works for you.

Sample Weekly Grocery Budgets to Get You Started

| Household Type | Thrifty Budget | Moderate Budget | Potential Annual Savings |

|---|---|---|---|

| Single/Student | $50/week | $75/week | $1,300 – $2,600+ |

| Couple | $90/week | $130/week | $2,080 – $4,160+ |

| Family of Four | $150/week | $220/week | $3,640 – $7,280+ |

Note: These figures are estimates. Your actual costs will vary based on your location, dietary needs, and local prices. The key is to find a number that challenges you but is still realistic.

This chart shows just how powerful small, consistent changes can be.

As you can see, even a “moderate” budget can free up a surprising amount of cash over a year. It’s not about a massive, painful overhaul—it’s about making smart, intentional choices every time you shop.

The Strategic Shopper’s Playbook: Win Before You Leave Home

Here’s a secret many people overlook: the battle for your grocery budget is won or lost before you even grab a shopping trolley. The biggest savings don’t come from a coupon you clip in the aisle; they come from the prep work you do in your own kitchen.

These aren’t just chores. Think of them as pre-shopping rituals that build a financial game plan, protecting you from impulse buys and needless waste.

The insights and tips we share on this blog are for general guidance and educational purposes. This isn’t professional financial advice. Any actions you take are your own, and if you need advice for your specific situation, we highly recommend chatting with a qualified financial adviser.

By taking just a few minutes to get organized, you can walk into any supermarket with the confidence of a pro, knowing exactly what you need and what you should be paying for it. It turns a mundane task into a powerful move toward your financial goals.

First, Take Stock of What You Already Own

Before you even dream of what to buy, you need to know what you have. This means a quick scan of your pantry, fridge, and freezer—no exceptions. How many times have you come home with a new jar of mayonnaise only to find two already hiding at the back of the fridge? It happens to the best of us.

This simple habit is your first line of defence against duplicate purchases, which are sneaky little budget-killers. It also helps you spot items nearing their best-before date, so you can plan to use them up first and cut down on costly food waste.

This “shop your kitchen first” mentality is a game-changer. You start building meals around ingredients you’ve already paid for, which drastically shrinks your shopping list and frees up cash for other things.

Master the Art of the Strategic Shopping List

Okay, inventory done. Now it’s time to build your shopping list. This isn’t a random collection of cravings; it’s a strategic document built from what you have and what you plan to eat this week.

A well-crafted list is your shield against the marketing tricks designed to make you spend more. With a clear plan, you’re far less likely to get sidetracked by flashy end-of-aisle displays or “special offers” on things you don’t actually need.

Your list is your script. Your mission: get in, get only what’s on the list, and get out. Every single item that goes into your trolley should have a job to do in a planned meal. If you want to really nail this, our guide on budget-friendly meal planning shows you exactly how to connect your meals with your money goals.

A shopping list without a meal plan is just a wishlist. To truly save money on groceries, every item you buy must have a purpose. This simple shift in mindset moves you from a reactive consumer to a proactive financial planner.

This process ensures every dollar you spend is an investment in meals you’ll actually eat, not just ingredients that will sit there until you throw them out.

Use Digital Tools to Compare Prices

Years ago, comparing prices meant driving to different stores or sifting through a pile of paper flyers. Today, technology has made this incredibly easy, putting powerful financial tools right in your pocket.

Before you decide where you’re going, spend a few minutes browsing digital flyers and store apps. Most big supermarkets put their weekly deals online, so you can quickly see who has the best price on your must-have items.

A few things to check:

- Store Apps: Make sure you’ve downloaded the apps for your local supermarkets. They often have exclusive digital coupons and loyalty offers you won’t find anywhere else.

- Flyer Comparison Websites: Use sites or apps that pull all the weekly flyers together. In seconds, you can see which store has the cheapest chicken, milk, or avocados this week.

- Loyalty Programs: Check that your loyalty accounts are active. The best deals are often reserved for members, and it costs nothing to sign up.

Doing this quick digital check-in helps you strategically pick the best store for this week’s list. It’s a small investment of time that can lead to some seriously big savings over the year, getting you closer to where you want to be financially.

Mastering the Aisles for Maximum Savings

The moment you walk through those automatic doors, you’re on a carefully crafted battlefield. Supermarkets are masters of psychology, using everything from the calming music to the strategic placement of pricey items at eye level to nudge you toward spending more. Every detail is designed to trigger an impulse buy.

