Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Think of your savings account like a vehicle. Is it slowly chugging along in the right lane, or is it speeding ahead in the express lane? A high-yield savings account (HYSA) puts your money in that express lane. It’s a secure place to park your cash, just like any other savings account, but with one critical difference: it pays you a whole lot more in interest.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

What Is a High Yield Savings Account in Simple Terms?

Simply put, a high-yield savings account—often just called an HYSA—is a savings account that offers an interest rate dramatically higher than what you’d find at a typical big-name, brick-and-mortar bank. It’s a supercharged version of the account you probably already have.

While a standard savings account might earn you literal pennies each year, an HYSA is built to actually help your money grow at a meaningful pace. This makes it an incredible tool for hitting your financial goals faster, whether you’re building an emergency fund, saving for a down payment on a house, or aiming for financial freedom. Your money is working for you, not just sitting there.

The Power of Higher Interest Rates

The magic of an HYSA is all about its Annual Percentage Yield (APY). This is the real rate of return you’ll get over a year because it includes the power of compound interest—meaning you earn interest on your interest. The difference this makes is staggering.

Today, some of the best high-yield savings accounts offer APYs of 5.00% or even higher. Let’s compare that to the national average for traditional savings accounts, which often hovers around a tiny fraction of a percent.

To see the real-world impact, imagine you have $5,000 to save.

- In a traditional account earning the national average, you might make about $22 in interest after a year.

- In an HYSA with a 5.00% APY, that same $5,000 would earn you around $256. That’s more than 11 times the earnings, all without taking on any extra risk. You can check out some of the current market data to see for yourself.

Key Features of a High Yield Savings Account

It’s not just about the rate. HYSAs come packed with other great features that make them a smart choice for any saver.

- FDIC or NCUA Insurance: Just like traditional bank accounts, your money is federally insured up to $250,000, so it’s completely safe.

- High Liquidity: Your money isn’t locked away. You can access your funds whenever you need them, which is perfect for emergency savings.

- Low or No Fees: Most HYSAs are offered by online banks. With lower overhead costs, they can eliminate monthly maintenance fees and pass those savings directly to you.

An HYSA strikes a perfect balance. It delivers much better growth than a standard savings or checking account but keeps your money safe from the volatility of the stock market. This makes it the ideal spot for your emergency fund and short-term savings goals. To get a better sense of how this fits into your overall plan, check out our guide on the difference between saving and investing.

How HYSAs Work to Grow Your Money Faster

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Okay, so you know what a high-yield savings account is. But the real magic happens when you understand how it actually works to make your money grow. It all comes down to two key ingredients: a much higher Annual Percentage Yield (APY) and the incredible power of compound interest.

When these two get together, they turn your savings from a lazy pile of cash into a hard-working asset.

The Snowball Effect: Compound Interest in Action

Compound interest is the secret sauce. Seriously. It’s the difference between your money just sitting there and your money actively making more money for you.

Here’s how it works: you earn interest not just on the money you first deposited, but also on the interest that has already been added to your account. Think of it like a snowball rolling downhill. It starts small, but as it rolls, it picks up more snow, getting bigger and moving faster.

With an HYSA, this usually happens every single day. The bank calculates a tiny bit of interest on your balance and adds it right back in. The next day, you earn interest on that new, slightly larger amount. It might not seem like much day-to-day, but over months and years, the effect is huge.

A Real-World Look at How Your Money Grows

Let’s put some real numbers to this. Imagine you put $10,000 into an HYSA with a solid 5.00% APY. Even if you never add another penny, here’s what daily compounding does for you:

- After 1 Year: Your balance climbs to around $10,512. That’s $512 you earned for doing absolutely nothing.

- After 5 Years: You’re looking at about $12,840. The snowball is picking up steam, adding more than $2,800 to your original stash.

- After 10 Years: That initial $10,000 has become nearly $16,487. You’ve earned over $6,400 in interest alone, just by choosing the right account.

This kind of steady, automatic growth is what makes HYSAs such a fantastic tool for hitting your financial goals without the stress and risk of investing. If you like managing your money from your phone, many of the best savings apps link up perfectly with these accounts.

Why Are the Rates So Much Higher?

It’s a fair question. How can one bank offer a rate that’s ten, twenty, or even thirty times higher than the big bank down the street? The answer is surprisingly simple: their business model.

The “secret” to high-yield savings accounts isn’t a complex financial trick—it’s just operational efficiency. Most of the banks offering these top-tier rates are online-only. They don’t have to pay for fancy branches, storefronts, or tons of tellers. They cut those massive overhead costs and pass the savings on to you in the form of higher interest rates.

