Table of Contents

- 1. <a href="https://www.chime.com/online-banking/mobile-banking/">Chime</a>

- 2. <a href="https://www.ally.com/">Ally Bank</a>

- 3. <a href="https://www.capitalone.com/bank/savings-accounts/online-performance-savings-account/">Capital One</a> — 360 Performance Savings

- 4. <a href="https://www.marcus.co.uk/uk/en">Marcus by Goldman Sachs</a>

- 5. <a href="https://www.sofi.com/banking/">SoFi</a> Checking & Savings

- 6. <a href="https://www.varomoney.com/">Varo Bank</a>

- 7. <a href="https://www.discover.com/">Discover Bank</a>

- 8. <a href="https://www.cit.com/cit-bank/bank/savings/platinum-savings-account">CIT Bank</a> (First Citizens) — Savings Connect / Platinum Savings

- 9. <a href="https://www.wealthfront.com/cash">Wealthfront — Cash Account</a>

- 10. <a href="https://www.betterment.com/cash-reserve">Betterment</a> — Cash Reserve

- 11. <a href="https://www.nerdwallet.com/banking/best/high-yield-online-savings-accounts">NerdWallet — Best High‑Yield Savings Accounts (editorial comparison)</a>

- 12. <a href="https://www.bankrate.com/banking/savings/best-high-yield-interests-savings-accounts/">Bankrate</a> — Best High‑Yield Savings Accounts (expert-verified list)

- Top 12 Savings Apps Comparison

- Choosing Your App and Starting Your Savings Journey Today

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

In today’s fast-paced world, reaching your financial goals, whether it’s building an emergency fund, saving for a down payment, or planning for retirement, can feel like an uphill battle. Manual transfers and traditional low-yield accounts often fail to keep up with our ambitions. Fortunately, technology offers a powerful solution. The right savings app can automate the process, turning saving from a chore into a seamless background habit.

By leveraging features like automatic round-ups, recurring transfers, and high-yield interest rates, these tools not only help you save more consistently but also make your money work harder for you. This guide will walk you through the 12 best savings apps available in 2025, breaking down their unique strengths, so you can choose the perfect partner for your journey toward financial freedom.

The aim of our blog is to provide valuable insights and practical tips to help readers manage their money more effectively. However, the information shared here is for general guidance and educational purposes only. It should not be regarded as professional financial advice. Any actions taken based on our content are entirely the responsibility of the reader, and we accept no liability for the outcomes of those actions. If you require financial advice tailored to your personal circumstances, we strongly recommend seeking assistance from a qualified financial adviser.

Finding the single best savings app depends entirely on your specific needs and financial situation. Are you a student looking for an account with no minimum balance? A family needing a joint account to manage household expenses? Or someone focused solely on maximizing your annual percentage yield (APY)? This resource is designed to cut through the noise and provide clear, actionable analysis.

We’ve categorized each platform by its primary use case, from the best for automatic saving to the best for high-yield interest, making it easy to compare your options. For each entry, you will find a detailed breakdown of its features, honest pros and cons, transparent pricing information, and security notes. We also include screenshots and direct links to help you get started immediately.

1. Chime

Best for: Effortless, automated saving integrated with a fee-free checking account.

Chime excels at making saving an unconscious habit rather than a conscious effort, positioning it as one of the best savings apps for those who prefer a “set it and forget it” approach. Its system is built around seamless integration with its own checking account, using your daily spending and income to fuel your savings goals automatically. This hands-off method is ideal for building an emergency fund or saving for a specific goal without feeling the pinch of large, manual transfers, helping you move closer to financial stability.

Key Features & User Experience

Chime’s strength lies in its two primary automation features. The “Round Ups” feature automatically rounds up debit card purchases to the nearest dollar and transfers the change to your savings. “Save When I Get Paid” allows you to automatically transfer a percentage of every direct deposit into savings, a powerful tool for paying yourself first. These automated transfers are a fantastic complement to a well-structured budget, which you can manage more effectively after you learn more about how to track your expenses on collapsedwallet.com. The mobile app is clean, intuitive, and makes moving money between your Chime accounts instantaneous.

- Pricing: No monthly service fees, no minimum balance requirements.

- Access: Requires opening a Chime Checking Account.

- Security: Funds are FDIC insured up to $250,000 through partner banks, The Bancorp Bank or Stride Bank, N.A.

| Pros | Cons |

|---|---|

| ✅ Strong, simple automation features | ❌ Must open a Chime Checking Account |

| ✅ No monthly fees or minimum balance | ❌ Highest APY requires a qualifying direct deposit |

| ✅ Excellent, user-friendly mobile app | ❌ Lower base APY than some competitors |

Learn More & Sign Up: Visit Chime’s Website

2. Ally Bank

Best for: Organizing multiple savings goals within a single, high-yield account.

Ally Bank is a powerhouse in the online banking space, making it one of the best savings apps for individuals who need to meticulously organize their savings without juggling multiple accounts. It’s designed for goal-oriented savers who want to visually track progress toward different objectives, like a down payment, a retirement fund, and an emergency fund, all from one central hub. Ally’s approach combines a competitive high-yield savings account with powerful organizational tools, offering a robust platform for structured, intentional saving to achieve financial independence.

Key Features & User Experience

Ally’s standout feature is “Buckets,” which lets you create up to 30 digital envelopes within your savings account to earmark funds for specific goals. This provides incredible clarity on where your money is going. The “Surprise Savings” booster acts as a smart automation tool, analyzing a linked checking account to identify and transfer small, safe-to-save amounts. With a user-friendly interface and highly-rated 24/7 customer support, Ally delivers a premium online banking experience from a well-established institution.

- Pricing: No monthly maintenance fees, no minimum balance requirements.

- Access: Can be opened as a standalone savings account.

