Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

So, a chunk of cash just landed in your lap. Fantastic. The first instinct for many is to immediately start thinking about how to invest lump sum and watch it grow. But hold on. Pumping it straight into the market without shoring up your finances first is like building a house on a shaky foundation.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your First Financial Moves with a Lump Sum

Getting a windfall—whether it’s from an inheritance, a big bonus, or selling an asset—can feel like a huge win. The temptation to dive headfirst into investing is real. But honestly, the most crucial steps are the ones you take before a single pound ever hits the stock market.

Think of it this way: you wouldn’t start putting up the walls of a house before you’ve poured a solid concrete foundation. It’s the same with your money. A few key pillars will protect you from financial shocks and set you up for success down the road.

Tackle High-Interest Debt First

Before you can seriously build wealth, you have to plug the holes that are sinking your financial boat. High-interest debt is the biggest leak of all. I’m talking about credit cards and personal loans, which can easily carry interest rates of 20% or more.

Let’s be blunt: no investment on earth can reliably guarantee that kind of return. The interest you’re paying is actively wiping out any gains you might hope to make elsewhere.

Paying off this kind of debt is, in itself, a guaranteed, tax-free return on your money. Think about it—by clearing a credit card with a 22% APR, you’ve essentially locked in a 22% return. You’d be thrilled with that from an investment, right?

Build Your Financial Safety Net

What if you lost your job tomorrow? Or what if your car’s engine decided to give up? Without a cash reserve, you’d likely have to sell your investments—maybe at a loss—or rack up more debt. This is exactly why an emergency fund isn’t just nice to have; it’s essential.

An emergency fund is simply a stash of cash, kept somewhere you can get to it quickly, for true emergencies. Most experts, myself included, suggest having enough to cover three to six months of your essential living expenses. That means things like:

- Your mortgage or rent

- Utility bills

- Groceries and fuel

- Insurance payments

This fund is your financial peace of mind. It allows your long-term investments to ride out life’s storms untouched. If you’re not sure how much is right for you, we’ve put together a guide on how to determine how much you need for an emergency fund.

A robust emergency fund is the firewall between a minor setback and a full-blown financial crisis. It allows you to weather storms without derailing your long-term goals to invest a lump sum.

Account for Potential Taxes

Finally, don’t forget about the taxman. Depending on where your lump sum came from, a piece of it might belong to HMRC. A big work bonus, for instance, will be taxed as income. If you sold a second property, you could be looking at a Capital Gains Tax bill.

Forgetting to set money aside for taxes is a surprisingly common and painful mistake. Before you do anything else, it’s worth getting a clear picture of what you owe. You might want to chat with a tax adviser to be sure.

A simple strategy is to move the estimated tax amount into a separate, easy-access savings account. That way, you won’t get a nasty surprise later. Only after you’ve handled these foundational steps is it really time to start putting your money to work.

Lump Sum vs Dollar Cost Averaging

Alright, you’ve handled the immediate financial housekeeping. Now comes the big question: how do you actually put this money to work? Do you dive in all at once, or do you wade in slowly? This is the classic debate between Lump Sum (LS) investing and Dollar-Cost Averaging (DCA).

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

The Case for Lump Sum Investing

Lump Sum investing is as straightforward as it gets: you take the whole pile of cash and invest it in one shot. The logic behind this is simple but powerful. Over the long haul, markets have a strong tendency to go up. By getting all your money in the market right away, you give it the maximum amount of time to compound and grow. More time in the market usually means more growth.

