Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

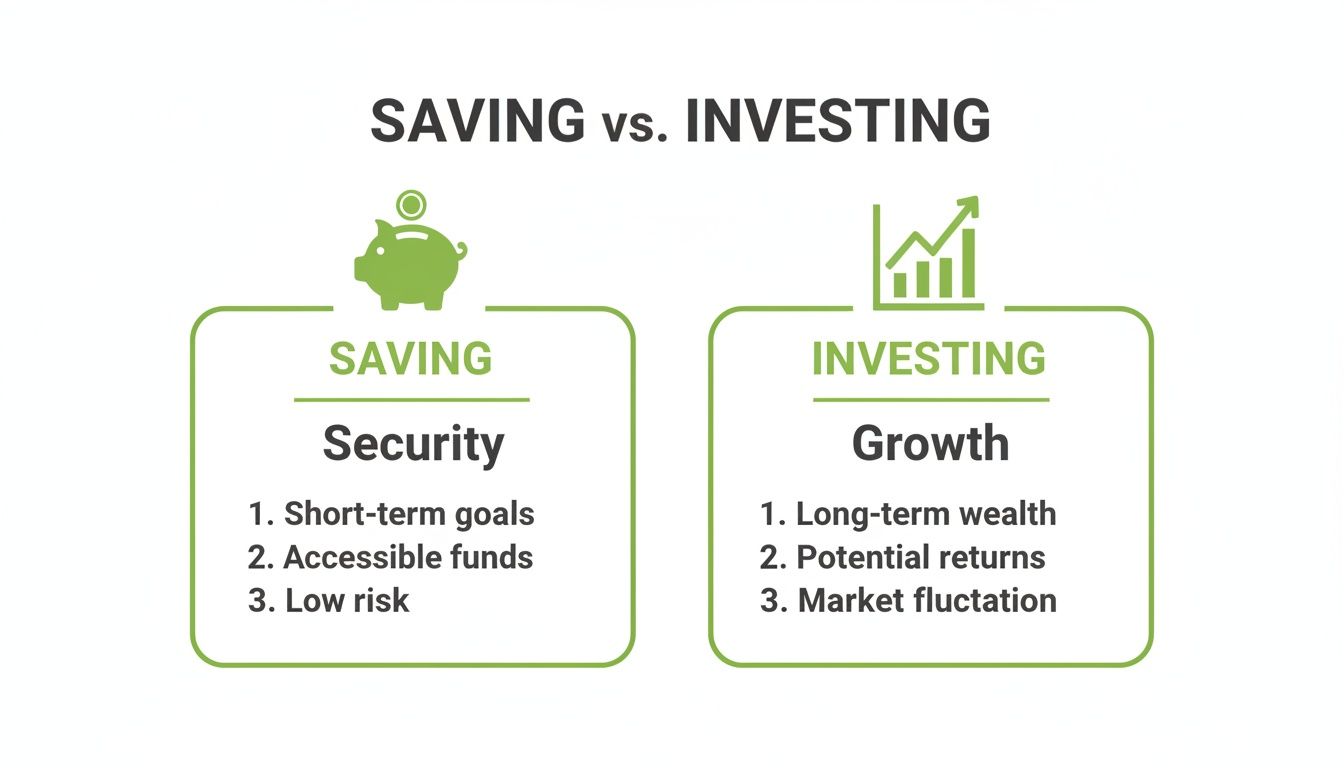

When you boil it down, the real difference between saving and investing is all about one thing: the trade-off between risk and growth.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of it this way: Saving is about preserving your money. It’s for your short-term goals, kept safe in accounts you can get to easily. On the flip side, investing is about growing your money over the long haul. This means taking on calculated risks in exchange for the chance at much higher returns.

The Different Jobs of Saving and Investing

Saving and investing are both non-negotiable for a solid financial future, but they play completely different roles on your team. Once you get the hang of what separates them, you can use each one strategically to hit your goals—whether that’s buying a car next year or retiring comfortably in thirty.

Saving is your financial safety net. It’s the money you stash in low-risk accounts where your cash is protected and ready when you need it. This is your go-to for short-term needs because the main point is keeping your money safe, not making it grow.

Investing, on the other hand, is your engine for building wealth. Here, you’re putting money into assets like ETFs that have the potential to grow significantly over time. This is how you tackle your big, long-term ambitions, because it’s the only way to make sure your money outpaces inflation and actually builds real wealth.

A Quick Side-by-Side

To put it as simply as possible, saving is for security, and investing is for growth. One shields you from life’s curveballs, while the other fuels your journey to financial freedom.