This online-first approach is a win-win. The bank runs a leaner operation, and you get a much better return on your savings. Plus, you get the convenience of managing everything from your phone or laptop. It’s a smarter way to save, plain and simple.

The Key Benefits of Using a High Yield Savings Account

Deciding where to park your savings isn’t just about finding a safe spot for your cash—it’s about making that cash work for you. A high-yield savings account is a fantastic tool for this, blending impressive growth, solid security, and easy access into one simple package. For anyone serious about building wealth, it’s a non-negotiable part of a smart financial strategy.

The number one reason to open an HYSA is simply getting a much better return on your money. With a higher APY, your balance actually grows at a noticeable rate, helping you outpace inflation instead of falling behind.

This extra growth isn’t just a few pennies here and there; it can seriously shorten the time it takes to hit your savings goals. Whether you’re saving for a down payment on a house, a new car, or a rainy-day fund, earning more interest gets you to the finish line much faster.

Reach Your Financial Goals Sooner

A high APY is more than just a number on a screen; it’s a real-world turbo-boost for your savings. Thanks to the power of compounding, the interest you earn starts earning its own interest, creating a snowball effect that builds momentum over time.

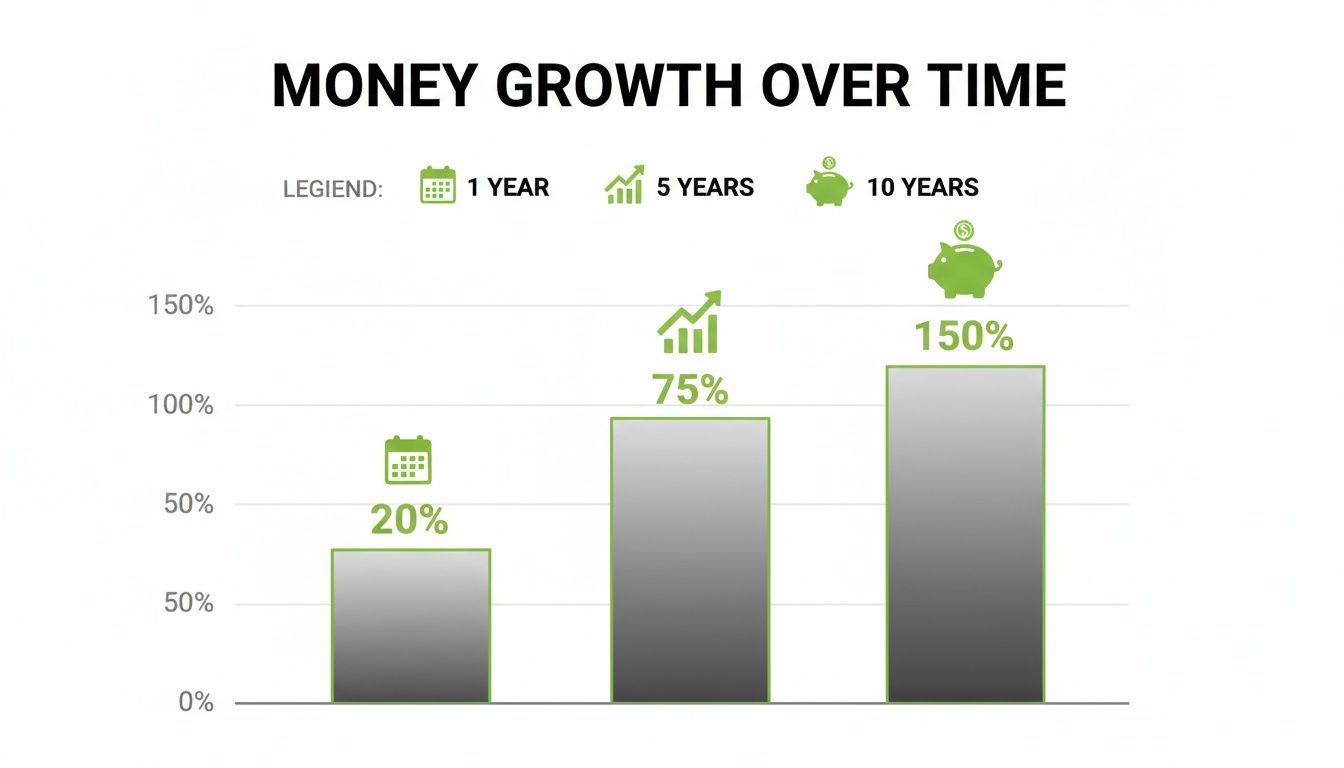

This chart gives you a visual of just how much a higher growth rate can impact your savings.

