Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

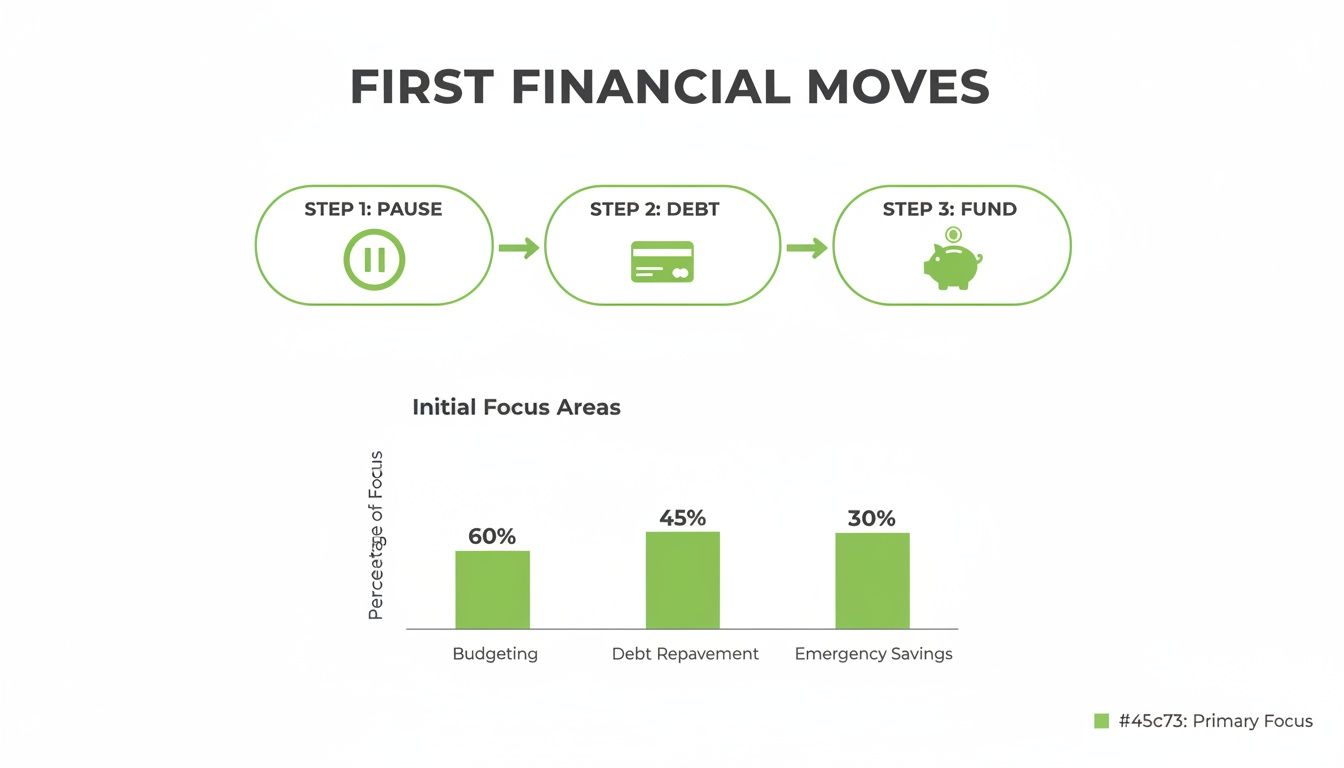

Looking to invest a lump sum for maximum growth? Maybe you’ve just come into a large sum of money. Fantastic. The first, and most important, thing to do is… nothing. The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Seriously. Take a breath. Resist the urge to make any sudden moves. Whether it’s from an inheritance, a big bonus, or selling a property, the temptation to immediately dive into the market is huge. But before you even think about investing, you need to make sure your financial house is in order. Getting this groundwork right ensures your new capital is set up for long-term growth, not just for patching up the next emergency.

Your First Moves After Receiving a Windfall

Getting a big chunk of cash all at once can feel a little overwhelming. But the smartest investors I know all do the same thing: they prepare. Rushing in without a plan is how you expose that new money to risks you don’t need to take.

