Table of Contents

- Defining Financial Independence Beyond Early Retirement

- Why Pursuing Financial Independence Truly Matters

- Calculating Your Personal Financial Independence Number

- Building Your Foundation by Eliminating High-Interest Debt

- Your Savings Rate: The Real Secret to Fast-Tracking Freedom

- Making Your Money Work for You Through Smart Investing

- Common Questions About Financial Independence

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let’s get one thing straight: financial independence isn’t about getting rich and sipping piña coladas on a beach somewhere (though it certainly can be). At its heart, it’s about freedom. It’s the point where your assets—your investments, your side hustles, your rental properties—generate enough income to cover all your living expenses. Work becomes a choice, not a necessity. That’s the real prize.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Defining Financial Independence Beyond Early Retirement

When most people hear “financial independence,” their mind immediately jumps to early retirement. While that’s a popular goal, it’s just one possibility. The real power of this concept is in the flexibility it gives you to design the life you want, long before you hit traditional retirement age.

I like to think of it as building your own personal “money machine.” You’re not just earning a paycheck; you’re constructing a system of assets that works for you around the clock. When that machine hums along, producing enough cash to cover your rent, groceries, and everything else, you’ve done it. You’ve reached FI.

This is the very idea that sparked the FIRE (Financial Independence, Retire Early) movement, a community dedicated to aggressively saving and investing to dramatically shorten the traditional 40-year career path.

The Blueprint for Your Money Machine

The FIRE movement isn’t about wishful thinking; it’s built on some surprisingly simple math. The goal is to reach a specific number—an amount of invested assets that can support you indefinitely. For most people, this target is 25 to 30 times their annual spending.

Where does that number come from? It’s based on a well-known guideline in retirement planning called the “4% Rule.” Decades of research suggest that you can safely withdraw 4% of your invested portfolio each year with a very high probability of it lasting a lifetime.

By flipping this rule, you can calculate your target for financial independence. If you can safely withdraw 4% of your portfolio each year, then having a portfolio that is 25 times your annual expenses (100% ÷ 4% = 25) means you have enough to live on.

Suddenly, a lofty dream becomes a clear, mathematical target. This simple calculation shows that financial independence isn’t some secret club for the super-rich. It’s an achievable goal for anyone willing to create a plan and stick with it.

The Core Principles of Financial Independence

To get started, you need to understand the fundamental parts that make this money machine run. These concepts are the bedrock of any solid financial independence strategy.

The table below breaks down the essential principles you’ll need to master.

| Concept | What It Means | Why It’s Crucial for FI |

|---|---|---|

| Passive Income | Money you earn without actively trading your time for it (e.g., stock dividends, rental income). | This is the fuel for your money machine. When your passive income covers your expenses, you’re financially free. |

| High Savings Rate | The percentage of your income you save and invest, rather than spend. | This is the single most powerful lever you can pull. A 50% rate gets you to FI far faster than a 15% one. |

| Compound Growth | Your investment earnings start to generate their own earnings, creating exponential growth over time. | Compounding does the heavy lifting for you, especially in the later years. It’s what makes your money work hard. |

These aren’t just buzzwords; they are the gears of your money machine. Mastering them is your path to building sustainable wealth.

You can learn more by exploring our complete guide on what is passive income.

Ultimately, this whole journey is about designing a life where you own your time. It’s a path built on intentional spending, strategic saving, and patient investing—the very things that empower you to leave financial stress behind and finally live life completely on your own terms.

Why Pursuing Financial Independence Truly Matters

We just talked about financial independence as building your own “money machine.” But what’s the point of going to all that trouble? Why build one in the first place?

It all boils down to one simple, powerful idea: reclaiming your most valuable, non-renewable resource—your time. The pursuit of financial independence is about taking back control of your life and finally stepping off the treadmill of trading hours for dollars just to keep the lights on.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

This journey is about so much more than numbers on a spreadsheet. It’s about getting out from under the crushing weight of financial stress. Imagine what life would feel like if you weren’t chained to a job you dislike or completely dependent on a single paycheck that could vanish tomorrow. That’s the real promise of FI.

