Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Diving into the stock market for the first time can feel intimidating, like you're trying to learn a whole new language. But the basic idea is actually pretty simple. Imagine a giant marketplace. Instead of selling fruits and vegetables, this market sells tiny pieces of ownership in public companies. When you buy a stock, you're literally buying a small slice of a business like Apple, Amazon, or your favorite coffee shop if it's publicly traded. This guide is here to demystify the process and show you how this marketplace can be a powerful tool for building real, long-term wealth on your journey to financial freedom.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

What Is The Stock Market And Why Does It Matter?

At its core, the stock market is simply a network of exchanges (like the New York Stock Exchange) where people can buy and sell shares of companies. When you purchase a share, you become a part-owner of that business. You're not just trading a ticker symbol on a screen; you're backing the company's future success.

This whole system is vital for a couple of big reasons. For companies, it’s a way to raise money—what's known as capital—to fund new ideas, build factories, or hire more people. But for you, the investor, it’s an opportunity to grow your money at a pace that can blow traditional savings out of the water.

Turning Savings Into a Wealth-Building Engine

Letting your money sit in a standard savings account feels safe, but there's a hidden risk: inflation. Over time, as the cost of everything goes up, the cash in your bank account buys less and less. You're effectively losing purchasing power without even realizing it.

Investing flips the script. Instead of just sitting there, your money gets put to work. By owning pieces of successful companies, you give your cash the potential to grow right alongside the broader economy. It's the key difference between saving and investing: one is about storing your money, and the other is about actively growing it.

The Power of Long-Term Growth

The news often focuses on the stock market's daily roller-coaster ride, which can make it seem volatile and scary. But if you zoom out and look at the big picture, a different story emerges—one of incredible long-term growth. History shows that despite the bumps along the way, the market has been a reliable engine for building wealth over decades.

The secret to successful investing isn't about perfectly timing the market's swings. It's about giving your money time in the market. Patience is your superpower here, allowing the magic of compounding to turn small, consistent investments into something truly substantial down the road.

Just look at the numbers. Since 1928, the S&P 500 (a benchmark for the US market) has delivered an average annual return of around 10.2% before you account for inflation. This incredible track record has consistently turned modest savings into significant wealth over time. This resilience—weathering wars, recessions, and crises—is precisely why the stock market is such a foundational tool for anyone looking to build a secure financial future.

Understanding Core Stock Market Concepts

Diving into the stock market can feel a bit like learning a new language. You're hit with a barrage of terms like "bulls," "bears," and "ETFs" that can sound like complete gibberish at first. But don't worry—once you get a handle on a few key ideas, the whole picture starts to make sense.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

