Table of Contents

- Understanding Financial Wellness Beyond Your Bank Balance

- The Core Components of a Financially Healthy Life

- How to Measure Your Current Financial Health

- The Real-World Benefits of Financial Wellness

- Actionable Steps to Improve Your Finances Today

- Building Your Secure Financial Future

- Got Questions About Financial Wellness? We've Got Answers.

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let's be honest, when most of us hear the term "financial wellness," our minds jump straight to a big, fat bank account. But that’s not the whole picture. Not even close.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Financial wellness is really about your relationship with money. It’s the feeling of control and confidence that comes from knowing you can handle life’s curveballs and still have the freedom to make choices that actually make you happy. Think of it less as a destination (like being a millionaire) and more as a state of being—a sense of calm and security in your financial life.

Understanding Financial Wellness Beyond Your Bank Balance

It's a common trap to measure our financial health by the number in our savings account. While savings are definitely part of the equation, true financial wellness goes much deeper.

Imagine it like physical health. You wouldn't say you're "fit" after just one good workout, right? It’s the result of consistent, healthy habits—eating well, moving your body, getting enough rest. Financial wellness works the same way. It’s built on a foundation of positive, repeatable actions that strengthen your financial big picture.

This means feeling on top of your day-to-day bills, knowing you could handle a surprise car repair without panicking, and feeling confident that you're making steady progress toward your big life goals. It’s the peace of mind that comes from having a plan.

Moving From Stress to Security

Money stress is real, and it’s a heavy weight to carry. A recent Bank of America study brought this into sharp focus, revealing that a staggering 66% of employees feel stressed about their finances. Even more telling, 76% feel like the rising cost of living is leaving their paychecks in the dust.

This isn't just a feeling; it's a widespread reality impacting tens of thousands of people. The report, which analyzed nearly 90,000 retirement plan participants, even pointed out a gender gap, with women reporting lower financial wellness scores than men.

This is exactly where financial wellness makes a difference. It’s the roadmap that guides you out of that stress. By building good habits, you create a financial cushion that protects you from the unexpected and gives you the confidence to live life on your terms, not just reacting to your next bill.

The Pillars of Financial Strength

So, how do you get there? Achieving this sense of control and freedom comes down to building on a few core pillars. Think of these as the foundation of a strong, resilient financial life. To give you a quick overview, here are the core components we’ll be exploring.

The Four Pillars of Financial Wellness at a Glance

| Pillar | What It Means for You |

|---|---|

| Budgeting & Spending | You have a clear handle on where your money goes and feel in control of your daily expenses. |

| Saving & Investing | You’re consistently putting money aside for emergencies and making progress toward long-term goals. |

| Debt & Credit | You have a manageable amount of debt and a clear strategy to pay it down, with a solid credit history. |

| Planning & Protection | You’re planning for the future (like retirement) and have protections (like insurance) in place. |

Let's break down what each of these pillars looks like in the real world.

- Effective Budgeting: This is about knowing exactly where your money goes each month. No guesswork, just clarity.

- Strategic Saving: Intentionally setting money aside for both emergencies and your future goals, like a down payment on a home.

- Debt Management: Having a concrete plan to tackle and eliminate high-interest debt so it doesn’t control your life.

- Future Planning: Actively saving and investing for long-term goals like retirement, so your future self will thank you.

A huge piece of this puzzle is understanding credit and why it matters, as it impacts everything from getting a loan to renting an apartment. Mastering these concepts is a major step in boosting your financial literacy. Speaking of which, if you're looking to build a stronger foundation, our guide on what is financial literacy and how to secure your future is a great place to start.

The Core Components of a Financially Healthy Life

Financial wellness isn't some abstract, single destination you arrive at one day. It’s more like building a house. You need a solid foundation, strong walls, and a leak-proof roof—all working together. If you neglect one part, the whole structure feels shaky.

Getting a handle on these key pieces is the first real step toward understanding what financial wellness actually feels like. Each one addresses a different part of your relationship with money, and shoring them up is what brings that sense of calm and control we're all after.