Gaining Freedom from the 9-to-5 Grind

For most people, the daily grind feels like running on a hamster wheel. You work hard, you get paid, you pay bills, and you do it all over again, often with very little to show for it at the end of the month. This cycle, famously called the “rat race,” can leave you feeling stuck and unfulfilled.

Financial independence is your off-ramp. It gives you the power to say “no” to a toxic work environment and a loud “yes” to things that actually light you up.

For example, you could:

- Follow a creative passion: Finally write that book, learn to paint, or start a woodworking shop in your garage without the pressure of it needing to pay the mortgage from day one.

- Give back to a cause you love: With your finances sorted, you can afford to dedicate your time to volunteering or supporting a non-profit.

- Be there for your family: FI means having the flexibility to care for an aging parent, be home when the kids get off the bus, or simply not miss the important moments.

The goal isn’t always to stop working entirely. It’s about getting to a place where work becomes a choice driven by purpose, not a necessity for survival.

Building a Fortress Against Uncertainty

Let’s face it: life is unpredictable. A sudden recession, an unexpected layoff, or a health emergency can throw a wrench into the most carefully laid plans. Financial independence is your buffer against that chaos. It’s a personal safety net that protects you and your family when things go sideways.

When you’re financially independent, losing your job is an inconvenience, not a catastrophe. You have the breathing room to find a new role that’s a great fit, instead of frantically taking the first offer that comes along just to pay the bills.

Financial independence isn’t about getting rich; it’s about becoming resilient. It turns your financial life from a fragile house of cards into a fortress that can withstand life’s storms.

That kind of security is life-changing. It dramatically lowers your day-to-day anxiety and gives you the confidence to make bolder, more authentic choices.

The Immediate Benefits of the Journey

Here’s one of the best parts: you don’t have to wait until you hit your final FI number to feel the benefits. The process of getting there improves your life right now.

As you start spending more intentionally, you’ll naturally cut out the purchases that don’t bring you real value. This simple shift helps you feel more mindful and content long before you ever think about quitting your job.

Developing strong money management skills is a reward in itself, giving you a powerful sense of control over your financial destiny from the moment you begin.

Calculating Your Personal Financial Independence Number

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Understanding the idea of financial independence is one thing. But to make it a real, tangible goal, you need to turn that dream into a number. This is your personal FI Number—the exact amount of money you need in investments to live off the returns forever, without ever needing a paycheck again.

Think of it as your personal finish line. Once you have a specific number to aim for, the whole journey becomes clearer and far more achievable. It transforms a fuzzy wish into a concrete, measurable mission.

The 25x Rule Explained

The simplest and most popular way to figure out your FI Number is with the “25x Rule.” It’s a fantastic rule of thumb that gives you a quick, reliable estimate of the portfolio size you’ll need to support your lifestyle.

The formula couldn’t be easier:

Your Annual Expenses x 25 = Your FI Number

This is the cornerstone of FI planning. Notice that it’s all about your spending, not your income. This simple shift in focus puts you squarely in the driver’s seat—the less you need to live on, the smaller your target becomes.

The Power of The 4 Percent Rule

The 25x Rule isn’t just some random multiplier. It’s the flip side of another crucial concept: the “4% Safe Withdrawal Rate” (SWR). The 4% Rule is born from extensive research into historical stock and bond market performance.

Basically, studies found that retirees could withdraw 4% of their starting portfolio value each year (adjusting for inflation) and have an extremely high chance of their money lasting for at least 30 years.

When you aim for a portfolio that’s 25 times your annual expenses, you’re setting yourself up to live on those 4% annual withdrawals. It’s the mathematical bedrock that makes the entire strategy work.

