Table of Contents

- Laying The Groundwork For Financial Literacy Ages 3-7

- Taking the Next Step: Earning and Budgeting for Kids Ages 8-12

- Navigating Complex Finances with Teenagers Ages 13-18

- Let’s Talk About Money: Making It a Normal Part of Family Life

- Common Mistakes to Avoid When Teaching Money Skills

- Common Questions About Kids and Money

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Teaching kids about money isn’t something you can save for their teenage years. The best lessons start small, and they start early. Something as simple as a few clear jars for saving, spending, and giving can make all the difference. This hands-on approach takes the mystery out of money and helps even the youngest kids build a healthy, positive relationship with it, setting them up for a future of financial confidence. This is your guide on how to teach kids about money!

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Laying The Groundwork For Financial Literacy Ages 3-7

It’s easy to think that three-year-olds are too young to understand money, but that’s a huge misconception. These early years, especially between ages three and seven, are when their fundamental attitudes and habits about money start to form. What they learn now will likely shape how they handle their finances for the rest of their lives.

A fascinating study from the University of Cambridge drove this point home for me: it found that a child’s core money habits are pretty much set by age seven. This isn’t about teaching them compound interest. It’s about making money real, visual, and connected to their world. You’re building an empowering foundation, not just a set of rules.

Making Money Concrete And Fun

For a toddler, money is magic. They see you tap a card, and suddenly, you have a cart full of groceries. The first step is to pull back the curtain on this magic show. Using actual cash, even just a handful of coins, helps them connect the dots—money is a real thing we exchange for other real things.

One of the most effective tools I’ve ever used is the classic three-jar system. Grab three clear containers and label them:

- Spend: For those small, immediate wants, like a sticker pack or a gumball.

- Save: For a bigger goal they’ve set their sights on, like a new Lego set.

- Give: To help others, whether it’s dropping coins in a donation tin or contributing to a friend’s fundraiser.

This visual method is brilliant because they can literally watch their money grow. As they drop coins into the “Save” jar, they see progress. It creates a tangible link between patience and reward.

The real power of the jar system is in the choices it forces. When a child has to physically take money from their ‘Save’ jar to move it to their ‘Spend’ jar, they feel the trade-off. It’s a low-stakes way to learn about opportunity cost.

