Table of Contents

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Let's be honest, life has a knack for throwing little financial curveballs when you least expect them. A flat tyre, a leaky pipe, an unexpected vet bill—these aren't full-blown emergencies, but they can certainly ruin your week and wreck your budget. This is exactly what a rainy day fund is for.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Think of it as your financial first-aid kit. It’s a small, easy-to-access pot of cash, usually somewhere between $500 to $1,000, designed specifically to handle these smaller, annoying surprises. It’s not meant to cover six months of unemployment; it's there to absorb the immediate impact of life's little bumps in the road.

What Is a Rainy Day Fund Anyway?

So, your boiler decides to give up the ghost in the middle of winter, or your kid comes home with a note about a last-minute school trip that costs a small fortune. These are the "rainy days" we're talking about. They’re frustrating, inconvenient, and almost always come with a price tag you weren't banking on.

Your rainy day fund is the hero of these stories. It's the dedicated cash you dip into so that a minor setback doesn't spiral into a major financial headache. It keeps you from having to reach for a credit card or derail your long-term savings goals just to fix a simple, everyday problem.

The Role of a Financial Buffer

Think of this fund as the crucial buffer between you and high-interest debt. That surprise $400 car repair could easily land on a credit card, gathering interest and throwing your whole monthly budget out of whack. A rainy day fund lets you pay for it outright, with cash, and simply move on.

Having this money set aside does wonders for your peace of mind. It's the first real step toward cutting down on money-related stress because you know you can handle a small financial shock without panicking.

A rainy day fund builds a protective wall between life's little annoyances and your big financial goals, like saving for a house or investing for your future.

Getting to grips with what a rainy day fund is—and why it’s so important—is a cornerstone of smart personal finance. It’s a simple but powerful tool that helps you stay in control, navigate life's unpredictability, and keep moving toward financial freedom.

Why This Fund Is Your First Step to Financial Freedom

Let's be honest: life is unpredictable. That’s why having a rainy day fund is about so much more than just stashing away cash. It’s about building a buffer between you and the kind of financial stress that keeps you up at night.

Think of this fund as your first line of defense. When a surprise expense pops up—and it always does—this little bit of savings is what prevents a minor inconvenience from snowballing into a major debt crisis. It means you can cover that unexpected bill without having to reach for a high-interest credit card or, even worse, a payday loan.

This small step fundamentally changes your relationship with money, replacing panic with confidence.

Protecting Your Bigger Financial Goals

Beyond just handling surprises, a rainy day fund acts as a bodyguard for your long-term ambitions. Imagine your car breaks down. Without this cash on hand, you might be forced to halt your retirement contributions or, in a worst-case scenario, sell off some of your investments at a terrible time.

Those kinds of setbacks can seriously derail your progress toward building real wealth.

By setting aside this dedicated pool of money, you’re creating a protective shield around your most important financial goals. It ensures a small, short-term problem doesn’t sabotage your long-term vision.

Building a rainy day fund isn’t just about saving for a 'what if' scenario. It’s an active step towards creating a more resilient financial life, one where you are in control.

Consider the ripple effect of having this security. With your rainy day fund in place, you can keep making consistent, uninterrupted contributions to your investments, letting them compound and grow. That consistency is the secret sauce for building momentum and achieving true financial freedom. This small, often overlooked fund is one of the most powerful tools you have.

Rainy Day Fund vs Emergency Fund

It’s easy to hear "rainy day fund" and "emergency fund" and think they’re the same thing. People often use the terms interchangeably, but in reality, they serve two very different—and equally important—roles in your financial life.

Mixing them up can leave you financially exposed when a true crisis strikes. Let's break down the difference.

A rainy day fund is your first line of defense against life's smaller, annoying, and often inevitable surprises. It's the money you tap for those "Ugh, really?" moments that aren't catastrophic but could easily derail your budget for the month.

Think about things like:

- A surprise $400 vet bill when your dog eats something it shouldn't have.

- Your dishwasher suddenly deciding to quit mid-cycle.

- Needing a last-minute flight to visit a sick family member.

This fund is designed to be smaller and easily accessible. A good target is usually between $1,000 and $2,000. The whole point is to cover these minor hiccups without having to reach for a high-interest credit card.

Understanding the Role of an Emergency Fund

Now, the emergency fund is the real heavyweight champion of your financial safety net. This isn't for minor inconveniences; it's for the major life events that can pull the rug out from under you.

An emergency fund is there to cover 3-6 months of your essential living expenses. It’s the money that keeps you afloat during a prolonged job loss, a serious medical issue, or a major, unexpected home repair.

This is the fund you hope you never have to use. It’s a much larger pool of money, and it should be kept separate and only touched in a genuine, life-altering emergency. If you're starting from scratch, our guide on how to build an emergency fund is the perfect place to begin.

It's also worth noting how an emergency fund fits into your bigger financial picture, which includes things like insurance. Some people wonder about the overlap, a topic explored in articles like Health Insurance Vs Personal Savings.