- Security: Funds are FDIC insured up to the maximum amount allowed by law.

| Pros | Cons |

|---|---|

| ✅ Clear goal visualization with ‘Buckets’ | ❌ APY is variable and not always the highest on the market |

| ✅ No monthly fees or minimums | ❌ ‘Buckets’ feature has experienced occasional glitches for some users |

| ✅ Excellent 24/7 customer support | ❌ Surprise Savings booster requires linking an external checking account |

Learn More & Sign Up: Visit Ally Bank’s Website

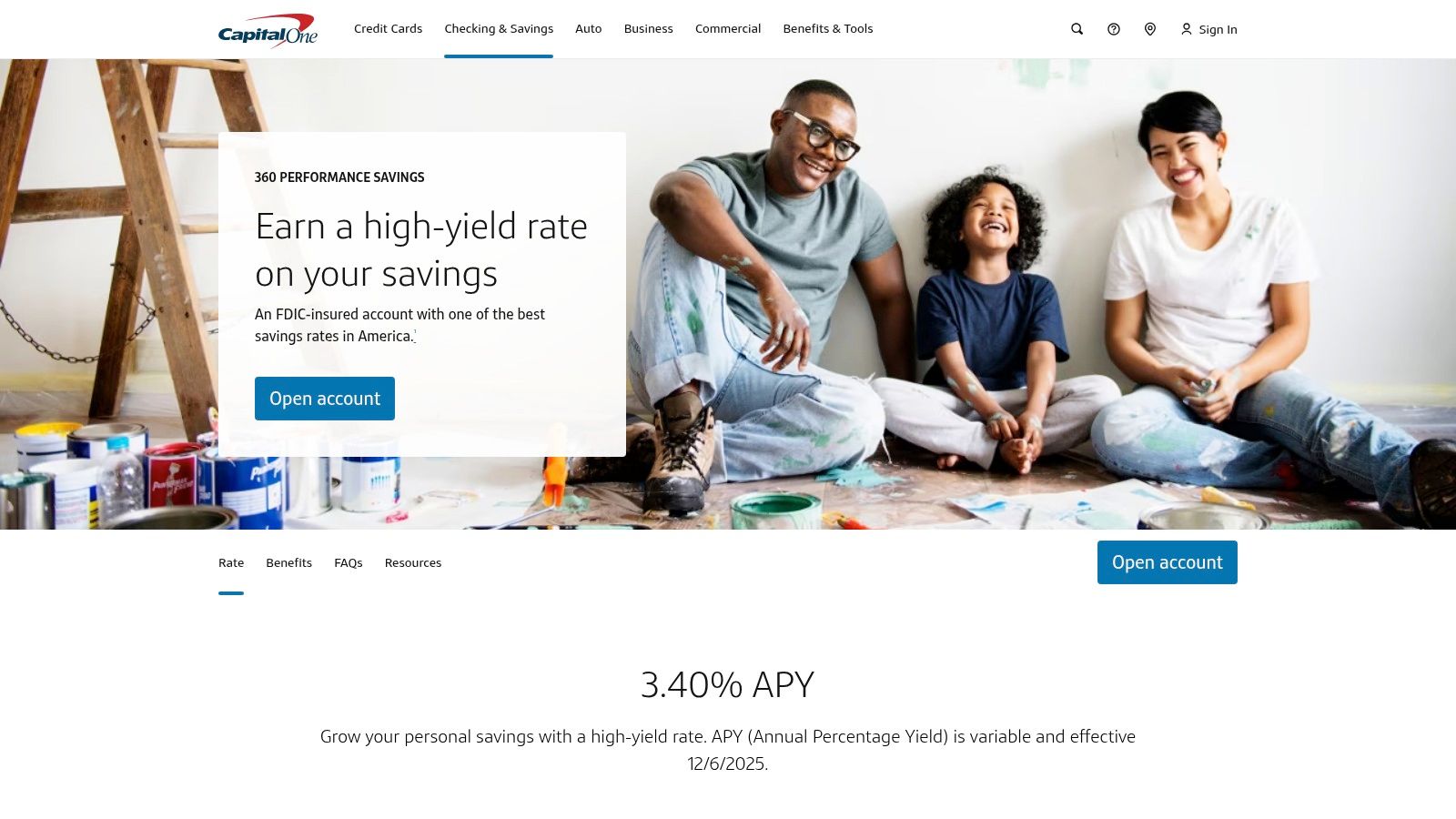

3. Capital One — 360 Performance Savings

Best for: A high-yield savings account (HYSA) from a major bank with a strong mobile app and no fees.

Capital One’s 360 Performance Savings account bridges the gap between a traditional brick-and-mortar bank and a modern fintech app. It offers a competitive high-yield interest rate without the monthly fees or minimum balance requirements that often come with accounts from major financial institutions. This makes it one of the best savings apps for those who value the security and broad service ecosystem of a large, established bank but want the high-interest, fee-free benefits of an online savings platform to accelerate their path to financial wellness.

Key Features & User Experience

The primary strength of the 360 Performance Savings account is its simplicity and strong earning potential. Users can set up automated, recurring transfers with its “AutoSave” feature, making it easy to build savings consistently. The Capital One mobile app is highly-rated, providing a clean interface for managing your account, setting savings goals, and transferring funds. For those who already use Capital One for checking or credit cards, the integration is seamless, offering a unified view of your finances.

- Pricing: No monthly service fees, no minimum balance requirements.

- Access: Open to all US citizens or lawful permanent residents, 18 or older.

- Security: Funds are FDIC insured up to the standard maximum of $250,000.

| Pros | Cons |

|---|---|

| ✅ Competitive high-yield interest rate | ❌ APY is variable and can change |

| ✅ No monthly fees or minimum balance | ❌ Limited physical branch access compared to traditional banks |

| ✅ Strong mobile app and brand support | ❌ Be sure you have the ‘Performance’ account for the best rate |

Learn More & Sign Up: Visit Capital One’s Website

4. Marcus by Goldman Sachs

Best for: A high-yield savings account with no fees and the backing of a major financial institution.

Marcus by Goldman Sachs offers a refreshingly simple and powerful high-yield savings account, making it one of the best savings apps for individuals who prioritize competitive interest rates without complex features. Its appeal lies in its transparency and simplicity, focusing on helping your money grow faster through daily compounding interest. This straightforward approach is perfect for parking your emergency fund or saving for major goals where earning a high, reliable return is the primary objective, helping you escape financial worries.