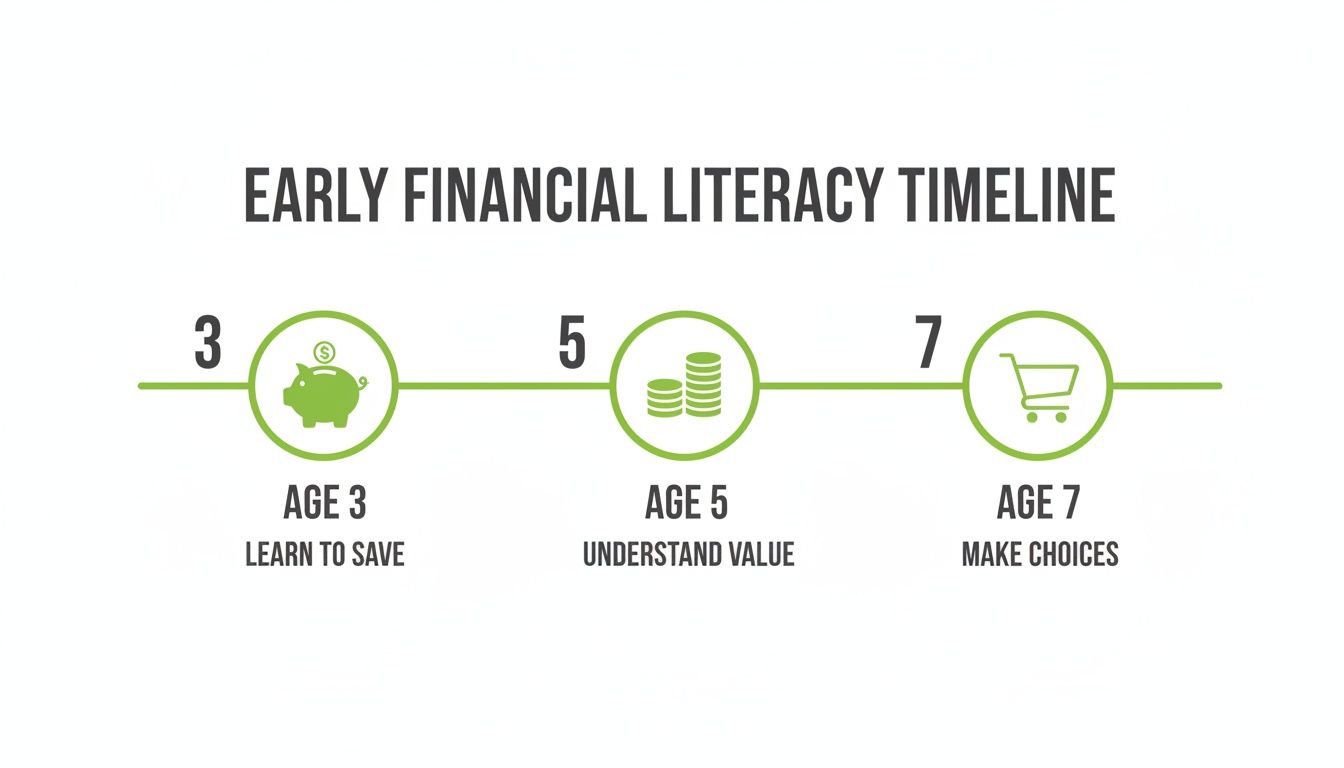

This simple timeline gives you a great visual for how these concepts build on each other during these critical early years.

It’s a natural progression—from just seeing money as something to collect at age three, to really understanding what it’s worth and making thoughtful choices by age seven.

To help you get started, here’s a quick cheat sheet with some ideas for each age group.

Early Childhood Money Concepts Ages 3-7

| Age Group | Key Concept | Practical Activity |

|---|---|---|

| Ages 3-4 | Identifying Money | Play “coin sort” with different denominations. Use play money in a toy cash register. |

| Ages 4-5 | Waiting and Saving | Set up the three-jar system (Spend, Save, Give). Help them save for a small, specific toy. |

| Ages 6-7 | Making Choices | Give them a small amount of money at the store to choose one item within their budget. |

These are just starting points, of course. The key is to keep it simple, fun, and directly related to their world.

Turning Everyday Moments Into Lessons

You don’t need a formal curriculum; your daily routine is already packed with teachable moments. The grocery store is a perfect example—it’s a living classroom for teaching the difference between needs and wants.

When your child grabs that brightly colored box of sugary cereal, it’s an opportunity. You could say something like, “That cereal looks really yummy, but it’s a ‘want.’ Right now, we ‘need’ to get milk and bread for the week. Let’s add that cereal to your wish list for another time.” This isn’t about saying no; it’s about introducing prioritization in a way they can understand. These little conversations are how you build foundational money management skills.

Nothing beats the experience of them saving for and buying something all on their own. Think about it: your child spends weeks saving up coins from small chores to buy that one toy they’ve been talking about nonstop. The moment they walk into the store, pick it out, and hand their own money to the cashier is pure gold. They’re not just buying a toy; they’re learning firsthand about earning, saving, and the pride that comes from working toward a goal. That feeling is what builds a healthy financial foundation, one coin at a time.

Taking the Next Step: Earning and Budgeting for Kids Ages 8-12

As kids hit the 8 to 12-year-old range, you’ll notice their thinking gets a lot more sophisticated. This is the sweet spot for moving beyond the basic “Save, Spend, Give” jars and introducing the real-world concepts of earning a steady income and making a plan for it—their very first budget.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

From Allowance to “Commission”

This is the perfect age to stop just handing over pocket money and start tying it to responsibility. I’m a big fan of a commission-based system. It’s not about paying them for basic life skills like making their bed or brushing their teeth—those are just part of being a family member. Instead, it’s about creating opportunities to earn money for jobs that help the whole household.