Finding Your Starting Point: Tracking Expenses

Before you can multiply anything by 25, you first have to know your annual expenses. This is the most important piece of the entire puzzle because your FI number is completely unique to your life.

The first step is getting an honest look at where your money is going. There are a few good ways to do this:

- Budgeting Apps: Modern apps can link to your bank accounts and credit cards, automatically categorizing your spending so you get a clear, real-time picture of your habits.

- The Spreadsheet Method: If you prefer a more hands-on approach, you can manually log every expense in a simple spreadsheet for a few months.

- Review Past Statements: Just look back at three to six months of your bank and credit card statements. This will help you spot patterns and calculate an average monthly spend. Then, just multiply that by 12.

Once you have this number, your path is clear. It also gives you a much better handle on your overall financial health, which is a vital part of the journey. For an even deeper look, it’s worth learning how to calculate net worth to unlock your potential.

To show how this works in the real world, here are a few examples.

Sample Financial Independence Calculations

The table below illustrates just how much your spending habits influence your final goal.

| Annual Spending | Calculation (Spending x 25) | Required FI Target |

|---|---|---|

| £30,000 | £30,000 x 25 | £750,000 |

| £45,000 | £45,000 x 25 | £1,125,000 |

| £60,000 | £60,000 x 25 | £1,500,000 |

As you can see, controlling your expenses has a massive impact on the size of the mountain you need to climb. Calculating your number is the first real, actionable step you can take toward financial freedom.

Building Your Foundation by Eliminating High-Interest Debt

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Before you can even think about building wealth, you have to deal with what’s actively tearing it down. For most people, the single biggest roadblock to financial independence isn’t a lack of income; it’s high-interest debt. This isn’t a small bump in the road—it’s a powerful riptide pulling you away from your goals.

Trying to save and invest while carrying expensive debt is like trying to fill a bucket with a massive hole in the bottom. For every £100 you pour in (your savings), £20 leaks out (the interest charges). You’re working hard but making frustratingly little progress. Getting rid of this debt isn’t just a good idea; it’s the absolutely essential first step to getting any real traction.

Why High-Interest Debt Is So Destructive

Look, not all debt is created equal. A mortgage on a home that’s growing in value can be a powerful tool. High-interest debt, on the other hand, is purely destructive. We’re usually talking about:

- Credit Card Debt: With interest rates often soaring past 20%, this is public enemy number one. It’s the most common and damaging kind of debt out there.

- Payday Loans: These are financial poison. They can have ridiculously high interest rates, sometimes in the triple digits, designed to trap you in a cycle you can’t escape.

- Personal Loans: While the rates might be lower than credit cards, they can still be high enough to quietly drain your income month after month.