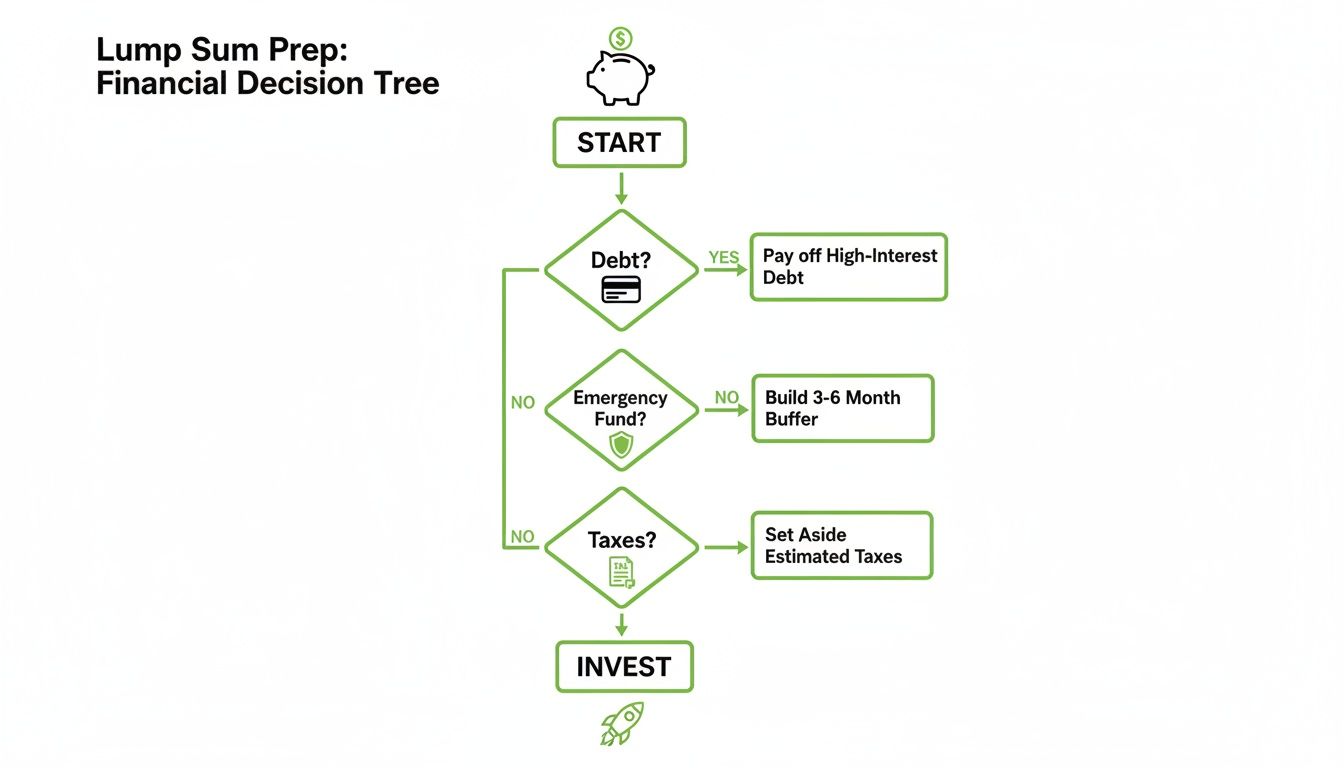

Before you even get to this stage, it’s crucial to make sure your financial foundation is solid. This decision tree lays out those preliminary checks perfectly.

Think of it as your pre-flight checklist. You wouldn’t take off without checking the essentials, and the same goes for investing. Tending to high-interest debt, your emergency fund, and any tax implications is the non-negotiable first step.

The data backs this up convincingly. A major Vanguard study looking at markets from 1976 to 2022 found that investing a lump sum beat dollar-cost averaging a staggering 68% of the time over a 12-month period. That’s a two-out-of-three chance that going all-in from the start would have left you better off.

The math generally favours getting your money into the market as soon as possible. Over time, the cost of waiting on the sidelines can be greater than the risk of investing at a temporary peak.

The Appeal of Dollar-Cost Averaging

If the numbers point so clearly to lump sum, why would anyone do it differently? The answer boils down to one thing: our emotions. It can be absolutely terrifying to invest a large sum of money, only to watch the market tank the next day.

Dollar-Cost Averaging is the antidote to that anxiety. You simply break your lump sum into smaller, equal chunks and invest them at regular intervals—say, once a month for six months or a year.

The real win here is psychological. DCA takes the pressure off trying to perfectly “time the market.” If the market drops after your first investment, you’re not kicking yourself; instead, your next purchase buys more shares at a cheaper price. It smooths out the ride and helps you avoid the paralyzing fear of investing at the absolute peak. This feeling of regret is a powerful force that can keep people on the sidelines for far too long.

Lump Sum vs Dollar Cost Averaging At a Glance

So, how do you decide? Sometimes seeing the two approaches side-by-side makes the choice clearer. This table breaks down the core differences.

| Feature | Lump Sum Investing (LS) | Dollar-Cost Averaging (DCA) |

|---|---|---|

| Market Exposure | Full and immediate, maximizing time in the market. | Gradual, spreading out market entry over a set period. |

| Statistical Edge | Historically outperforms DCA about two-thirds of the time. | Statistically less likely to produce the highest returns. |

| Emotional Comfort | Can be stressful, especially if markets dip right after investing. | Reduces the anxiety of market timing and the fear of a crash. |

| Best For | Investors focused on long-term data and maximizing potential returns. | Risk-averse investors or those worried about short-term volatility. |

| Biggest Risk | Investing at a market peak just before a significant correction. | “Cash drag”—uninvested money sits on the sidelines, missing potential gains. |

Ultimately, choosing between Lump Sum and Dollar-Cost Averaging is less about math and more about your own personality. What will allow you to invest and then sleep at night?