Think of this phase as essential financial housekeeping. By methodically shoring up your finances first, you create a secure launchpad for your investments. This way, your money can grow without being derailed by life’s inevitable curveballs or dragged down by expensive debt.

Create a Secure Financial Buffer

Before a single dollar goes into the stock market, your top priority is building a rock-solid safety net. This buffer is what protects you from having to sell your investments at the worst possible time just to cover an unexpected car repair or medical bill. A healthy emergency fund is the bedrock of any financial plan.

You should aim to have 6 to 12 months of essential living expenses stashed away in cash. And I don’t mean in your regular chequing account. Park it in a high-yield savings account where it’s out of sight, out of mind, but still easily accessible. If this is new territory for you, our guide on how to build an emergency fund walks you through exactly how to calculate your number and get it done.

A strong emergency fund isn’t just about saving; it’s about buying peace of mind. It lets you invest with confidence, knowing you have a cushion to fall back on, no matter what the market does.

Eliminate High-Interest Debt

The second non-negotiable step is to obliterate any high-interest debt. Let’s put this in perspective: paying off a credit card with a 20% APR is like getting a guaranteed, tax-free 20% return on your money. You simply cannot find an investment that reliably delivers that.

Use a portion of your windfall to wipe the slate clean. Go after the debts that are actively working against you.

- Credit Card Balances: These are usually public enemy number one, with sky-high interest rates.

- Personal Loans: Double-digit interest rates here can seriously drain your resources over time.

- Payday Loans: Their predatory rates make them an absolute emergency to clear.

Getting rid of this debt immediately boosts your cash flow and frees you up to focus on building wealth. It’s like plugging a massive leak in your financial bucket, letting you finally move forward on solid ground.

So, you’ve done the hard work, secured your financial foundations, and now you’re staring at a lump sum of cash. What’s next? This brings us to one of the most classic debates in personal finance: should you invest it all at once or ease into the market over time?

This is the core of the Lump Sum Investing (LSI) versus Dollar-Cost Averaging (DCA) dilemma. LSI is exactly what it sounds like—putting your entire sum to work in one go. DCA, on the other hand, means you break that sum into smaller, equal chunks and invest them at regular intervals.

There’s no single right answer here. The best path forward often hinges more on your personality and comfort with risk than on any market forecast.

Before you make that call, though, it’s critical to make sure you’re truly ready to invest. The first moves should always be about building a solid base: pausing to make a plan, knocking out high-interest debt, and making sure your emergency fund is solid.

Getting these fundamentals right gives you a stable platform, no matter which investment strategy you choose.

The Numbers Don’t Lie: The Case for Lump Sum Investing

If we look at this from a purely statistical standpoint, the evidence leans heavily in favor of lump sum investing. The logic is simple: historically, markets go up more often than they go down. By getting your money in the market all at once, you give it the maximum amount of time to benefit from that general upward trend and the magic of compounding.

Every day your cash sits on the sidelines is a day it isn’t working for you. Holding back to drip-feed it into the market often means you’re missing out on gains you could have captured.

A study from Northwestern Mutual drove this point home. They compared investing a $1 million lump sum against dollar-cost averaging the same amount over 12 months. The results? The lump sum approach won about 75% of the time over rolling 10-year periods. This pattern held up even when they tested different portfolios, from 100% stocks to a more balanced 60/40 stock-and-bond mix.

The takeaway is that time in the market consistently beats timing the market. You can dig into the full lump sum versus DCA performance data yourself for a closer look.

The biggest edge LSI gives you is maximizing your time in the market. Since markets have a long-term upward bias, investing sooner gives your money more time to grow and compound—the most powerful wealth-building engine there is.

This isn’t an isolated finding. A landmark Vanguard study reached a similar conclusion, finding that LSI outperformed DCA roughly two-thirds of the time. They also noted that the longer you stretch out the DCA period, the more likely LSI is to come out ahead.

The Human Element: The Psychological Comfort of DCA

If the math is so clear-cut, why does anyone even consider dollar-cost averaging? The answer is all about human psychology.