This table lays out the core differences at a glance:

| Attribute | Saving | Investing |

|---|---|---|

| Primary Goal | Keeping your money safe and secure | Growing your money and building wealth |

| Risk Level | Very low; your initial money is generally safe | Higher; its value will go up and down with the market |

| Potential Return | Low interest, often less than inflation | Higher potential for major long-term growth |

| Best For | Short-term goals (1-5 years) | Long-term goals (5+ years) |

| Liquidity | High; you can get your cash out quickly | Lower; it can take time to sell assets and get your money |

Saving vs. Investing: What’s The Real Difference?

So, what’s the actual difference between saving and investing? While people often use the terms interchangeably, they’re two completely different tools for two very different jobs. Think of it this way: saving is about building a secure foundation for today, while investing is about building the framework for your financial future.

Getting this distinction right is the first step to making your money truly work for you, not against you.

This visual captures the core idea perfectly—saving is all about security, while investing is about driving growth.

Knowing when to use which strategy is critical for hitting your financial goals, whether they’re next year or decades away. Let’s break down the key differences.

Risk: Playing It Safe vs. Taking a Calculated Chance

When you save, you’re prioritizing safety above all else. The money you put into a high-yield savings account is protected, and its balance won’t drop if the stock market has a bad day. It’s predictable and secure.

Investing is a different beast entirely. It means accepting a calculated risk for the chance of a much bigger reward. The value of your investments, like stocks or ETFs, will absolutely fluctuate. You could lose money, especially in the short term. That volatility, however, is the engine that drives long-term growth.

Return: Keeping Pace vs. Building Wealth

This is where the risk-reward trade-off becomes crystal clear. With saving, your returns come from interest, which is often frustratingly low. Most of the time, the interest you earn won’t even keep up with inflation, meaning your money is slowly losing its buying power.

Investing, on the other hand, gives you the potential for returns that significantly outpace inflation. This is how you build real wealth over time, letting your money grow and compound into something much larger than what you started with.

The goal of saving is capital preservation—protecting the money you have. The goal of investing is capital appreciation—growing what you have into something more.

Timeframe: Now vs. The Future

Perhaps the most practical way to decide between saving and investing is to look at your timeline.

Saving is tailor-made for your short-term goals—anything you need the money for within the next five years. This is the perfect tool for your emergency fund, a down payment on a car, or that vacation you’ve been planning.

Investing is a long game. It’s designed for goals that are at least five years away, and ideally much longer. Think retirement, your kids’ college education, or any other major life goal far down the road. The long runway gives your investments time to recover from market dips and harness the power of compounding.

Liquidity: Cash on Hand vs. Cashing Out

Liquidity is just a fancy word for how quickly you can get your hands on your money without losing value.

Savings are highly liquid. You can pull cash from your savings account at a moment’s notice with no penalty. That easy access is exactly what you want for an emergency fund.

Investments are much less liquid. Selling stocks or mutual funds can take a few days to settle before the cash hits your bank account. More importantly, if you’re forced to sell when the market is down, you’ll lock in a loss.

Purpose: Safety Net vs. Growth Engine

At the end of the day, it all comes down to purpose. What job do you need your money to do?

The purpose of saving is to create a financial safety net and fund predictable, near-term expenses. It’s all about security and stability.

The purpose of investing is to build wealth for the future. It’s your engine for growth, designed to achieve ambitious, long-term goals that inflation would otherwise make impossible.

For a quick summary, this table lays out the core differences side-by-side.

Saving vs. Investing Key Differences at a Glance

| Attribute | Saving | Investing |

|---|---|---|

| Risk | Very low. Your initial capital is safe. | Higher. The value can go up or down. |

| Return | Low. Often struggles to beat inflation. | Higher potential for long-term growth. |

| Time Horizon | Short-term (under 5 years). | Long-term (5+ years). |

| Liquidity | High. Easy, immediate access to cash. | Lower. Takes time to sell and access funds. |

| Purpose | Security, emergencies, and near-term goals. | Wealth creation and long-term goals. |

As you can see, saving and investing aren’t in competition—they’re teammates. A smart financial plan needs both working together to cover all your bases, from immediate needs to far-off dreams.

When Saving Your Money Is The Right Move

Investing gets all the headlines, but let’s be clear: saving isn’t its less-exciting cousin. It’s the essential first step. There are absolutely times when keeping your money safe and accessible is the smartest—and only—move you should make.

Think of it this way: saving is the solid foundation you pour before you even think about building the rest of your financial house. Without it, everything else is at risk of collapsing.

And that foundation starts with one non-negotiable account: your emergency fund.

Building Your Financial Safety Net

Life happens. A boiler gives out, your car needs an urgent repair, or you’re suddenly faced with a job loss. These curveballs can send your finances into a tailspin if you’re not ready for them. This is exactly what an emergency fund is for—it’s the bedrock of real-world financial security.