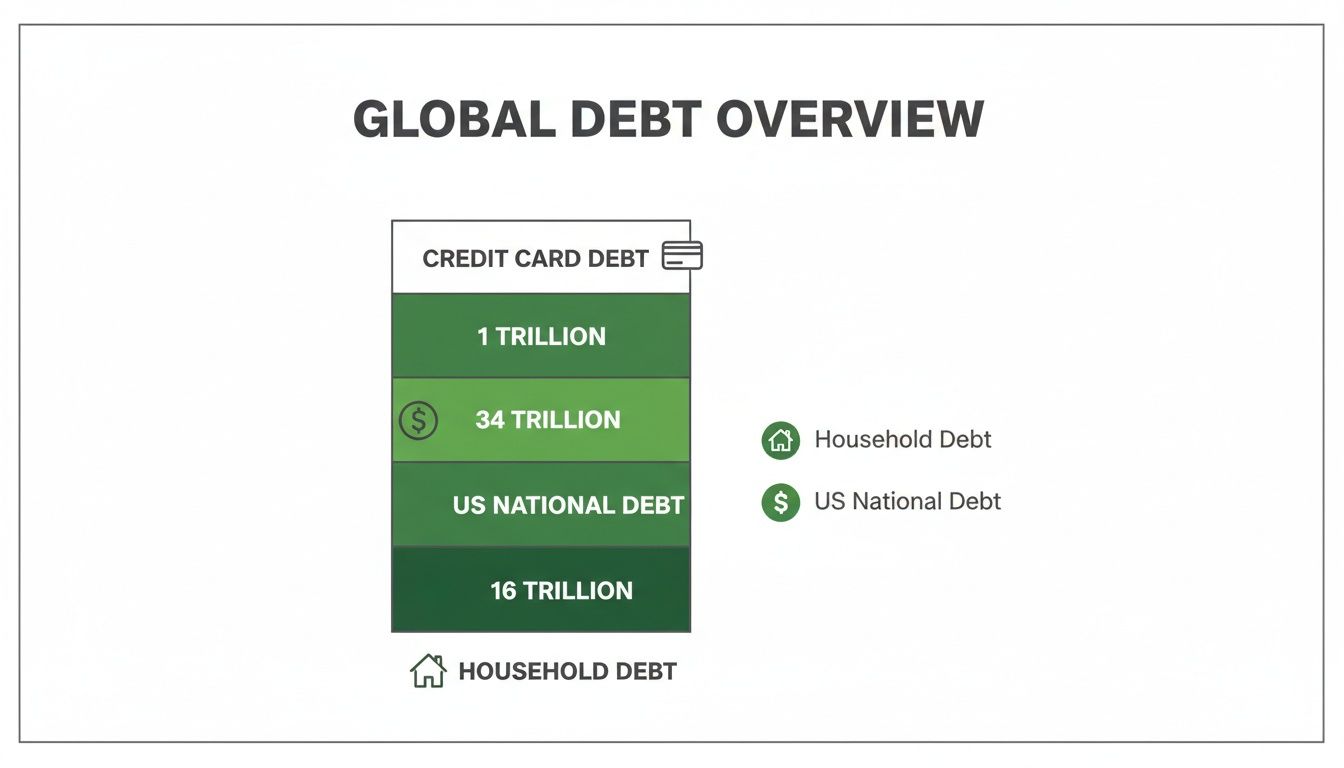

This kind of debt is like compounding interest in reverse. Instead of your money making more money, your debt is busy making more debt, and it does it at a frightening speed. It’s a silent wealth killer that chains millions of people to jobs they hate, all while the interest payments pile up relentlessly. It’s a massive global problem, with household debt hitting a staggering $59 trillion in 2023. If you’re serious about financial independence, building a debt-free foundation is completely non-negotiable. You can learn more about the scale of this issue by reading about the global financial landscape on weforum.org.

The Debt Avalanche: A Proven Strategy

So, how do you break free? The most powerful strategy for crushing high-interest debt is the Debt Avalanche method. The logic behind it is simple and mathematically sound: you throw every spare penny you have at the debt with the highest interest rate first, while just making the minimum payments on everything else.

The Debt Avalanche method saves you the most money in interest payments over time. By targeting the most expensive debt first, you stop the biggest financial “leak” and accelerate your path to being debt-free.

Once that first, most expensive debt is gone, you take the entire amount you were paying on it (the minimum payment plus all the extra cash) and roll it over to the debt with the next-highest interest rate. This creates a powerful repayment snowball that picks up speed, knocking out each debt faster and faster.

Let’s break it down into a simple, actionable plan.

Your Action Plan to Clear High-Interest Debt

- List All Your Debts: Grab a piece of paper or open a spreadsheet. Write down every single debt you have, from credit cards to personal loans. For each one, note the total balance and, most importantly, the Annual Percentage Rate (APR).

- Order by Interest Rate: Now, rearrange that list. Put the debt with the highest APR at the very top and the lowest at the bottom. This is your hit list.

- Focus Your Firepower: Keep making the minimum payments on all your debts. This is crucial to keep your accounts in good standing. Then, funnel every spare pound you can find toward that number one debt on your list.