A simple way to structure this is:

- Family Contributions: These are the unpaid, everyday expectations, like keeping their own room tidy.

- Earning Opportunities: These are extra jobs with a clear payment attached. Think bigger-picture tasks like helping pull weeds in the garden, washing the car, or taking on pet care duties beyond the basics.

This approach teaches one of life’s most valuable lessons: work creates income. It also gives them a predictable stream of money, which is the essential first step to learning how to manage it.

Introducing Their First Budget

Once they have money coming in, the next logical question is, “Where does it all go?” A simple budget isn’t about restricting their fun; it’s about empowering them. It hands them the controls and lets them see how their choices directly impact what they can and can’t do.

You don’t need a fancy spreadsheet. A piece of paper with two columns labeled “Money In” and “Money Out” is perfect. In one column, they list their earnings. In the other, they write down every single thing they spend money on.

This simple tracking exercise can be a huge eye-opener. When a kid sees that £15 of their £20 monthly earnings went to random snacks and small toys, the lightbulb goes on. They start to grasp opportunity cost—they could have been so much closer to that awesome video game they wanted.

This is their first real taste of personal finance. If you want a more detailed framework that you can simplify for them, check out our guide on how to track your expenses.

The Magic of a Savings Goal

Budgeting for the sake of budgeting is boring. It needs a purpose. This is where you connect their efforts to something they really want—a bigger-ticket item that feels just out of reach, like a new bike, a coveted Lego set, or the latest video game.

Sit down and do the math with them. If the item costs £80 and they can earn £5 a week, how many weeks will it take to save up? This simple calculation makes delayed gratification feel real and achievable. It shows them that small, consistent efforts add up to big rewards.

This skill is absolutely foundational. The World Bank agrees, noting that early investments in cognitive skills pay massive dividends later in life. In fact, their projects invested $18.7 billion in early childhood development between 2014-2024, directly boosting the abilities needed for financial management. You can read more about these crucial childhood development investments on their site.

Using Tech to Keep Them Engaged

While pen and paper are great, let’s be honest—this generation is digital. Kid-friendly apps like GoHenry or RoosterMoney can make this whole process more interactive and fun. They create a safe, controlled digital space where kids can see their earnings, set goals, and track their spending visually.

These platforms are fantastic because they often let parents:

- Set up recurring payments for regular chores.

- Create specific savings goals with visual progress bars.

- Oversee spending via a linked prepaid debit card.

Introducing a digital tool now prepares them for the future. It demystifies digital banking and gives them a safe environment to learn—and even make a few small, recoverable mistakes—with you right there to guide them.

Navigating Complex Finances with Teenagers Ages 13-18

The teenage years are the final dress rehearsal for financial independence. As your kids start thinking about driving, university, and moving out, the money lessons need to keep pace. It’s time to graduate from piggy banks and simple chores to the real-world mechanics of banking, earning, and long-term planning.

Giving them these skills now, while you’re still there to act as a safety net, is one of the most powerful things you can do. You’re helping them turn abstract concepts about money into practical know-how they can lean on for the rest of their lives.

Opening Their First Bank Account

If their savings are still in a jar on their dresser, it’s time for an upgrade. Helping your teen open their first bank account is a massive rite of passage. Most banks have custodial or teen accounts that are perfect for this—they give your teen a sense of ownership while still allowing you some oversight.

Make sure the account comes with a debit card, not a credit card. This is a critical distinction.

- A debit card is directly linked to the money they actually have. It’s the ultimate budgeting tool, as it physically stops them from spending what isn’t there.

- A credit card is basically a loan. Handing one to a financial beginner is like giving them a shovel and telling them not to dig a hole of debt. It’s a lesson for another day.