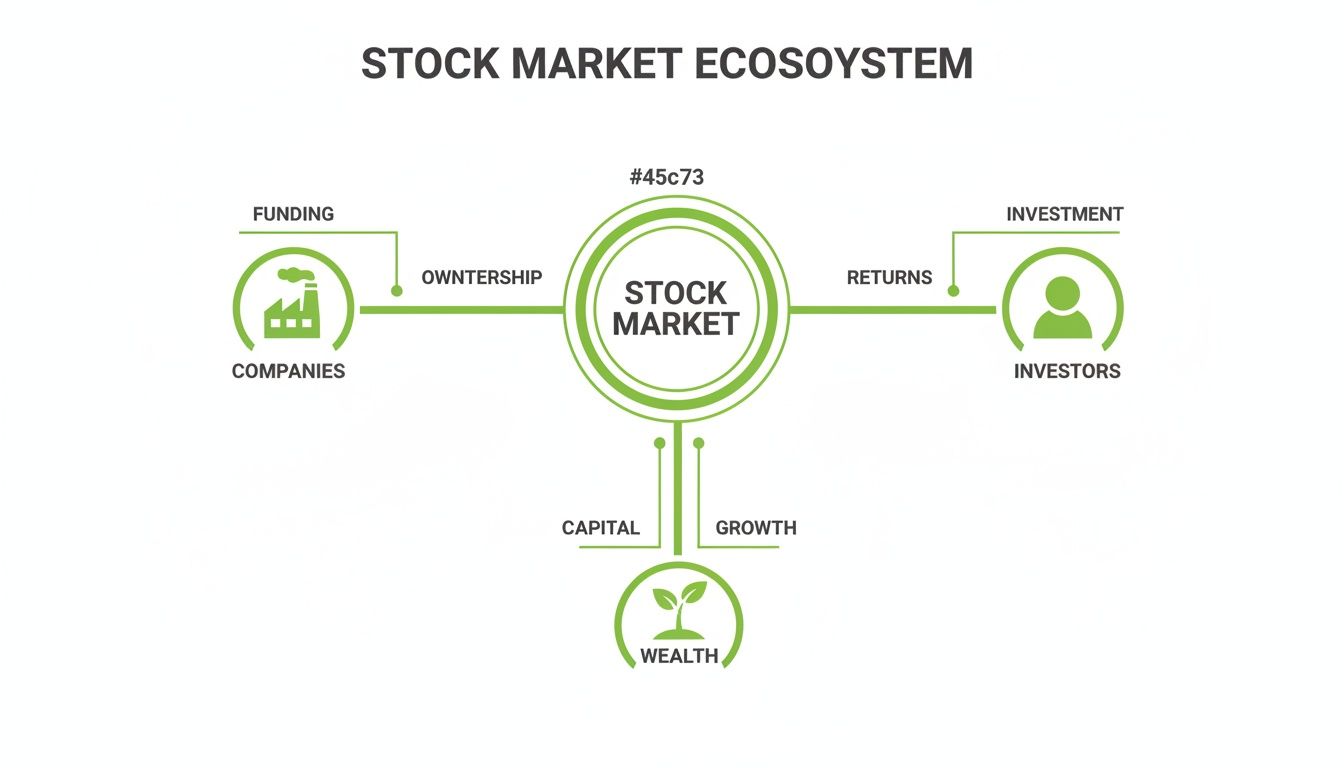

Now, let's get to it. Think of the stock market as a big, interconnected system where companies, investors, and money all work together.

As you can see, it's a cycle. Companies need money to grow, you provide that money by investing, and in return, you get a chance to grow your own wealth. To help you navigate this world, we'll start with the most important terms.

To make things easier, here's a quick cheat sheet for the most common terms you'll hear.

Key Investing Terms Explained Simply

| Term | Simple Explanation | Why It Matters to You |

|---|---|---|

| Stock | A small piece of ownership in a company. | You're not just buying a piece of paper; you're becoming a part-owner. If the company succeeds, the value of your piece can grow. |

| Bond | A loan you give to a company or government. | It's a way to earn a predictable return (interest). Bonds are generally safer than stocks but usually offer lower growth potential. |

| Market Index | A "scoreboard" that tracks the performance of a group of stocks. | Indexes like the S&P 500 give you a quick snapshot of how the overall market is doing. |

| ETF | A basket of stocks or bonds you can buy with a single click. | ETFs are a fantastic way to instantly diversify and own a little bit of everything without having to pick individual stocks. |

| Diversification | The old rule: "Don't put all your eggs in one basket." | Spreading your money across different investments reduces your risk if one of them performs poorly. |

Think of this table as your go-to reference. Now, let's dive a little deeper into these concepts.

Stocks and Bonds: The Building Blocks

At the heart of investing are two main asset types: stocks and bonds. They might seem similar, but they're fundamentally different ways to put your money to work.

-

Stocks: Buying a stock (also called a share or equity) means you're buying a tiny slice of a company. You become a part-owner. Your goal is for the company to do well, because if its value goes up, so does the value of your slice.

-

Bonds: A bond is much simpler—it's just a loan. You're the lender, and a company or a government is the borrower. In exchange for your cash, they promise to pay you back in full on a specific date, with regular interest payments along the way.

Market Indexes: The Scorecards

So, how do you know if the market is having a good or bad day? You check an index. An index is simply a tool that tracks the combined performance of a specific group of stocks, serving as a benchmark for that part of the market.

The most famous one is the S&P 500. It follows the 500 largest public companies in the U.S., from Apple to Amazon. When you hear a news anchor say, "The market was up today," they're usually talking about the S&P 500. It’s the quickest way to gauge the health of the U.S. economy.

Market Moods: Bull vs. Bear

You'll often hear the market's overall attitude described with animal names. It's a bit quirky, but it's a helpful shorthand for understanding market trends.

A bull market is when everything is on the upswing. Stock prices are rising, and investors are feeling confident and optimistic. Think of a bull thrusting its horns upward—that's the market's direction.

On the flip side, a bear market is when prices are falling and pessimism takes over. This name comes from the way a bear swipes its paws downward to attack. During these times, investors get nervous and start selling.

ETFs and Mutual Funds: Your All-in-One Solution

For most beginners, the idea of researching and picking individual stocks is daunting. Where do you even start? This is where funds come in to save the day.

Exchange-Traded Funds (ETFs) and mutual funds are collections of dozens, or even hundreds, of different investments—like stocks and bonds—all bundled together into a single package. Instead of buying just one company, you can buy a fund that holds a little bit of everything.

