Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Wondering how you can stop impulse buying? To get a handle on it, you have to understand the ‘why’ behind your unplanned purchases. Once you see the pattern, you can create a deliberate pause between the urge to buy and the act of buying. This means figuring out your emotional triggers, honestly questioning if you really need something, and giving yourself a cooling-off period—like the classic 24-hour rule—to let logic catch up with emotion.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Understanding the Psychology Behind Impulse Buys

Before you can stop making impulse buys, you have to look inward. An unplanned purchase is rarely about the item itself. It’s almost always a reaction to a deeper emotional or psychological trigger. Getting to know what drives these decisions is the absolute first step to taking back control.

For many of us, impulse buys are a way to deal with feelings we’d rather not face. Stress, boredom, anxiety, even the high of a good day can send us straight to the online checkout. That little dopamine hit from a new purchase feels like a quick fix, a momentary distraction from whatever is really going on.

An impulse buy isn’t a financial decision; it’s an emotional reaction. The moment you reframe it this way, you begin to see the pattern and can start to dismantle it.

And let’s be honest, modern marketing is designed to prey on these exact vulnerabilities. Retailers are masters at creating a sense of urgency that short-circuits the logical part of your brain.

The Role of Instant Gratification

In a world of one-click ordering and same-day delivery, we’re all wired for immediate rewards. The time between wanting something and owning it has shrunk to almost nothing, which makes it incredibly hard to resist the lure of a quick mood boost.

This pull for instant gratification is a powerful force. It’s that little voice whispering, “I deserve this right now,” conveniently ignoring how it might mess with your long-term financial goals. Acknowledging that voice is key to building better habits.

Common Triggers That Drive Impulse Spending

Pinpointing your personal spending triggers is like drawing a map of your financial danger zones. Once you know where they are, you can learn to steer clear.

Some of the most common culprits include:

- Your Emotional State: Feeling drained after a long day at work? Bored on a Sunday afternoon? These are prime times for the allure of online shopping to kick in.

- Social Media Influence: Instagram and TikTok are highlight reels of “must-have” products and perfect lifestyles. This constant exposure creates a powerful FOMO (fear of missing out) that pushes you to buy now.

- Sneaky Marketing Tactics: “Limited-time offer!” “Flash sale ends tonight!” “Only 2 left in stock!” These are all carefully crafted to make you panic and act before you can think.

- Environmental Cues: Sometimes it’s as simple as walking past your favorite shop or seeing a promotional email pop up in your inbox. These cues can trigger the urge to spend almost automatically.

The first move in getting a handle on these triggers is simply to notice them. A fantastic way to start is by getting serious about tracking your spending. We walk you through exactly how to do this in our guide on how to track your expenses.

By logging not just what you bought but also how you were feeling when you bought it, you’ll start to connect the dots. This self-awareness is the bedrock for every other strategy and will set you up to build a more intentional, financially healthy life.

Build a Bulletproof Pre-Purchase Routine

Look, figuring out your triggers is a huge first step, but it’s only half the battle. Now we need to disarm them. This is where you shift from just knowing why you overspend to actively stopping it from happening. We’re going to build a deliberate, non-negotiable pause between the “I want it!” urge and that final click.

Honestly, creating this pre-purchase routine is the single most powerful tool you have to shut down impulse buying for good.

It’s all about rewiring your default behavior. Instead of reacting emotionally with a lightning-fast “add to cart,” you’re creating a system that forces your logical brain to get involved. This tiny bit of friction is often all it takes to diffuse that initial shopping high and see the purchase with a clear head.

Implement the 24-Hour Rule

The cornerstone of this whole strategy is the 24-hour rule. It’s beautifully simple: for any purchase that isn’t a true necessity, you have to wait a full day before buying it. This isn’t about punishing yourself or denying joy; it’s about making sure your purchases are intentional, not just a reaction to a fleeting feeling.