While LS usually wins on paper, DCA is a fantastic strategy if it’s what gets you to actually start investing. The truly worst decision is letting fear lead to inaction, leaving your hard-earned cash to be slowly eaten away by inflation.

Building Your Personal Investment Plan

Alright, you’ve secured your financial foundations and have a clear strategy in mind. Now for the fun part: building an investment plan that actually fits your life. This isn’t about chasing hot stock tips or getting tangled in complex financial products. It’s about creating a simple, durable, and goal-focused portfolio you can actually stick with. Think of this plan as the bridge that takes you from having a lump sum to achieving what you want in life.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

First things first, you need to get crystal clear on what you’re investing for. A vague goal like “to make money” just won’t cut it. You need to define specific objectives with real timelines.

- Short-Term Goals (1-5 years): This is money for a house down payment, a new car, or maybe starting a business. The short runway means you have less time to recover if the market takes a dive, so keeping your money safe is the top priority.

- Medium-Term Goals (5-10 years): Maybe you’re saving for your kid’s university education or planning a major home renovation. Here, you can afford to dial up the risk just a bit for a shot at better returns.

- Long-Term Goals (10+ years): Retirement is the classic example. With decades ahead of you, you can embrace the market’s ups and downs and really go for maximum long-term growth.

Matching Your Plan to Your Timeline

Your timeline is probably the single most important factor in how you should invest. A long time horizon is your best friend—it gives your money more time to compound and smooths out the bumps from inevitable market dips.

The power of time is just incredible. Consider this: if you had invested just $100 into the S&P 500 back in 1926 and reinvested all the dividends, it would have mushroomed into a staggering $2,007,202.95 by the end of 2026. That’s the result of a 10.41% average annual return. The historical data on S&P 500 returns shows the raw power of investing a lump sum in a diversified index and just letting it ride.

This really gets to the heart of the difference between saving and investing. Saving is about protecting what you have; investing is about making it grow. You can dig deeper into this in our guide on the difference between saving and investing.

Understanding Your Risk Tolerance

Next, it’s time for an honest conversation with yourself about risk. How would you really feel if your portfolio dropped 20% in a single month? Would you panic and hit the sell button, or would you see it as just part of the ride?

Your risk tolerance isn’t about being brave; it’s your emotional capacity to handle market swings without making a rash decision you’ll regret later. The best investment plan is one you can actually stick to when things get a little chaotic.

Answering this question is key to figuring out your asset allocation—the specific mix of investments, like stocks (equities) and bonds, that you’ll hold.

Simple Asset Allocation Examples

You don’t need to be a Wall Street wizard to do this well. For most people, a simple portfolio built from low-cost, diversified Exchange-Traded Funds (ETFs) or index funds is a fantastic way to go. These funds do the heavy lifting for you by holding hundreds or thousands of different stocks or bonds, which automatically spreads out your risk.

Here are a few common allocations based on risk tolerance:

1. Conservative Portfolio (Short-Term Goals)

- 80% Bonds: Provides stability and a bit of income.

- 20% Stocks: Adds a small engine for growth.

This mix is all about protecting your initial capital, not chasing massive returns.

2. Balanced Portfolio (Medium-Term Goals)

- 40% Bonds: Acts as a solid anchor in stormy seas.

- 60% Stocks: Offers a healthy potential for long-term growth.

This is a classic middle-of-the-road strategy that balances growth with a sensible amount of safety.

3. Aggressive Portfolio (Long-Term Goals)

- 10% Bonds: Just a small defensive buffer.

- 90% Stocks: Aims for maximum growth over many years.

This portfolio is built for people with long timelines who can stomach big market swings for a shot at the highest possible returns.

By nailing down your goals, understanding your timeline, and picking the right asset mix, you’ll have a solid, personal plan to invest your lump sum and build a much brighter financial future.

Time to Pull the Trigger: How to Actually Invest Your Lump Sum

You’ve done the hard work of planning, and now it’s time to put that money to work. This is the part that can feel a bit nerve-wracking, but honestly, the mechanics of moving money from your bank into the market are simpler than you probably think. Let’s walk through the practical steps to get it done.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Choosing and Opening the Right Account

Before you can buy anything, your money needs a home. The type of account you pick is a big deal because it directly affects your tax bill and when you can get to your money.

