Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

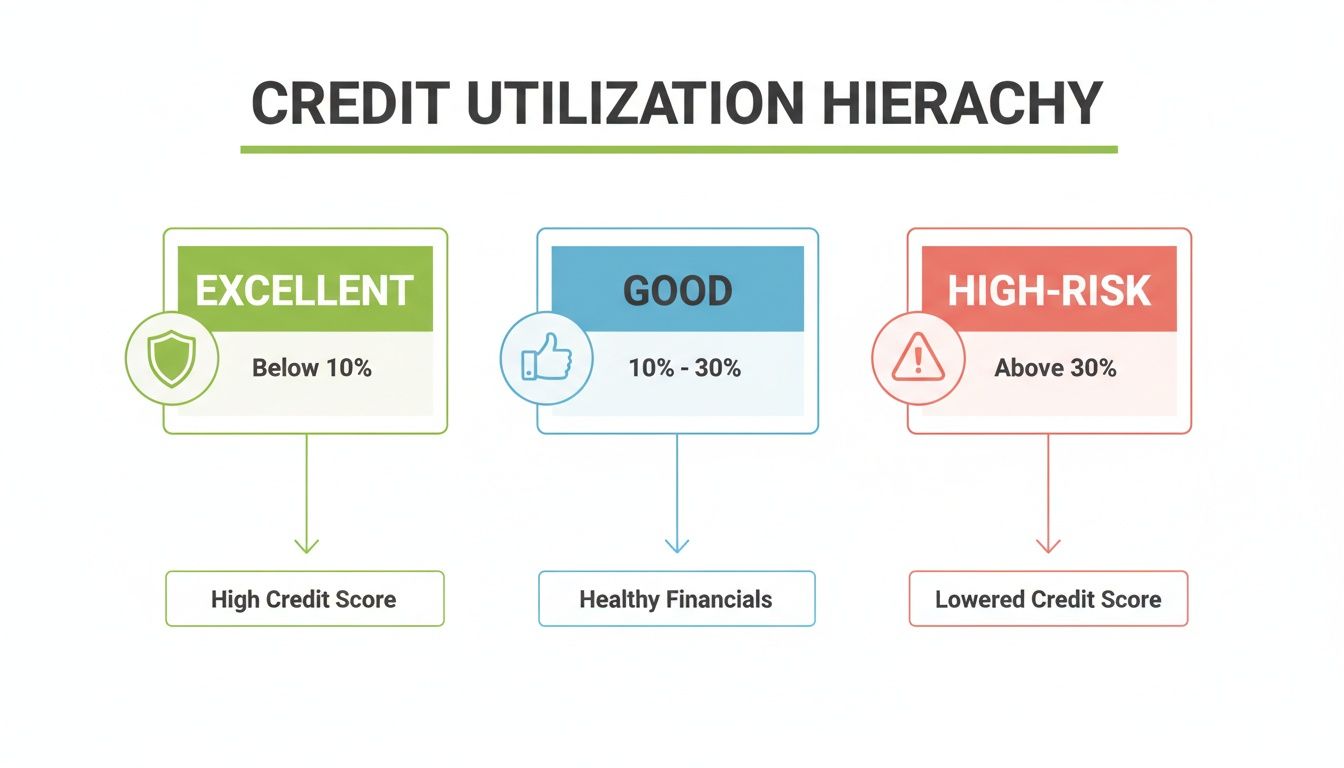

So, what’s the magic number for credit utilization? While the golden rule you’ve probably heard is to keep it under 30%, the real sweet spot for an excellent score is actually under 10%. Think of your credit utilization ratio as a quick snapshot of how you handle debt. It’s simply the percentage of your available credit that you’re currently using. The lower that number is, the more responsible you appear to lenders, which can open up a world of financial opportunities.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Breaking Down the Ideal Ratio

That 30% figure is a great starting point and a solid rule of thumb for maintaining a healthy credit score. Sticking to it will generally keep you out of trouble.

But if you really want to supercharge your credit score, aiming for the single digits—somewhere between 1% and 9%—is the goal. A ratio that low sends a powerful message to lenders: you’re not just managing your debt, you’re mastering it. On the flip side, a high ratio can be a major red flag, suggesting you might be relying too heavily on credit to get by.

Excellent, Good, and High-Risk Tiers

To give you a clearer picture of how lenders see these numbers, let’s break down the different tiers.