Key Features & User Experience

Marcus shines with its no-frills, high-performance savings account. There are no monthly maintenance fees and no minimum deposit requirements to open an account or earn the stated APY. Interest compounds daily and is credited monthly, maximizing your earning potential. Its clean mobile app and website make it easy to link an external bank account, set up transfers, and monitor your savings growth. This simplicity is ideal when you want to securely store and grow your money, and you can learn more about how to build an emergency fund on collapsedwallet.com to get started.

- Pricing: No monthly fees, no minimum balance requirements.

- Access: Can be opened online and requires linking an external bank account for funding.

- Security: Funds are FDIC insured up to the maximum allowable limit.

| Pros | Cons |

|---|---|

| ✅ Consistently competitive high-yield APY | ❌ No checking account or ATM access |

| ✅ No monthly fees or minimum balances | ❌ Must use an external bank for transfers |

| ✅ Simple, user-friendly digital platform | ❌ APY is variable and can change over time |

Learn More & Sign Up: Visit Marcus by Goldman Sachs’ Website

5. SoFi Checking & Savings

Best for: All-in-one banking with a high-yield savings account for qualifying depositors.

SoFi Checking & Savings is an excellent choice for individuals who want to consolidate their daily banking and high-interest savings into a single, streamlined platform. It stands out by offering a highly competitive annual percentage yield (APY) to users who set up direct deposit or make substantial monthly deposits, making it one of the best savings apps for those looking to maximize their returns within their primary banking relationship. This integrated approach simplifies money management, allowing you to spend, save, and earn interest without juggling multiple apps.

Key Features & User Experience

SoFi’s platform is built around a unified account that includes both checking and savings balances. A key feature is “Vaults,” which allows you to create sub-accounts within your savings to organize funds for specific goals, like an emergency fund or a major investment. The app offers a clean, modern interface that makes it easy to track spending, monitor savings growth, and manage your goals. To unlock the highest APY, users must meet direct deposit or monthly deposit minimums, a crucial detail for maximizing the account’s potential.

- Pricing: No monthly maintenance fees or overdraft fees.

- Access: Available to all U.S. residents who open a SoFi Checking & Savings account.

- Security: SoFi is a bank, so deposits are FDIC insured up to $250,000 per depositor.

| Pros | Cons |

|---|---|

| ✅ High APY available with qualifying deposits | ❌ Best interest rate requires meeting deposit criteria |

| ✅ Excellent goal-setting with “Vaults” feature | ❌ Lower base APY if you don’t meet requirements |

| ✅ No account fees or overdraft fees | ❌ APY is variable and can change |

Learn More & Sign Up: Visit SoFi’s Website

6. Varo Bank

Best for: Maximizing interest on everyday savings by meeting simple monthly qualifications.

Varo Bank stands out in the competitive landscape of the best savings apps by offering one of the highest promotional Annual Percentage Yields (APYs) available. It’s designed for savers who are willing to engage with their bank account each month to unlock a premium interest rate on their initial savings balance. This structure makes Varo an excellent choice for building an emergency fund or saving for a short-term goal, as it aggressively rewards active users for their everyday banking habits, fast-tracking their progress toward financial freedom.

Key Features & User Experience

Varo’s main draw is its tiered interest rate system. To earn the top-tier 5.00% APY, users must meet specific monthly qualifications, such as receiving qualifying direct deposits and maintaining a positive balance. If the criteria are not met, the account earns a lower, yet still competitive, base APY. Varo also provides automated savings tools, including “Save Your Pay,” which transfers a chosen percentage of your direct deposit to savings, and “Save Your Change,” which rounds up debit card transactions. The mobile-first platform is modern and easy to navigate, making it simple to track your progress toward the monthly qualifications.

- Pricing: No monthly maintenance fees, no overdraft fees, and no minimum balance requirements.

- Access: Requires opening a Varo Bank Account (checking) alongside the Varo Savings Account.

- Security: Funds are FDIC insured up to $250,000 through Varo Bank, N.A., Member FDIC.

| Pros | Cons |

|---|---|

| ✅ One of the highest available APYs on a capped balance | ❌ Top interest rate only applies to the first $5,000 |

| ✅ Clear and achievable monthly qualification criteria | ❌ Must re-qualify each month to maintain the highest APY |

| ✅ No monthly fees or minimum balance requirements | ❌ Requires opening a Varo Bank (checking) Account |

Learn More & Sign Up: Visit Varo’s Website

7. Discover Bank

Best for: A reliable, fee-free high-yield savings account from a major, trusted bank.

Discover Bank provides a straightforward and dependable option for savers who value the security and customer support of a large, established financial institution. While it’s a full-service online bank, its Online Savings Account is a standout product that competes well against many app-first fintech companies. It’s an excellent choice for those who want a simple, no-frills high-yield savings account (HYSA) without the complexity or uncertainty of newer platforms, making it one of the best savings apps for consolidating funds with a trusted name.

Key Features & User Experience

Discover’s strength is its simplicity and transparency. There are no account fees, no minimum deposit to open, and no minimum balance requirements to earn the stated APY. Interest is compounded daily and paid monthly, maximizing your returns. The mobile app and website are clean and easy to navigate, allowing for simple transfers, balance checks, and account management. The standout feature is its highly-rated, 24/7 U.S.-based customer service, providing peace of mind that help is always available.

- Pricing: $0 monthly maintenance fees and $0 minimum opening deposit.

- Access: Available to U.S. residents and can be opened online in minutes.