As you can see, the longer you let your money sit and grow, the more powerful compounding becomes. It’s how a modest savings habit can grow into a seriously substantial nest egg.

Security and Peace of Mind

Beyond the impressive growth, HYSAs offer rock-solid security. Just like any standard savings account at a traditional bank, your money is federally insured.

Your deposits are protected up to $250,000 per depositor, per insured institution. This coverage comes from the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions, which means your principal is safe.

An HYSA offers a rare combination in the financial world: the potential for solid returns without the market risk associated with investing. This makes it the perfect home for your emergency savings, giving you a safety net that grows steadily and reliably.

If building that safety net is your top priority, our guide on how to build an emergency fund offers a step-by-step plan that works perfectly with an HYSA.

Unmatched Flexibility and Access

One of the biggest perks of an HYSA is its liquidity. Unlike investments that tie up your money, an HYSA keeps your funds accessible when you need them.

- No Lock-In Periods: You can pull your money out at any time without getting hit with early withdrawal penalties, which are a common feature of products like Certificates of Deposit (CDs).

- Easy Transfers: Most online banks make it incredibly easy to move money between your HYSA and your checking account, usually within a couple of business days.

This flexibility makes an HYSA the ideal place for money you need to keep safe but might need to grab on short notice, like for a sudden car repair or an unexpected medical bill.

Avoid Costly Bank Fees

Finally, HYSAs help you keep more of your own money. Most are offered by online-only banks, which have lower overhead costs and pass those savings on to you.

That means you’ll typically find:

- No monthly maintenance fees

- No minimum balance fees

This fee-free structure ensures every cent of interest you earn actually stays in your account, helping your savings grow even faster. It’s a simple but powerful advantage that reinforces what a savings account should be all about—helping you save money, not spend it on fees.

How HYSAs Compare to Other Financial Tools

To really grasp the value of a high-yield savings account, it helps to see where it fits into the bigger picture of your financial life. It’s not the only tool out there, of course, but it plays a very specific and powerful role. When you put it side-by-side with other options, its unique strengths become crystal clear.

Think of it this way: every financial product, from your everyday checking account to a long-term investment fund, is designed for a different job. The right choice always comes down to your specific goals, your timeline, and how comfortable you are with risk. A high-yield savings account (HYSA) hits a sweet spot, making it a versatile and essential part of almost any financial strategy.

HYSA vs. Traditional Savings Accounts

This is the most direct comparison, and it’s where an HYSA really separates itself from the pack. Both are safe places to stash your cash, typically insured by the FDIC or NCUA, and both keep your money accessible. The real difference? The earning potential is night and day.

A traditional savings account, especially one from a big, brick-and-mortar bank, often pays a shockingly low interest rate—sometimes as little as 0.01%. In contrast, a great HYSA can offer a rate that’s 10 to 20 times higher, or even more. This isn’t just a minor bump; it’s the difference between your money just sitting there and your money actively working to grow itself.

HYSA vs. Checking Accounts

Your checking account is your financial command center. It’s built for action—paying bills, daily spending, and frequent transfers. Its main purpose is convenience, not growth, which is why the vast majority of checking accounts earn no interest at all.

An HYSA is the complete opposite. It’s specifically engineered for saving. While your money is still liquid (meaning you can get to it), it isn’t set up for dozens of transactions a month. By moving your savings into a separate HYSA, you create a healthy psychological barrier that curbs impulse spending while putting your idle cash to work.

HYSA vs. Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are another insured and safe way to earn interest. They often dangle slightly higher rates than HYSAs, but there’s a catch: you have to trade flexibility for that extra return. When you open a CD, you agree to lock your money away for a set term, ranging anywhere from a few months to several years.

This creates a key trade-off:

- Access to Your Money: HYSAs let you pull out your funds whenever you need them, penalty-free. With a CD, an early withdrawal means you’ll get hit with a penalty, often forfeiting a chunk of the interest you’ve earned.

- Interest Rate Changes: CD rates are locked in for the entire term. That’s great if market rates fall, but it means you miss out if rates go up. HYSA rates, on the other hand, are variable, so you can benefit when interest rates rise.

A CD is perfect for a savings goal with a firm deadline, like a down payment you know you’ll need in 18 months. An HYSA is much better for your emergency fund or any goal that demands flexibility.

HYSA vs. Investing (like ETFs)

Putting your money into the market through investments like Exchange-Traded Funds (ETFs) offers the potential for much, much higher returns than any savings account. Historically, the stock market has been an incredible engine for building serious long-term wealth for goals like retirement.