The different tiers of credit utilization give a clear idea of where you stand and what your ratio signals to financial institutions. Here’s a simple table to show how these percentages typically affect your score.

Credit Utilization Tiers and Their Impact

| Utilization Ratio | Rating | Impact on Credit Score |

|---|---|---|

| 0%–9% | Excellent | Has a very positive impact, signaling top-tier credit management. |

| 10%–29% | Good | Generally seen as responsible and has a positive effect on your score. |

| 30%–49% | Fair | Starts to negatively impact your score; lenders may view it as a risk. |

| 50% and above | High-Risk | Can significantly lower your credit score and raise red flags for lenders. |

As you can see, keeping your balance low relative to your limit is the name of the game.

The difference this makes is anything but small. For example, recent Experian data showed that people with the highest FICO scores (in the 800-850 range) had an average credit utilization ratio of just 7.1%. Contrast that with those who had poor scores (300-579), whose average ratio was a staggering 80.7%.

The correlation is crystal clear: lower utilization is a key ingredient for excellent credit health. For more strategies on managing your spending, check out our guide to budgeting with credit cards.

Why This Simple Number Is a Big Deal

So, why are we making such a fuss about this one little percentage? Because your credit utilization ratio is a heavyweight champion when it comes to your credit score. In fact, according to FICO, the entire “amounts owed” category—where utilization is the star player—makes up a whopping 30% of your score. That makes it one of the most powerful levers you can pull to give your financial health a quick and meaningful boost.

A low ratio sends a powerful message to lenders: you’re in control of your finances and not relying on credit to get by. On the flip side, a high ratio can look like a major red flag, hinting at financial stress and a greater risk that you might not be able to pay back new debt. In short, this single number tells a surprisingly detailed story about your financial habits.

A Real-World Car Loan Scenario

Let’s see how this plays out in the real world with two people, Alex and Ben. They both have the same income and are applying for the same £20,000 car loan. The only real difference is how they manage their credit.

- Alex: He’s careful to keep his credit card balances low, which gives him a healthy credit utilization ratio of just 8%. To a lender, Alex looks like a safe bet.

- Ben: He often maxes out his credit cards to cover his expenses, pushing his utilization ratio up to a risky 85%. Lenders see Ben as financially stretched thin.

When the loan applications come in, the decisions are worlds apart. Alex doesn’t just get approved; he’s offered a fantastic interest rate of 5.9% APR. Ben, on the other hand, is flat-out denied because of his high-risk profile.

This scenario drives home a critical point: a good credit utilization ratio isn’t just about chasing a higher score. It’s about unlocking better financial products, securing lower interest rates, and ultimately, gaining more financial freedom.

The lender’s decision wasn’t about who earned more—it was about who managed their existing credit more responsibly. This shows just how much control you have over your financial opportunities by simply mastering your utilization. When you understand what is a good credit utilization ratio and work to maintain it, you turn your credit from a potential liability into a powerful asset.

How to Calculate Your Credit Utilization Ratio

Ready to crunch the numbers and see where you stand? The good news is, you don’t need to be a maths whiz to figure this out. The formula is actually quite simple.

At its core, credit utilization is just the total amount you owe on your credit cards divided by your total credit limits.

(Total Credit Card Balances ÷ Total Credit Limits) x 100 = Overall Credit Utilization Ratio

This single percentage gives you a snapshot of your credit health. But here’s something important to know: lenders don’t just stop at the overall number. They also zoom in on the utilization for each individual card, so it’s smart to calculate both.

Calculating Your Per-Card Ratio

Let’s start with a single card. Say you have a credit card with a £2,000 limit and you’ve spent £400 on it this month.

The calculation is straightforward:

- (£400 ÷ £2,000) x 100 = 20%

Your utilization on this particular card is 20%, which is a healthy figure. It’s a really good habit to keep an eye on each card’s balance. Why? Because maxing out even one card—pushing it to 90% or higher—can send up a red flag to lenders, even if your other cards are completely paid off.

Calculating Your Overall Ratio

Now, let’s look at the bigger picture. Imagine someone who juggles a few different cards.

- Card A: £1,000 balance on a £5,000 limit (20% utilization)

- Card B: £500 balance on a £10,000 limit (5% utilization)

- Card C: £250 balance on a £2,500 limit (10% utilization)

First, we’ll add up all the outstanding balances and then all the available credit limits.