Rainy Day Fund vs Emergency Fund at a Glance

To make it even clearer, let's put them side-by-side. This table breaks down the key differences to help you see their distinct roles.

| Feature | Rainy Day Fund | Emergency Fund |

|---|---|---|

| Purpose | Small, unplanned expenses | Major financial crises |

| Typical Size | $1,000 – $2,000 | 3-6 months of living expenses |

| Accessibility | Very high (e.g., checking account) | High, but not instant (e.g., HYSA) |

| Use Frequency | More frequent, as needed | Rarely, for true emergencies only |

| Examples | Flat tire, broken appliance | Job loss, medical emergency |

Think of it this way: your rainy day fund is the umbrella that keeps you dry during a passing shower, while your emergency fund is the lifeboat that saves you in a hurricane. You absolutely need both.

How Much Money Should You Actually Save?

Alright, let’s move from theory to action and pin down a real number for your rainy day fund. For most people, a fantastic starting point is $1,000. That’s a solid amount that can handle a lot of life’s little curveballs, but it doesn’t feel so big that it’s impossible to reach.

Of course, your “perfect” number really depends on your life. If you’re driving an older car that’s prone to breakdowns, own a home where appliances can die at any moment, or have a furry friend who might need an unplanned trip to the vet, you’ll probably want to aim a bit higher. In those cases, a target of $1,500 or even $2,000 might make more sense.

The trick is to pick a concrete, achievable goal that gets you excited to start saving. Remember, we’re not talking about funding your retirement here—this is all about building a quick and accessible cash buffer.

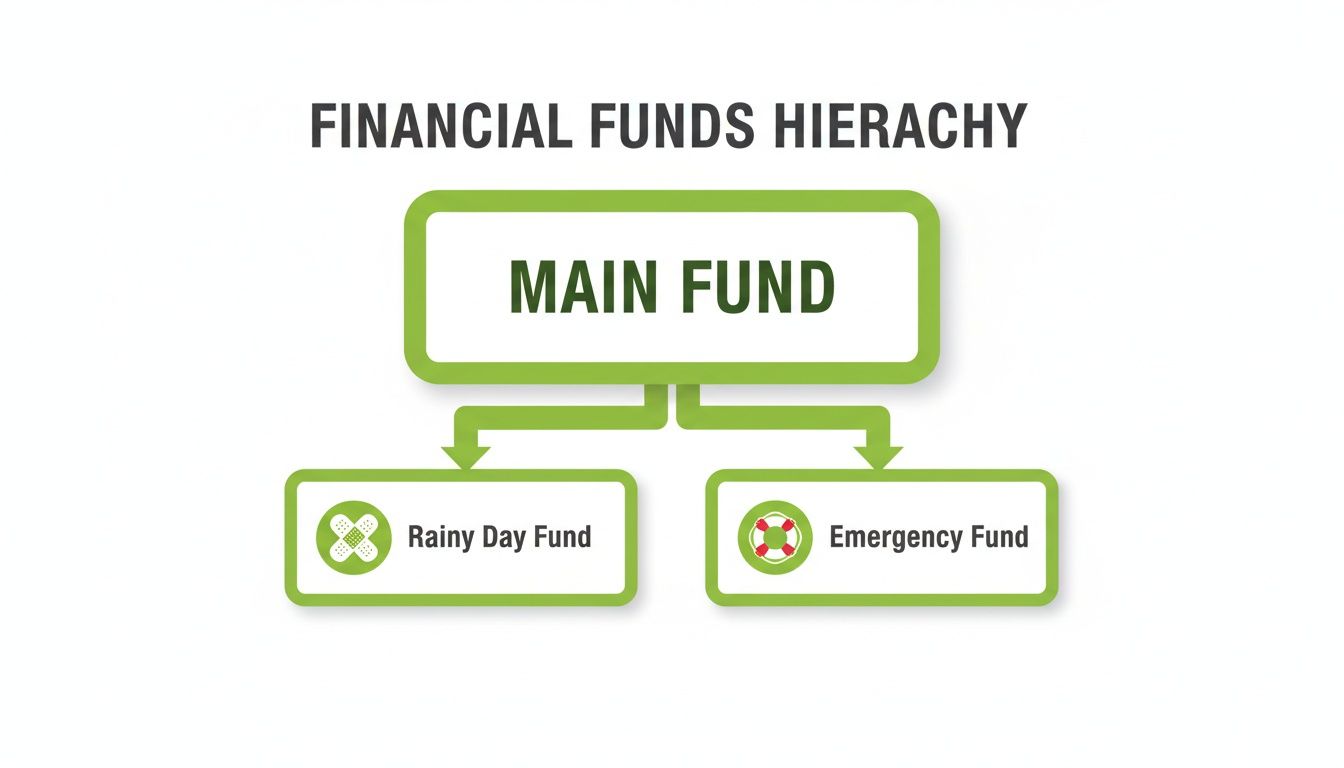

Visualizing Your Financial Defenses

It can be helpful to see exactly where this little fund fits into your bigger financial picture. Think of your rainy day fund and your emergency fund as two different layers of defense, both branching out from your main financial strategy.

This shows it perfectly: the rainy day fund is your financial first-aid kit, ready for immediate use. Your much larger emergency fund? That’s the life preserver you hope you never need, but it’s there for a true crisis.