Let’s be honest: investing a big chunk of money can be incredibly nerve-wracking. The single biggest fear is that you’ll put all your money in right before a massive market crash. We’ve all heard the horror stories.

DCA is, at its heart, a strategy for minimizing regret. It smooths out the emotional journey by reducing the risk of buying in at the absolute worst moment.

Here’s how DCA acts as a psychological safety net:

- It averages out your purchase price. By spreading your investments out, you inevitably buy at different price points. If the market dips, your next investment buys more shares for the same money, lowering your average cost.

- It builds discipline. Automating your investments takes emotion out of the equation. It prevents that “analysis paralysis” where you’re too scared to ever pull the trigger.

- It lets you ease in. For anyone new to investing or just feeling anxious, DCA is like dipping a toe in the water instead of doing a cannonball. It makes the whole process feel much more manageable.

Ultimately, DCA is less about squeezing out every last percentage point of return and more about managing your emotions so you can stay in the game. And that’s crucial. The best investment strategy is the one you can actually stick with.

Comparing Lump Sum Investing vs Dollar-Cost Averaging

To make the choice clearer, it helps to see the two approaches side-by-side. Each has its place, depending on what you’re trying to achieve and what helps you sleep at night.

| Feature | Lump Sum Investing (LSI) | Dollar-Cost Averaging (DCA) |

|---|---|---|

| Primary Goal | Maximize long-term returns by getting money into the market as soon as possible. | Minimize regret and emotional stress by spreading out market entry risk. |

| Historical Edge | Statistically outperforms DCA about 2/3 of the time due to the market’s upward trend. | Tends to underperform LSI because some cash remains on the sidelines, missing potential gains. |

| Best Case Scenario | You invest right before a bull market, capturing the full upside from day one. | You begin investing before a market downturn, allowing you to buy more shares at lower prices. |

| Worst Case Scenario | You invest at a market peak, just before a significant crash. | The market rises steadily, and you consistently buy at higher prices, missing out on earlier gains. |

| Ideal Investor | A long-term, disciplined investor who is comfortable with market volatility and trusts the data. | An investor who is anxious about market timing, prone to regret, or needs a disciplined system. |

While data favors LSI for maximizing returns, DCA is an incredibly valuable tool for managing the psychological side of investing. The “better” strategy is the one that prevents you from making a costly emotional mistake, like panic selling at the bottom.

Finding a Practical Middle Ground

The decision doesn’t have to be all or nothing. You don’t have to choose between going all-in immediately or painstakingly dripping your money in over a year. Many savvy investors find success with a hybrid approach that gives them the best of both worlds.

Here’s a balanced way to think about it:

- Invest a big chunk now. Put 50% to 70% of your lump sum to work right away. This gets a meaningful amount of your capital invested, aligning with the powerful historical data favoring LSI.

- Dollar-cost average the rest. Invest the remaining 30% to 50% in equal portions over a set timeline that feels comfortable, like the next six to twelve months. This helps soothe that fear of a sudden market drop.

This hybrid model is a fantastic compromise. It ensures you participate in potential market gains with the majority of your funds while still giving you an emotional buffer against the fear of bad timing. It’s a pragmatic way to honor the math while respecting your own human nature.

What’s the Money For? Defining Your Goals and Time Horizon

Before you even think about putting that lump sum to work, you have to answer one deceptively simple question: “Why?” Investing without a clear purpose is like driving without a destination—you’re just burning fuel. Your goals are the bedrock of your entire investment plan; they turn a pile of cash into a tool for building the future you want.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of it this way: your goals determine how much risk you should take and for how long. They anchor every decision you’ll make from here on out.

Linking Your Money to Your Timeline

Every single financial goal has a time horizon—that’s just the fancy term for how long you have until you need the money back. This is probably the most critical piece of the puzzle when you’re investing a lump sum because it directly shapes your asset allocation (the mix of stocks, bonds, and other investments you choose).

Let’s break down goals by their timeline:

- Short-Term Goals (1-3 years): This is money for things like a new car, a dream vacation, or a kitchen remodel. The number one priority here is capital preservation. You simply can’t risk a market crash wiping out your funds right when you need to pay the contractor.