But you can absolutely win this game. With a bit of prep and a few savvy tactics, you can navigate the aisles on your own terms and turn every trip into a financial victory. This is where your budget and shopping list become your shield, helping you cut through the marketing noise and stay focused on your mission: getting the best value for every dollar. If you find yourself tempted by shiny displays, our guide on how to stop impulse buying can help you build up that resistance.

Decode the Price Tag with Unit Pricing

One of the most powerful tools in the store is hiding in plain sight: the unit price. It’s that tiny print on the shelf tag that most people ignore. While the big, bold number screams the total cost, the unit price whispers the real cost—breaking it down by weight or volume (like per 100g or per litre).

This little number is your secret weapon for making true apples-to-apples comparisons. Is the bigger box of cereal actually a better deal? The unit price will tell you. Sometimes, you’ll find that two smaller, on-sale containers are cheaper than the jumbo “family size.” Getting into the habit of checking the unit price empowers you to spot genuine value, saving you money on dozens of items every single trip.

By focusing on the unit price, you shift your mindset from buying products to buying value. This small change in perspective can lead to hundreds of dollars in savings annually, money that can be reallocated to debt repayment or investments.

Embrace Store Brands for Big Savings

So many of us grab name brands out of pure habit, but switching to store brands (sometimes called private label) is one of the fastest ways to slash your grocery bill without noticing a difference in quality.

For pantry staples like flour, sugar, canned goods, and pasta, the store brand is often made in the exact same facility as its famous-brand cousin. The only real difference is the label and the price tag, which can be 20-40% lower.

Just look at how quickly it adds up on a few common items:

| Item | Name Brand Price | Store Brand Price | Potential Savings |

|---|---|---|---|

| Cereal | $4.50 | $2.75 | $1.75 |

| Pasta Sauce | $3.75 | $2.25 | $1.50 |

| Cheese | $5.00 | $3.50 | $1.50 |

| Canned Beans | $1.50 | $0.90 | $0.60 |

| Total | $14.75 | $9.40 | $5.35 |

That’s over $5 saved on just four things. Imagine applying that strategy across your entire shopping cart—the savings become significant, fast.

Be Smart About Loyalty Programs and Sales

Loyalty programs can be great for snagging exclusive discounts, but remember, they’re also designed to make you spend more. The key is to use them strategically. Sign up for the programs at stores you already shop at, but only buy what’s on your list, no matter how tempting a “members-only” deal seems.

Think of weekly sales flyers as your guide, not your boss. Let the sales dictate your meal plan, especially for big-ticket items like meat and produce. If chicken breast is deeply discounted, that’s your cue to plan a few chicken-based meals. And when non-perishable staples you use all the time go on sale, that’s the time to stock up.

This approach also applies to where you shop. With grocery inflation becoming a major concern for 70% of U.S. shoppers, switching to discount grocers is a no-brainer. With the average household spending around $170 a week, even a modest 10-20% savings from shopping smarter could put an extra $880 to $1,760 back in your wallet every year.

Let Technology Do the Heavy Lifting for You

Think of your smartphone as more than just a way to stay connected—it’s one of the best savings tools you own. The right apps and a smart online strategy can turn every grocery run into a chance to get cash back, pushing you closer to your financial goals without much extra effort.

This isn’t your grandma’s coupon clipping. We’re talking about simple, smart tech that works in the background to make saving a natural part of your shopping routine.

Put Savings on Autopilot with Cashback Apps

Cashback and rebate apps have completely changed how we save. The idea is brilliant in its simplicity: you buy what you were already going to buy, and they give you a slice of that money back. It’s a direct discount on your food costs.

These apps partner with countless brands and stores, offering rebates on everything from fresh produce to your favorite snacks. All you have to do is activate the offers, shop like you normally would, and then snap a quick picture of your receipt to claim your cash.

The real beauty of these apps is how little effort they take. A few minutes scanning a receipt after a shopping trip can easily put $20, $30, or even more back in your pocket each month. Over a year, that adds up to a few hundred dollars you can use to crush debt, build up your emergency fund, or kickstart an investment.

Master the Art of “Deal Stacking”

Ready to take your savings to the next level? It’s time to learn about deal stacking. This is the secret sauce for paying the absolute lowest price possible by layering multiple discounts on the same item.

Here’s how it works: you combine a store’s sale price, a digital manufacturer’s coupon from the store app, and a cashback rebate from a third-party app.