- Security: Funds are FDIC insured up to the maximum amount allowed by law ($250,000).

| Pros | Cons |

|---|---|

| ✅ Reliable, big-brand experience | ❌ APY has trended mid-pack compared with top rate chasers |

| ✅ Simple, fee-free HYSA with straightforward account opening | ❌ Rates are variable and can change |

| ✅ 24/7 U.S.-based customer support | ❌ Fewer innovative features than some fintech apps |

Learn More & Sign Up: Visit Discover Bank’s Website

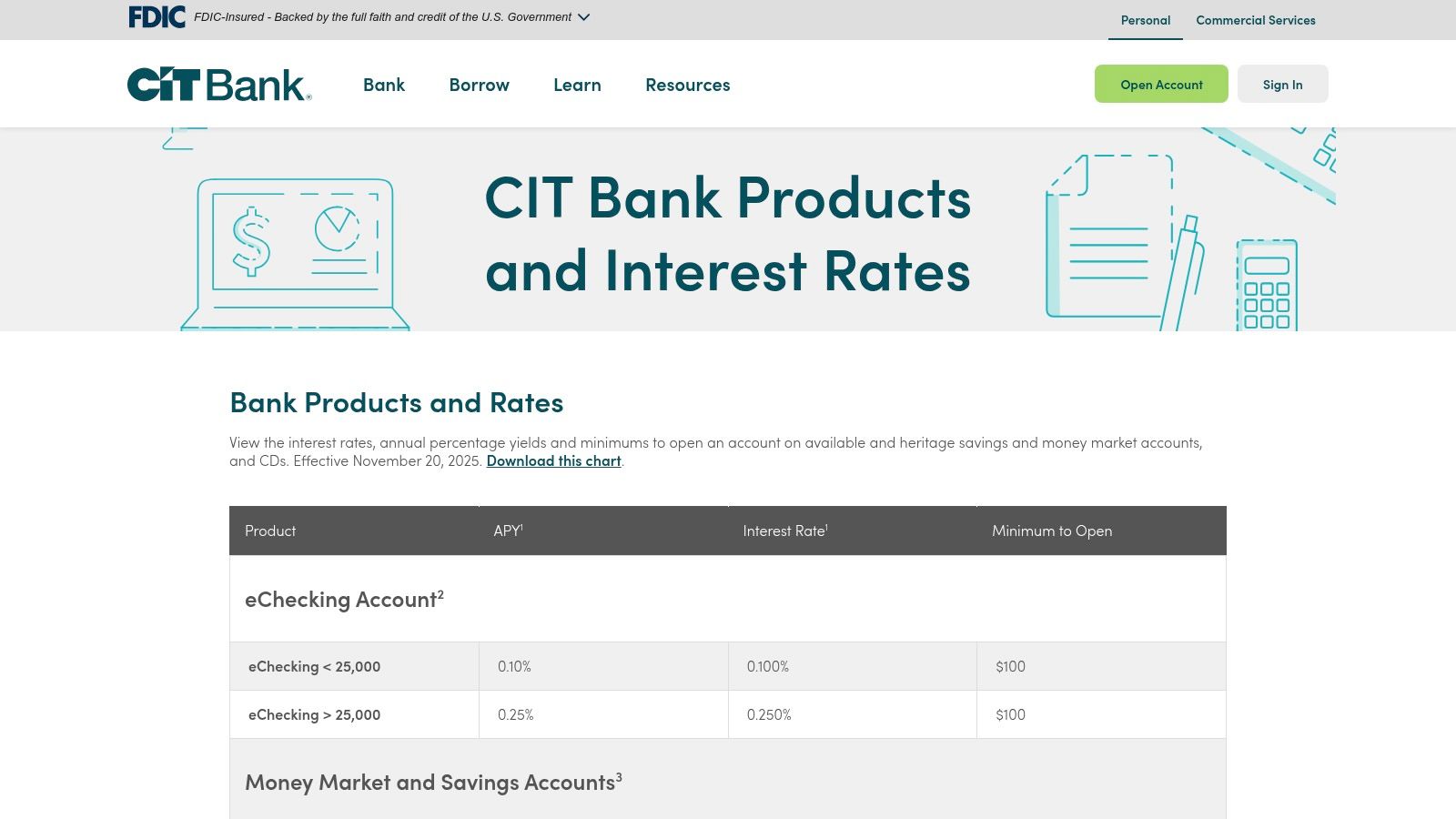

8. CIT Bank (First Citizens) — Savings Connect / Platinum Savings

Best for: Savers with larger balances seeking top-tier, high-yield interest rates.

CIT Bank, a division of First Citizens Bank, stands out for savers focused purely on maximizing their annual percentage yield (APY). It offers specialized high-yield savings accounts like Savings Connect and Platinum Savings, which frequently feature some of the most competitive rates on the market. These accounts are designed for individuals who have already built a substantial savings cushion and want to put that money to work earning the highest possible interest, making it one of the best savings apps for serious yield-seekers aiming for financial freedom.

Key Features & User Experience

CIT Bank’s primary appeal is its tiered interest rate structure. For example, the Platinum Savings account offers a top-tier APY for balances over a certain threshold (such as $5,000), rewarding those with significant funds. This makes it a great choice for parking an emergency fund or savings for a major purchase. The accounts compound interest daily and have no monthly maintenance fees, ensuring your returns aren’t diminished. While the user experience is more akin to a traditional online bank than a slick modern app, it is functional for managing deposits and tracking interest growth.

- Pricing: No monthly service fees. Some accounts may have a minimum opening deposit requirement.

- Access: Fully online account opening and management.

- Security: Funds are FDIC insured up to $250,000 through First Citizens Bank.

| Pros | Cons |

|---|---|

| ✅ Consistently offers market-leading APYs | ❌ Best rates often require a high minimum balance |

| ✅ Multiple account options to fit different needs | ❌ Some users report the website can be clunky |

| ✅ No monthly maintenance fees | ❌ Minimum opening deposit on certain accounts |