For most UK investors, the choice boils down to a few main options:

- Stocks and Shares ISA: This is almost always the best place to start. You can currently put in up to £20,000 each tax year, and every penny of growth or income is completely tax-free. It’s a fantastic tool for building wealth.

- General Investment Account (GIA): Filled up your ISA for the year? A GIA is the next logical step. There are no limits on how much you can invest, but you’ll have to pay Capital Gains Tax on any profits that go over your annual allowance.

- Self-Invested Personal Pension (SIPP): If your goal is retirement, a SIPP is your best friend. The government gives you tax relief on your contributions, but the trade-off is that you can’t touch the money until you’re at least 55 (soon to be 57).

Getting an account open is usually a quick online job with any major brokerage platform. You’ll need some ID and personal details. My advice? Look for a platform with low fees, a solid selection of the funds you want (like ETFs), and a website or app that doesn’t make your head spin.

Placing Your Trades with Confidence

Okay, your account is open and the money is in. Time to buy. When you go to place a trade, you’ll see a couple of “order types.” Knowing the difference is key to not being surprised by the price you pay.

Market Order vs. Limit Order

- A market order is the “just get it done” option. It tells your broker to buy your chosen investment right now, at the best price available. It’s fast and guaranteed to happen, but the final price might be a fraction different from the quote you saw.

- A limit order puts you in control. You set the exact price you’re willing to pay. Your trade only executes if the market hits your price or a better one. This is handy if you’re targeting a specific entry point and don’t mind waiting.

Honestly, for a long-term investor buying a big, popular ETF, a market order is perfectly fine. A few pennies’ difference won’t matter in 20 years. If you’re brand new to all this, our full guide on how to start investing for beginners covers these basics in more detail.

The most important thing isn’t which order type you use; it’s that you actually place the order. Don’t let small technical details cause “analysis paralysis” and keep your cash sitting on the sidelines.

The Simple Discipline of Rebalancing

Investing isn’t a one-and-done deal, but it also doesn’t mean you need to be checking your phone every five minutes. Over time, your investments will grow at different speeds, and this can slowly push your portfolio out of alignment with your plan.

Imagine you started with a “60/40” stock-to-bond portfolio. After a great year for stocks, it might have drifted to become “70/30” without you doing anything. Your portfolio is now carrying more risk than you originally signed up for.

Rebalancing is just the act of nudging it back into place. You do this by selling a small slice of what’s done well and using that cash to top up the assets that have lagged behind. It’s a disciplined way to manage risk that naturally makes you “sell high and buy low.”

For most people, checking in and rebalancing once or twice a year is plenty. It’s a simple but powerful habit that keeps your strategy on track with your goals.

Navigating Common Investing Fears and Pitfalls

When it comes to investing a large sum of money, the biggest hurdles you’ll face probably won’t be on a spreadsheet. They’re emotional. The fear of getting it wrong—of putting a lifetime of savings into the market right before a massive crash—can be paralyzing. It’s a feeling that keeps good people with good intentions stuck on the sidelines for years.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Conquering the Fear of Investing at the Top

I get it. The idea of investing your cash just as the market hits a new all-time high feels like walking a tightrope without a net. What if this is the absolute peak right before a plunge? It’s a completely valid fear, but the data tells a different, more optimistic story.

Believe it or not, even when the market is hitting new highs, lump-sum investing usually comes out ahead. Since 1990, the market has hit a new all-time high about 20 times a year on average. More importantly, the returns following those peaks have often been stronger than average.

Even after terrifying drops like the 40% plunge in 2008 or the shocking 34% crash in March 2020, lump-sum strategies have historically outperformed gradual ones. This resilience shows that market peaks are a normal feature of a market that trends upward over the long haul. Waiting for a dip often means missing out on significant gains while your cash loses purchasing power to inflation. You can dig deeper into the data on lump-sum investing’s long-term performance to see for yourself.

Avoiding “Analysis Paralysis”

With endless financial news and expert opinions at our fingertips, it’s incredibly easy to fall into the trap of “analysis paralysis.” You could spend months researching the perfect funds, reading conflicting economic forecasts, and waiting for every star to align.

A little research is smart, but obsessive analysis is often just a form of procrastination fueled by fear. And every month you wait is a month of potential growth you can never get back.

Here’s how to break the cycle and get moving:

- Keep It Simple. You don’t need a complex, exotic strategy. A diversified portfolio of low-cost index funds or ETFs is a time-tested approach that works for millions. Stick to your plan.