This is the easiest way to achieve diversification, which is the golden rule of investing. It means you aren't betting your entire nest egg on a single company's success.

For example, you can buy a single share of an S&P 500 ETF. With that one purchase, you're instantly invested in all 500 companies in the index. It's one of the most effective and recommended strategies for beginners looking to build long-term wealth without the stress of stock picking.

How To Start Investing Step By Step

Alright, you've got the basics down. Now for the exciting part: moving from theory to actually putting your money to work. This is your roadmap for getting into the stock market. I’ll walk you through the exact steps, and you’ll see it’s no more complicated than opening a simple savings account.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Before you even think about investing your first pound, make sure your financial foundations are solid. That means having a safety net. If you don't have one yet, take a moment to learn how to build an emergency fund. This stash of cash prevents you from having to sell your investments at a terrible time just to cover a surprise car repair or an unexpected bill.

With that sorted, let's get you invested.

Choose Your Brokerage Account

The first real step is picking a home for your investments. This home is called a brokerage account, which is simply an account that lets you buy and sell things like stocks, bonds, and ETFs.

There are a couple of main types to consider, each with different tax rules.

- Standard Brokerage Account: This is your basic, flexible investment account. There are no limits on how much you can put in, and you can take your money out whenever you want. The trade-off? You'll pay taxes on any profits you make.

- Individual Retirement Account (IRA): An IRA is built for long-term retirement savings and comes with some serious tax perks. A Roth IRA, for example, lets you contribute money you've already paid tax on. The incredible benefit is that your investments can grow and be withdrawn completely tax-free once you retire.

For most beginners looking to build wealth over the long haul, a Roth IRA is a brilliant place to start because of that powerful tax-free growth.

Open Your Account

Once you know which type of account you want, it's time to choose a brokerage firm. Thankfully, a wave of new, user-friendly apps and online platforms has made this easier than ever.

When you're comparing brokers, look for these features:

- Low or no account minimums: Many great platforms let you get started with as little as £1.

- Low fees: Commission-free trading for stocks and ETFs is pretty much standard now. Don't settle for less.

- Fractional shares: This is a game-changer for beginners. It lets you buy a tiny piece of an expensive share for just a few pounds.

Signing up is a lot like opening a new bank account online. You'll need to provide your personal details—name, address, National Insurance number—to verify who you are.

Don't get stuck here. The goal is to just get started. Picking any well-known, low-cost broker is a perfectly good decision for your first account. You can always change later if you need to.

Fund Your Account and Place Your First Trade

Account approved? Great! Now you just need to link it to your bank account and transfer some money in. This is usually a quick and painless process.

Once the cash lands in your account, you're ready to make your first investment. Let's say you want to buy into a low-cost S&P 500 ETF. You just need to know two basic ways to place an order:

- Market Order: This is the "just buy it now" button. It tells your broker to purchase the investment at the best price available at that very moment. It's fast, simple, and guarantees your trade goes through.

- Limit Order: This gives you a bit more control. You set the maximum price you're willing to pay. Your order will only be filled if the investment's price hits your target price or drops even lower.

As a long-term investor buying a broad-market ETF, a market order is all you need. Just search for the ETF's ticker symbol (for a UK-based S&P 500 ETF, that might be something like VUSA), type in how much you want to invest, select "Market Order," and hit confirm.

And just like that, you're an investor. Congratulations

Smart Investing Strategies For Beginners

Forget the Hollywood stereotype of a frantic stock-picker trying to find the next big thing. Successful investing isn’t about that at all. It’s really about building simple, powerful habits that let your money grow steadily over the long haul. With the right strategies, you can put your wealth-building on autopilot and sidestep the stress that trips up so many people.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Embrace Diversification: Your First Line of Defense

If there's one golden rule in investing, it's this: don't put all your eggs in one basket. This simple idea, known as diversification, is your single best tool for managing risk. It just means spreading your money across different investments, industries, and even countries.

When you're properly diversified, a big dip in one area won't torpedo your entire portfolio. Think of it as a shield. For example, the S&P 500 index is naturally diverse, holding companies from various sectors like 32% in Information Technology, 11% in Consumer Discretionary, and 9% in Communication Services. This built-in variety is why a broad index fund is a much smarter starting point than gambling on a handful of individual stocks. For a deeper look at the S&P 500's makeup, check out the great visual guide from The Prudent Speculator.

Use Dollar-Cost Averaging to Invest Consistently

Trying to "time the market"—predicting the absolute perfect moment to buy low and sell high—is a fool's errand. Even the pros can't do it consistently. A far more effective and less stressful approach is dollar-cost averaging.