- Medium-Term Goals (4-9 years): Think of a down payment on a house or helping a teenager with university fees. For these, you can take on a little more risk to hopefully get a better return, but you still need to be pretty cautious.

- Long-Term Goals (10+ years): This is the classic stuff—retirement, building serious wealth for the next generation, or saving for a newborn’s university education. With decades on your side, you can afford to ride out the market’s inevitable ups and downs to capture the power of compounding.

The longer your timeline, the more risk you can afford to take. A bad year in the market feels a lot different when your goal is 25 years away versus just two.

Building a Portfolio for Each Goal

Once you’ve sorted your goals into these time buckets, you can start building a specific strategy for each. The way you invest your five-year house deposit fund should look completely different from your 30-year retirement nest egg.

For Long-Term Goals (Like Retirement)

Here, you can lean heavily into growth. Time is your superpower, allowing you to recover from market dips and chase higher potential returns from stocks. A common and effective strategy is to use low-cost, broad-market Exchange-Traded Funds (ETFs) that track major indexes like the S&P 500.

For a goal that’s decades away, a portfolio might be 80% or more in stock ETFs, with a smaller slice in bonds to add a bit of diversification.

For Medium-Term Goals (Like a Down Payment)

This calls for a more balanced approach. You still want your money to grow, but protecting what you have becomes much more important as your goal approaches. This usually means a more moderate mix, like a 50/50 or 60/40 split between stocks and bonds. This blend gives you growth potential while providing a cushion against a sudden market downturn.

For Short-Term Goals

Safety is everything. The stock market is far too volatile for money you know you’ll need in the next year or two. Don’t even think about it. Instead, you should be looking at things that keep your principal safe:

- High-yield savings accounts

- Short-term government bonds

- Certificates of Deposit (CDs)

These options won’t make you rich, but they’ll make sure the money is there, in full, when the bill comes due. By splitting your lump sum based on these timelines, you’re not just investing—you’re creating a smart, purposeful plan that connects your money directly to your life.

Building Your Diversified Investment Portfolio

Alright, you’ve defined your goals and you’re ready to put your money to work. Now we get to the fun part: building the engine that will actually grow your lump sum over time. This is where you move from planning to doing.

The great news is that you don’t need to get bogged down in the risky and complicated world of picking individual stocks. The modern approach is far simpler and more effective. We’ll focus on accessible, low-cost tools that give you instant diversification, letting you own a small slice of thousands of companies with a single click.

ETFs and Mutual Funds: Your Best Friends

For almost everyone investing a lump sum, Exchange-Traded Funds (ETFs) and mutual funds are the way to go. Think of them as pre-packaged baskets of investments. You buy one fund, and you instantly own hundreds of different stocks or bonds, spreading your risk across different markets and industries. It’s a far cry from betting your future on the fortunes of just a few companies.

Many of these funds are designed to simply track a broad market index, like the S&P 500. This “passive” strategy has proven incredibly effective over the long run and comes with rock-bottom fees, which means more of your money stays in your pocket, working for you. If this is new territory, our guide on how to start investing for beginners is a great place to get up to speed.

Why Asset Allocation Is Everything

Here’s the single most important decision you’ll make: your asset allocation. This is simply the mix of stocks and bonds in your portfolio. It’s not about picking the one “perfect” fund; it’s about creating a blend that matches your personal risk tolerance and how long you plan to invest.

Stocks are your growth engine, but they come with a bumpy ride (volatility). Bonds are the shock absorbers; they provide stability and income but with lower long-term growth. Nailing this balance is the key to building a portfolio that lets you sleep at night while still making real progress.

Asset allocation is the art and science of diversification. A well-allocated portfolio is designed to smooth out the ride, so you’re not overly exposed to the performance of any single asset class.

Sample Portfolios for Different Investors

To make this tangible, let’s walk through a few examples. These aren’t one-size-fits-all recommendations, but they show how your mix of stocks and bonds should change based on your comfort with risk and your timeline.