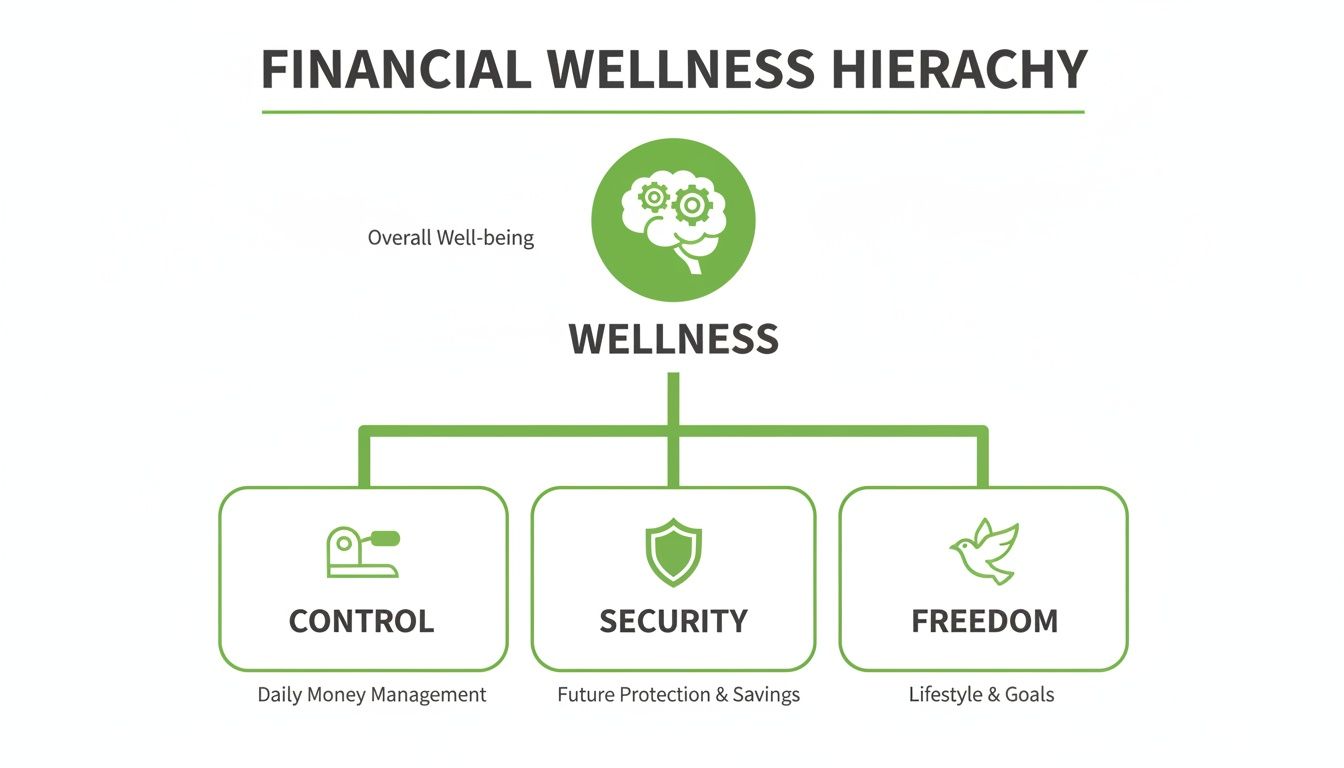

This hierarchy shows how the fundamental pieces build on each other, moving you from simply managing your daily finances to achieving true financial freedom.

As you can see, real wellness starts with control over your day-to-day money, which then provides the security to handle life's curveballs, and ultimately gives you the freedom to make choices that align with your best life.

Budgeting and Spending Control

It all starts here. The absolute foundation is getting a grip on your cash flow through budgeting and being intentional with your spending. This isn’t about depriving yourself of everything you love. It’s about empowerment—telling every dollar where to go so you're in charge.

A budget is just a plan for your money, nothing more. It shows you exactly what’s coming in and what’s going out, letting you make conscious decisions instead of just reacting. Without that clarity, it's all too easy to wonder where your paycheck went.