Learn More & Sign Up: Visit CIT Bank’s Website

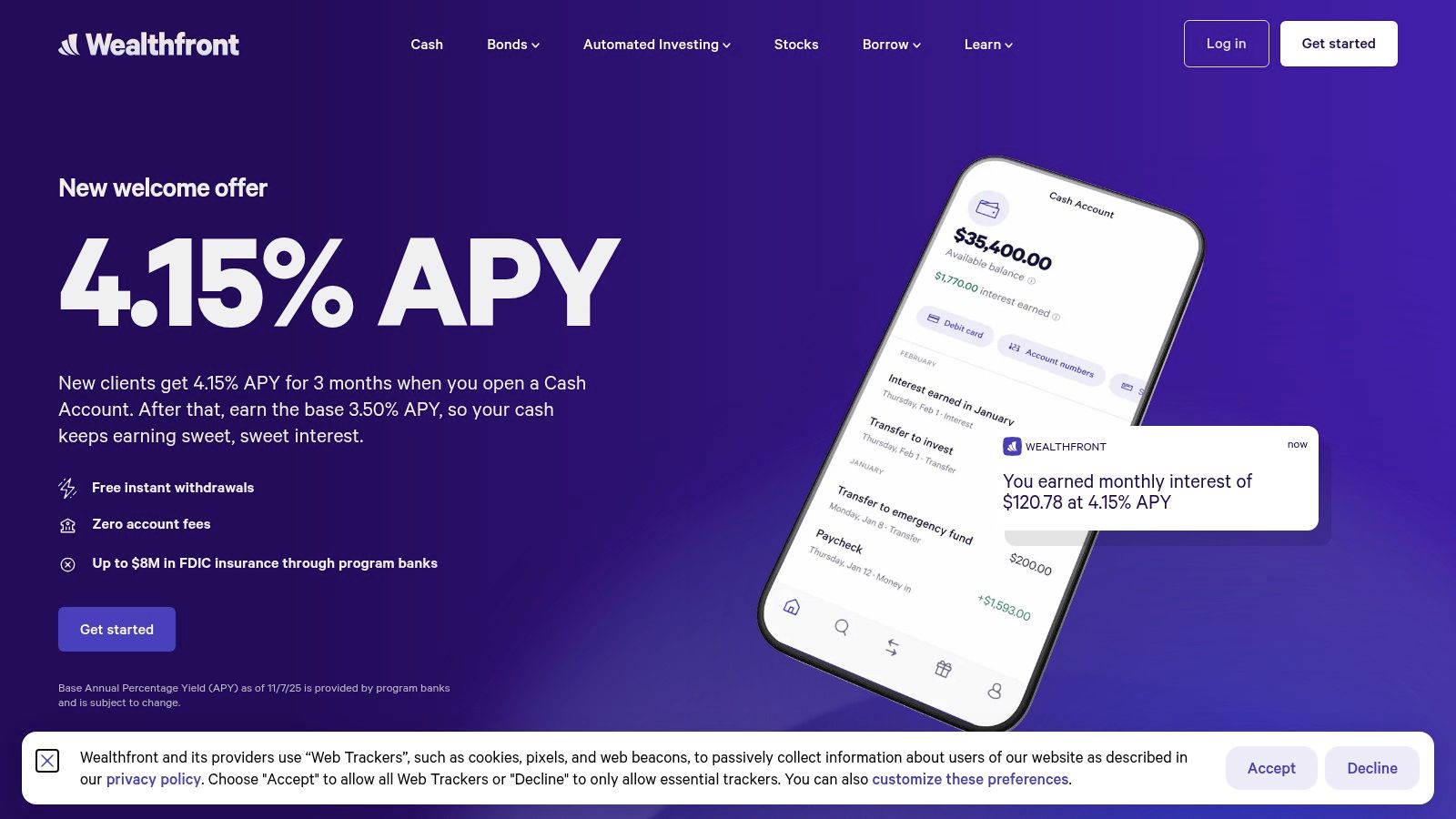

9. Wealthfront — Cash Account

Best for: Savers seeking high FDIC insurance coverage combined with a competitive APY and checking features.

Wealthfront’s Cash Account is a powerful hybrid, blending the high-yield interest of a top savings account with the flexibility of a checking account. It is specifically designed for individuals who hold large cash balances and want extended FDIC insurance without spreading their funds across multiple banks manually. By automatically “sweeping” funds to a network of partner banks, it offers significantly higher insurance coverage than a standard account, making it one of the best savings apps for those prioritizing both high returns and maximum security for substantial cash reserves.

Key Features & User Experience

The standout feature is Wealthfront’s cash sweep program, which distributes your money across multiple FDIC-insured partner banks, providing high combined coverage. The user experience within the app is polished and modern, allowing for easy goal organization, automated transfers, and fast access to funds. It also provides a debit card, direct deposit capabilities, and bill pay, giving it the utility of a primary checking account while your money earns a high APY. The interface makes it simple to track savings progress and manage automated contributions.

- Pricing: No account fees, no minimum balance requirements.

- Access: Available to any US citizen or resident with a Social Security Number.

- Security: High combined FDIC insurance through a network of program banks.

| Pros | Cons |

|---|---|

| ✅ Unusually high combined FDIC coverage | ❌ APY may include a temporary boost for new clients |

| ✅ Polished automation and fast access to funds | ❌ Not a traditional bank; uses a sweep structure |

| ✅ Combines high-yield APY with checking features | ❌ The investment platform is the company’s core focus |