1. The Conservative Investor (Low Risk Tolerance / Shorter Timeline)

This person is more focused on protecting their money than shooting for the moon. Maybe their goal is only 5-7 years away, or they just can’t stomach big market swings.

- Stocks: 40% (a mix of global and domestic stock ETFs)

- Bonds: 60% (a mix of government and corporate bond funds)

This portfolio is built for stability. The heavy bond allocation acts as a ballast during stock market storms.

2. The Moderate Investor (A Balanced Approach)

This is a common middle ground for someone with a 10+ year timeline. They want solid growth but are keen to dial back the turbulence of an all-stock portfolio.

- Stocks: 60%

- Bonds: 40%

The classic 60/40 portfolio has long been a benchmark for a reason. It offers a good shot at growth while still keeping a lid on downside risk.

3. The Aggressive Investor (High Risk Tolerance / Long Timeline)

This is someone with decades until they need the money, like a young person saving for retirement. They’re comfortable with wild market swings because they have time on their side to recover and reap the rewards of higher long-term returns.

- Stocks: 80-90%

- Bonds: 10-20%

This allocation leans heavily into the growth potential of stocks. History shows this pays off over the long haul; since 1928, U.S. equities have delivered an average annual return of around 10.06%. If you like digging into the data, you can see the full historical market returns on the NYU Stern website.

Don’t Give Money to the Taxman: Use Tax-Advantaged Accounts

Before you invest a single dollar, figure out where to put the investments. Always, always prioritize tax-advantaged accounts first. These are special accounts that give you huge tax breaks, dramatically boosting your returns over time.

- ISAs (UK): You can contribute a generous amount each year, and all your investment growth and withdrawals are completely tax-free.

- 401(k)s / IRAs (US): These retirement accounts let your money grow either tax-deferred (Traditional) or completely tax-free upon withdrawal in retirement (Roth).

Use your lump sum to max out these accounts first. Sheltering your gains from taxes is one of the most powerful things you can do for your wealth. Over a few decades, this simple step can be worth tens or even hundreds of thousands of dollars. Once these accounts are full, you can invest the rest in a standard taxable brokerage account.

Putting Your Plan Into Action (and Sticking With It)

A great investment plan is just a piece of paper until you act on it. This is where the rubber meets the road—where your careful planning starts building real wealth. Getting the money invested is the easy part. The real challenge? Building the discipline to stay the course, especially when the market gets choppy.

First things first, you’ll need to open an investment account. Look for a reputable, low-cost brokerage firm. The whole process is usually quick and can be done online in minutes. Once you’ve funded the account with your lump sum, you’ll simply place “buy” orders for the ETFs or mutual funds you picked for your asset allocation.

Conquering the Mental Game of Investing

Once your money is in the market, the real work begins. The stock market is an emotional rollercoaster, and honestly, your biggest enemy will often be yourself. It’s deeply unsettling to watch your portfolio value drop during a market downturn, but reacting emotionally is one of the most damaging mistakes an investor can make.

That gut-wrenching urge to sell when markets are tanking is powerful. It’s driven by a primal fear of losing even more. But history has shown us, time and time again, that markets recover. Selling in a panic just locks in your losses and guarantees you’ll miss the inevitable rebound. The secret to long-term success when you invest a lump sum is simply staying put.

To see just how powerful this is, consider this: if someone had invested just $100 into the S&P 500 at the start of 1926 and reinvested all the dividends, it would have grown to an astonishing $1,866,611.71 by the end of 2025. This is the incredible magic of time in the market—a benefit you maximize by getting your money invested right away. You can dig into the S&P 500 performance data yourself to see the numbers.

The Power of Automatic Maintenance: Rebalancing

Discipline isn’t just about resisting the urge to panic-sell; it’s also about proactive, unemotional maintenance. This is where portfolio rebalancing comes into play. Over time, some of your investments will grow faster than others, causing your carefully crafted asset allocation to drift. For instance, a great year for stocks might push your 60/40 stock/bond portfolio to a 70/30 split, making it riskier than you originally intended.

Rebalancing is the simple process of trimming your winners and buying more of your laggards to get back to your target mix.