- Automate and Eliminate: The moment that first debt is paid off, take a second to celebrate! Then, immediately redirect the full amount you were paying on it to the next debt on your list. Repeat this until you’re completely free.

This focused approach gives you a clear roadmap. It stops you from making lenders rich and lets you start paying yourself instead. This is the foundational work that makes everything else—building wealth, investing, and achieving financial independence—truly possible.

Your Savings Rate: The Real Secret to Fast-Tracking Freedom

Want to know the single biggest lever you can pull on your journey to financial independence? It’s not about earning a six-figure salary or picking a once-in-a-lifetime stock. It’s much simpler and far more powerful: your savings rate.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

This is the percentage of your take-home pay you stash away and invest. More than anything else, this number dictates how quickly you can leave the rat race behind.

Think about it this way: someone earning £40,000 a year but saving a massive 50% of it will reach FI decades sooner than someone earning £100,000 who only saves 10%. Why does this work? A high savings rate is a brilliant two-pronged attack.

First, you’re obviously building up your investment pot much, much faster. But just as important, you’re also training yourself to live happily on less. This directly shrinks the amount of money you’ll need to be free, shortening the finish line itself. It’s a powerful one-two punch that completely changes the timeline.

Of course, getting that savings rate up isn’t always easy when you’re fighting against the tide of debt.

As you can see, things like high-interest credit cards and other debts are a huge drag on your ability to save. They’re a headwind pushing you back while you’re trying to move forward.

How to Actually Boost Your Savings Rate

Ramping up your savings doesn’t mean you have to live on bread and water. It’s about being deliberate with your money and making sure it aligns with what you really want—freedom.

Here are a few high-impact strategies that work:

- Pay Yourself First (And Make It Automatic): This is the golden rule for a reason. Set up an automatic transfer to your investment account for the day you get paid. The money is gone before you even have a chance to miss it or spend it.

- Attack the Big Three: Don’t sweat the small stuff, like giving up your daily latte. Instead, focus your energy on your biggest expenses: housing, transport, and food. Downsizing your car, finding a cheaper place to live, or using budgeting apps to track food spending can free up hundreds of pounds a month—far more than any small cutbacks.

- Dodge “Lifestyle Creep”: It’s so tempting to upgrade your life every time you get a raise or a bonus. Resist! If you can funnel the majority of that new money straight into your investments, you can supercharge your savings rate without ever feeling the pinch of a cutback.

A high savings rate isn’t about deprivation. It’s a mindset shift. You’re not focused on what you’re giving up today; you’re focused on what you’re gaining tomorrow: complete control over your time and your life.

The numbers don’t lie. Many in the FI community aim to save 50-70% of their income, which is a world away from the national averages. Someone saving a typical 15% is probably looking at a traditional retirement around age 65. But someone saving 50%? They could be done by their late 30s. The maths is compelling.

You can dive deeper into global economic prospects and savings trends on desapublications.un.org to see just how much of an outlier this aggressive approach to saving really is.

Making Your Money Work for You Through Smart Investing

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Saving a big chunk of your income is a huge accomplishment—it’s the engine of your FI journey. But investing? That’s the rocket fuel.

If you just let your savings pile up in a standard bank account, you’re actually losing money over time. The quiet, constant creep of inflation eats away at your purchasing power year after year. Investing is how you fight back, get ahead, and make your money start working for you.

The real magic here is unlocking compound growth. This is the phenomenon where your investment earnings begin to generate their own earnings. It’s a slow-building snowball effect that can transform a modest portfolio into a life-changing nest egg over the long haul. This is what truly gets your “money machine” humming.

The Beginner’s Approach to Investing

Here’s the good news: you don’t need an MBA or a fancy Wall Street terminal to get started. For most of us on the path to financial independence, the simplest approach is actually the most effective one. It all boils down to using low-cost, diversified funds.