Learn More & Sign Up: Visit Wealthfront’s Website

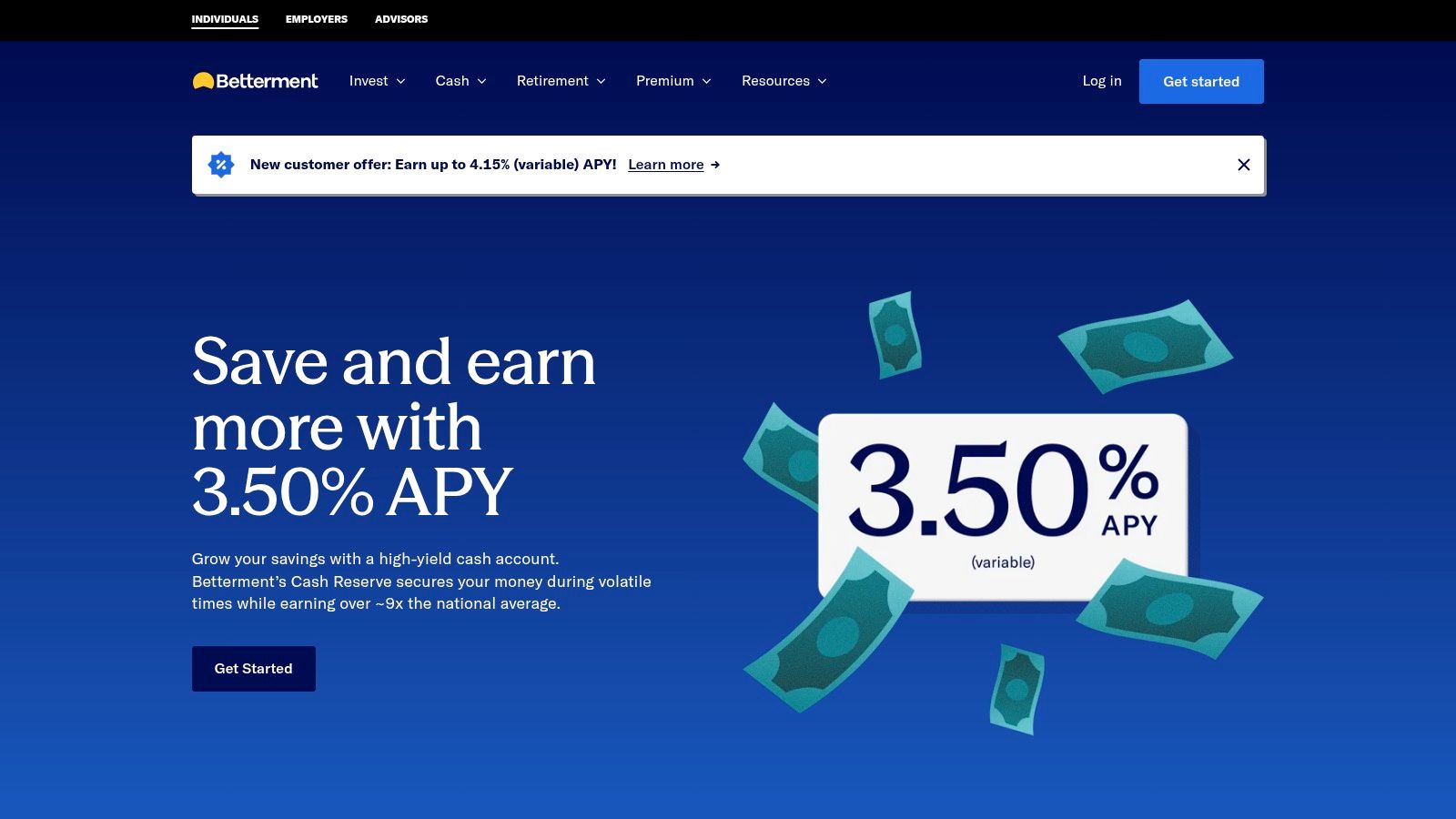

10. Betterment — Cash Reserve

Best for: Integrating high-yield cash savings with a leading robo-investor platform.

Betterment’s Cash Reserve account is an excellent choice for savers who also have an eye on investing. It functions as a high-yield cash management account, offering a competitive variable APY without the complexities of a traditional bank. This makes it one of the best savings apps for those who want a simple, efficient place to park their emergency fund or short-term savings while having a seamless pathway to move money into investment portfolios when they’re ready.

Key Features & User Experience

Betterment simplifies cash management by sweeping your funds across multiple partner banks, which expands your FDIC insurance coverage well beyond the standard limit. The platform stands out for its tight integration with Betterment’s core robo-investing services, allowing for effortless transfers between your cash and investment accounts. This synergy provides an excellent on-ramp for those new to the market, and you can learn how to start investing for beginners on collapsedwallet.com to build your confidence. The user interface is clean, modern, and focused on helping you reach your financial goals, whether saving or investing.

- Pricing: No monthly maintenance fees or minimum balance requirements.

- Access: Open to all U.S. residents; no Betterment investing account required to open.

- Security: Funds are FDIC insured up to program limits through a partner bank sweep program.

| Pros | Cons |

|---|---|

| ✅ High potential APY with no fees or minimums | ❌ Not a bank; it’s a cash management brokerage account |

| ✅ Seamless integration with robo-investing services | ❌ APY is variable and can change with market rates |

| ✅ Expanded FDIC insurance coverage via sweep program | ❌ Lacks traditional banking features like check writing |

Learn More & Sign Up: Visit Betterment’s Website

11. NerdWallet — Best High‑Yield Savings Accounts (editorial comparison)

Best for: Comparing current high-yield savings account rates from multiple banks in one place.

Instead of being a savings app itself, NerdWallet acts as a powerful research tool. It excels at helping you find the absolute best savings apps and high-yield accounts by aggregating and comparing them in regularly updated editorial roundups. For anyone serious about maximizing their interest earnings, this platform provides an essential, up-to-date snapshot of the market, allowing you to see which banks are offering the highest APYs and most favorable terms at any given time.

Key Features & User Experience

NerdWallet’s strength is its clarity and comprehensive comparison data. The platform presents leaderboards that clearly outline the APY, minimum deposit requirements, and monthly fees for dozens of financial institutions. This makes it easy to spot the top contenders without having to visit each bank’s website individually. The editorial team provides concise summaries, pros, and cons for each listed account, giving you a quick yet informative overview to guide your decision-making process.

- Pricing: Free to use.

- Access: It is a website for research and comparison; you apply for accounts on the banks’ official sites.