- How it works: You periodically sell a small portion of the assets that have done well and use that cash to buy more of the assets that have underperformed.

- Why it’s brilliant: It forces you to buy low and sell high on a systematic basis, completely removing emotion from the equation.

- How often: For most people, rebalancing once a year is plenty. Another good trigger is if any single asset class drifts more than 5% from its target.

Rebalancing is your secret weapon for automated discipline. It keeps your portfolio’s risk level in check and forces a smart, systematic approach to managing your money, eliminating guesswork and emotional reactions.

Staying Sane for the Long Haul

Ultimately, successfully investing a lump sum is a test of temperament, not intellect. The financial markets are a machine for transferring wealth from the impatient to the patient. Your ability to stay calm during a storm will be the single biggest factor in your long-term success.

So, how do you build that resilience? You have to focus on what you can actually control. You can’t control the market, but you can control your own behavior.

- Stop checking your portfolio every day. Seriously. Constant monitoring just amplifies the short-term noise and feeds anxiety. A quarterly or semi-annual check-in is more than enough.

- Keep your eyes on the prize. Remember why you’re investing. Whether it’s for a comfortable retirement or financial independence, that long-term goal is what matters—not the daily market chatter.

- Automate everything you can. If your brokerage offers automatic rebalancing, turn it on. The less you have to actively mess with your investments, the less likely you are to make a costly, emotional mistake.

Got Questions About Investing a Lump Sum?

It’s completely normal to have a few lingering questions, even after you’ve mapped out a solid plan. Dropping a large amount of money into the market is a big step, so let’s tackle the “what-ifs” that might be on your mind. Getting these concerns out in the open will give you the confidence to move forward.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Alright, let’s dive into some of the most common questions we hear.

What if I Invest Everything Right Before a Market Crash?

This is the big one. It’s the number one fear that keeps people up at night and makes dollar-cost averaging seem so tempting. And yes, it’s possible you could invest at a market peak. It happens.

But here’s the thing: perspective is everything. If your timeline is long—we’re talking 10 years or more—you have plenty of time to recover from any downturn. History has shown us time and again that markets eventually bounce back and continue their climb. Even lump sums invested at the worst possible moments have turned out just fine over the long haul.

Should I Bring in a Financial Adviser for This?

For a really significant amount of money, hiring a qualified, fee-only financial adviser is almost always a smart call. They do more than just pick investments; they build a holistic plan that weaves in tax strategy, estate planning, and your specific life goals.

Think of them as a behavioral coach, too. A good adviser is the voice of reason that stops you from panic-selling during a market dip or making other emotional mistakes that can cost you dearly.

How Big of a Deal Are Taxes?

Taxes are a huge deal, and you can’t ignore them. First, consider where the money came from—an inheritance, a bonus, a property sale—as that might have its own tax rules. When it’s time to invest, your first stop should always be maxing out tax-advantaged accounts like your ISA or 401(k)/IRA.

For anything left over that goes into a standard brokerage account, you need to be mindful of capital gains taxes. You’ll owe these on any profits when you eventually sell. You can soften the blow by using tax-efficient funds from the get-go. And before investing a single penny, it’s often wise to see if you can how to pay off debt fast with some of the cash. Paying off a high-interest credit card is like getting a guaranteed, tax-free return on your money.

Can I Do a Little of Both—Lump Sum and DCA?

Absolutely! This isn’t an all-or-nothing decision. A hybrid approach is a fantastic compromise that respects both the data (which favors lump-sum) and your own peace of mind.

A common strategy is to invest a big chunk of it right away—maybe 50% to 60%—to make sure your money isn’t just sitting on the sidelines. Then, you can invest the rest in smaller, regular chunks over the next six months or so.

This balanced method lets you capture a good chunk of the market’s potential upside while still giving you an emotional buffer against the fear of a sudden drop.

At Collapsed Wallet, we’re all about giving you clear, actionable guidance to build a more secure financial future. Want to learn more? Visit us at https://collapsedwallet.com and explore our resources.

2 thoughts on “How to Invest a Lump Sum for Maximum Growth”