This delay gives your brain a much-needed cooling-off period, letting rational thought catch up with those powerful emotional urges. It really works. Consumer trend analyses have shown that people who practice waiting periods can slash their impulse spending by 30-50%. Think about that. Average monthly impulse spending actually dropped from $314 in 2022 to just $151 in 2023 as people started being more mindful.

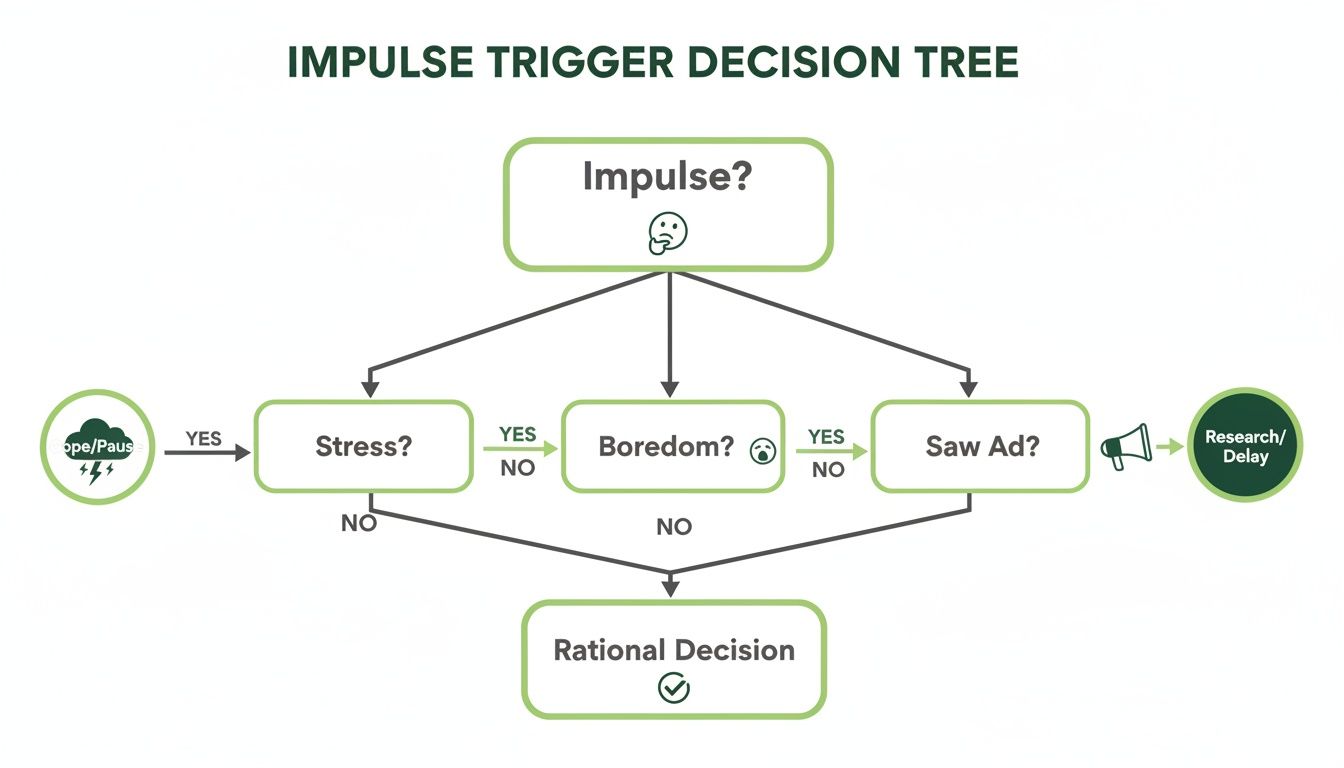

This simple flowchart breaks down exactly how that emotional trigger process works and where the pause fits in.

As you can see, that urge often starts with something like stress, boredom, or a slick ad. But giving yourself that pause lets you choose a healthier way to cope instead of defaulting to an instant purchase.

To see the real-world impact, let’s compare the immediate gratification of an impulse buy with the more considered outcome after applying the 24-hour rule.