- Total Balances: £1,000 + £500 + £250 = £1,750

- Total Limits: £5,000 + £10,000 + £2,500 = £17,500

Now, we just plug those totals back into our formula:

- (£1,750 ÷ £17,500) x 100 = 10%

This person’s overall credit utilization is a fantastic 10%, putting them in an excellent position.

Here’s a final pro tip to keep in mind: card issuers usually report your balance to the credit bureaus on your statement closing date, not your payment due date. This little detail trips a lot of people up. Even if you religiously pay your balance in full every month, a high balance on that specific reporting date can still make your utilization look high. Understanding this timing is one of the smartest ways to keep your ratio low and your score high.

Decoding the Numbers: What Lenders Really Want

You’ve probably heard the “under 30%” rule for credit utilization. It’s a solid piece of advice, for sure, but think of it as the bare minimum—the starting line, not the finish line. If you really want to understand what gets you approved for the best loans and credit cards, you have to look past that basic number. Lenders aren’t just checking a box; they’re trying to gauge your financial habits.

One of the most persistent myths out there is that you have to carry a balance from month to month to build a good credit history. That’s just not true, and it’s an expensive mistake to make. The truth is, having a tiny balance report to the credit bureaus is often better than having a zero balance. While a 0% utilization ratio won’t hurt you, consistently landing between 1% and 9% shows the credit scoring models that you’re actively and responsibly using your credit.

From Good to Elite Credit Management

Keeping your utilization below 30% is great for protecting your score from taking a major hit. But it won’t get you into the elite club where the best financial products live. The people who snag the absolute best loan terms and lowest mortgage rates? They almost always keep their utilization under 10%.

That isn’t just some random number. When you consistently keep your ratio that low, you’re sending a powerful signal to lenders. It tells them you have plenty of cash on hand and don’t need to rely on credit to get by. It screams financial discipline, making you the kind of low-risk customer they are eager to lend to.

Across the board, financial experts agree that while the 30% rule keeps you safe, the real magic happens in the single digits. As sources like The Points Guy and myFICO often point out, the top 25% of people with the highest credit scores (FICO scores above 795) have an average utilization of just 7%.

Why a 1-9% Ratio Is the Sweet Spot

Think about what your utilization ratio says about you. A ratio of 28% might say, “I’m getting by.” But a ratio of 8% says, “I’m in complete control.” That small difference in perception can be massive when you’re applying for a mortgage or a new car loan.

Lenders see a low credit utilization ratio not just as a number, but as evidence of responsible behaviour. It suggests you have a financial buffer and are a low-risk borrower, which is exactly what they are looking for.

This is how you graduate from having “good” credit to having truly “excellent” credit. It’s not just about dodging negative marks; it’s about proactively building a credit profile that showcases exceptional financial responsibility. For more strategies on building a stronger profile, take a look at our guide on how to improve your credit score fast. This kind of proactive approach is a cornerstone of achieving long-term financial health.

Actionable Strategies to Lower Your Ratio Today

Alright, so you know what your credit utilization ratio is. That’s the first step. But the real magic happens when you start taking control of it. Getting from a “good” ratio to an “excellent” one doesn’t mean you have to make huge, painful changes to your life. It’s really about making a few smart, tactical moves that can give your credit score a serious boost.

Now, let’s get into the practical stuff. With a few key strategies, you can grab the reins of this crucial number and see some positive movement pretty quickly.

Pay Before Your Statement Closes

This is probably the single most powerful trick in the book, yet so few people know about it. Most of us wait for the bill to show up, then we pay it. But here’s the inside scoop: credit card companies usually report your balance to the credit bureaus on your statement closing date.

So, even if you’re a rockstar who pays your bill in full every single month, a high balance on that one specific day can make it look like you’re maxing out your cards.

The fix is simple: make a payment before your statement closes. By knocking down most of your balance a few days early, you ensure the number that gets reported is tiny. This one move can slash your utilization for the month.

Make Multiple Small Payments

Why wait for one big due date? Get into the habit of making several smaller payments throughout the month. This is a great way to keep your running balance low and manageable.

For instance, if you just made a big purchase, you don’t have to let it sit there until the bill is due. Hop online and pay it off right then and there. This approach is a triple-win:

- Keeps your balance from getting scary: It stops your debt from piling up into a mountain you dread climbing.

- Lowers your reported balance: You’re constantly chipping away at the amount, reducing the odds of a high balance being reported.