Getting comfortable with a debit card is a hands-on, low-risk way to learn about tracking balances and managing digital money before the stakes get any higher.

Managing a Real Paycheck

Many teens get their first part-time job during these years, and there’s no better classroom for money management. When that first paycheck hits, it’s a golden opportunity to talk about how income really works. This is where they’ll bump into things like income tax, National Insurance, and direct deposits.

Don’t just let the money land in their account unnoticed. Sit down with their first payslip and walk them through it. Explain what the deductions are for—that taxes are how we all chip in for public services like roads and hospitals. This simple conversation demystifies the difference between gross pay (the big, exciting number) and net pay (what they actually take home).

This is also a great moment to talk about different ways to earn. For some inspiration, you can check out our guide on side hustle ideas for students.

That first paycheck is a huge moment of pride. Use that excitement. Help them sketch out a simple budget for their new income, splitting it between immediate spending, short-term savings (for that new phone), and maybe even a small amount toward a much bigger goal.

The Power of Long-Term Goals

A 10-year-old saving for a new video game is a great start. But a 16-year-old can—and should—be thinking bigger. Start talking about the major life goals that require serious financial muscle: a car, university tuition, or even a deposit on their first flat.

This is the perfect time to introduce the magic of compound interest. You don’t need complex charts; just explain it simply. Compound interest is when your money starts earning its own money. It’s like a snowball rolling downhill—it picks up more snow and gets bigger all by itself.

A quick example makes it click:

If they put £1,000 into an account with a 5% annual return, after a year, they’d have £1,050. Simple enough. But the next year, they’d earn 5% on the £1,050, not just the original £1,000. It seems tiny at first, but over decades, the growth is staggering. This one concept shows exactly why starting to save early, even with small amounts, is a superpower.

An Introduction to Low-Risk Investing

Once they grasp compound interest, you can gently introduce the idea of investing. Explain that money sitting in a standard savings account often loses its buying power over time because of inflation. Investing is how you make your money work for you, so it can grow faster than prices do.

You don’t need to turn them into stock-picking experts. Just introduce simple, diversified options like index funds or ETFs. Frame it as buying a tiny slice of hundreds of successful companies at once, which spreads out the risk. The goal isn’t to get them day trading; it’s to plant the seed that smart, long-term investing is a fundamental part of building wealth.

The proof is in the data. OECD’s 2025 Education at a Glance notes that countries averaging USD 13,331 per child on early education in 2022 saw better financial literacy later on. A program in Peru that built budgeting into the school curriculum led to a 40% jump in parents’ awareness of their own debt. These lessons stick. By having these conversations at home, you’re giving your teen a massive head start.

Let’s Talk About Money: Making It a Normal Part of Family Life

Here’s a secret I’ve learned over the years: financial literacy isn’t built in a single lesson. It’s built in the hundreds of tiny, everyday conversations you have with your kids. The single most powerful thing you can do is to just start talking about money, openly and without making it a big deal.

When you strip away the mystery and stigma, money just becomes another part of life, like talking about what’s for dinner or who’s walking the dog. Your casual chats and the way you handle money day-to-day become the real classroom.

Turning Daily Routines into Teachable Moments

You don’t need a PowerPoint presentation; your daily life is already packed with teachable moments. The trick is to start narrating your financial thought process in simple terms your kids can understand. It’s about thinking out loud.

Next time you’re shopping online, pull them over for a second. Instead of just clicking “buy,” show them how you’re comparing the same pair of trainers on two different websites. Say something like, “Look, this site is a little cheaper, but that one has free shipping. Let’s see which one is actually the better deal.”

The grocery store is a goldmine for this. As you’re walking the aisles, you can talk through your choices. “We’re going with this brand of pasta today because it’s on sale. That means we’ll have a little extra in the food budget for that ice cream you wanted.” These quick comments demystify spending and introduce the idea of value without a lecture.