Let’s break down two of the most popular and beginner-friendly options:

- Index Funds: Think of an index fund as a basket that holds tiny pieces of every company in a major market index, like the S&P 500. Instead of trying to find the one needle in the haystack, you just buy the entire haystack.

- Exchange-Traded Funds (ETFs): These are very similar to index funds (many ETFs are index funds), but they trade on stock exchanges just like individual stocks. They’ve become incredibly popular for their low fees, flexibility, and ease of use.

Both of these give you instant diversification, which is just a fancy way of saying “don’t put all your eggs in one basket.” By spreading your investment across hundreds of companies, the poor performance of any single one won’t sink your entire portfolio.

Why Diversified Funds Are a Top Choice

There’s a reason these funds are the go-to choice for the FI community. For one, they are incredibly cheap. Low fees mean that more of your money stays invested and continues to grow for you, instead of lining a fund manager’s pocket.

They also encourage the right mindset for long-term success. Since you’re invested in the overall market, your job isn’t to guess what will happen tomorrow. It’s to hang on and let the market do its thing over years and decades.

The secret to building wealth isn’t about timing the market; it’s about time in the market. The key is to stay the course, tune out the daily news cycles, and let compounding work its magic.

This “set it and forget it” mentality is your best defense against making emotional, knee-jerk decisions that can sabotage your progress.

Simplifying the Process with Technology

It wasn’t that long ago that investing felt like a club for insiders. Today, technology has blown the doors wide open. Robo-advisors are a perfect example.

These platforms use smart algorithms to build and manage a portfolio for you, all based on your specific goals and comfort with risk. You answer a few simple questions, set up automatic deposits, and the platform does the heavy lifting. It’s a brilliant way to make consistent investing a simple, automatic habit on your path to what is financial independence.

Common Questions About Financial Independence

Once you start digging into the idea of financial independence, you’re bound to have questions. It’s a big goal, after all, and it’s totally normal to have a few “what ifs” or need some extra clarity on the core ideas. Let’s tackle some of the most common questions that pop up.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Getting these cleared up can give you the confidence to take those first important steps.

Do I Need a High Income to Achieve Financial Independence?

Not at all. This is one of the biggest myths out there. While a big salary can definitely get you there faster, financial independence is really about your savings rate—the slice of your income you manage to save and invest.

Think about it this way: someone with a modest salary who squirrels away 50% of their income will reach FI much, much faster than a high-earner who only saves 10%. The real magic happens when you widen the gap between what you earn and what you spend. That’s what makes this goal achievable for anyone, regardless of their annual salary, as long as they’re willing to be intentional with their money.

Is the 4 Percent Rule Still a Safe Guideline?

The 4% Rule is a fantastic starting point. It’s a guideline, based on decades of market history, that helps you figure out a safe amount to withdraw from your investments each year for a traditional 30-year retirement. But it’s not an ironclad promise.

Economic conditions can change. A nasty bout of high inflation or a major market crash right after you retire could put a strain on the 4% rule’s long-term success.

Because of that uncertainty, many people in the FI community play it a bit safer. They might aim for a more conservative 3.5% or even a 3% withdrawal rate. This builds an extra cushion into their plan, giving them more confidence that their money will truly last a lifetime.

What Is the Difference Between Being Rich and Financially Independent?

This is such a crucial distinction to understand. Being “rich” is usually tied to having a high income or a massive net worth, but it doesn’t automatically mean you’re free. A surgeon earning £300,000 a year who lives a £295,000 lifestyle is still chained to their next paycheck.

Financial independence, on the other hand, is all about cash flow. You’re financially independent when your assets generate enough passive income to cover your living expenses, period. It’s about security, freedom, and having choices—not just about having a big number in a bank account.

At Collapsed Wallet, we’re focused on creating clear, actionable guides to help you master your money. From budgeting basics to smart saving strategies, we have the resources you need to build a more secure financial future. Explore more of our articles and start your journey today at https://collapsedwallet.com.