But—and it’s a big but—that potential for higher reward comes with risk. The value of your investments can drop, and it’s possible to lose money, including your initial principal. An HYSA, being federally insured, has none of that risk. Your deposit is completely safe, up to the insurance limits.

This is what defines their roles:

- HYSAs are for saving. They are the ideal home for short-term goals (1-3 years), emergency funds, and any cash you absolutely cannot afford to lose.

- Investments are for growing wealth. They are best suited for long-term goals (5+ years out), giving you time to weather the market’s inevitable ups and downs.

To help you visualize where each tool fits, here’s a quick comparison.

Comparing Financial Tools for Your Savings Goals

This table outlines the pros and cons of different savings and investment vehicles to help you decide where to put your money.

| Account Type | Best For | Typical Return (APY) | Risk Level | Liquidity |

|---|---|---|---|---|

| High-Yield Savings | Emergency funds, short-term goals (1-3 yrs) | 4.00% – 5.00%+ | Very Low | High |

| Traditional Savings | Storing small amounts of cash with a familiar bank | ~0.45% | Very Low | High |

| Checking Account | Daily spending and bill payments | Usually 0% | Very Low | Very High |

| Certificate of Deposit (CD) | Goals with a fixed timeline (1-5 yrs) | Often slightly higher than HYSAs | Very Low | Low (penalties for early withdrawal) |

| Investing (ETFs/Stocks) | Long-term wealth growth (5+ yrs) | 7-10% (historical average) | Medium to High | High (but value fluctuates) |

Ultimately, a smart financial plan doesn’t force you to choose one over the other. It uses them all in harmony. Your checking account handles the day-to-day, your HYSA protects and grows your emergency savings, and your investments are busy building your future wealth. Knowing what an HYSA is—and what it isn’t—helps you put it in its rightful place as the crucial bridge between spending and investing.

How to Choose and Open Your First HYSA

Alright, you’ve got the basics down. You know what a high-yield savings account is and how it stacks up against other options. Now for the fun part—actually picking one and putting your money to work.

Opening an HYSA is one of the quickest, most satisfying financial wins you can get. The whole process takes just a few minutes, but it sets you on a much faster track to hitting your savings goals.

Thankfully, the market for these accounts is packed with online banks and fintech companies all competing for your attention. That competition is fantastic news for you, because it keeps rates high and fees low.

What to Look for in a Great HYSA

While a juicy APY is what gets your attention, it isn’t the only thing that matters. The best account for you will be a sweet spot between a great rate and features that make your life easier.

Here’s a checklist of what to look for:

- Competitive Annual Percentage Yield (APY): This is the headliner. You want an account with a rate that’s significantly higher than the national average. That’s the whole point, after all.

- No Monthly Maintenance Fees: Fees are the enemy of growth. They can gobble up your interest earnings in a hurry. A top-tier HYSA shouldn’t charge you a dime just to keep your money there.

- Low (or No) Minimum Balance: The best HYSAs don’t have gatekeepers. You should be able to open an account with $0 or $1, making them perfect for anyone just starting out.

- FDIC or NCUA Insurance: This is an absolute must-have. Make sure the bank or credit union is federally insured. This protects your deposits up to $250,000, so your money is completely safe.

- A Solid App and Website: Since most HYSAs are online-only, their digital experience is everything. A clunky app can be a dealbreaker. Check app store reviews to see how easy it is to manage your account, check your balance, and move money around.

The Step-by-Step Process to Open Your Account

Getting a high-yield savings account set up is incredibly simple—most people are done in under 10 minutes. You’ll just need to have a bit of personal information handy before you start.

Picking the right HYSA is your first big decision. The field is crowded, with many online banks offering rates that leave traditional savings accounts in the dust. As of early 2026, for instance, you could find established players like Marcus by Goldman Sachs offering a solid 3.65% APY, while newer options like Openbank from Santander have jumped in with rates as high as 4.20% APY with no monthly fees. It’s always a good idea to discover more insights about top-rated accounts before making a final choice.

Here’s exactly what to do.

1. Gather Your Info:

Get these documents ready before you click “apply.” It’ll make the whole process a breeze.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- A government-issued photo ID (like a driver’s license or passport)

- Your current address and contact info (phone and email)

- Your date of birth

2. Fill Out the Online Application:

Head over to the bank’s website and look for the “open an account” button. You’ll fill out a secure form with the personal details you just gathered. This is a standard identity check required by federal law to keep your account safe.

3. Fund Your New Account:

The last step is to make your first deposit. The easiest way is to link another bank account, like your primary checking account. You’ll need that bank’s routing and account numbers to set up an electronic transfer.

Once the accounts are linked, you can move over your initial deposit. Pro-tip: set up recurring transfers right away to make saving automatic.