A budget tells your money where to go instead of you wondering where it went. This shift from reactive to proactive money management is the cornerstone of financial control.

Gaining this control means you're no longer just a passenger along for the ride. You’re in the driver's seat of your own financial life, and that's the difference between ending the month with stress and ending it with confidence.

Saving and Investing for Your Future

Once you know where your money is going, the next step is to build for tomorrow. Saving and investing is the bridge from just getting by today to actually thriving in the future. It’s how you create a safety net for yourself while also putting your money to work.

This has two crucial parts:

- Building an Emergency Fund: Life happens. An unexpected trip to the ER, a surprise car repair, or a sudden layoff can throw you for a loop if you're not ready. An emergency fund—ideally 3 to 6 months' worth of essential living expenses—is the buffer that lets you handle these bumps without a financial crisis.

- Investing for Long-Term Goals: This is where you actually build wealth. Investing isn’t just for Wall Street experts; it’s a powerful tool for everyone. By consistently putting money into things like low-cost Exchange-Traded Funds (ETFs), you tap into the magic of compound growth, where your money starts earning its own money over time.

This two-pronged approach gives you both short-term security and long-term momentum. You're protected from immediate shocks while actively building a richer future.

Strategic Debt Management

Debt, especially the high-interest kind from credit cards and personal loans, can feel like an anchor dragging you down. It eats into your income, adds a ton of stress, and makes it nearly impossible to save and invest. The third pillar is all about creating a smart, strategic plan to manage and ultimately eliminate that weight.

Getting out of debt isn't about feeling guilty; it's about taking clear-eyed action. It starts by getting honest about exactly what you owe and to whom. From there, you can prioritize which debts to attack first—usually the ones with the highest interest rates—to save yourself the most money in the long run.

Think of every extra debt payment as chipping away at that anchor. It might feel slow at first, but each chip lightens the load and brings you closer to floating free.

Comprehensive Financial Planning

This is the pillar that ties everything else together. Financial planning is where you look ahead, define what you truly want out of life, and draw a map to get there. It’s about designing your future on purpose, not by accident.

Financial planning is what helps you answer the big questions:

- When do I want to retire, and what will that look like?

- Do I want to buy a home or start my own business someday?

- How can I make sure my kids' education is covered?

When you have clear, meaningful goals, your daily money habits suddenly have a powerful "why" behind them. Saving an extra $100 a month doesn't feel like a sacrifice when you know it's a concrete step toward a down payment on your dream home. This is what turns budgeting and saving from chores into purposeful actions on the path to a life you've built yourself.

How to Measure Your Current Financial Health

Knowing what financial wellness is made of is a great start, but to make any real progress, you need a clear picture of where you are right now. You can't improve what you don't measure. Let's walk through a few practical ways to give yourself a quick financial check-up and see exactly where you stand.

Think of this as a snapshot of your financial life. By looking at a couple of key numbers and asking yourself some honest questions, you can quickly identify what’s working well and what might need a little more attention. This isn’t about judgment—it’s about getting the clarity you need to move forward with confidence.

Key Metrics to Calculate

Numbers tell a story, and you don’t need to be a math whiz to understand what they're saying about your finances. Here are two of the most revealing metrics that give you a high-level view of your situation.

Your debt-to-income (DTI) ratio is a big one. It simply compares how much you owe each month to how much you earn. Lenders look at this number all the time to see if you can handle new debt, but it's just as important for you to know. A low DTI is a great sign you've got a healthy balance between your income and your debts.

To figure it out, just add up your monthly debt payments (think mortgage, car loans, student loans, and credit card minimums) and divide that total by your gross monthly income (your pay before taxes). Multiply by 100 to get the percentage. For a full breakdown, check out our guide on how to calculate your debt-to-income ratio.

Next up is your savings rate, which is the percentage of your income you're stashing away for the future. This little number is a powerful indicator of your ability to build wealth and hit your long-term goals. The higher your savings rate, the bigger the gap between what you earn and what you spend—and that gap is where financial freedom is born.

