Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let’s be honest, getting hit with an overdraft fee feels like a kick in the gut. It’s a costly penalty for what’s often a simple mistake. The good news? You can make them a thing of the past. It really boils down to a handful of smart moves: opting out of overdraft coverage, linking your checking to a savings account, keeping a small cash buffer, and turning on low-balance alerts. Think of these as your financial safety net, stopping small miscalculations from snowballing into expensive fees. This is your ultimate guide on how to avoid overdraft fees!

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Why Overdraft Fees Happen and How to Stop Them

So, what exactly triggers an overdraft fee? It happens when you don’t have enough cash in your account to cover a transaction, but your bank, in its “generosity,” pays it for you anyway. Then they charge you for the favor.

This can sneak up on you in a few common ways:

- You swipe your debit card for a purchase, not realizing your balance is a few dollars short.

- An automatic bill payment you set up months ago hits your account unexpectedly.

- A check you wrote finally gets cashed, but your balance has dipped since you wrote it.

The True Cost of Overdrafts

These “small” fees are a massive deal. In a single year, Americans paid a jaw-dropping $12.1 billion in overdraft and NSF fees. That number was a shocking 48% higher than previous estimates, showing just how common this problem is. For big banks like JPMorgan Chase and Wells Fargo, these fees are a goldmine, with each pulling in over $1 billion. What’s a minor shortfall for you is a major revenue stream for them. You can dig into the full stats over at finhealthnetwork.org.

It’s a frustrating cycle. One fee can drain your account just enough to trigger another, making it feel impossible to get back on solid ground. But you absolutely have the power to break that cycle.

Key Takeaway: Overdraft fees are not a fact of life. They are a preventable expense, and you can get them under control by being proactive with your account settings and habits.

Taking Control of Your Finances

The first step is to stop seeing these fees as just a penalty. Instead, view them as a signal—a prompt to take a closer look at your financial habits. Once you know what’s triggering them, you can build a system to protect yourself.

This journey often starts with getting a crystal-clear picture of where your money is going. Being able to quickly scan your account activity is a game-changing skill. If you want to get good at this, our guide on how to read a bank statement in minutes is a great place to start.

Ultimately, learning to sidestep overdraft fees isn’t just about saving a few bucks; it’s a powerful step toward financial peace of mind.

Master Your Bank Account Settings to Block Fees

The most powerful tools for dodging overdraft fees are probably sitting right inside your bank account, waiting for you to flip the switch. You don’t need fancy software or complicated systems. With just a few clicks in your online banking portal or mobile app, you can build a powerful, automated defense against those painful charges.

It really boils down to two core strategies you can set up yourself: opting out of overdraft coverage completely or, alternatively, setting up overdraft protection. They sound almost the same, but they work in completely different ways. Getting a handle on that difference is the first real step toward picking the right strategy for your money.

Choose Your Defense Strategy

Let’s walk through a common scenario. You’re at a store, and your cart total comes to $50, but you’ve only got $40 in your checking account. Here’s how it plays out:

- If You’ve Opted Out of Overdraft Coverage: Your debit card will simply be declined. It might be a little awkward, but the important part is you won’t get hit with a fee. You can just put an item back or pay a different way.

- If You Have Overdraft Protection: Your bank automatically pulls the $10 you’re short from a linked account—like your savings or a line of credit—to let the purchase go through. You avoid the nasty $35 overdraft fee, though you might pay a much smaller transfer fee instead.