And that’s it! Once your deposit clears, your money officially starts earning interest at that impressive new rate. You’ve successfully put your savings in the fast lane.

Time to Put Your Money to Work

So, we’ve walked through the ins and outs of high-yield savings accounts, and hopefully, you can see just how powerful they can be. Think of an HYSA as the perfect sweet spot—it offers far more growth than your everyday checking account but without the risks that come with dipping your toes into the stock market.

It’s a straightforward, safe, and surprisingly effective way to make sure your cash isn’t just sitting there. The whole idea is simple: earn a lot more interest on your savings without giving up easy access to your money. This isn’t just a tiny step up; it’s a completely different way of thinking about your savings, transforming idle cash into an asset that’s actively growing every single day.

Getting Clear on Your Financial Goals

Whether you’re building up an emergency fund, saving for a down payment on a house, or putting money aside for a new car, an HYSA can get you there faster. That higher APY, combined with the power of compounding interest, means you hit your goals sooner. It’s incredibly motivating to see your balance tick up in a meaningful way.

This isn’t about complex financial strategies or confusing products. It’s about making one smart choice that literally pays you back, day after day. The benefits are crystal clear:

- Safety: Your money is federally insured, so it’s a completely risk-free place to park your essential savings.

- Growth: The interest rates blow traditional savings accounts out of the water, helping your money keep up with inflation and actually grow.

- Flexibility: Need your cash? No problem. You can get to it when you need it, making HYSAs perfect for emergency funds and other short-term goals.

What’s Your Next Move?

Just understanding what a high-yield savings account is puts you ahead of the curve. Now, it’s time to turn that knowledge into action. Take a quick look at where you’re keeping your savings right now. Is your money parked in an account earning practically nothing? If the answer is yes, you’re missing out on easy growth.

Opening a high-yield savings account is more than just another bank transaction. It’s a real commitment to your future self—a simple, concrete step you can take today to build a stronger financial foundation and feel more secure.

Think of this as your nudge to get started. Spend a little time researching a few accounts, see how they stack up, and take the 10 minutes to open one. It’s one of the easiest and most impactful moves you can make for your finances. Your money should be working for you 24/7, and an HYSA makes sure it does.

Answering Your Final Questions

It’s totally normal to have a few lingering questions as you get ready to open a high-yield savings account. Making sure you have all the details ironed out is the final step before you can confidently put your money to work.

Let’s tackle some of the most common questions that pop up. These are the practical, real-world things people want to know before they get started.

Are High-Yield Savings Accounts Safe?

Absolutely. HYSAs are just as safe as any traditional savings account. As long as you choose a reputable institution, your money is protected.

Accounts from banks are insured by the Federal Deposit Insurance Corporation (FDIC), and accounts from credit unions are insured by the National Credit Union Administration (NCUA). This government-backed insurance covers your deposits up to $250,000 per depositor, per institution. So, in the very unlikely event your bank fails, your money is safe and sound.

Do I Have to Pay Taxes on the Interest I Earn?

This is a great question, and the short answer is yes. The interest you earn from your HYSA is considered taxable income, just like income from a job.

If you earn more than $10 in interest in a year, your bank will send you a Form 1099-INT. You’ll use this form to report the interest income on your federal and state tax returns. While nobody loves paying taxes, remember that you only pay tax on the new money you’ve earned.

Think of it this way: paying a small amount of tax on a large gain is always better than earning almost nothing in the first place. An HYSA ensures your money is growing at a rate that makes the tax consideration a minor part of a much bigger win.

Can the Interest Rate on an HYSA Change?

Yes, and it’s important to know this going in. The interest rate on a high-yield savings account is variable, which means it can go up or down over time. This is a major difference when compared to a Certificate of Deposit (CD), where your rate is locked in for a specific term.

HYSA rates tend to follow the lead of the Federal Reserve. When the Fed raises its key interest rate, banks usually boost their APYs to attract more savers. When the Fed cuts rates, HYSA rates often follow suit and dip a little.

This variability isn’t necessarily a bad thing:

- The upside: In a rising-rate environment, your earnings can increase automatically without you having to lift a finger.

- The downside: In a falling-rate environment, your APY might drop.

Even when rates fall, a good HYSA will still pay you many times more than a standard savings account. This is a core part of understanding what is a high-yield savings account—it’s designed to consistently keep your money working much harder for you, no matter the economic climate.

Ready to stop letting your savings sit idle? The team at Collapsed Wallet is dedicated to providing the clear, practical guidance you need to make smarter money moves. Explore more of our guides and start building your financial confidence today. Learn more at https://collapsedwallet.com.