Finding your savings rate is easy: take the amount you save each month, divide it by your take-home pay, and multiply by 100. Even a tiny bump in this percentage can grow into a massive sum over time, all thanks to the magic of compounding.

A Simple Self-Assessment Checklist

Beyond the hard numbers, a huge part of financial wellness is just how you feel about your money. Confidence and peace of mind are just as important as the figures on a spreadsheet. Run through this quick checklist to get a sense of where you are.

Give yourself a simple "yes" or "no" for each question:

- Emergency Ready: Could you handle an unexpected $1,000 expense without swiping a credit card or selling something?

- Consistent Saver: Are you saving a piece of your income every single month, no matter how small?

- Debt Under Control: Do you feel like your debt is manageable and you have a solid plan to pay it down?

- On-Time Payments: Are all your bills paid on time each month without causing you stress?

- Future-Focused: Are you actively putting money into a retirement account or other long-term investments?

If you answered "no" to a few of these, that's completely fine! All it does is shine a light on the exact areas where you can start making improvements.

The goal of a financial self-assessment isn't to get a perfect score. It's to gain self-awareness. Knowing your vulnerabilities is the first step toward turning them into strengths.

When you combine these key metrics with your self-assessment, you get a much fuller picture of your financial health. This newfound clarity is your starting line. From here, you can set meaningful goals and start taking the right steps to build a stronger financial future.

The Real-World Benefits of Financial Wellness

So, what's the big deal about financial wellness? It’s not about hitting some magic number in your bank account or being able to buy more stuff. The real payoff is measured in something far more valuable: your quality of life. When you get a handle on your money, you gain less stress, more freedom, and a genuinely healthier outlook.

Think about it. When you aren't constantly worried about money, you free up a huge amount of mental and emotional bandwidth. That clarity lets you be more present with your family, focus better at work, and actually enjoy life’s little moments without that nagging cloud of financial anxiety hanging over you.

Less Stress, Better Health

Financial stress is a heavy weight to carry, and it doesn't just stay in your wallet. It seeps into every part of your life, impacting your mental health with anxiety and sleepless nights. It can even show up physically as headaches or high blood pressure. Study after study confirms that for most people, money is the number one source of stress.

Building financial wellness creates a powerful buffer against this pressure. An emergency fund means a surprise car repair is just an annoying inconvenience, not a full-blown crisis. A clear debt repayment plan turns a source of dread into a series of achievable steps.

Tackling this chronic stress is one of the quickest and most profound benefits you'll feel. You’re not just organizing numbers; you're making a direct investment in your long-term mental and physical health.

More Freedom, More Opportunities

Financial stability is the key that unlocks a world of new possibilities. It gives you the power to design a life that actually reflects your values and passions, rather than one dictated by the urgent need to make it to the next paycheck.

Just imagine having the freedom to:

- Switch careers to do something you truly love, even if it means a temporary pay cut.

- Launch a passion project or a small business without putting your family’s security on the line.

- Take a much-needed break and make priceless memories, completely free of spending-guilt.

- Invest in yourself by going back to school or learning a skill that opens up new doors.

Financial wellness is about moving from a mindset of scarcity to one of possibility. It’s the solid ground you stand on to take smart risks and build the life you actually want.

This feeling of control is incredibly empowering. It's the difference between feeling stuck and feeling equipped to build your own future.

Part of a Bigger Picture

The push for financial wellness isn't happening in a bubble—it’s a key piece of a much larger global trend. The Global Wellness Institute reports that the global wellness economy recently swelled to an incredible $6.8 trillion. That figure has more than doubled since 2013 and now makes up over 6% of global GDP.

This shows a huge shift in what people value: holistic health that includes physical, mental, and financial well-being. In uncertain economic times, people are realizing that managing money well is just as vital as eating right or getting exercise.

You can dive into the full report on the Global Wellness Institute's website to see the data for yourself. Finding financial peace of mind isn't just a smart personal goal; it’s a core part of a worldwide movement toward healthier, more balanced living.