An emergency fund is simply a pile of cash set aside for true emergencies. The gold standard is to have 3-6 months’ worth of essential living expenses tucked away in an account you can access instantly, like a high-yield savings account. It’s the buffer that stops you from racking up debt or, even worse, being forced to sell your long-term investments at the worst possible moment. If you’re starting from scratch, you can learn more about how to build an emergency fund and create that crucial financial cushion.

Having an emergency fund in place is the ultimate act of financial self-defence. It ensures that a short-term crisis doesn’t turn into a long-term setback, giving you peace of mind and control.

Without this safety net, any unexpected bill can throw your entire financial future off course.

Saving For Clear Short-Term Goals

Beyond just emergencies, saving is the hands-down winner for any specific goal you need to hit within the next five years. For these kinds of targets, the risk of a stock market downturn is just too great. You have to be certain that the money you’ve put away will be there when you need it.

Just think about these common situations where saving is the only logical choice:

- A House Deposit: You’ve worked out you need £20,000 for a down payment in the next three years. If you invest that money and the market drops right before you’re ready to buy, a chunk of your hard-earned deposit could vanish. It’s a gamble not worth taking.

- A New Car: You’re planning to buy a car for £10,000 next year. The number one priority is protecting that principal amount. Saving guarantees the full £10k is ready and waiting on your timeline.

- A Wedding: You have a fixed date and a firm budget. Putting that money into a high-yield savings account gives you total certainty. The last thing you want is for your wedding fund to shrink because of market volatility.

In all of these examples, the goal is capital preservation, not growth. The chance of earning a higher return through investing simply doesn’t outweigh the risk of not having the money when you need it. Saving offers the stability and predictability you need to hit your short-term goals without any sleepless nights.

When to Invest for Long-Term Growth

Once you’ve built a solid financial safety net, the conversation can pivot from simply protecting your money to actively growing it. For any major goal that’s more than five years down the road, investing isn’t just an option—it’s the engine you need to get there.

Think of it this way: saving is for the short haul, but investing is for the marathon. It’s the strategy that ensures your money doesn’t just sit there but works to build real wealth over time.

This is where the line between saving and investing becomes crystal clear. While saving keeps your cash safe and accessible for immediate needs, investing is what will multiply it for your future self.

Fuelling Your Retirement

Retirement is the classic long-term goal. If you’re looking at a 20, 30, or even 40-year horizon, you have the most powerful asset on your side: time. This long runway gives your money plenty of room to ride out the market’s inevitable ups and downs and, more importantly, to tap into the magic of compounding.

Compounding is the snowball effect where your investment returns start earning their own returns. A savings account just can’t compete. Over decades, its low interest rates mean your money is almost guaranteed to lose purchasing power to inflation. Investing is the only practical way to build a nest egg that will actually support your lifestyle in retirement.

While investing involves market risk, not investing for long-term goals like retirement carries a bigger, more certain risk: inflation will silently eat away at your savings, leaving you with less real-world money than you started with.

Achieving Major Life Milestones

Investing isn’t just about retirement, though. It’s the right tool for any significant, far-off goal that requires serious growth to become a reality.

Think about these common long-term ambitions:

- Funding a Child’s Education: With a newborn, you have an 18-year runway before those college tuition bills arrive. Investing that money gives it nearly two decades to grow, potentially covering a much larger chunk of the cost than saving alone ever could.

- Reaching Financial Independence: This is the point where your wealth generates enough income to cover your living expenses, making work optional. You can’t get there without a portfolio that grows faster than your spending—something only long-term investing can deliver.

- A Future Major Purchase: Dreaming of a vacation home in 10 years? Investing your dedicated funds gives you a fighting chance to hit that big number much faster.

For goals like these, diversified investments like Exchange-Traded Funds (ETFs) are a great place to start. They spread your money across hundreds or thousands of companies, which helps cushion you from the poor performance of any single one. If you’re just getting started, our guide on how to start investing for beginners breaks down the first steps in a clear, confident way.

Ultimately, when your timeline is measured in years or decades, investing is how you turn today’s money into a more prosperous future.

Building Your Financial Action Plan

Knowing the difference between saving and investing is a great start, but the real power comes from putting that knowledge to work. Let’s walk through a simple, step-by-step roadmap that takes you from theory to action. This is your game plan for making smart, confident decisions that actually move the needle on your financial future.

Step 1: Secure Your Foundation First

Before you even think about investing a single pound, your first job is to build a solid financial foundation. This means getting an emergency fund in place with 3-6 months’ worth of essential living expenses. Seriously, this isn’t just a friendly suggestion—it’s the bedrock of any successful financial plan.

This cash needs to be stashed in a high-yield savings account where it’s safe, liquid, and ready at a moment’s notice. It’s your financial shock absorber. It’s what protects you from life’s curveballs—a sudden job loss, a surprise medical bill, or a leaky roof—without forcing you to rack up debt or cash out your long-term investments at the worst possible time.