The strategy is simple: you invest a fixed amount of money on a regular schedule, say every month, regardless of what the market is doing. This takes all the emotion and guesswork out of the equation. When prices are high, your fixed investment buys fewer shares. When prices are low, that same amount gets you more shares. Over time, this smooths out your average purchase price and dramatically reduces the risk of dumping all your money in right before a downturn.

If you've come into a larger amount of cash, you might be wondering how to apply this. We've got you covered in our guide on how to invest a lump sum for maximum growth.

Focus on Passive Investing with ETFs

For the vast majority of people, passive investing is the most reliable way to build wealth. Instead of trying to outsmart the entire market by picking individual stocks (which is called active investing), you simply aim to match the market's overall performance.

The easiest way to do this is with low-cost index funds or Exchange-Traded Funds (ETFs). These funds are designed to track a major market index, like the S&P 500. With a single purchase, you get instant diversification across hundreds of America's top companies. This "set it and forget it" approach is perfect for anyone who wants their money to work for them without becoming a full-time stock analyst.

Passive investing isn't about settling for average; it's about smartly capturing the market's proven long-term growth. By keeping costs low and staying diversified, you often end up ahead of most active investors who try to outperform the market and fail.

Harness the Magic of Compounding

The last strategy is the most powerful force in finance: compounding. Often called the eighth wonder of the world, compounding is what happens when your investment earnings start generating their own earnings. It creates a snowball effect that can turn small sums into a fortune.

Let’s say you invest £1,000 and earn a 10% return in the first year. You now have £1,100. The next year, you earn 10% on the full £1,100, not just your original investment. The numbers might seem small at first, but over decades, this chain reaction can transform modest, regular investments into a life-changing amount of money.

The secret ingredient? Time. The sooner you start, the more time you give this magic to work.

Common Mistakes New Investors Make

The fastest way to learn a new skill is often by studying the mistakes of those who came before you. Investing is no different. It's an exciting journey, but the road is littered with common pitfalls that can easily trip up newcomers. Knowing what they are ahead of time is your best defense.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Letting Emotions Drive Decisions

By far, the single biggest mistake I see new investors make is reacting emotionally to the market's daily drama. When stocks are soaring, the fear of missing out (FOMO) kicks in. It's a powerful feeling that tempts you to pile into over-hyped trends, often right at their peak.

The flip side is just as dangerous. When the market inevitably drops, panic takes over. Many investors sell everything in a rush, locking in their losses instead of giving their solid investments time to recover.

A key principle for achieving financial freedom is to treat investing like planting a tree, not like playing a slot machine. You cultivate it over time with patience and discipline, ignoring the daily weather reports in favor of focusing on the long-term growth.

This emotional roller coaster is exhausting, and worse, it’s a terrible way to manage your money. A solid, pre-written investment plan, created when you're calm and rational, is your best shield against making impulsive decisions you'll almost certainly regret.

Trying to Time the Market

Everyone has the same fantasy: buy a stock at its absolute lowest point and sell at its absolute peak. This is called timing the market, and for most people, it remains just that—a fantasy. It’s a losing game.

Even the pros on Wall Street, with all their supercomputers and teams of analysts, can't do it consistently. The market is just too unpredictable in the short term.

Instead of trying to master the impossible art of timing the market, focus on a much more powerful and proven strategy: time in the market. By simply staying invested through the good times and the bad, you allow your money to benefit from the market's long-term upward trend and the magic of compounding. A simple strategy like dollar-cost averaging, where you invest a set amount regularly, takes all the guesswork out of it.

Investing Money Needed in the Short Term

This one is critical. Never, ever invest cash you know you'll need within the next few years. I'm talking about money for a house deposit, a wedding, or your emergency fund.

The stock market is a tool for long-term growth. That growth comes with short-term volatility, meaning its value can swing up and down quite a bit from one year to the next.

Imagine the market takes a dive right when you need that money for your down payment. You'd be forced to sell your investments at a loss, wrecking both your immediate financial goals and your long-term investment plan.

Here's a simple rule of thumb to live by:

- Invest money for long-term goals (5+ years away): This gives your portfolio plenty of time to ride out any downturns and recover.

- Save money for short-term goals (less than 5 years): Keep these funds somewhere safe and accessible, like a high-yield savings account.

Ignoring the Impact of High Fees

Fees are the silent killers of investment returns. They seem so small on paper—a tiny 1% or 2% here and there—but over time, they can eat away a shocking amount of your hard-earned money. It's like compound interest working in reverse, against you.

For example, a 1% annual fee on a £100,000 portfolio might not sound like a big deal. But fast forward 30 years, and that "small" fee could have cost you tens of thousands of pounds in lost growth compared to a lower-cost option.