For example, a jar of pasta sauce is on sale for $2.50 (usually $4.00). The store’s app has a digital coupon for $0.50 off. Then, your favorite cashback app is offering a $0.75 rebate on that exact sauce. By stacking all three, your final cost plummets to just $1.25. That’s a huge win.

The key to pulling this off is a little bit of planning. Before you head to the store, cross-reference the weekly sales flyers with your go-to apps. This transforms your shopping from a simple errand into a strategic mission.

Here’s your game plan:

- Start with the Sales Flyers: See what’s on deep discount at your store.

- Check the Store App: Hunt for digital coupons that match those sale items.

- Open Your Cashback Apps: Find rebates for the same products on your list.

- Combine and Conquer: Apply the discounts at checkout, then scan your receipt for the rebate later.

Why Shopping for Groceries Online is a Budgeting Game-Changer

Shopping online isn’t just about convenience; it’s a surprisingly powerful tool for sticking to your budget. When you’re in the store, it’s easy to get sidetracked by tempting end-cap displays or those last-minute impulse buys at the checkout counter. Online shopping cuts out all that noise.

You can see your cart’s total add up in real-time, making it painfully obvious when you’re about to go over budget. If the number gets too high, you can easily remove an item or two before you click “buy”—something that feels a lot harder to do when you have a physical cart full of food. Plus, comparing unit prices between different brands and sizes is a breeze online, so you know you’re getting the best deal.

Building your meal plan around sales is a proven strategy. With the average U.S. household now spending $170 on groceries each week and 70% of shoppers worried about rising prices, every dollar saved makes a difference. In fact, recent data shows a 21% increase in consumers noticing grocery promotions, which means stores are fighting for your business.

By planning your meals based on the weekly ads, you can realistically slash your bill by 20-30%. For that average $170 shopping trip, that’s a savings of $34-$51 every week. That could add up to $2,652 a year—a serious chunk of change. If you’re curious, you can learn more about modern grocery shopper trends and how they affect your wallet.

Post-Shopping Habits That Protect Your Budget

Your money-saving work isn’t over when you walk out of the grocery store. Far from it. What you do at home—the habits you build in your own kitchen—is just as crucial for making sure every dollar you spent was worth it. This is where you turn groceries into meals instead of letting them become expensive food waste.

Think of it this way: your kitchen is the last line of defense for your budget. The way you store, prep, and manage your food directly dictates how much you actually save and how soon you have to go back to the store. A few smart routines can slash your waste and stop you from caving to pricey takeout orders.

Smart Storage for Maximum Shelf Life

The minute you get home and start unpacking, you have an opportunity to save money. Storing food correctly is a simple, yet powerful, way to protect your investment. Let’s be honest, improper storage is a silent budget killer, causing good produce to wilt and other items to spoil before you ever get a chance to use them.

Making a few small tweaks can have a huge impact:

- Herbs and Leafy Greens: I treat fresh herbs like a bouquet of flowers—it sounds fancy, but it works. Just place them stem-down in a jar with a bit of water, cover them loosely with a plastic bag, and pop them in the fridge. For greens like spinach or lettuce, storing them in a container with a paper towel keeps them from getting slimy by absorbing extra moisture.

- Root Vegetables: Potatoes, onions, and garlic need to breathe. They prefer cool, dark, and dry spots, so keep them out of the refrigerator. Also, keep them separated—onions release gasses that make potatoes sprout much faster.

- Fruits and Vegetables: It helps to know which produce plays well together. Some items, like apples, bananas, and tomatoes, produce ethylene gas, which speeds up ripening. Keep them away from ethylene-sensitive produce like broccoli, carrots, and leafy greens to prevent them from spoiling too quickly.

When you take a few minutes to store your food properly, you’re not just organizing your fridge. You’re actively preserving the cash you just spent. Every piece of food that stays out of the trash can is a direct win for your wallet.

This little bit of effort after a shopping trip really pays off, ensuring the food you bought actually gets eaten.

The Financial Discipline of Meal Prepping

If there’s one habit that will fundamentally change your food budget, it’s meal prepping. Seriously. Taking an hour or two on a Sunday to wash, chop, and cook ingredients for the week ahead is your secret weapon against impulse spending.

When you have ready-to-eat meals waiting in the fridge, you completely sidestep that dreaded “what’s for dinner?” panic that so often leads to a $20 delivery fee. You’ve already made the decision. This proactive approach ensures you use up what you bought, cutting down on waste and making that grocery bill work for you all week long.