Impulse Action vs 24-Hour Rule Outcome

| Factor | Immediate Impulse Purchase | Outcome After Applying 24-Hour Rule |

|---|---|---|

| Initial Feeling | A quick rush of excitement and dopamine. | Desire is acknowledged but controlled. |

| Financial Impact | Money is gone instantly, often without a plan. | Purchase is considered within your budget. |

| Long-Term Emotion | Often leads to buyer’s remorse, guilt, or clutter. | Leads to intentional ownership or the satisfaction of saving money. |

| Goal Alignment | Moves you further away from your financial goals. | Aligns spending with what truly matters to you. |

The table makes it clear: the temporary high from an impulse buy is rarely worth the long-term financial and emotional cost.

Create a Purchase Pause List

A super practical way to enforce the 24-hour rule is to create a ‘purchase pause list’—basically, a cool-down zone for your wants. Instead of buying something on the spot, you just add it to the list. This simple act validates the desire without you having to give in to it right away.

You can use a notes app on your phone, a Google Sheet, or even an old-school notebook. The tool doesn’t matter, but the process is everything. When you see something you want, just jot it down and walk away. Revisit the list once a day or once a week. I promise you’ll be shocked at how often the initial “must-have” excitement has totally evaporated.

A purchase pause list isn’t a “to-buy later” list. It’s a holding pen where most of your fleeting wants will go to fade away.

This process also has a fantastic side effect: it helps you save for the things you truly want. When an item has been sitting on your list for weeks and you still feel it would add genuine value to your life, you can start planning for it. It’s a perfect way to build dedicated savings pots, which you can learn more about in our guide on how sinking funds can supercharge your savings goals.

Ask These Critical Questions

During your 24-hour wait, you need a framework to actually evaluate the purchase. Just waiting isn’t enough; you have to actively question it. Before your self-imposed deadline is up, run through these questions:

- Is this a genuine need or just a fleeting want? Be brutally honest. Could you get by without it for another month?

- How does this fit with my financial goals? Is this purchase moving me closer to or further away from paying off my debt, saving for a house, or retiring early?

- Do I already own something that does the same thing? Seriously, check your closets and cupboards. We often buy duplicates of things we completely forgot we had.

- How many hours of my life did I have to work to afford this? Framing the cost in terms of your time and effort is a powerful reality check that can completely change your perspective on the price tag.

This quick interrogation grounds your decisions in your actual life, not in the emotional fantasy sold by a clever marketing campaign. It connects every potential purchase back to your bigger picture, making it so much easier to walk away from the things that don’t really matter.

Get Your Money Right with a Smarter Budget

While mind hacks like the 24-hour rule are great for pumping the brakes on a bad decision, the real, long-term fix for impulse buying comes down to solid money management. It’s time to build a budget that does more than just list your bills—it needs to actively defend your bank account from those unplanned purchases.

Think of a good budget as your financial roadmap. It doesn’t just tell you where you are; it shows you where you’re going and makes sure every dollar you spend has a purpose. This isn’t about feeling restricted. It’s about feeling empowered to spend on things you genuinely value while having the confidence to say “no” to the stuff that just gets in the way of your goals.

Build a ‘Fun Money’ Fund You Can Spend Guilt-Free

Here’s a secret: most budgets fail because they’re way too strict. When you feel like you can’t buy anything fun, the urge to rebel and splurge on something completely random becomes almost impossible to ignore. The trick is to plan for fun.

A guilt-free spending fund is a small, specific amount of cash you set aside each month just for those little “wants.” It could be for a fancy coffee, a new book, or an app you’ve been eyeing. By giving yourself this planned allowance, you kill that feeling of deprivation and massively cut down the temptation for bigger, more damaging impulse buys.

This simple move completely changes the game. Instead of fighting a constant war against every little desire, you create a controlled outlet that satisfies the itch to spend without derailing your entire financial plan.