Always check the fees. Make it a habit. Prioritise platforms and funds with low expense ratios. This is why low-cost index funds and ETFs are such a great starting point—their fees are minimal, which means more of your money stays in your pocket, working for you. It's a simple check that can have a massive impact on where you end up financially.

Your Simple Starter Investment Checklist

We’ve covered a lot of ground in this guide. Now, it's time to put all that knowledge into practice. This final checklist is designed to cut through the noise and give you a clear, simple plan to get started with confidence.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of these as your launch codes. Working through them will take you from someone who reads about investing to someone who is actively building their financial future.

Your Action Plan for Getting Started

This is where the rubber meets the road. Follow these four steps to take control and start your wealth-building journey today.

-

Define Your Financial Goals

Before a single dollar leaves your bank account, you need to know why you’re investing. Are you aiming for retirement in 30 years? A down payment on a house in 10? Your timeline and target amount dictate every other decision, so get specific. Write it down. Make it real. -

Choose and Open Your Brokerage Account

Find a low-cost, beginner-friendly brokerage. Look for platforms with zero account minimums, commission-free ETF trading, and the ability to buy fractional shares. Opening an account is usually a quick online process, much like setting up a new bank account. -

Set Up Your First Automatic Investment

This is the most powerful step. Link your bank account and schedule a recurring, automatic transfer into a diversified, low-cost ETF (like an S&P 500 index fund). Even a small, consistent amount puts dollar-cost averaging to work and sets your wealth-building on autopilot. -

Commit to a Long-Term Mindset

The final step is a mental one. Make a pact with yourself right now: you won’t panic-sell when the market drops, and you won’t get greedy when it soars. You're in this for the long haul. Success comes from patience and consistency, not trying to time the market perfectly.

By completing this checklist, you're laying the foundation for financial freedom. You aren't just buying stocks; you're buying a piece of the future and taking a real step toward a life with fewer money worries.

Got Questions? We've Got Answers

Alright, you've got the foundational concepts down. But I know there are always those nagging little practical questions that pop up right when you're ready to get started. Let's tackle them head-on.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

How Much Money Do I Actually Need to Start Investing?

This is, without a doubt, the number one question I hear. The answer is probably a lot less than you think: you can get started with pocket change.

Seriously. Thanks to a brilliant innovation called fractional shares, you no longer need a pile of cash to own a piece of a big-name company. Modern brokers let you buy a small slice of a share, meaning you can start investing with as little as £1 or £5.

The real secret isn't how much you start with, but how often you do it. Investing a small amount consistently is way more powerful than waiting to save up a huge lump sum. Starting small and starting now is how you give your money the maximum amount of time to grow.

What's the Real Difference Between an ETF and a Mutual Fund?

Good question. Both are fantastic tools that let you buy a pre-packaged bundle of hundreds or even thousands of investments in one go. The main difference comes down to how they're bought and sold.

- ETFs (Exchange-Traded Funds): These trade on a stock exchange just like an individual stock. Their price moves up and down all day long, and you can buy or sell them whenever the market is open.

- Mutual Funds: These are a bit different. They only price once a day, right after the market closes. You place your order, and it gets executed at that single end-of-day price.

For most people starting out, ETFs often win out. They tend to be a bit more flexible, easier to understand, and frequently come with lower fees. They make for a perfect first investment.

How Often Should I Be Checking My Portfolio?

I get the temptation. It's exciting to watch your money, but checking it every day (or every hour!) is one of the worst things you can do. The market's daily jitters are just noise, and watching them will only stress you out and lead to bad, emotional decisions—like selling in a panic when things dip for a day.

My advice? For a long-term investor, checking in once a quarter is plenty. It’s enough to stay informed and make sure you're on track without getting sucked into the daily drama.

Remember, you're playing the long game. Don't get tripped up by the short-term noise.

Is My Money Actually Safe in a Brokerage Account?

Yes, it is. Regulated brokers in the UK have serious protections in place. They are covered by the Financial Services Compensation Scheme (FSCS).

This means that if your brokerage firm were to go out of business, your investments are protected up to £85,000 per person, per firm.

Just to be crystal clear: this doesn't protect you from the value of your investments going down—that's normal market risk. But it does protect the assets themselves, giving you crucial peace of mind that your money is secure with a regulated company.

Here at Collapsed Wallet, our whole mission is to cut through the jargon and give you clear, straightforward advice to help you build a stronger financial future. We take complicated stuff and break it down into simple steps. For more guides on making your money work for you, come visit us at https://collapsedwallet.com.