- Set a Deadline. Give yourself a hard date to make your investment. This simple trick creates a sense of urgency and stops you from endlessly second-guessing.

- Automate It. If you do choose a dollar-cost averaging approach, set up automatic transfers from your bank. This takes the emotion and guesswork out of the equation each month.

The goal isn’t to make the perfect investment decision, because there’s no such thing. The goal is to make a good decision and get your money working, letting time and compound interest do the heavy lifting.

Resisting the Urge to Panic Sell

This is probably the most destructive mistake of all: panic selling. Markets go up, but they also go down. When a downturn inevitably happens, seeing your portfolio value drop can trigger a primal fight-or-flight response. Your gut will scream, “Sell! Get out now before it gets worse!”

Acting on that impulse is almost always a catastrophic error.

Selling during a downturn doesn’t stop the pain; it just locks in your losses permanently. It also puts you on the sidelines, guaranteeing you’ll miss the eventual recovery. Market rebounds are often surprisingly swift and powerful, with some of the best days happening right after the worst ones.

Successful long-term investing requires discipline and a strong stomach. By creating a solid plan when you’re calm and rational, you give yourself a roadmap to follow when emotions are running high. Trust the plan you built, stay diversified, and remember that volatility is simply the price of admission for achieving long-term growth.

Got Questions About Lump Sum Investing? Let’s Clear Them Up.

We’ve walked through the mechanics of investing a lump sum, but it’s totally normal to still have a few “what if” scenarios running through your mind. When you’re about to commit a chunk of money, you want to be sure. Let’s tackle some of the most common questions I hear from investors to help you move forward with confidence.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

“But My Lump Sum Isn’t That Big…”

I get this one a lot. People often think these strategies are only for lottery winners or those who’ve received a massive inheritance. Is it really worth it to invest, say, £1,000 or £5,000 all at once?

Absolutely. The principles of investing don’t change with the size of the cheque.

Whether you have £1,000 or £100,000, getting that money into the market gives it the maximum amount of time to work for you. The power of compounding doesn’t care about the starting number—it just needs time. The data showing that lump-sum investing usually beats phasing it in is all based on percentage returns, so the logic is just as solid for smaller amounts. Honestly, the most important thing is just getting started.

What About Taxes?

Ah, the taxman. You can’t ignore him. The tax implications of your lump sum are a critical piece of the puzzle, and they start from day one.

First, think about where the money came from. A bonus from work? That’s taxed as income. An inheritance? That might be tax-free up to a certain point. Then, once you invest, any profit you make is potentially subject to Capital Gains Tax when you sell. This is where you can be really smart about it.

Tax-efficient accounts are your best friend here. By using wrappers like a Stocks and Shares ISA, you can legally shield your investments from tax. Every single penny of growth is yours to keep, which can make a staggering difference to your final pot over the years.

If you’re at all unsure, a quick chat with a tax professional can save you a lot of headaches and money down the line.

How Do I Handle a Volatile Market?

Okay, so what if the market is going crazy right when you’re ready to invest? It’s incredibly tempting to wait on the sidelines for things to “calm down.” But this is just market timing in disguise, and it rarely works out.

For anyone investing for the long haul, the best move during a choppy market is almost always to stick to your plan.

Market history is one long story of ups and downs, but the long-term trend has always been up. Downturns are a normal, expected part of the journey. Making emotional, knee-jerk decisions based on scary headlines is probably the single biggest destroyer of wealth. If your portfolio is well-diversified and built for your timeline, volatility is just the price you pay for the potential of long-term growth.

How Often Should I Be Checking My Investments?

Once you’ve invested your lump sum, how often should you log in to check on it? The answer might surprise you: way less than you think.

Checking your portfolio constantly is a recipe for anxiety. It tempts you to tinker and react to daily noise, which is a losing game.

For a long-term, diversified portfolio, a quick check-in once or twice a year is plenty. The main reason for looking is simply to rebalance—that is, to sell a bit of what’s done well and buy more of what’s lagged to get back to your original target allocation.

So, when should you peek?

- Annual Review: A perfect time to rebalance and make sure your strategy still fits your life.

- Major Life Event: Things like a new job, a baby, or buying a house might mean your goals have changed, so it’s a good time for a review.

Resist the urge to watch the daily market ticker. Your focus is on the next decade, not the next ten minutes.

At Collapsed Wallet, our goal is to give you clear, no-nonsense guidance to help you make smarter moves with your money. To build your confidence and get more practical tips, find out more at https://collapsedwallet.com.