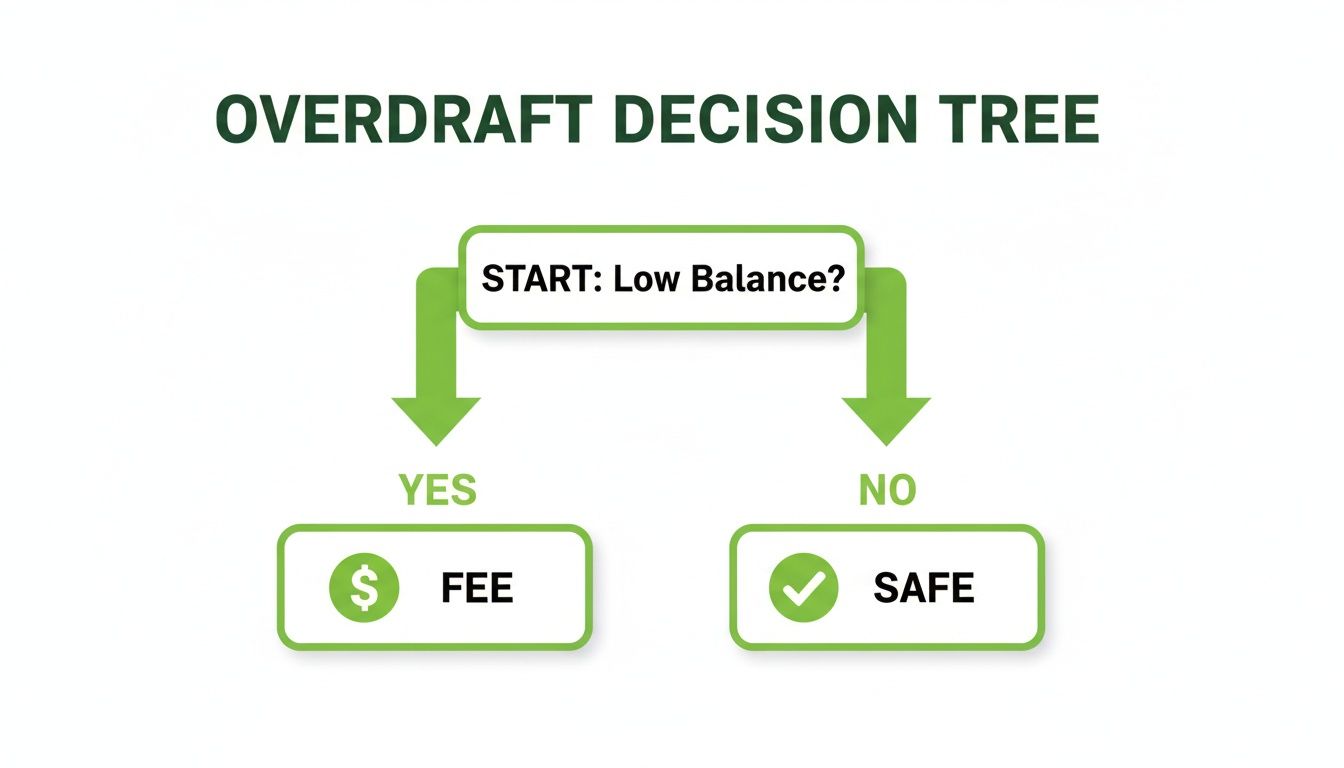

This flowchart breaks down that critical moment when your bank balance gets low.

As you can see, the path splits the second your balance is too low. Your account settings are what decide whether you get hit with a fee or not.

Overdraft Coverage vs. Overdraft Protection

To make an informed choice, you need to understand the fundamental differences between these two bank features. One is a service that costs you money by design, while the other is a safety net you set up yourself.

Let’s compare them side-by-side.

| Feature | Opt-Out of Overdraft Coverage | Set Up Overdraft Protection |

|---|---|---|

| How It Works | You tell your bank “no.” They must decline debit card and ATM transactions that would overdraw your account. | You link your checking account to another account (savings, credit card, line of credit). |

| Outcome of a Shortfall | The transaction is declined. | The bank automatically transfers funds from the linked account to cover the shortfall. The transaction is approved. |

| Associated Costs | $0. There is no fee for a declined transaction. | A small transfer fee (typically $5-$12) may apply, but it’s much less than a standard overdraft fee. |

| Best For | People who want a hard stop to prevent overspending and avoid all potential fees on debit purchases. | People who want to ensure critical payments (like rent or utilities) always go through without incurring a high overdraft fee. |

Ultimately, choosing to opt out is the most direct route to stopping fees from debit card purchases. However, it’s not a silver bullet—it won’t stop overdrafts from recurring auto-payments or old-school paper checks. Overdraft protection gives you more flexibility and peace of mind.

The fear of overdraft fees is so real that it’s a major reason millions of people avoid traditional banking altogether. This distrust hits lower-income families the hardest and can seriously undermine their financial stability.

This isn’t a small problem. Even with recent changes, banks raked in $5.8 billion from these fees, with giants like JPMorgan Chase and Wells Fargo accounting for over $2 billion of that in a single year.

What’s really shocking is that research shows only 35% of people who get hit with overdrafts even knew they had the right to opt out of the “coverage” that caused the fee in the first place. You can dig into more of these banking statistics from the Consumer Federation of America. If your bank hasn’t made this choice obvious, it’s time to take control.

Build Proactive Money Management Habits

Changing your bank settings is a great defensive play, but the best long-term strategy is to build financial habits that make overdrafts a non-issue. The goal isn’t just to react when your balance gets low; it’s to manage your money so you rarely find yourself in that position in the first place. This is all about taking back control.

These habits aren’t complicated. They’re just small, consistent actions that add up to a strong financial foundation. By weaving them into your routine, you can stop worrying about surprise fees and gain some real peace of mind.

Create a Checking Account Buffer

One of the most powerful things you can do is create a buffer in your checking account. Basically, you decide on a new “zero.” Instead of letting your account dip to $0, you treat $100—or even $200—as your absolute floor.