- Security: NerdWallet is an informational resource; security of your funds depends on the FDIC-insured bank you ultimately choose.

| Pros | Cons |

|---|---|

| ✅ Excellent snapshot of current market-leading APYs | ❌ Is not an account provider, it’s an editorial site |

| ✅ Aggregates multiple providers for quick comparison | ❌ Some listings may be partners or advertisers |

| ✅ Clear summaries of account requirements and fees | ❌ Requires you to verify all details on the bank’s site |

Learn More & Compare Rates: Visit NerdWallet’s Website

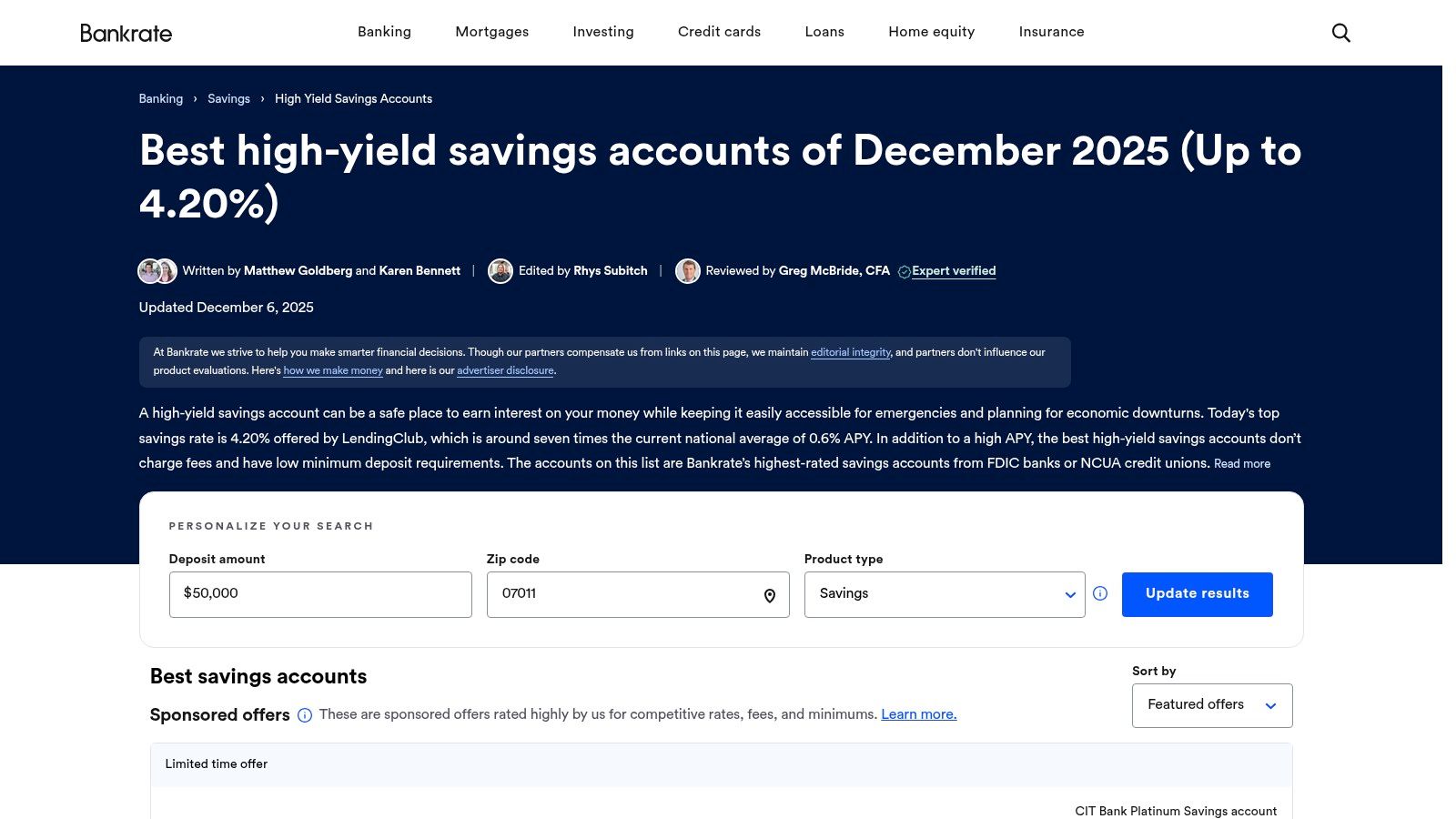

12. Bankrate — Best High‑Yield Savings Accounts (expert-verified list)

Best for: Comparing and finding the highest APY savings accounts from an authoritative source.

Bankrate isn’t an app where you deposit money but rather an indispensable research tool for anyone serious about maximizing their interest earnings. It functions as an expert-verified comparison platform, presenting a regularly updated list of the top high-yield savings accounts available. This makes it one of the best resources to consult before opening a new savings account, ensuring you are making an informed decision based on current market rates, fees, and account requirements rather than just marketing.

Key Features & User Experience

Bankrate’s primary value lies in its clear, concise comparison tables. Users can quickly see the current APY, minimum deposit, and any monthly fees for dozens of financial institutions. The platform provides detailed notes, expert commentary, and rate history, offering valuable context that helps you understand market trends. Its filtering tools allow you to sort accounts based on your priorities, making the process of finding the right high-yield savings account significantly more efficient. The interface is clean, date-stamped for accuracy, and designed for easy comparison.

- Pricing: Free to use.

- Access: It is a public website; no account is needed to view comparisons.

- Security: Bankrate is a research tool; it does not handle your funds. The banks it lists are typically FDIC insured.

| Pros | Cons |

|---|---|

| ✅ Trusted, expert-verified rate information | ❌ It is an editorial/comparison site, not a bank |

| ✅ Easy to compare APYs, fees, and requirements | ❌ Rates change frequently; always confirm on the bank’s site |

| ✅ Deep financial content and explanatory guides | ❌ Does not offer an integrated app to manage savings |

Learn More & Sign Up: Visit Bankrate’s Website

Top 12 Savings Apps Comparison

| Product | Core features | UX / Quality (★) | Value (💰) | Best for (👥) | Unique selling point (✨ / 🏆) |

|---|---|---|---|---|---|

| Chime | Round‑Ups; Paycheck autosave; FDIC via partners; no monthly fees | ★★★★☆ mobile‑first, simple | 💰 No fees; base APY modest (Chime+ for higher) | 👥 Hands‑off, mobile savers | ✨ Automation (Round‑Ups + Save When Paid); 🏆 habit building |

| Ally Bank | Buckets (30 sub‑goals); Surprise Savings; $0 min; 24/7 support | ★★★★ organized goal UX | 💰 No fees; competitive APY (variable) | 👥 Goal‑oriented savers who want one account | ✨ Buckets + Surprise Savings visualization; 🏆 goal clarity |