Actionable Steps to Improve Your Finances Today

Knowing what financial wellness is is one thing. Actually doing something about it is where the real change begins. This is where the rubber meets the road. No matter where you are in life, there are concrete, practical things you can do right now to start building momentum toward a healthier financial future.

Everyone’s journey looks a little different. A student figuring things out for the first time has vastly different priorities than a family juggling a mortgage and college savings, or a couple gearing up for retirement. The trick is to stop trying to do everything at once and instead focus on the actions that will make the biggest difference for you.

We’ve laid out a simple path forward with clear, manageable tasks. Don't think of this as a massive, stressful overhaul. Instead, see it as a series of small wins that stack up over time. By tackling one step at a time, you can make real progress without feeling buried.

For Students Building a Foundation

If you're a student, you have a golden opportunity to build financial habits that will pay dividends for the rest of your life. Right now, it's all about getting a handle on your cash flow and building a solid credit foundation.

First things first: track every penny for 30 days. This isn't about shaming yourself for that extra coffee; it’s purely about gathering data. Use a budgeting app or even a basic spreadsheet to see where your money actually goes. The results might surprise you, and that awareness is the first real step toward control.

Next up, focus on building credit wisely. A good credit score is like a key that unlocks better financial opportunities down the road. A great way to start is with a student credit card with a low limit. Use it for one or two small, predictable purchases each month (like your Netflix subscription), and—this is the crucial part—pay the balance in full, every single time. This proves you can borrow responsibly without getting trapped in debt.

For Families Managing Growth

For families, financial wellness often means wrangling a more complex budget while aiming for huge long-term goals. Your game plan should center on efficiency, protection, and planning for the future.

Start with the easiest win: automating your savings. This is the single most effective way to make sure you're consistently setting money aside. Set up automatic transfers from your checking to your savings accounts—for emergencies, college funds, or retirement—the day you get paid. What starts as a small, painless transfer grows into a significant safety net over time.

Then, it's time to go on the offensive against high-interest debt. Credit card debt, with its punishing interest rates, can feel like running on a treadmill. Pick one high-interest debt to attack—either the one with the smallest balance (the "snowball" method) or the highest interest rate (the "avalanche" method)—and throw every extra dollar you can find at it.

Financial progress is not about making one giant leap. It's about taking small, consistent steps in the right direction. Automating your savings is a perfect example of a small action that delivers huge long-term results.

Finally, do a quick check-up on your insurance and protection. As your family and responsibilities grow, so should your safety net. Make sure you have adequate life and disability insurance to protect your loved ones if the unexpected happens. It's a cornerstone of true family financial security.

For Pre-Retirees Maximizing a Legacy

When retirement is on the horizon, the focus shifts to turbo-charging your savings and designing a sustainable income plan for the years ahead. The moves you make now are absolutely critical for a comfortable and stress-free retirement.

Your number one priority is to supercharge your retirement contributions. If you're over 50, you can make "catch-up" contributions to your retirement accounts. This is a powerful tool designed specifically to help you bulk up your nest egg in your final working years. Take full advantage of it.

Next, it’s time to create a detailed retirement budget. Don't just guess what you'll spend; map it out. Think through healthcare costs, travel dreams, and day-to-day living expenses to get a realistic picture of the income you'll need to live the life you want.

Lastly, start to strategize your income streams. How are you going to turn that big pile of savings into a steady "paycheck" in retirement? This involves planning when to take Social Security, figuring out a smart withdrawal strategy from your investments, and exploring other potential income sources. Chatting with a financial advisor at this stage can bring incredible clarity.