The financial case for cooking at home has never been stronger. The gap between what we spend eating out versus cooking at home has exploded. A recent analysis from the JLL Grocery Report 2025 revealed this spending gap hit over $21 billion in the U.S. by the end of 2024. That’s a six-fold jump in just a couple of years.

Think about it: for a family with a $170 weekly grocery bill, skipping just one takeout order a week saves $1,040 over a year. It’s a clear financial win.

Transform Your Freezer into a Financial Tool

Your freezer is so much more than a holding cell for ice cream and frozen peas. It’s a financial asset, plain and simple. Used correctly, it can help you lock in savings, eliminate waste, and build a stockpile of convenient meals.

Here’s how to put your freezer to work for your budget:

- Freeze Leftovers Immediately: Don’t let that extra chili sit in the fridge until you forget about it. Portion it into single-serving containers and freeze it right away. Future you will be grateful for a quick, free lunch.

- Preserve Produce: See some bananas getting a little too brown or spinach starting to wilt? Don’t toss them. Chop them up and freeze them. They’re perfect for throwing into smoothies, soups, or stir-fries later.

- Batch Cook and Freeze: When you’re making a freezer-friendly meal like soup, lasagna, or a casserole, just double the recipe. Eat one batch this week and freeze the second for a busy night when you don’t have time to cook.

By making these post-shopping habits second nature, you complete the savings cycle. You planned your shop, you bought smart, and now you’re making sure every penny spent nourishes you, not the landfill. This is the final, crucial step to turning your grocery budget into a powerful tool for building financial freedom.

Common Questions Answered

When you start getting serious about cutting your grocery bill, a few common questions always pop up. Let’s tackle some of the biggest ones I hear all the time so you can feel confident in your plan.

How Much Can a Single Person Realistically Save?

It’s easy to wonder if all this effort is worth it when you’re just shopping for one. The good news? It absolutely is.

A single person can realistically aim to save between $50 to $150 per month by being consistent. We’re not talking about eating ramen every night, either. It’s about being smart. Think about it: swapping just two $15 takeout meals a week for something you cook at home instantly puts $120 back in your pocket each month.

From there, if you start using a cashback app, you could easily add another $20-$30 on top of that. Suddenly, you’ve got a significant chunk of change to throw at debt, savings, or your investment goals.

As you get into the swing of things, you’ll find even more ways to trim the budget. Here’s a quick look at a few common questions that come up along the way.

| How Much Can a Single Person Realistically Save? | Are Coupon and Cashback Apps Worth the Effort? | How Can I Save Money with Special Dietary Needs? |

|---|

It all comes down to building small, sustainable habits. Each smart choice you make, from cooking at home to scanning a receipt, adds up to real money over time.

Are Coupon and Cashback Apps Worth the Effort?

Yes, a thousand times yes. I know the idea of clipping digital coupons or scanning receipts can sound like a chore, but modern apps have made it incredibly simple.

The trick is not to download every single app out there. Just pick one or two that work for you. For instance, an app like Ibotta or Fetch can easily net you $20-$40 a month. That’s for a few minutes of work, maybe while you’re watching TV.

Think of it as a small time investment that pays a direct financial dividend. It’s one of the easiest ways to use tech to your advantage and keep more money in your wallet.

How Can I Save Money with Special Dietary Needs?

This is a huge one. When you’re managing a gluten-free, vegan, or allergy-specific diet, it can feel like your grocery bill is destined to be high. But it doesn’t have to be. The secret is to shift your focus from pricey, processed specialty items to whole foods that are naturally compliant.

A few tips that really work:

- Lean into Whole Foods: Center your meals around things that are naturally cheap and fit your diet—think rice, beans, lentils, potatoes, and seasonal vegetables.

- Hit the Bulk Bins: Things like gluten-free oats, nuts, seeds, and dried fruit are almost always cheaper per pound when you buy them from the bulk section.

- Hunt Down Store Brands: Most major grocery chains now have their own “free-from” product lines that are much more affordable than the big name brands.

It just takes a bit more planning, but you can absolutely eat well and manage your dietary needs without breaking the bank. It’s all about getting back to basics with simple, cost-effective ingredients.

At Collapsed Wallet, our goal is to give you the straightforward financial advice you need to feel in control of your money. To find more tested strategies for smart spending and effective budgeting, check out all the resources we have at Collapsed Wallet.