| Capital One — 360 Performance | AutoSave scheduling; $0 min/fees; strong app; easy pairing | ★★★★ simple & reliable | 💰 Fee‑free; APY variable — verify online | 👥 Users wanting integrated bank + in‑person options | ✨ Easy pairing with Capital One ecosystem; 🏆 broad support |

| Marcus by Goldman Sachs | No fees/min; daily compounding; easy transfers; 24/7 support | ★★★★☆ clean, no‑frills UX | 💰 No fees; consistently competitive APY | 👥 Savers preferring straightforward HYSA from big name | ✨ Transparent product info; 🏆 steady competitive rates |

| SoFi Checking & Savings | Unified checking+savings; Vaults; APY boost with deposits | ★★★★ integrated app experience | 💰 No fees; top APY needs qualifying deposits | 👥 All‑in‑one app users who spend & save in one place | ✨ Vaults + deposit‑tied APY boost; 🏆 combined convenience |

| Varo Bank | Up to 5.00% APY on first $5k (monthly qualifiers); round‑ups | ★★★★☆ promo‑rate leader (app‑first) | 💰 No fees; top APY capped and requires re‑qualify | 👥 Promo‑rate chasers who meet monthly criteria | ✨ Very high promo APY on first $5k; 🏆 yield leader (capped) |

| Discover Bank | $0 min; no fees; FDIC; 24/7 U.S. support; web/mobile | ★★★★ reliable, big‑brand UX | 💰 No fees; mid‑pack APY | 👥 Savers who value brand reliability & US support | ✨ U.S.‑based 24/7 support; 🏆 trusted bank experience |

| CIT Bank (First Citizens) | Multiple HYSA products; tiered APYs; daily compounding | ★★★★ high‑yield focus (some UX quirks) | 💰 Competitive APYs; some products may require $100 open | 👥 Yield‑focused savers matching product to balance | ✨ Choice of HYSA structures & tiered rates; 🏆 frequent rate leaders |

| Wealthfront — Cash Account | Cash sweep to program banks for expanded FDIC; instant withdrawals | ★★★★ polished fintech UX | 💰 Variable APY; high combined FDIC via sweep | 👥 Users wanting extra FDIC coverage + access | ✨ Sweep for expanded FDIC coverage; 🏆 cash + debit‑style access |

| Betterment — Cash Reserve | Broker sweep to partner banks; integrates with investing; no min | ★★★★ easy cash ↔ investing flow | 💰 No min; APY variable; FDIC via sweep | 👥 Investors who park cash and want seamless investing | ✨ Instant moves into robo‑investing; 🏆 simple cash + invest path |

| NerdWallet (editorial) | Updated leaderboards; pros/cons; links to offers | ★★★★☆ research‑friendly, transparent | 💰 Free research; may include partners/ads | 👥 Shoppers wanting quick market snapshots | ✨ Daily/weekly leaderboards & methodology; 🏆 editorial clarity |

| Bankrate (editorial) | Expert‑verified tables; rate history; filters & context | ★★★★☆ authoritative, filterable | 💰 Free in‑depth analysis; verify on bank pages | 👥 Users wanting historical context & expert notes | ✨ Expert commentary + rate history; 🏆 trusted comparison tools |

Choosing Your App and Starting Your Savings Journey Today

Navigating the landscape of the best savings apps can feel overwhelming, but the journey to financial wellness begins with a single, decisive step. As we’ve detailed, the “perfect” app is not a one-size-fits-all solution; it’s the one that aligns seamlessly with your unique financial personality, habits, and long-term goals. The key is to move from analysis to action.

Making Your Decision: A Quick Recap

Let’s distill the choices down to their core strengths to help you make a final decision. Your primary objective should be your guiding star.

- For the “Set It and Forget It” Saver: If you thrive on automation and want to build savings without constant manual effort, platforms like Chime and Ally Bank are exceptional choices. Their automatic savings rules and round-up features make saving an effortless background activity.

- For the Interest Rate Maximizer: If your main goal is to earn the highest possible return on your cash, a high-yield savings account is non-negotiable. Varo Bank, Marcus by Goldman Sachs, and CIT Bank consistently offer competitive APYs, ensuring your money works harder for you.

- For the All-in-One Optimizer: For those who prefer a consolidated financial life, an integrated solution is key. SoFi excels here, combining high-yield savings, checking, investing, and loan products into one streamlined platform.

- For the Informed Researcher: If you’re committed to finding the absolute top-tier rates at any given moment, aggregator platforms are your best friend. NerdWallet and Bankrate provide expertly curated and continuously updated lists, saving you the legwork of comparing dozens of institutions.

Your Action Plan: From Reading to Saving

Choosing an app is only the first part of the equation. True success comes from implementation and consistency. Once you’ve identified the tool that resonates with your needs, commit to the following steps within the next 24 hours.

- Download and Install: Go to your phone’s app store and download your chosen app. The initial barrier to entry is just a few taps away.

- Complete the Onboarding: The sign-up process for these modern fintech apps is typically fast, often taking less than 15 minutes. Have a form of identification and your Social Security number ready to expedite the process.

- Link Your Primary Bank Account: Securely connect your existing checking account. This is the crucial link that will allow you to fund your new savings account.

- Set Up Your First Transfer: This is the most important step. Don’t just open the account; fund it immediately. Schedule a recurring automatic transfer, even if it’s just a small amount to start. This single action creates momentum and turns your intention into a habit.

Building a robust savings habit is a cornerstone of achieving financial freedom. It’s not about the initial amount; it’s about establishing the discipline of paying yourself first. The powerful technology embedded in the best savings apps handles the heavy lifting, automating the process so you can focus on your goals. Whether you are saving for an emergency fund, a down payment, or long-term financial independence, the right tool will make the journey significantly smoother. Don’t let indecision be a barrier to progress. Pick the app that feels right for you, take that first small step today, and empower your future self.

Ready to take control of every aspect of your financial life? While these apps help you save, Collapsed Wallet provides the tools and insights you need to track spending, manage budgets, and achieve total financial clarity. Visit Collapsed Wallet to see how our platform can complement your savings strategy and accelerate your journey to financial independence.

8 thoughts on “12 Best Savings Apps in 2025 to Supercharge Your Finances”