This simple mental trick completely changes how you see your available balance. If your account has $150, you don’t think “I have $150 to spend.” You think, “I have $50.” That cushion is your safety net, ready to absorb a small math error or an unexpected debit without triggering that dreaded fee.

My Favorite Tip: Don’t just hope a buffer materializes. Automate it. Set up a recurring transfer of just $5 or $10 each week from your savings into your checking. Before you know it, you’ll have a solid buffer without even feeling the hit.

This is a different beast from a full-blown emergency fund, which is meant for much larger, unexpected life events. If you’re ready to tackle that, our guide on how to build an emergency fund can get you started.

Master the Two-Minute Balance Check

Here’s another game-changer: the daily two-minute balance check. It’s exactly what it sounds like. Take a couple of minutes every morning to pop open your banking app and scan your balance and recent activity.

This quick check-in is surprisingly effective. Here’s why:

- You’ll see what’s coming. A purchase you made on Saturday might not officially post until Tuesday. Seeing it in the “pending” section is a crucial reminder that your actual balance is lower than what the main number shows.

- You’ll anticipate auto-payments. “Oh, right, my car insurance comes out tomorrow.” That little thought prompts you to make sure the money is there, ready to go.

- You can spot trouble instantly. A fraudulent charge or a restaurant that accidentally billed you twice gets caught right away, not days later when it’s already caused an overdraft.

Making this a daily habit keeps you completely in tune with your money. It takes the anxiety out of checking your account and turns that number into just another piece of information you can manage.

Put Technology to Work for You

Good financial habits are your best defense, but let’s be realistic—nobody’s perfect. Thankfully, you don’t have to rely on memory and willpower alone. The smartphone in your pocket can be an incredible tool for keeping your finances on track and heading off overdraft fees before they ever happen.

It’s all about making technology your financial co-pilot, automating the boring stuff so you can focus on other things.

Customize Your Bank Alerts

Your bank’s mobile app is way more than just a place to peek at your balance. Hidden in the settings is a powerful early-warning system. Take a few minutes to explore the notification options—it’s one of the easiest ways to prevent a costly mistake.

The absolute must-have is a low-balance alert. You get to decide the threshold. Set it to $100 or $200—whatever number gives you enough breathing room—and your bank will ping your phone the second your balance dips below it. This simple heads-up gives you precious time to transfer money or hold off on that next purchase.

While you’re in there, don’t stop at low balances. Most banks let you set up other incredibly useful alerts:

- Large Transactions: Want a notification anytime a charge over $50 hits your account? You can do that. It’s fantastic for keeping tabs on big spending and spotting fraud immediately.

- Upcoming Bill Payments: Get a reminder a day or two before a big auto-payment is scheduled to come out. No more surprises.

- Big Deposits: It’s also nice to get that “cha-ching” notification when your paycheck finally lands.

These little automated pings are lifesavers. They can easily be the difference between a stress-free month and a $35 fee.

My Take: Think of bank alerts as your personal financial assistant. They do the constant watching for you, so you don’t have to. This frees up your mental bandwidth while making sure nothing important gets missed.

Get the Big Picture with Budgeting Apps

While your bank’s app is essential for day-to-day monitoring, it only shows you one piece of the puzzle. This is where a good budgeting app comes in.

Tools like Mint or YNAB connect all your accounts—checking, savings, credit cards, you name it—into one central dashboard. This gives you a complete, real-time view of your entire financial world, something your bank’s app just can’t do.

This all-in-one view is their superpower. A budgeting app can see that your checking account is trending low and that you have a big credit card bill due next Friday. It can flag this potential cash crunch well in advance, giving you plenty of time to move money around. If you’re new to these tools, exploring some of the best free budgeting apps is a great way to start.

Ultimately, these apps help you connect the dots between your spending, your bills, and your income, which is the key to staying out of the red for good.

How to Get an Overdraft Fee Refunded

So, it happened. Despite all your planning, an overdraft fee showed up on your statement. It’s frustrating, but don’t just accept it as a loss. You have a lot more influence than you might realize, and asking for a refund is often surprisingly effective.

The trick is to move fast and be both polite and confident. Think of it less as a confrontation and more as a conversation with your bank.

Your Game Plan for Getting Your Money Back

Before you dial that customer service number or head to a local branch, get your thoughts organized. The goal is to be friendly, firm, and to the point. No need to invent a complicated story—a simple, honest request is always best.

Here’s a simple script you can make your own:

“Hi, I’m calling about my account. I noticed an overdraft fee for [Amount], and I was hoping you could help me with it. I’ve been a customer for [Number] years, and this isn’t a regular occurrence for me. Would it be possible to get a one-time waiver as a courtesy?”