The Eye-Opening Power of Tracking Every Penny

You can’t manage what you don’t measure. Honestly, the single most powerful thing you can do for your finances is to track every single purchase for at least one month. This isn’t about judging yourself for past spending; it’s about getting cold, hard data to build a better future.

When you log everything, you get an undeniable picture of where your money is really going. For most people, that awareness alone is enough to put the brakes on mindless spending. Seeing the numbers in black and white is often the wake-up call you need.

Tracking your spending makes the invisible visible. It’s like flipping on the lights in a dark room—suddenly you can see all the stuff you were tripping over and easily walk around it.

The data backs this up. Tracking your spending in a journal or an app is a proven way to get a handle on impulse buys. It’s no surprise that 89% of shoppers admit to making impulse purchases, adding up to an average of $281.75 per month. But get this: people who started tracking their spending saw those impulse buys plummet by an incredible 45%. You can find out more about these consumer spending trends and see for yourself.

Find the Budgeting Tool That Actually Works for You

The best way to track your money is whichever way you’ll actually stick with. Whether that’s a beat-up notebook or a slick app, consistency is the only thing that truly matters.

- The Old-School Journal: Never underestimate the power of a pen and paper. The physical act of writing down a purchase makes you pause and acknowledge it, which makes the transaction feel much more real than just tapping a card.

- Budgeting Apps: If you’d rather automate things, apps like Mint or YNAB (You Need A Budget) are fantastic. They sync with your bank accounts, automatically categorize your spending, and show you exactly what’s happening in real-time.

Many of these apps have features built specifically to help you stop impulse spending:

- Spending Limits: You can set a firm cap for your trigger categories, like “Shopping” or “Restaurants.” The app will ping you when you’re getting close to your limit.

- Transaction Alerts: Get an instant notification every time you spend money. This keeps your spending front and center in your mind.

Choosing the right tool is completely personal. If you’re looking for more ways to make your money go further, check out our guide on practical budget living tips. Don’t be afraid to try a few things to see what feels right. The whole point is to create a system that gives you clarity and control, turning your budget from a chore into your best weapon for winning with money.

Design an Environment That Resists Temptation

While building better budgets and habits is crucial, you can give yourself a massive head start by simply making it harder to spend. Let’s be honest, fighting off temptation is a lot easier when you aren’t constantly dodging it in the first place.

The idea here is to play offense. Instead of just reacting to an urge when it hits, you proactively redesign your world—both digital and physical—to build in a little healthy friction. That tiny bit of effort makes a mindless click or tap a much more deliberate choice.

Clean Up Your Digital Hotspots

Your online world is probably the main battlefield in the war against impulse buys. Companies spend billions of dollars to make their “buy now” buttons as seamless and irresistible as possible. It’s time to take back control.

Here are a few things you can do right now to make your digital space support your goals, not sabotage them:

- Go on an unsubscribing spree. Seriously, open your inbox and hit “unsubscribe” on every single marketing email. If you’re overwhelmed, a tool like Unroll.Me can help you mass-unsubscribe. If you don’t see the flash sale, you can’t be tempted by it.

- Delete your saved payment info. This is a big one. Go into your Amazon, eBay, and other favorite online shopping accounts and remove your saved credit card details. The simple act of having to get up, find your wallet, and manually type in the numbers adds a powerful pause to the process.

- Curate your social media feeds. Be ruthless. If an influencer or a brand consistently makes you feel like you need something, unfollow or mute them. Your feed should be a place of inspiration or education, not a 24/7 commercial.

The most effective way to resist temptation is to remove it entirely. You can’t buy what you don’t see, and you’re less likely to buy if it’s not a one-click process.

By sanitizing your digital world, you dramatically reduce your exposure to the cues that trigger your spending. This isn’t about depriving yourself; it’s about being intentional.

Redesign Your Physical World

It’s not just our screens; our physical surroundings play a huge role in our spending habits, too. You can make small tweaks to your daily life that naturally discourage impulse buys. It just starts with recognizing the real-world situations that usually end with you pulling out your wallet.