Step 2: Tackle High-Interest Debt

Once you have a starter emergency fund saved up (even £1,000 can be a game-changer), it’s time to go on the offensive against high-interest debt. I’m talking about credit card balances, payday loans, or any personal loan with a double-digit interest rate.

Think about it this way: paying off a credit card with an 18% interest rate is the same as earning a guaranteed 18% return on your money. You simply won’t find a legitimate investment that offers that kind of risk-free return. Wiping out this debt frees up your cash flow, allowing you to save and invest for your future instead of someone else’s bottom line.

High-interest debt is like an anchor dragging your financial ship down. Paying it off is one of the most powerful moves you can make to speed up your journey to financial freedom.

Step 3: Define Your Goals and Timeline

With your emergency fund started and your most expensive debt out of the way, you can start mapping out what you want to achieve. This is where you get intentional and decide whether saving or investing is the right tool for the job. Just grab a notebook or open a doc and jot down what you’re working toward.

Get specific and put a date on it. Your list might look something like this:

- Short-Term (1-5 Years): These are your saving goals. Think of a down payment for a car, a wedding fund, or that big trip you’ve been dreaming about. The name of the game here is capital preservation.

- Long-Term (5+ Years): These are your investing goals. We’re talking about retirement, your kids’ education, or simply building enough wealth to achieve financial independence. You need real growth to beat inflation over time.

To figure out how much you can actually set aside, you need to know where your money is going right now. Learning how to track your expenses is a non-negotiable skill that shines a light on how much you can allocate to each goal.

Step 4: Explore Your Investing Options

Once you’ve identified your long-term goals, it’s time to look at how to make your money grow. For most people starting out, the best approach is to keep it simple with diversified, low-cost options. You don’t need to be a stock-picking wizard.

Here are two of the most popular starting points for new investors:

- Index-Tracking ETFs: These are funds designed to simply mirror a broad market index, like the S&P 500. They give you instant diversification across hundreds of different companies in one go, which is a fantastic way to manage risk.

- Target-Date Funds: These are brilliant “set-it-and-forget-it” funds. You pick a fund based on your expected retirement year, and it automatically adjusts its risk level for you, becoming more conservative as you get closer to that date.

Follow these four steps in order, and you’ll be on a clear, logical path to building wealth. You’ll be protecting yourself from today’s risks while setting yourself up for tomorrow’s growth.

Common Questions About Saving and Investing

Even with a solid plan, a few questions always seem to pop up when you’re figuring out what to do with your money. Getting these sorted can give you that final bit of confidence to really get moving. Let’s tackle some of the most common ones.

Can I Lose Money in a Savings Account?

The short answer is no, not in the way you might think. Your account balance won’t drop because of a stock market dip; it’s shielded from that kind of volatility. But there’s a quieter, more sneaky risk at play: inflation.

Inflation is just the gradual increase in the cost of everything. If your savings account is earning 1% interest, but inflation is chugging along at 3%, your money is effectively losing 2% of its buying power every single year. The number in your account is safe, but what that number can actually buy is shrinking.

How Much Money Do I Need to Start Investing?

This is probably one of the biggest myths holding people back. The old idea that you need a huge pile of cash to even think about investing is completely outdated. These days, technology has made it possible for anyone to get started.

Most modern brokerage accounts have no minimum deposit. You can genuinely start investing with as little as £25 or even less by buying fractional shares—tiny slices of a more expensive stock.

It’s not about how much you start with. It’s about starting. The magic of compounding means that even small, regular contributions can snowball into serious wealth over time.

Should I Pay Off All Debt Before I Invest?

This one isn’t a simple yes or no; it really depends on the kind of debt you’re carrying. A good rule of thumb is to compare the interest rate you’re paying on the debt to the returns you could realistically expect from investing.

- High-Interest Debt: Think credit cards, which often have interest rates of 18% or higher. Wiping this out should be your absolute first priority. Paying off that debt is like getting a guaranteed, risk-free return of 18%—you just won’t find that anywhere else.

- Low-Interest Debt: For things like a mortgage or student loan with an interest rate under 5%, the decision gets a bit more interesting. Historically, the stock market has returned more than that over the long run. In this scenario, it can make sense to keep making your regular loan payments while also putting money into your investments, because your potential gains could easily outpace what the debt is costing you.

How Does Inflation Affect My Choice?

Inflation is probably the single biggest reason why investing is non-negotiable for long-term goals. As we just saw, cash sitting in a low-interest savings account is a guaranteed loser in the race against rising prices.

Investing is what gives your money a fighting chance to grow faster than inflation. This is how you ensure the wealth you build today still has real muscle when you need it for retirement decades down the road. It’s the difference between just having money and building real wealth.

2 thoughts on “What Is The Difference Between Saving And Investing?”