Talking About the Family Budget (Without the Stress)

Bringing up the household budget isn’t about scaring your kids with your mortgage payment or salary details. It’s about giving them a basic understanding of where the family’s money goes. A fantastic and low-stakes way to do this is with the utility bills.

When the electricity bill comes, use it as a prop. Show them the total and say, “This is what it costs to keep our lights on and our tablets charged. If we all get better at turning off lights when we leave a room, we can help make this number smaller next month.”

This simple act connects their habits directly to a real financial outcome. Suddenly, they’re not just being nagged—they’re contributing members of the household team.

The goal is never to burden kids with financial stress. It’s to empower them with understanding. When they see that money is a limited resource that requires smart choices, they begin to build a healthy respect for it.

Starting these conversations can feel awkward, but you can easily tailor them to your child’s age. Here are a few simple ways to break the ice.

Family Money Conversation Starters by Age

This is a simple guide to kick-start age-appropriate financial discussions and make money talk feel completely normal in your home.

| Age Group | Conversation Topic | Example Question |

|---|---|---|

| Ages 5-8 | The Cost of Fun | “The cinema tickets cost £25. How many weeks of your allowance would it take to save up for that?” |

| Ages 9-12 | Household Bills | “Our Wi-Fi bill is £30 every month. What are some of the things we use the internet for that make this a ‘need’ for our family?” |

| Ages 13-18 | Major Purchases | “We’re saving for a family holiday that costs £1,500. What are some small things we could all cut back on to reach our goal faster?” |

These questions aren’t about getting the “right” answer. They’re about getting your kids to think about the financial decisions happening around them every single day.

Connecting the “Give” Jar to a Real-World Impact

The “Give” jar is a brilliant start, but its true magic is revealed when you connect that money to a meaningful purpose. As your kids grow, help them look beyond just dropping coins into a collection tin. It’s time to start talking about what it means to give thoughtfully.

Involve them directly in choosing where their “give” money goes. Maybe they love animals—let them research a local animal shelter. Perhaps they’re passionate about the environment—find a community clean-up project.

When it’s time to donate, make it an event. Take them with you to drop off the money, or let them click the button on the online donation form. This hands-on experience teaches a profound lesson: that being good with money isn’t just about what you can get for yourself. It shows them that money is a powerful tool for making a real difference in the world, fostering a sense of generosity that will last a lifetime.

Common Mistakes to Avoid When Teaching Money Skills

Knowing what to teach your kids about money is one thing, but knowing which common traps to sidestep is just as critical. Many parents, with the best of intentions, can accidentally undermine their own lessons by making a few classic mistakes.

If you can steer clear of these pitfalls, you’ll be in a much better position to raise kids who are both capable and resilient when it comes to their finances.

Bailing Them Out of Every Mistake

It’s tough to watch your child realize they’ve blown their entire month’s savings on some impulse buy, leaving them with nothing for that cinema trip they were so excited about. Our instinct is to swoop in and fix it.

But constantly rescuing them from their poor choices robs them of a powerful learning opportunity.

Small, managed financial failures are invaluable. When a child experiences the natural consequences of overspending—like missing out on an experience with friends—the lesson sticks far better than any lecture ever could. They learn about regret and opportunity cost in a real, tangible way.

Instead of just handing over more cash, help them brainstorm a solution. Can they do extra chores to earn the money back? Maybe sell an old toy they no longer play with? This approach teaches problem-solving and resilience, not dependence. It shows them that mistakes aren’t dead ends, but chances to find a new path forward.

Overcomplicating Things or Being Too Abstract

Trying to teach a seven-year-old about ETF expense ratios is a surefire way to make their eyes glaze over. A huge mistake is jumping to advanced concepts before they’ve even mastered the basics. The lessons have to be age-appropriate to land.

For young kids, money needs to be physical—coins and notes they can actually see and touch.