For instance, is aimlessly wandering through shops your go-to activity when you’re bored or have time to kill? The key is to consciously replace that habit with something more fulfilling and, frankly, less expensive.

Practical Physical Strategies

- Find new, low-cost hobbies. If your default weekend plan is “let’s go to the mall,” it’s time for a change. Find something that keeps your hands and mind busy. This could be anything from learning an instrument, hiking local trails, or just getting lost in a good book from the library. The goal is to swap the shopping habit with a more productive one.

- Try a no-spend day. Pick one day a week and commit to spending absolutely zero money. This simple challenge forces you to get creative—you’ll have to plan your meals, brew coffee at home, and find free ways to have fun. It’s a fantastic way to reset your brain and appreciate what you already own.

- Avoid your trigger stores. We all have them. That one bookstore, that cute home goods shop. If you know you can’t walk in without buying something, then don’t go in. It might mean taking a different route home from work, but it’s a simple and incredibly effective way to sidestep temptation altogether.

By tweaking both your digital and physical environments, you create a powerful support system for your financial goals. Each small change makes the right decision the easy decision, putting you firmly on the path to financial peace of mind.

Develop Healthier Habits to Replace the Urge

Let’s be honest: that sudden urge to shop often has very little to do with the item you’re about to buy. It’s usually a knee-jerk reaction to something else entirely—boredom, stress, anxiety, or even just the desire for a quick win after a long day. If you want to stop impulse buying for good, you have to look past the shopping cart and address what’s really driving you there.

This is all about rewiring your brain’s reward system. Instead of the fleeting dopamine hit you get from a package arriving at your door, the goal is to find lasting satisfaction from activities that actually align with your bigger life goals. The secret is having a toolkit of alternatives ready to deploy before the urge even strikes.

Identify Your Trigger and Map a Replacement

First things first, you need to become a detective of your own habits. You have to get brutally honest about when and why you’re most likely to start scrolling through online stores. For a lot of people I’ve worked with, the biggest culprit is unstructured downtime, especially in the evenings.

Think about your last few impulse buys. What were you doing right before you started browsing? How were you feeling? Once you can pinpoint that primary trigger, you can create a specific, healthier replacement.

This isn’t about mustering up more willpower; it’s about having a better plan. You’re essentially creating an “if-then” script for your brain to automate a better decision. For example: “If I feel bored and find myself opening a shopping app, then I will immediately listen to a new episode of my favorite financial podcast instead.”

Build Your Toolkit of Fulfilling Alternatives

Having a pre-approved list of go-to activities makes it infinitely easier to redirect that impulsive energy. The best alternatives are usually free or low-cost and give you a genuine sense of accomplishment, connection, or relaxation.

Here are a few ideas to get you started:

- Engage Your Mind: Dive into something that genuinely fascinates you. Listen to a podcast about reaching financial independence, watch a documentary on a topic you’ve always been curious about, or start learning a new language on a free app like Duolingo.

- Get Creative: Find a hobby that keeps your hands and mind busy. This could be anything from sketching, learning to code online, practicing an instrument, or exploring new financial management techniques.

- Reconnect with People: Sometimes that urge to shop is really a pang of loneliness. Instead of scrolling, pick up the phone and call a friend you haven’t talked to in a while. Real connection offers a much deeper sense of fulfillment than any purchase ever could.

- Move Your Body: Physical activity is one of the fastest ways to change your mental state. Go for a walk around the block, pull up a quick workout video on YouTube, or just do a few minutes of stretching. The endorphin release is a powerful antidote to stress-fueled shopping.

Replacing a bad habit isn’t about deprivation; it’s about upgrading. You’re not just stopping an action—you’re actively choosing a more rewarding and beneficial one that serves your future self.

Make the Healthy Habit the Easier Choice

The final piece of this puzzle is making your good habits more accessible than your bad ones. If your phone’s home screen is a minefield of shopping apps, you’re setting yourself up to fail. It’s time to rearrange your digital environment to support your new goals.