This works because you’re reminding them of your good history and loyalty without being demanding. You’re framing the overdraft as a rare slip-up, which gives the bank representative an easy reason to help you out.

Why Banks Are More Willing to Bend These Days

The good news is that the banking world has changed. Facing pressure from consumers and regulators, many banks are far more flexible with fees than they used to be.

In fact, overdraft fee revenue has dropped by more than 50% from what it was before the pandemic. That translates into an estimated $6.1 billion in annual savings for consumers by 2023. We’ve seen huge players like Bank of America cut their overdraft fees by a staggering 91%. Others, like TD Bank and PNC, have rolled out new features like grace periods or small negative balance cushions.

With seven in ten Americans calling a typical $35 fee unfair, banks are listening. You can read more about these major fee reductions straight from the Consumer Financial Protection Bureau.

Here’s a pro tip: Most banks give their employees the power to offer a “courtesy waiver.” If you’re a long-standing customer with a clean record, the first person you talk to can often reverse the fee right then and there.

If you don’t get a “yes” on the first try, don’t hang up. Calmly ask if you can speak with a manager or supervisor. Sometimes, all it takes is a conversation with someone who has a bit more authority.

The worst they can do is say no. But if you don’t ask, you’ll never know. By making that simple call, you stand a great chance of getting your money back.

A Few Common Questions About Overdraft Fees

Even with the best strategies in place, the details around overdrafts can still be a bit murky. It’s completely normal to have questions about how the rules work and what they mean for you. Let’s clear up some of the most common ones.

Can a Bank Really Charge an Overdraft Fee Without My Permission?

This is a great question, and the answer is a bit of a “yes and no.” For your everyday debit card purchases and ATM withdrawals, federal rules are on your side. Thanks to Regulation E, a bank can’t charge you an overdraft fee on these transactions unless you’ve explicitly given them permission by opting in to their overdraft service. If you haven’t opted in, they should just decline the transaction. No harm, no foul.

But here’s the catch: that protection doesn’t apply to everything. Banks can still hit you with an overdraft fee for older-school transactions like bouncing a check or for a recurring automatic payment that comes through (think Netflix or your car insurance). This is a critical loophole that trips a lot of people up, and it’s exactly why keeping that little cash buffer in your account is so important.

Will Using My Savings for Overdraft Protection Sabotage My Savings Goals?

I hear this concern all the time. You work hard to build up your savings, and the last thing you want is for a checking account hiccup to drain it. It feels counterproductive, right?

The best way to think about it is by comparing the costs. Is a $5 transfer fee from savings a better deal than a $35 overdraft penalty? Absolutely. To avoid dipping into your main nest egg, try this pro tip: open a separate, smaller savings account and link that one to your checking.

Think of it as your “overdraft buffer account.” Just keep a small amount in there—maybe $100 to $200—as a dedicated safety net. That way, if a transfer is ever needed, it pulls from this mini-account, leaving your long-term savings for emergencies and big goals completely untouched.

This strategy is all about compartmentalizing. Your primary savings stays focused on growth, while this small buffer account absorbs the little shocks of daily financial life.

Are There Any Bank Accounts That Just Don’t Have Overdraft Fees at All?

Yes, and they’re becoming more common! As customers have pushed back against hefty fees, many banks—especially newer, digital-first ones—have gotten rid of overdraft fees completely. If you’re tired of worrying about them, switching to one of these accounts can be a game-changer.

Here are a few options you’ll likely run into:

- Challenger Banks: Online banks like Chime and Varo built their reputations on being fee-friendly. No-fee overdraft is often a core feature.

- Accounts with a “Cushion”: Some banks now offer a small, built-in buffer. They might let your balance dip by $50 or so without charging a fee.

- “SpotMe”-Style Features: This is a popular feature where the bank spots you a small, fee-free amount to cover an overdraft, which you then automatically repay with your next direct deposit.

Taking a little time to explore these alternatives could permanently take the stress of overdraft fees off your plate.

What’s the Maximum Number of Overdraft Fees I Can Get in a Single Day?

This is where things can get ugly, and unfortunately, there’s no universal rule. The policy is entirely up to the bank. In the past, it wasn’t uncommon for banks to charge a separate fee for every single transaction that pushed you further into the red. You can imagine how five small purchases could suddenly turn into $175 in fees.

Thankfully, after a lot of public pressure, many big banks have reined this in. Some now have daily caps, limiting you to, say, one or three fees per day, no matter how many transactions clear. The only way to know for sure is to dig into your bank’s fee schedule (usually found on their website). It’s essential reading to avoid any devastating surprises.

At Collapsed Wallet, our goal is to give you clear, straightforward advice to help you feel more in control of your money. For more tips on budgeting, saving, and reaching your financial goals, check out our other guides at https://collapsedwallet.com.