Your Financial Wellness Action Plan

No matter where you're starting from, just taking that first step is what truly matters. We've put together a simple table to help you pinpoint the most impactful actions for your current stage of life.

| Life Stage | Top 3 Priority Actions |

|---|---|

| Students | 1. Track your spending for 30 days to gain awareness. |

| 2. Build a positive credit history with a student credit card. | |

| 3. Create your very first simple budget. | |

| Families | 1. Set up automatic transfers to your savings and investment accounts. |

| 2. Choose one high-interest debt and create a plan to pay it off. | |

| 3. Review and update your life and disability insurance coverage. | |

| Pre-Retirees | 1. Maximize catch-up contributions to your retirement accounts. |

| 2. Create a detailed budget for your expected retirement lifestyle. | |

| 3. Develop a clear strategy for creating income from your savings. |

Remember, financial wellness isn’t a destination; it's a journey of continuous improvement. Pick just one action from this list and commit to doing it this week. Those small, decisive steps you take today are what build a future of financial security and freedom.

Building Your Secure Financial Future

Think of financial wellness not as a destination you arrive at, but as a journey you're always on. It’s about building a set of healthy money habits that stick with you for life, creating a foundation of stability that only gets stronger over the years. We’ve covered the core ideas and practical steps to help you get a firm grip on your finances, dial down the stress, and build that secure future you deserve.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Your Path to Empowerment

Let’s circle back to those three key ideas we talked about: control, security, and freedom. They’re like stepping stones. First, you get control over your daily money, then you build a cushion of security, and finally, you gain the freedom to design the life you truly want.

It's the small, consistent things you do today that add up to real wealth and peace of mind down the road. And as you look further ahead, getting smart about strategies like how to salary sacrifice super can give your retirement savings a serious boost.

The journey of a thousand miles begins with a single step. Start with one simple action from this article, and know that you are on the right path to financial empowerment.

Whether that first step is tracking your spending for a month or setting up a small, automatic transfer to your savings account, every positive choice counts.

Ready to look beyond wellness and toward the next big goal? You can dive deeper into what is financial independence in our detailed guide. You have everything you need to start your journey right now.

Got Questions About Financial Wellness? We've Got Answers.

Diving into your finances can feel like opening a can of worms, and it's totally normal to have a ton of questions. Let's tackle some of the most common ones that pop up, so you can get started with a clear head and a little more confidence.

Where on Earth Do I Even Begin?

When you’re feeling overwhelmed, the best place to start is actually pretty simple: track your spending for one month. Seriously, that's it. Don't worry about making changes or judging yourself. Just get a clear picture of where your money is actually going.

Think of it as gathering intel. You can use an app on your phone or just a good old-fashioned notebook. This single, small step gives you the awareness you need to build everything else on. It’s the foundation, and it's not nearly as scary as it sounds.

How Long Until I Actually See a Difference?

Let’s be real: this is a marathon, not a sprint. You might feel a wave of relief the moment you have a plan in place, but seeing those big, tangible results—like a zero balance on a credit card or a fully-stocked emergency fund—takes time and consistency.

It's a lot like getting in shape. You don't get a six-pack after one trip to the gym, but you might feel a little stronger and more energetic right away. With your finances, you’ll start to notice small wins in the first few months. Maybe you'll feel less dread as payday approaches, or you'll see your savings account actually start to grow. The major milestones often take a year or more of sticking with it.

Progress in financial wellness isn't about speed; it's about direction. If you're consistently making small, smart choices, you're already winning.

Is This Even Possible on a Low Income?

Yes, one hundred percent. Financial wellness isn't about the size of your paycheck; it’s about what you do with it. A bigger income certainly gives you more breathing room, but the core habits of budgeting, saving, and managing debt are the same for everyone.

When your budget is tight, the game plan just shifts toward making every single pound work harder. That means:

- A rock-solid budget: You need to know exactly where every bit of your money is headed.

- Small, steady savings: Even putting away £10 a week can grow into a significant buffer over time.

- Avoiding new debt like the plague: With less wiggle room, high-interest debt is your worst enemy.

- Finding ways to boost your income: A side hustle or a path to a better-paying job can be a game-changer.

Your journey might take a bit more discipline, but getting to a place where you feel in control and secure is absolutely achievable, no matter what you earn.

At Collapsed Wallet, our goal is to give you the clear, no-nonsense guidance you need to build real financial confidence. Keep exploring our resources to take your next step. https://collapsedwallet.com