Setting Realistic Savings Goals

Even with a rainy day fund in place, it’s natural to want a bigger safety net for real peace of mind. There’s often a gap between what we feel we need and what we actually have. A recent Bankrate emergency savings report found that while 85% of Americans believe they need at least three months of living expenses saved, only 46% have hit that mark.

This is exactly why starting with a smaller, more manageable rainy day fund is such a powerful strategy. It builds confidence and creates momentum. As you think about your long-term goals, it’s a good idea to also figure out how much emergency fund you should eventually aim for.

The first step is setting that clear, initial goal. From there, you can figure out where to find the extra cash. Our guide on how to track expenses is a great place to start looking for ways to free up money to build this crucial buffer.

Simple and Practical Ways to Build Your Fund

Starting a rainy day fund doesn’t have to be a huge, painful effort. The secret is making it so easy and automatic that saving becomes a background habit, not a daily chore you have to think about.

The single most effective first step is opening a separate savings account. This simple action creates a mental and practical barrier between your spending money and your savings, making it far less tempting to dip into your fund for a casual purchase.

Put Your Savings on Autopilot

When it comes to saving, consistency beats size every time. The best way to achieve this is to set up a recurring, automatic transfer from your main account into your new savings account.

It could be £10 every payday or £50 a month. Honestly, the exact amount isn’t as important as the habit itself. Those small, steady contributions add up surprisingly fast, building your financial buffer without you even noticing. For a deep dive into the best accounts for this strategy, check out our guide on what is a high yield savings account.

Automating your savings removes willpower from the equation. It’s the most reliable way to turn good intentions into real money in the bank.

Use Technology to Your Advantage

You’ve got some powerful tools right in your pocket that can supercharge your savings. Many modern banking and budgeting apps have features designed to help you save without even trying.

- Round-Up Features: These clever tools round up your daily purchases to the nearest pound and sweep the spare change into your savings. A few pence here and there really adds up.

- Cashback Apps: Use apps or browser extensions that give you cashback on your everyday shopping. You can often set them to deposit those earnings directly into your rainy day fund.

- Budgeting Tools: Some apps analyze your spending habits and can spot leftover cash at the end of the month, prompting you to move it over to savings instead of just letting it disappear.

By leaning on these methods, you turn saving from an active chore into something that just happens. This is the foundation of building a solid rainy day fund and, ultimately, achieving real financial peace of mind.

Got Questions? Let’s Talk Rainy Day Funds

Even the best-laid plans come with questions. When you’re trying to build a new savings habit, it’s natural for a few things to feel a little fuzzy. Let’s clear up some of the most common questions people have about their rainy day funds.

My goal here is to make sure you have the practical, real-world answers you need to make this fund a permanent and powerful part of your financial life. Think of it as your first line of defense against those small, annoying financial curveballs life loves to throw.

Where Should I Keep My Rainy Day Fund?

The hands-down best place for your rainy day fund is a high-yield savings account (HYSA). These accounts are perfect because they keep your money completely safe and liquid—meaning you can get to it right away without any penalties.

But here’s the key difference: an HYSA pays you a much higher interest rate than the savings or checking account you probably have at your main bank. Just make sure you open it at a different bank than your everyday checking account. That little bit of separation creates a psychological barrier, making you far less likely to dip into it for a morning coffee or an impulse buy.

Can I Invest My Rainy Day Fund Money?

I’ll make this one easy: absolutely not. The money you’ve earmarked for your rainy day fund should never, ever be invested. This cash needs to be 100% safe and available the second you need it.

Investing comes with risk. The market could take a nosedive right when your car’s transmission decides to give up. If that happens, you’d be forced to sell your investments at a loss, which completely undermines the whole point of having the fund. Keep it simple and stick to a secure savings account.

Your rainy day fund is insurance, not an investment. Its job is to provide stability and quick cash, not to grow into a fortune. The real “return” you get is the peace of mind that comes from knowing a small financial hiccup won’t send you into a panic or into debt.

What Should I Do After I Use The Money?

So you had to use some of it. That’s exactly what it’s there for! But once the dust settles, your number one priority is to build it back up. Think of it like a first-aid kit; after you use a few bandages, you restock it so you’re ready for the next scrape.

Put a temporary pause on other savings goals, like extra retirement contributions or saving for a vacation. Funnel that cash back into your rainy day fund until it’s back to your target amount. Getting your financial defenses back to full strength should always come first.

How Can I Stay Motivated To Save?

Let’s be honest, saving can feel like a grind. The trick is to make it feel like a win. Instead of focusing on the final number, set small, achievable mini-goals. High-five yourself when you hit $250, then do it again at $500.

Another great mental hack is to nickname your savings account something specific, like “Flat Tire Fund” or “Vet Bill Buffer.” It’s a simple reminder of why you’re saving. Using a budgeting app to see a progress bar fill up can also be incredibly motivating, turning what feels like a chore into a rewarding game.

At Collapsed Wallet, we’re all about giving you the clear, practical tools you need to build a secure financial future. For more tips on making your money work for you, explore our guides at https://collapsedwallet.com.