Try creating a “Growth” or “Learn” folder on your phone’s main screen. Fill it with your podcast, audiobook, and educational apps. That way, when you mindlessly reach for your phone, your thumb is more likely to land on something that enriches your life instead of draining your bank account.

This kind of strategic replacement is how you build a lasting defense against impulse buying. It’s a gradual process of teaching yourself that true satisfaction comes from building a richer life, not from accumulating more stuff. Every single time you choose a healthy alternative over a checkout button, you’re casting a vote for your own financial freedom.

Got Questions About Impulse Buying? You’re Not Alone.

Even with the best plan, kicking a habit as ingrained as impulse buying can feel like an uphill battle. It’s totally normal to hit a few snags or have questions pop up. Let’s walk through some of the most common hurdles I see people face.

Think of this as your go-to guide for those tough moments when your resolve is being tested. Knowing how to handle a slip-up or a high-pressure sales event is just as important as setting up your budget in the first place.

“I Messed Up and Made an Impulse Purchase. Now What?”

First, take a deep breath. A single slip-up doesn’t wipe out all your hard work. The biggest mistake you can make right now is falling into an all-or-nothing trap, where one unplanned purchase makes you feel like a total failure. That’s just not true.

Acknowledge what happened, but do it without beating yourself up. Instead of letting guilt take over, get curious. What was the trigger? Did you skip your 24-hour rule because you were in a hurry? Were you feeling extra stressed or maybe just bored? Figure out where your system broke down.

Every mistake is a lesson in disguise. Jot down what happened and brainstorm how you can handle that specific trigger differently next time. We’re aiming for progress here, not perfection.

“Seriously, How Long Will This Take?”

I wish I could give you a magic number, but the truth is, it’s different for everyone. What the research on habit formation tells us is that it can take anywhere from a few weeks to several months for a new routine to feel second nature.

The key isn’t the timeline; it’s consistency. Every single time you use a strategy—whether it’s pausing with the 24-hour rule, logging an expense, or going for a walk instead of browsing online—you’re literally rewiring your brain.

Focus on those small, daily wins. If you stick with your new routines, you’ll almost certainly see a major drop in your urge to splurge within the first 30-60 days.

Remember, you’re undoing years of conditioning. That takes patience, so give yourself a little grace.

“Are There Any Apps That Can Actually Help With This?”

Absolutely. The right tech can be a game-changer when you’re trying to get a handle on your spending. A few types of apps can make a real difference:

- Budgeting Apps: Tools like YNAB (You Need A Budget) or Mint are brilliant for tracking your spending in real time. When you create a specific budget category for “Fun Money” or “Shopping,” you build automatic guardrails for yourself.

- Site Blockers: There are simple browser extensions you can install to block your go-to shopping sites for certain periods. This is a lifesaver when you need to focus at work and Amazon starts calling your name.

- Automated Savings Apps: Some apps round up your purchases to the nearest dollar and sweep the change into a savings or investment account. It’s a clever way to hijack that spending impulse and redirect it toward your financial goals.

The best app is the one you’ll actually use. Try a couple out and see what clicks with your lifestyle.

“How Do I Survive Big Sales Like Black Friday?”

Let’s be clear: major sales events are psychological minefields. They are expertly engineered to create a sense of urgency and a massive fear of missing out (FOMO). Your best defense is a good offense—a plan you make long before the sales even start.

Before the event, create a specific, budgeted list of things you already planned to buy. If it’s not on the list, it’s not a deal—no matter how big the discount is. End of story.

A few weeks out, unsubscribe from all those promotional emails. Cut the temptation off at the source. And when the sales are on, be extra strict with your 24-hour rule. That pause is crucial for making sure you’re buying with your head, not just reacting to the hype.

At Collapsed Wallet, our mission is to provide you with the clear, practical guidance you need to take control of your finances and build a more secure future. We turn complex money topics into simple, actionable steps. Explore more of our guides and tools by visiting Collapsed Wallet.

3 thoughts on “How to Stop Impulse Buying: Your Guide to Sensible Spending”