To avoid this, match the lesson to their developmental stage:

- Ages 3-7: Focus on tangible actions. Think sorting coins, using a clear savings jar, and physically handing money to a cashier at the shop.

- Ages 8-12: Introduce simple budgets, earning through chores, and saving for specific goals they really care about, like a new video game.

- Ages 13-18: This is the time to transition to digital tools like bank accounts, discuss long-term goals like saving for a car, and explain the magic of compound interest.

The core idea here is to keep it simple and relevant to their world. A teenager might be ready for a conversation about a part-time job and taxes, but a first-grader just needs to understand that the toy they want costs five of their saved pound coins.

Making Money a Taboo Topic

Perhaps the biggest mistake of all is simply not talking about money. When finances are only discussed behind closed doors or in hushed, stressed tones, kids learn that it’s a scary, mysterious, or even rude topic. This silence creates a vacuum that gets filled with bad information from friends, social media, and advertising.

Normalizing money conversations is one of the most important things you can do. You don’t need to get into the weeds of your mortgage or disclose your salary, but you can talk openly about everyday financial decisions.

Explain why you’re choosing the store-brand cereal or why you’re putting money into a savings account for the family holiday. These small, everyday conversations make a world of difference.

By avoiding these common slip-ups, you create a much more effective and positive learning environment. You’ll be teaching your kids not just how to count their coins, but how to make smart, confident decisions that will serve them for the rest of their lives.

Common Questions About Kids and Money

Even with the best game plan, teaching kids about money inevitably brings up some tricky questions. Let’s be honest, there isn’t a single right answer for every family, but knowing how other parents handle these common situations can give you the confidence to find what works for yours.

Think of this as your quick-reference guide for those moments you’re not quite sure what to do next.

When Should We Start Giving Our Kid an Allowance?

There’s no magic number, but most parents I’ve talked to find that age five or six is a great time to start. At this point, kids are starting to get the basic idea that money buys things, so the concept isn’t totally abstract. They’ve seen you pay for groceries or a toy, and they’re ready to connect the dots themselves.

The real key is to link the allowance to some simple responsibilities. Don’t just hand it over. Whether you call it “commission” or “payday,” this small shift frames money as something that’s earned. It’s a powerful first lesson that lays the groundwork for a solid work ethic.

How Much Allowance Should I Actually Give?

A popular rule of thumb is giving half their age in pounds each week. So, an eight-year-old would get £4. But honestly, that’s just a starting point. The right amount really depends on what you expect them to do with that money.

Think about it this way:

- Small Treats: If it’s just for sweets or stickers, a smaller amount is totally fine.

- Saving for a Goal: If they’re saving for a £20 LEGO set, they need enough to feel like they’re making progress. A tiny allowance can make saving feel impossible and kill their motivation.

- Bigger Responsibilities: For older kids and teens, you might increase the amount to cover things like cinema tickets or lunches out with friends. This forces them to make real-world budgeting decisions.

You want to give them enough to make meaningful choices, but not so much that they never have to say “no” to themselves.

At the end of the day, the right amount is one that fits your family’s budget and your child’s maturity. The conversation about why they get that amount is often more important than the number itself.

What Are the Best Apps for Teaching Kids About Money?

For kids who live on screens, technology can be your best friend here. The right app creates a safe sandbox where they can practice managing money without any real-world risk, all with you looking over their shoulder.

A few of the best ones out there are GoHenry, Starling Kite, and RoosterMoney. They’re all built specifically for kids and teens, and they do a fantastic job of making financial concepts visual and easy to grasp. Most come with a prepaid debit card, which lets your child practice tracking their spending and setting savings goals in a way that feels grown-up. For parents, you get total oversight with spending controls and notifications.

These apps are especially brilliant for tweens and teens who are moving beyond physical cash and need to build confidence with digital money.

At Collapsed Wallet, we’re dedicated to turning complex financial topics into simple, actionable advice for you and your family. For more practical tips on building a secure financial future, explore our guides at https://collapsedwallet.com.