- Makes you a smarter spender: Paying more often forces you to be more conscious of where your money is going.

Request a Credit Limit Increase

Here’s another powerful lever you can pull. If your balance stays the same but your total credit limit goes up, your utilization percentage automatically drops. It’s simple math.

If you’ve been good about paying on time and have a steady income, give your credit card company a call and ask for a credit limit increase. Many banks even let you request one right through their app or website. Just be sure to ask if it will trigger a “hard inquiry” on your credit report, as that can cause a small, temporary dip in your score.

A higher credit limit gives you more breathing room and instantly improves your ratio, provided you don’t increase your spending along with it. The goal is to increase the denominator in the utilization equation, not the numerator.

Keep Old Credit Cards Open

That old, dusty credit card you never use? It might be tempting to close it for good, but you should probably think twice. When you close an account, you instantly lose its credit limit from your total available credit, which can make your utilization ratio shoot up.

An old card with a zero balance is quietly helping you in the background. It adds to your overall credit limit and lengthens your credit history—another key factor in your score. Unless it’s costing you a hefty annual fee for no real benefit, keeping it open is almost always the right call for your credit health. If you’re struggling with balances on other cards, other strategies can help. Our guide on how to consolidate credit card debt walks you through some practical options.

Common Questions About Credit Utilization

Getting a handle on credit utilization can feel like trying to solve a puzzle, but it really just comes down to a few core ideas. Let’s walk through some of the most common questions that pop up. Once we clear the air on these, you’ll have the confidence to manage your credit like a pro.

A lot of people stress that one month of high spending might permanently stain their credit history. The good news? That’s not how it works. Your credit score is much more of a live snapshot than a permanent record.

Does a High Ratio Permanently Damage My Score?

Absolutely not, and this is one of the most powerful things to understand about your credit. Your credit utilization ratio has no memory in most of the scoring models used today, including the widely used FICO 8. This means a high ratio from last month won’t come back to haunt you this month.

Let’s say you max out a card for a big, necessary purchase in May. Your score might take a temporary hit. But if you pay that balance down to under 10% in June, your score will typically bounce right back as soon as that new, lower balance gets reported. This makes managing your utilization one of the fastest ways to give your score a boost.

Your credit utilization is a fluid number. A high ratio is a temporary problem with a straightforward solution—pay down your balance. Once the lower balance is reported, your score will reflect that positive change.

This lack of “memory” puts you firmly in the driver’s seat. Even if your utilization was high in the past, you get a clean slate to work with every single month.

Is a 0 Percent Utilization Ratio the Ultimate Goal?

It seems logical: if a low ratio is good, then a 0% ratio must be perfect, right? This is a super common misconception. While having a 0% ratio won’t actively harm your score, it might not help it as much as having a very low, positive number would.

Think about it from a lender’s perspective. Scoring models are built to predict how you’ll handle debt in the future. A 0% utilization shows that you aren’t using credit at all, which doesn’t give them any recent data on your borrowing habits. Lenders really want to see that you can manage credit responsibly, even if it’s just a small amount.

For this reason, a ratio somewhere between 1% and 9% is often considered the sweet spot. It proves you’re an active and responsible credit user, which signals to lenders that you know how to borrow without over-relying on it.

How Often Is My Ratio Updated on My Credit Report?

This detail is critical, especially if you’re actively trying to improve your score. Your credit card companies typically report your account details—including your current balance and credit limit—to the three big credit bureaus (Experian, TransUnion, and Equifax) once a month.

This reporting day usually lines up with your statement closing date. This is precisely why paying your bill before the statement date can be such a powerful strategy. The balance that gets reported is whatever is on your account on that specific day.

Because of this monthly reporting cycle, you can see the impact of your actions on your credit score pretty quickly.

- Quick Feedback: The changes you make this month can show up on your credit report and score in as little as 30 to 45 days.

- Strategic Timing: If you’re gearing up to apply for a big loan like a mortgage, you can strategically pay down your balances a month or two ahead of time to make sure your report looks its best when it matters most.

By understanding the answers to these common questions, you can stop guessing and start managing your credit with real precision. Knowing what is a good credit utilization ratio is step one; putting that knowledge to work is how you build a solid financial future.

At Collapsed Wallet, our goal is to provide clear, actionable advice to help you build financial confidence. Discover more tips and strategies by visiting us at https://collapsedwallet.com.